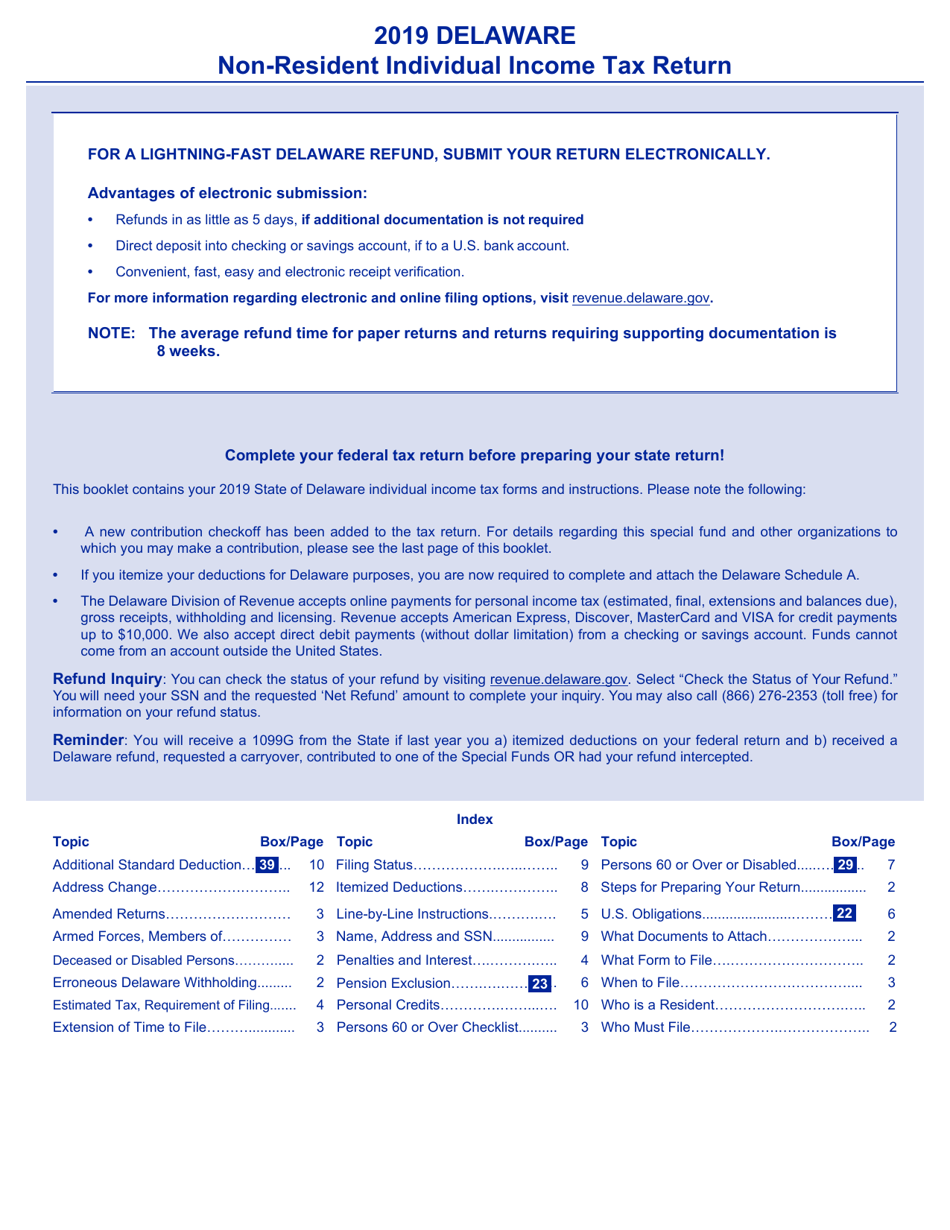

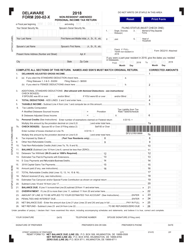

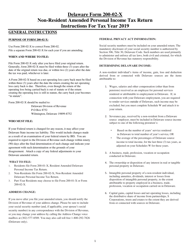

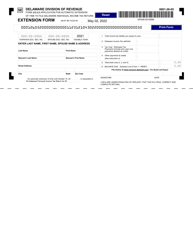

Instructions for Form 200-02 NR Non-resident Individual Income Tax Return - Delaware

This document contains official instructions for Form 200-02 NR , Non-resident Individual Income Tax Return - a form released and collected by the Delaware Department of Finance - Division of Revenue.

FAQ

Q: What is Form 200-02 NR?

A: Form 200-02 NR is the Non-resident Individual Income Tax Return specifically for Delaware.

Q: Who should file Form 200-02 NR?

A: Non-resident individuals who earned income in Delaware but do not meet the requirements for being a resident should file Form 200-02 NR.

Q: What is the purpose of Form 200-02 NR?

A: The purpose of Form 200-02 NR is to report and pay income tax on income earned in Delaware as a non-resident individual.

Q: What information is required to complete Form 200-02 NR?

A: To complete Form 200-02 NR, you will need to provide your personal information, details of your income earned in Delaware, and any applicable deductions or credits.

Q: When is the deadline to file Form 200-02 NR?

A: The deadline to file Form 200-02 NR is the same as the federal incometax filing deadline, which is usually April 15th of each year.

Q: Are there any penalties for late filing of Form 200-02 NR?

A: Yes, there may be penalties for late filing of Form 200-02 NR, including interest charges and potential additional fees.

Q: Do I need to include copies of my federal tax return with Form 200-02 NR?

A: No, you do not need to include copies of your federal tax return with Form 200-02 NR. However, you may need to provide certain information from your federal return.

Instruction Details:

- This 14-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Delaware Department of Finance - Division of Revenue.