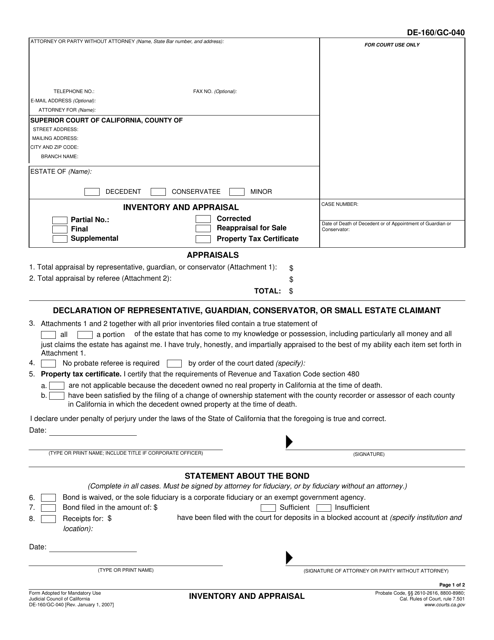

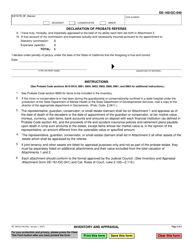

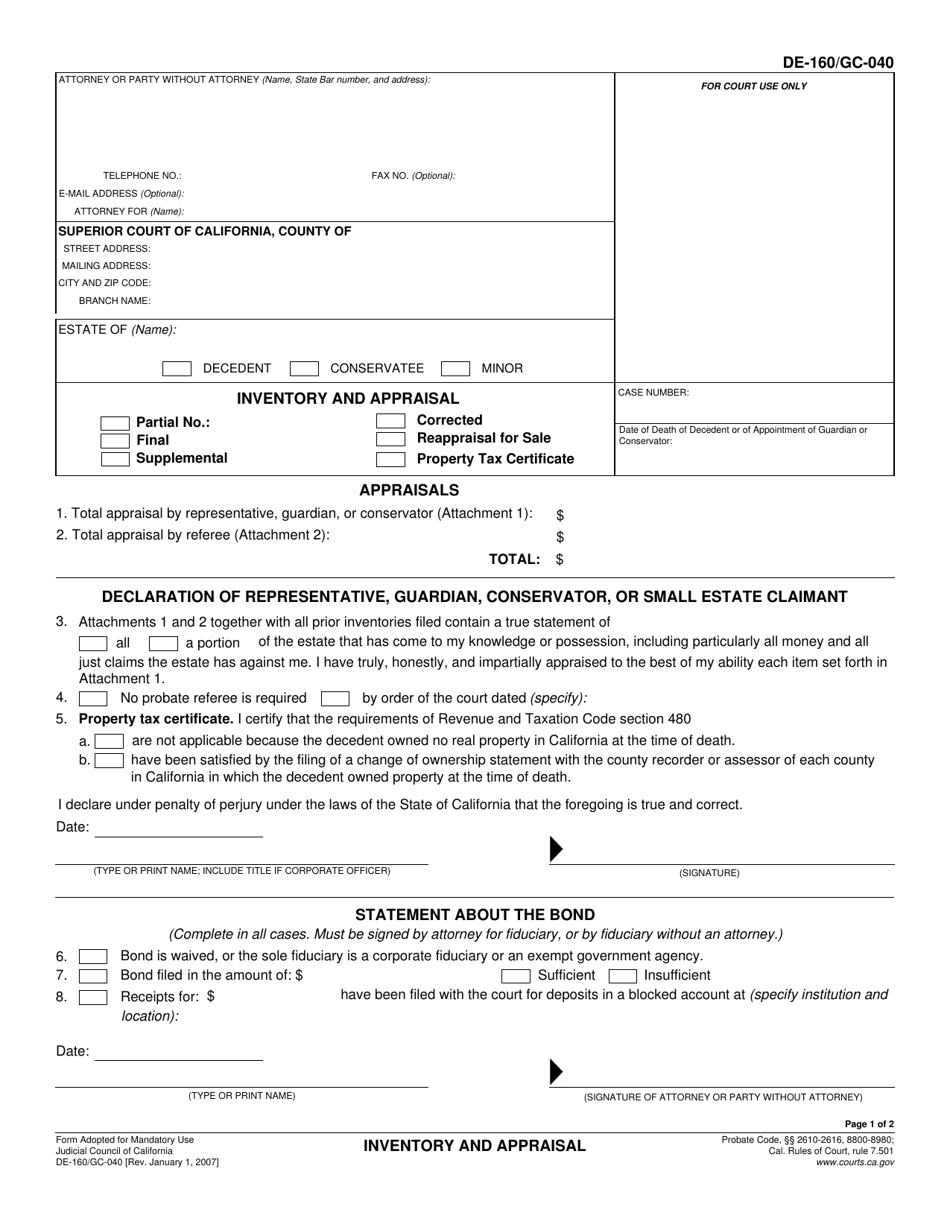

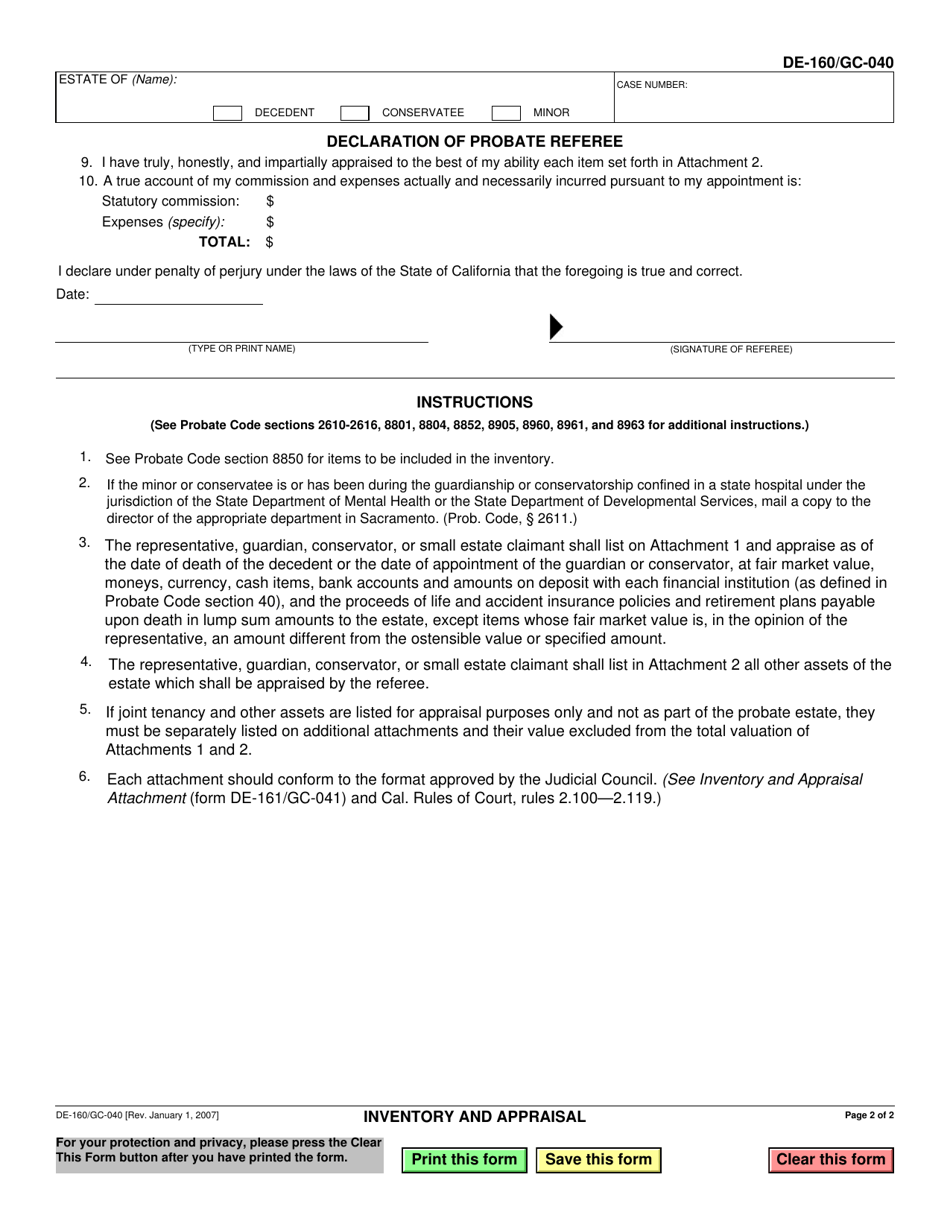

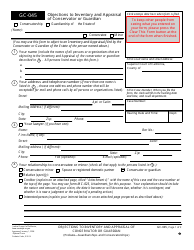

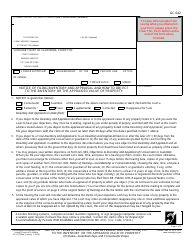

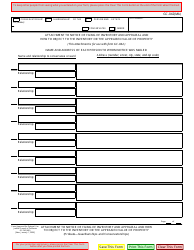

Form DE-160 (GC-040) Inventory and Appraisal - California

What Is Form DE-160 (GC-040)?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DE-160?

A: Form DE-160, also known as GC-040, is the Inventory and Appraisal form used in California.

Q: What is the purpose of Form DE-160?

A: The purpose of Form DE-160 is to list and value all assets and debts of an estate for probate proceedings in California.

Q: Who needs to fill out Form DE-160?

A: Form DE-160 must be filled out by the personal representative or executor of an estate.

Q: When should Form DE-160 be completed?

A: Form DE-160 should be completed and filed with the court within four months of the personal representative's appointment.

Q: Is Form DE-160 specific to California?

A: Yes, Form DE-160 is specific to California and should only be used for probate cases in California.

Form Details:

- Released on January 1, 2007;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DE-160 (GC-040) by clicking the link below or browse more documents and templates provided by the California Superior Court.