This version of the form is not currently in use and is provided for reference only. Download this version of

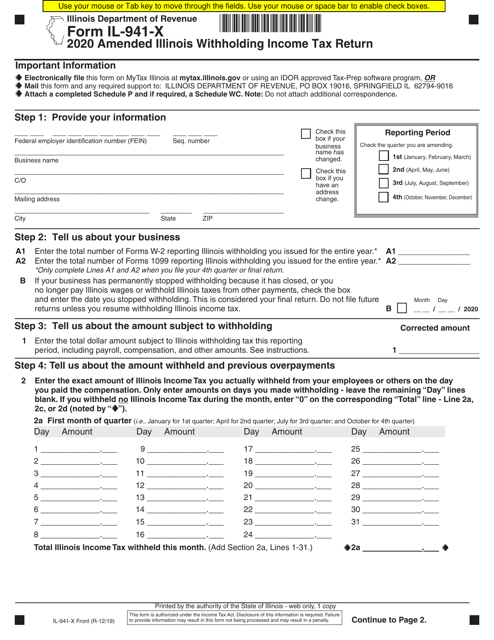

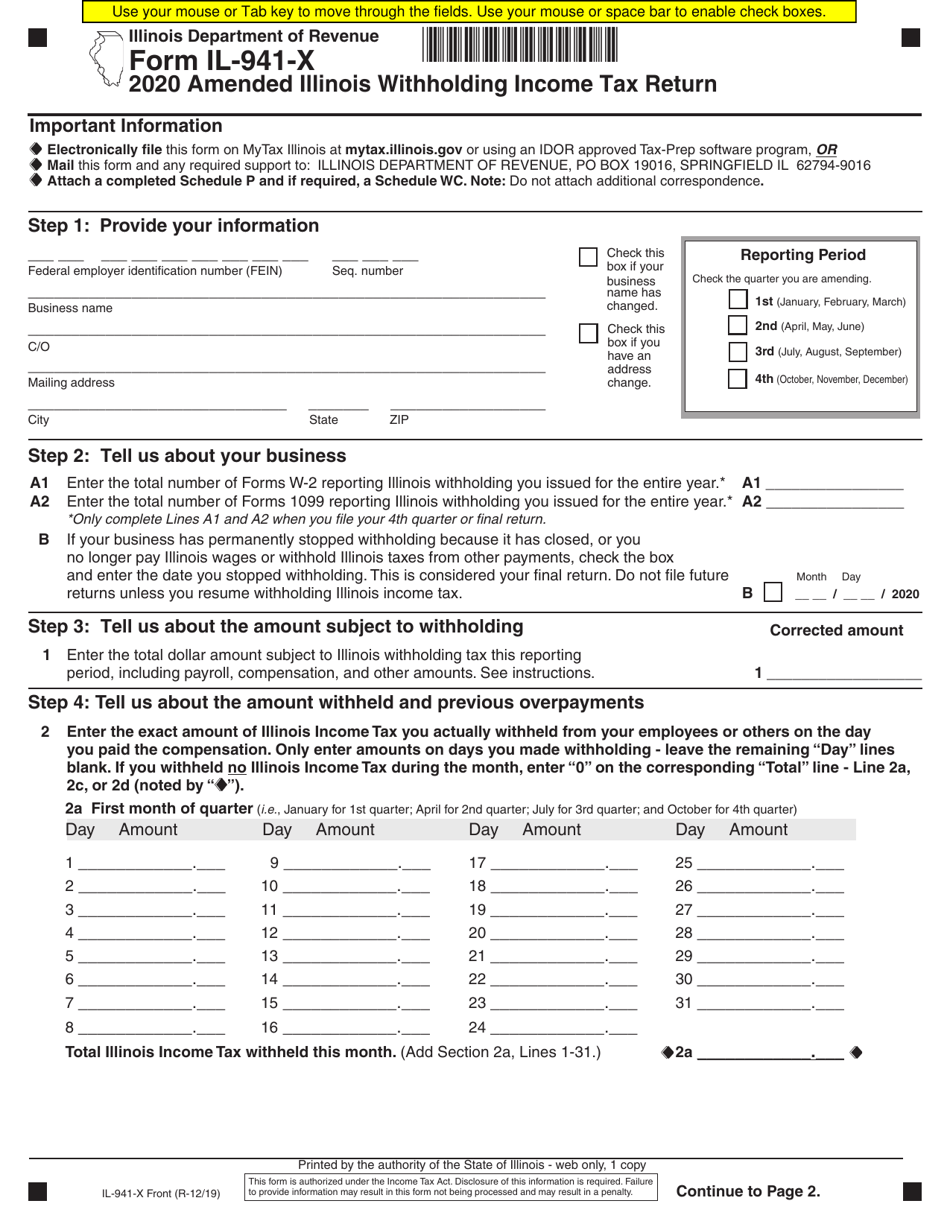

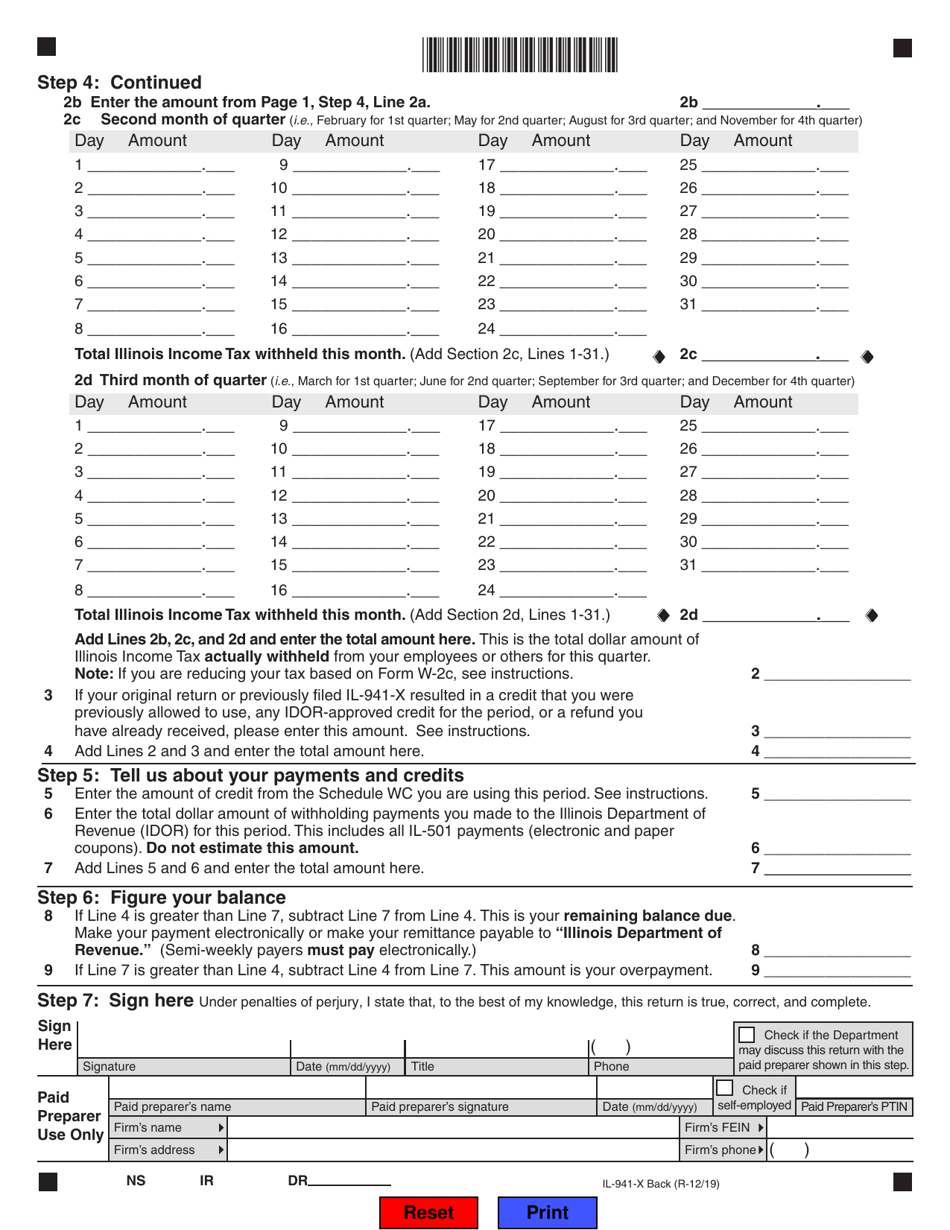

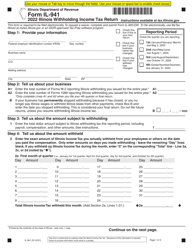

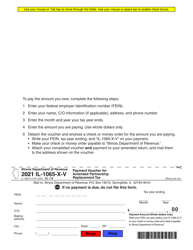

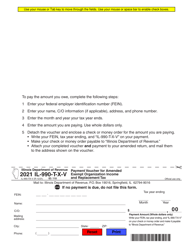

Form IL-941-X

for the current year.

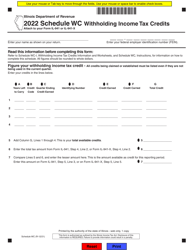

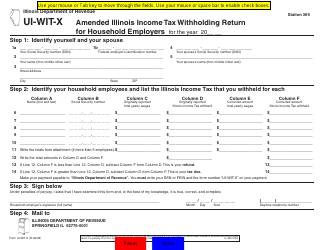

Form IL-941-X Amended Illinois Withholding Income Tax Return - Illinois

What Is Form IL-941-X?

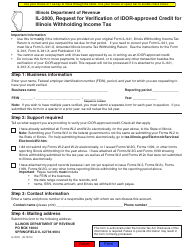

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-941-X?

A: Form IL-941-X is the Amended Illinois Withholding Income Tax Return.

Q: When should I use Form IL-941-X?

A: You should use Form IL-941-X to correct any errors or make changes to a previously filed IL-941.

Q: What is the purpose of Form IL-941-X?

A: The purpose of Form IL-941-X is to report any adjustments to the withholding tax information that was previously reported on Form IL-941.

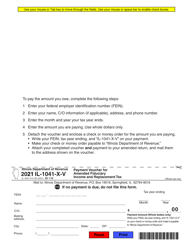

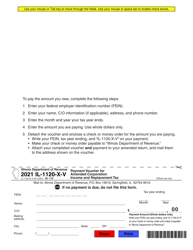

Q: How do I file Form IL-941-X?

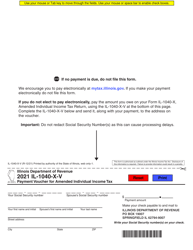

A: You can file Form IL-941-X by mail or electronically.

Q: Do I need to attach any supporting documents with Form IL-941-X?

A: Yes, you need to attach a copy of the Illinois Withholding Income Tax Return (Form IL-941) that you are amending.

Q: Is there a deadline for filing Form IL-941-X?

A: Yes, the deadline for filing Form IL-941-X is the same as the deadline for filing the original Form IL-941, which is the last day of the month following the end of the quarter.

Q: What happens if I don't file Form IL-941-X?

A: If you don't file Form IL-941-X to correct any errors or make changes, you may face penalties or interest on the underpaid or overpaid withholding taxes.

Q: Can I amend multiple quarters on one Form IL-941-X?

A: No, you must file a separate Form IL-941-X for each quarter that you need to amend.

Q: Who is required to file Form IL-941-X?

A: Employers who have previously filed Form IL-941 for reporting Illinois withholding income taxes and need to make corrections or changes to the previously reported information must file Form IL-941-X.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-941-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.