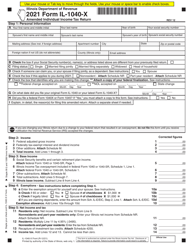

This version of the form is not currently in use and is provided for reference only. Download this version of

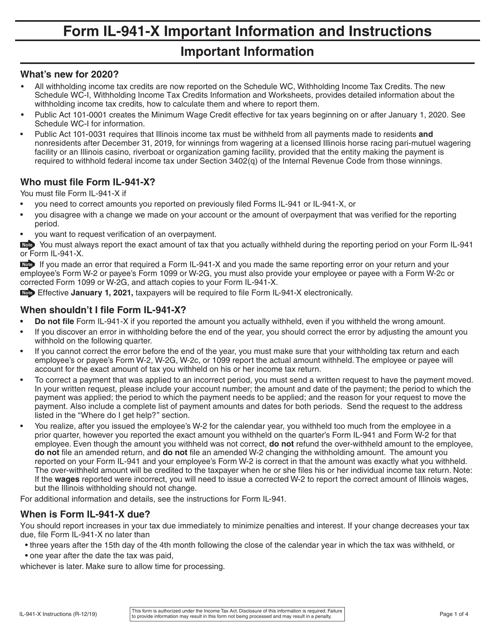

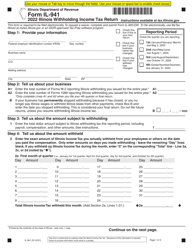

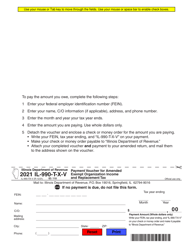

Instructions for Form IL-941-X

for the current year.

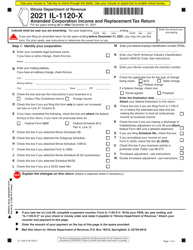

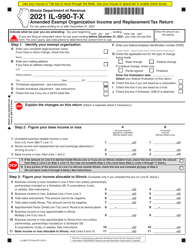

Instructions for Form IL-941-X Amended Illinois Withholding Income Tax Return - Illinois

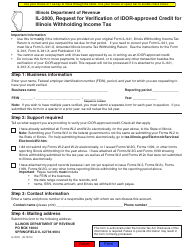

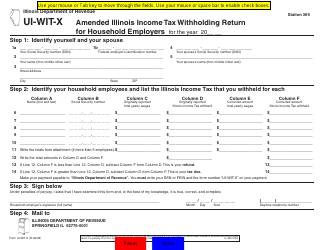

This document contains official instructions for Form IL-941-X , Amended Illinois Withholding Income Tax Return - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form IL-941-X is available for download through this link.

FAQ

Q: What is Form IL-941-X?

A: Form IL-941-X is the Amended Illinois Withholding Income Tax Return.

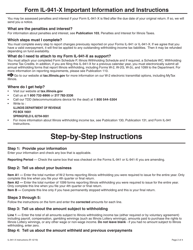

Q: When should I file Form IL-941-X?

A: You should file Form IL-941-X when you need to make corrections or changes to a previously filed Illinois Withholding Income Tax Return.

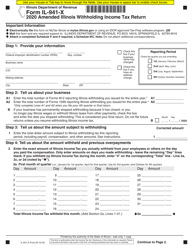

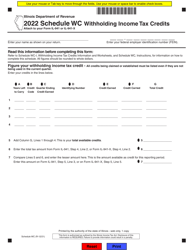

Q: What information do I need to include on Form IL-941-X?

A: You should include the corrected or updated information for each quarter that you are amending, including the employer's identification number, employee wages, and withholding amounts.

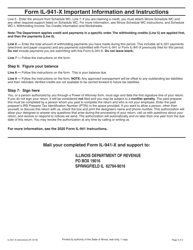

Q: Can I file Form IL-941-X electronically?

A: No, Form IL-941-X must be filed by mail.

Q: Is there a deadline for filing Form IL-941-X?

A: Yes, Form IL-941-X must be filed within three years from the original due date of the Illinois Withholding Income Tax Return being amended.

Q: What happens after I file Form IL-941-X?

A: The Illinois Department of Revenue will review your amended return and process any refund or credit due to you, or send you a bill for any additional taxes owed.

Q: Do I need to attach any documentation with Form IL-941-X?

A: Yes, you should attach any documentation that supports the changes or corrections you are making on the amended return, such as W-2 forms or payroll records.

Q: Can I file an amended return for multiple quarters on the same Form IL-941-X?

A: No, you must file a separate Form IL-941-X for each quarter that you are amending.

Q: What should I do if I have already paid the additional taxes owed on the original return?

A: If you have already paid the additional taxes owed on the original return, you should indicate this on Form IL-941-X. The Illinois Department of Revenue will adjust your account and either issue a refund or apply the payment to any outstanding tax liabilities.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.