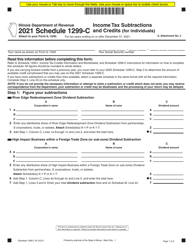

This version of the form is not currently in use and is provided for reference only. Download this version of

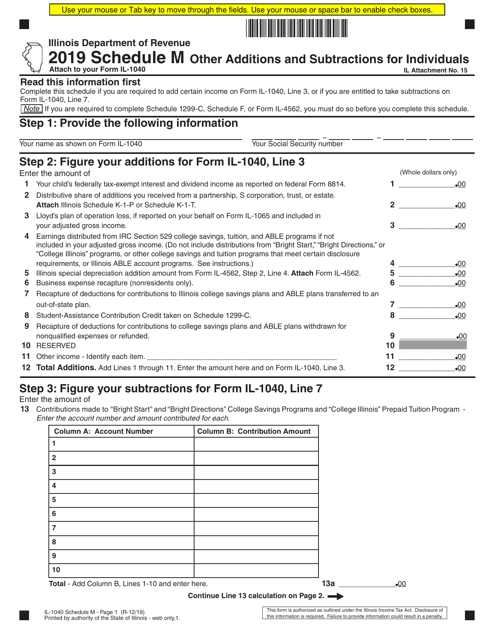

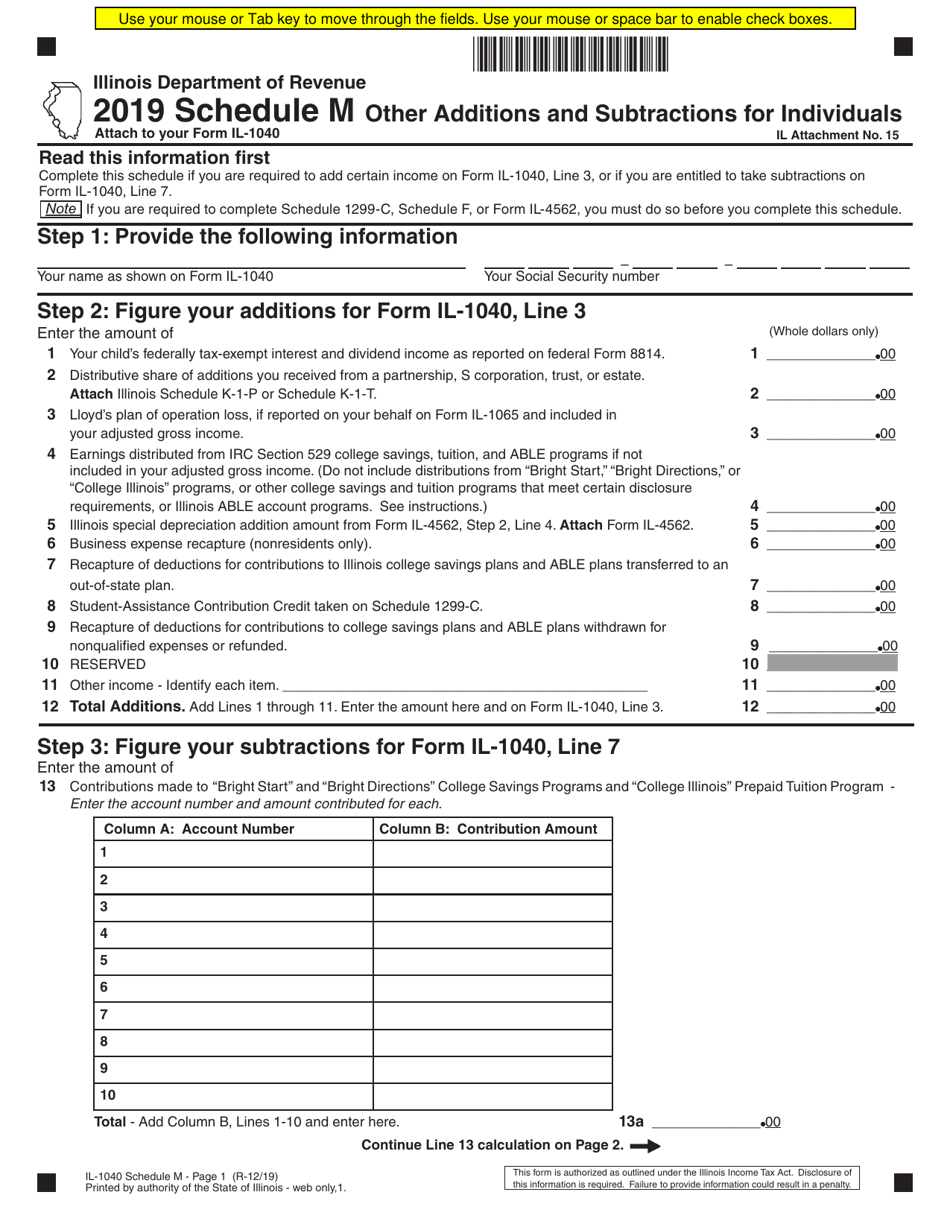

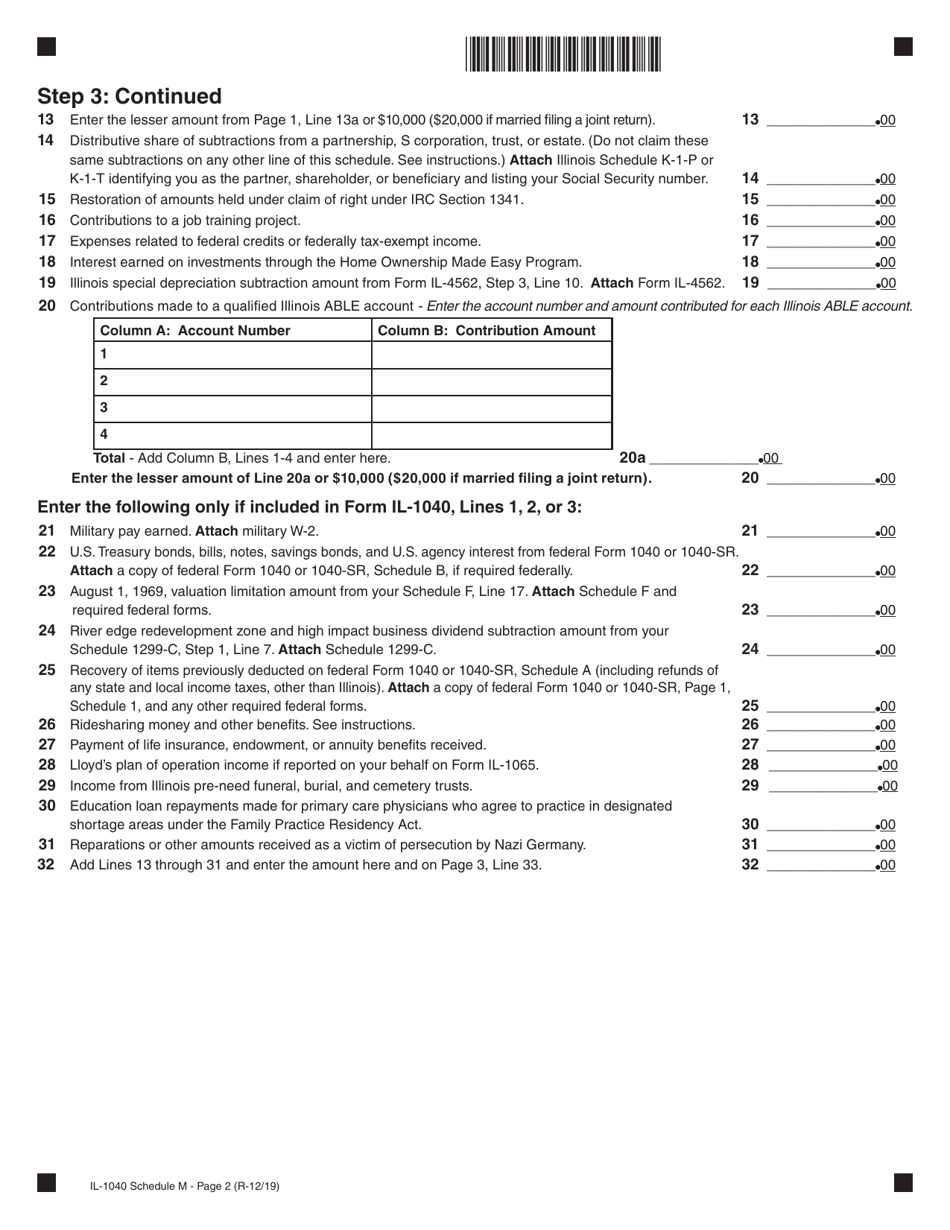

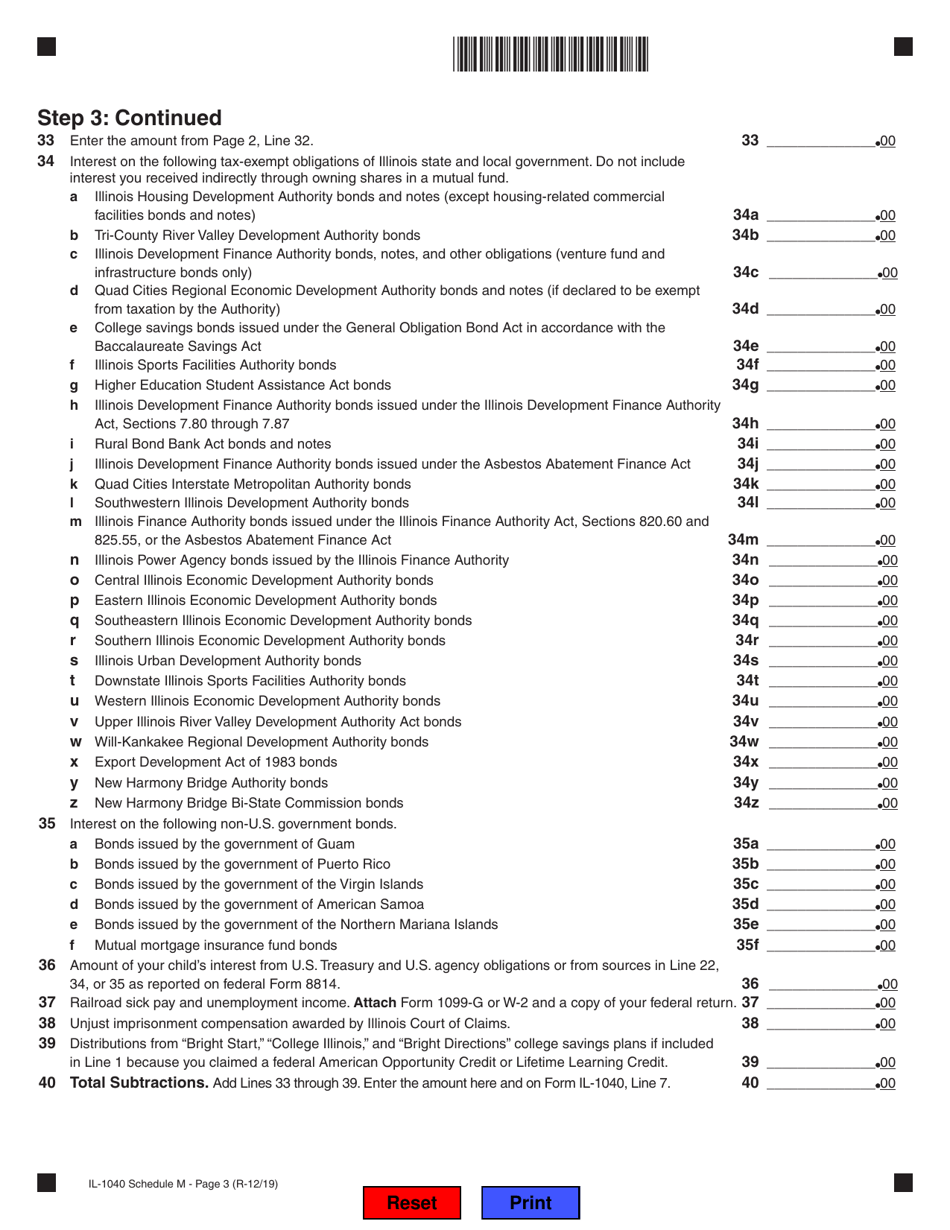

Form IL-1040 Schedule M

for the current year.

Form IL-1040 Schedule M Other Additions and Subtractions for Individuals - Illinois

What Is Form IL-1040 Schedule M?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois.The document is a supplement to Form IL-1040, Individual Income Tax Return. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-1040 Schedule M?

A: Form IL-1040 Schedule M is a tax form used by individuals in Illinois to report other additions and subtractions that affect their tax liability.

Q: What is the purpose of Form IL-1040 Schedule M?

A: The purpose of Form IL-1040 Schedule M is to calculate the additional income or deductions that need to be added or subtracted from the taxpayer's Illinois tax return.

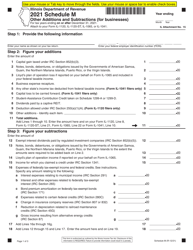

Q: What are examples of additions on Form IL-1040 Schedule M?

A: Examples of additions on Form IL-1040 Schedule M can include taxable income from another state, interest income from municipal bonds issued by other states, and certain federal deductions that were added back for Illinois tax purposes.

Q: What are examples of subtractions on Form IL-1040 Schedule M?

A: Examples of subtractions on Form IL-1040 Schedule M can include income earned in another state that is not taxable in Illinois, certain retirement income exclusions, and certain federal deductions that were subtracted for Illinois tax purposes.

Q: When is Form IL-1040 Schedule M due?

A: Form IL-1040 Schedule M is due on the same date as your Illinois income tax return, which is typically April 15th.

Q: Can I file Form IL-1040 Schedule M electronically?

A: Yes, you can file Form IL-1040 Schedule M electronically if you are e-filing your Illinois income tax return.

Q: What should I do if I am not sure how tofill out Form IL-1040 Schedule M?

A: If you are not sure how to fill out Form IL-1040 Schedule M, it is recommended to seek guidance from a tax professional or use tax preparation software that can assist you with the process.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1040 Schedule M by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.