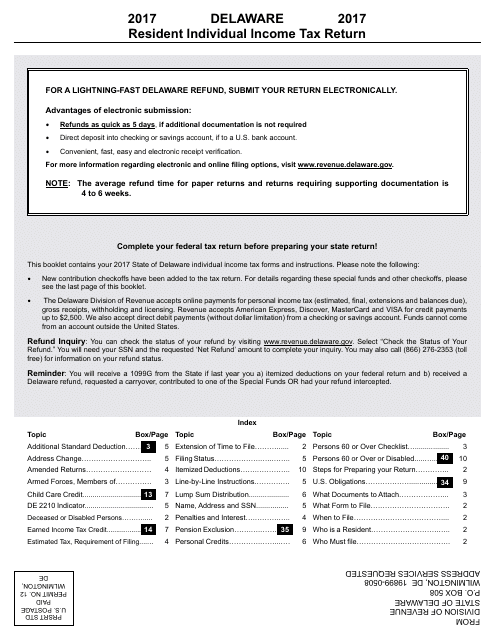

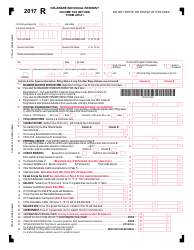

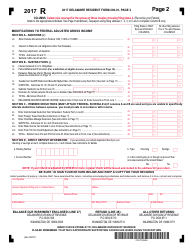

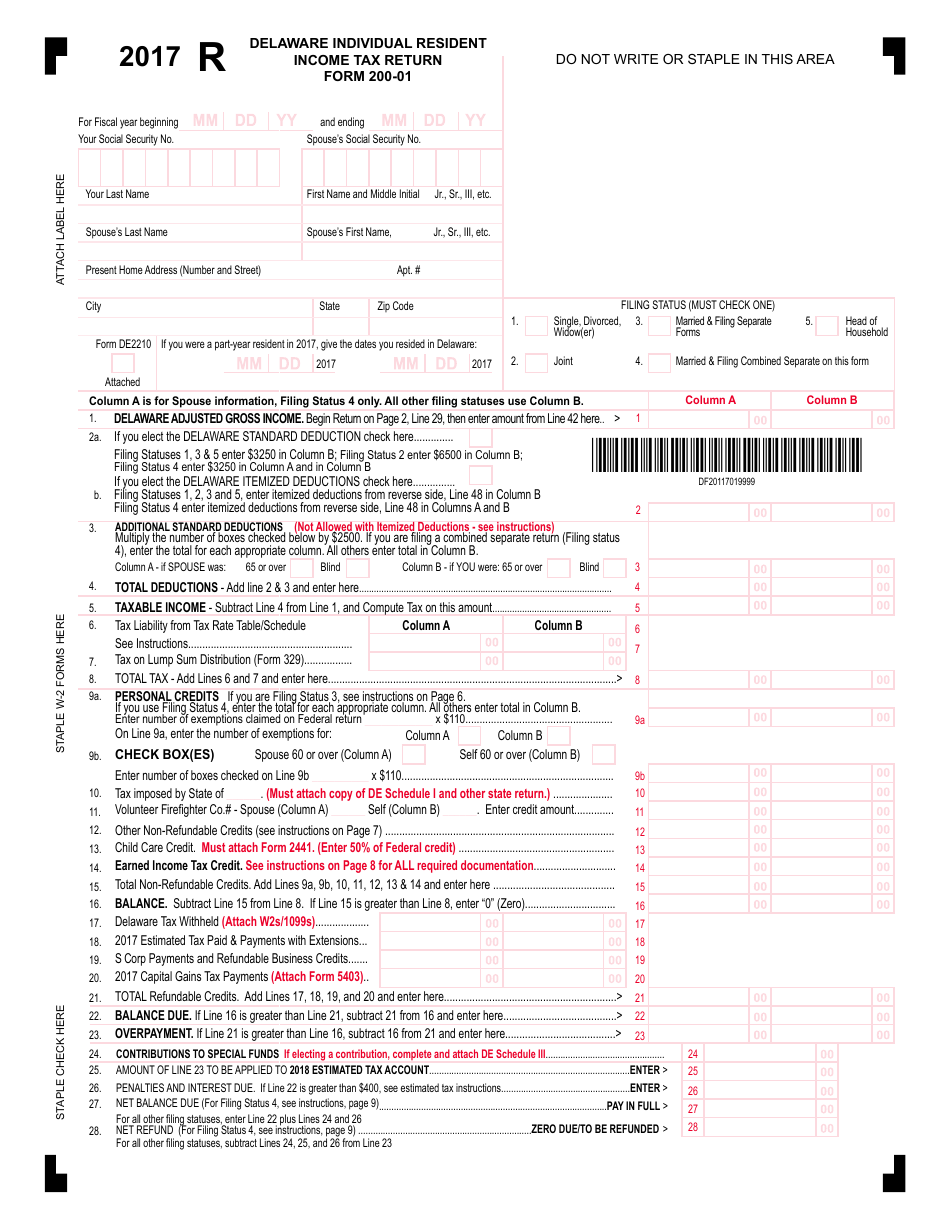

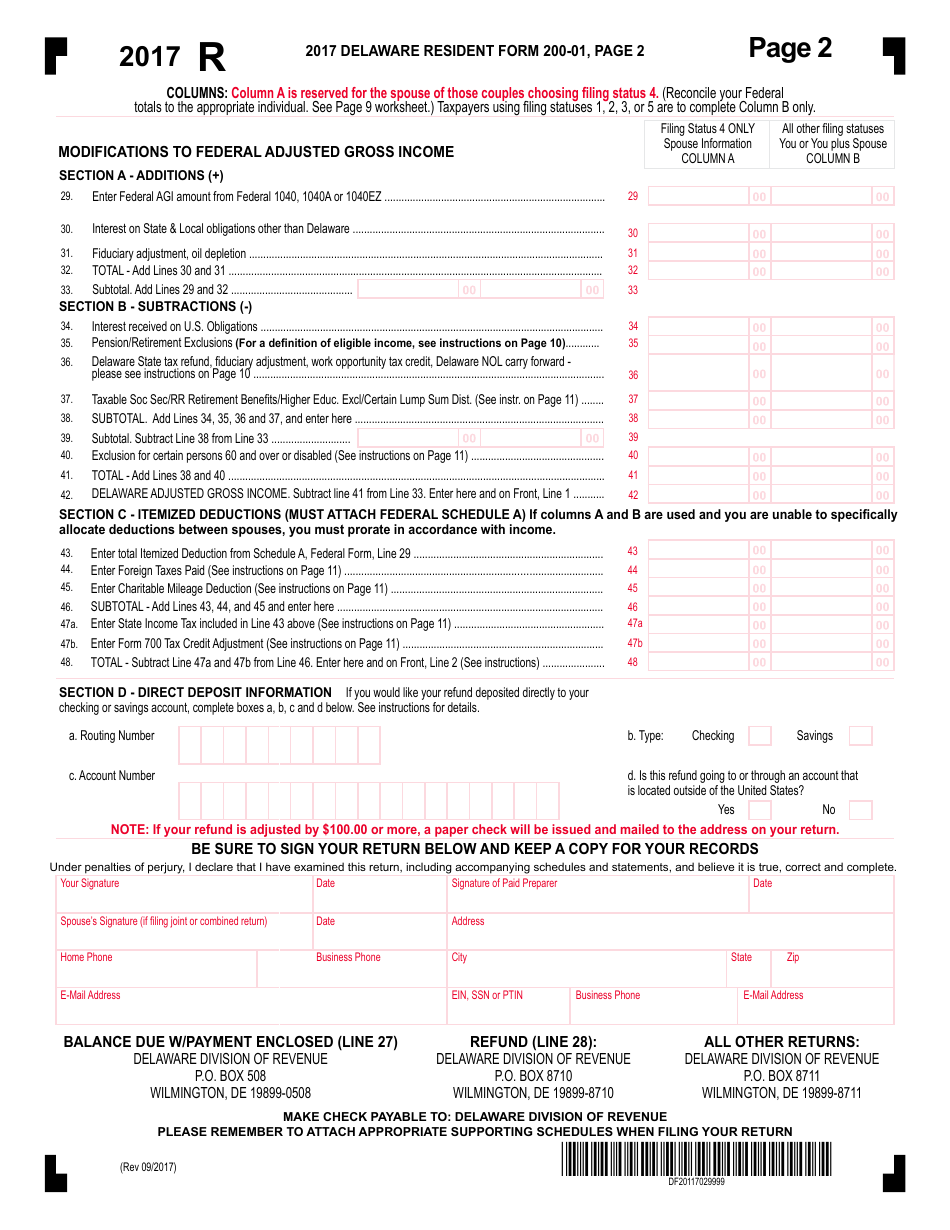

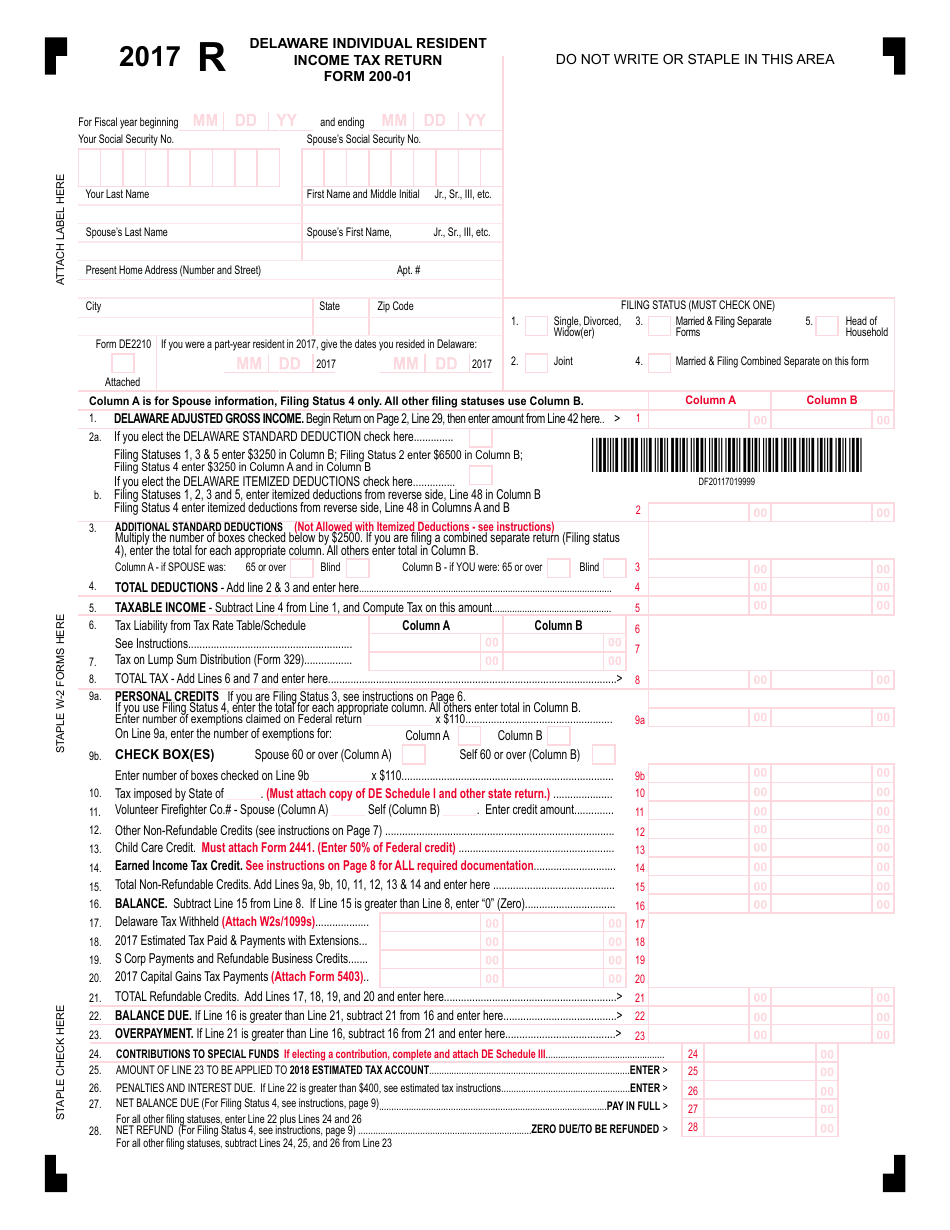

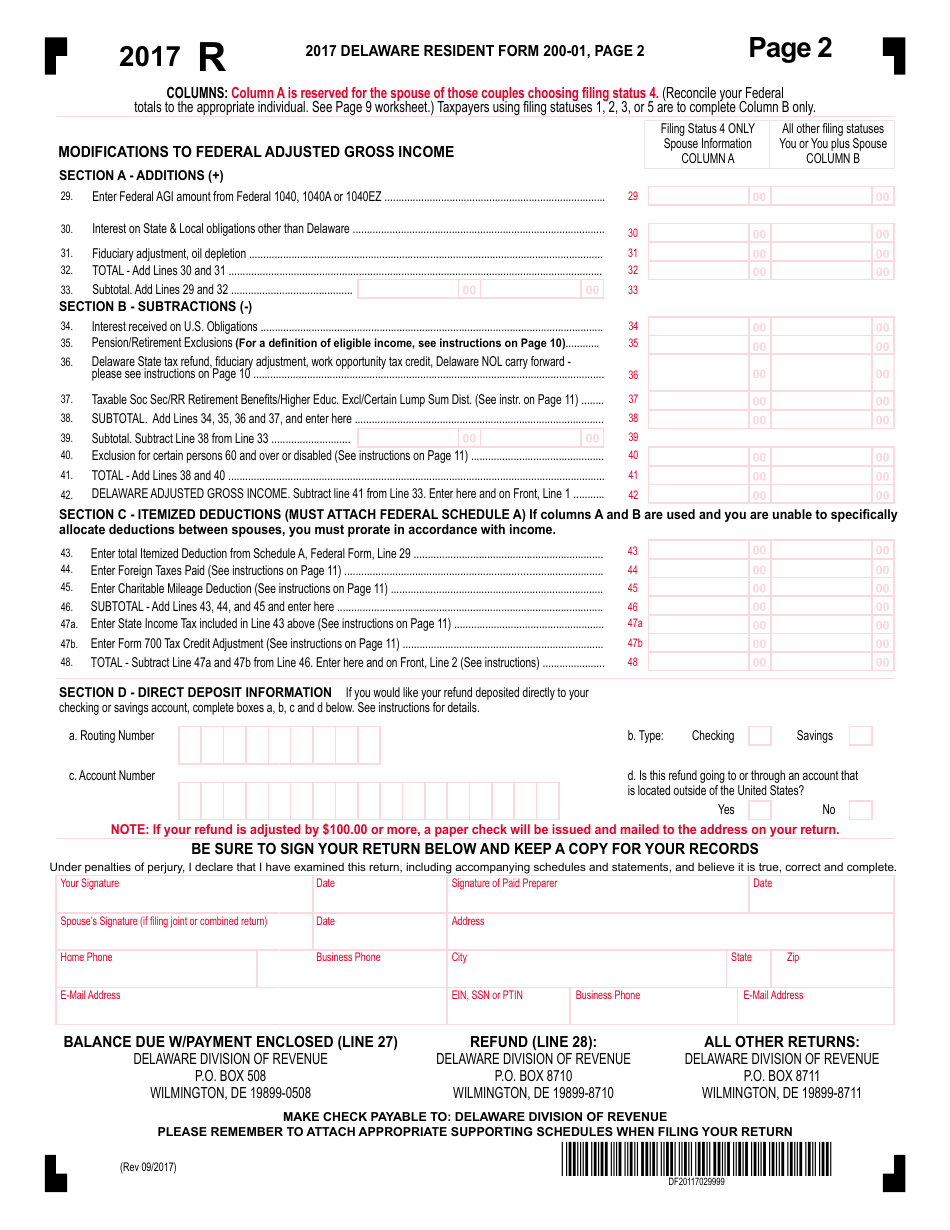

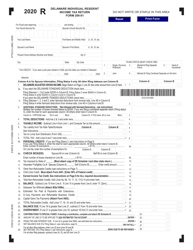

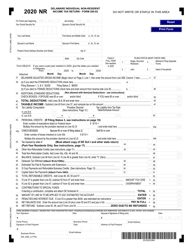

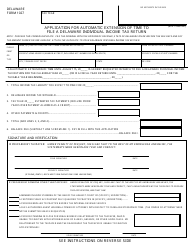

Form 200-01 Resident Individual Income Tax Return - Delaware

What Is Form 200-01?

This is a legal form that was released by the Delaware Department of Finance - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 200-01?

A: Form 200-01 is the Resident Individual Income Tax Return for Delaware.

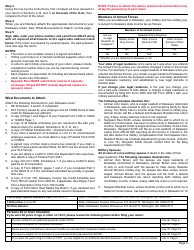

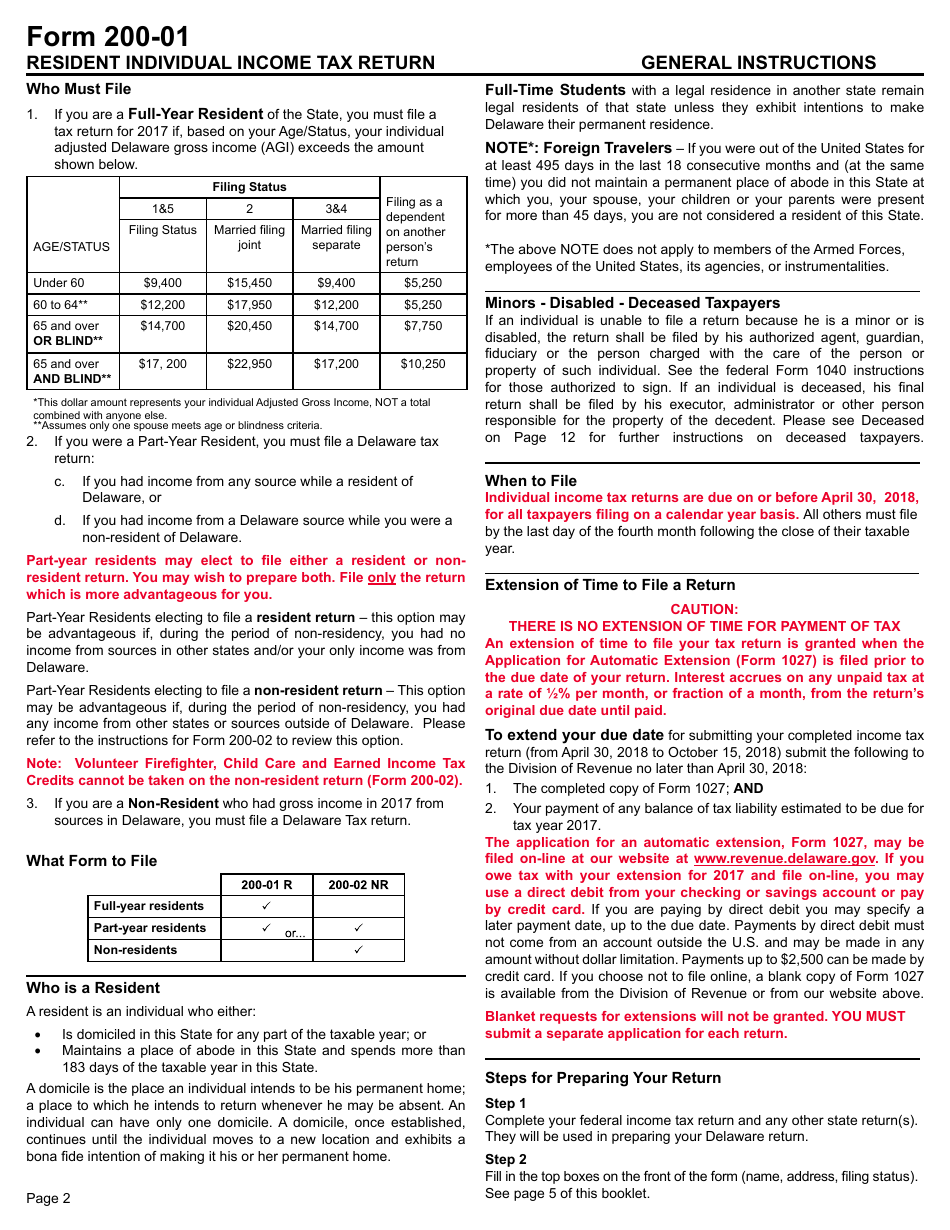

Q: Who is required to file Form 200-01?

A: Residents of Delaware who have income that is subject to state income tax are required to file Form 200-01.

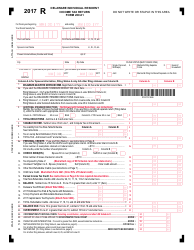

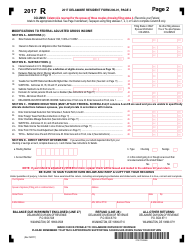

Q: What is the purpose of Form 200-01?

A: Form 200-01 is used to report and calculate the amount of income tax owed by Delaware residents.

Q: What type of income is reported on Form 200-01?

A: All sources of income, including wages, salaries, tips, interest, dividends, and rental income, are reported on Form 200-01.

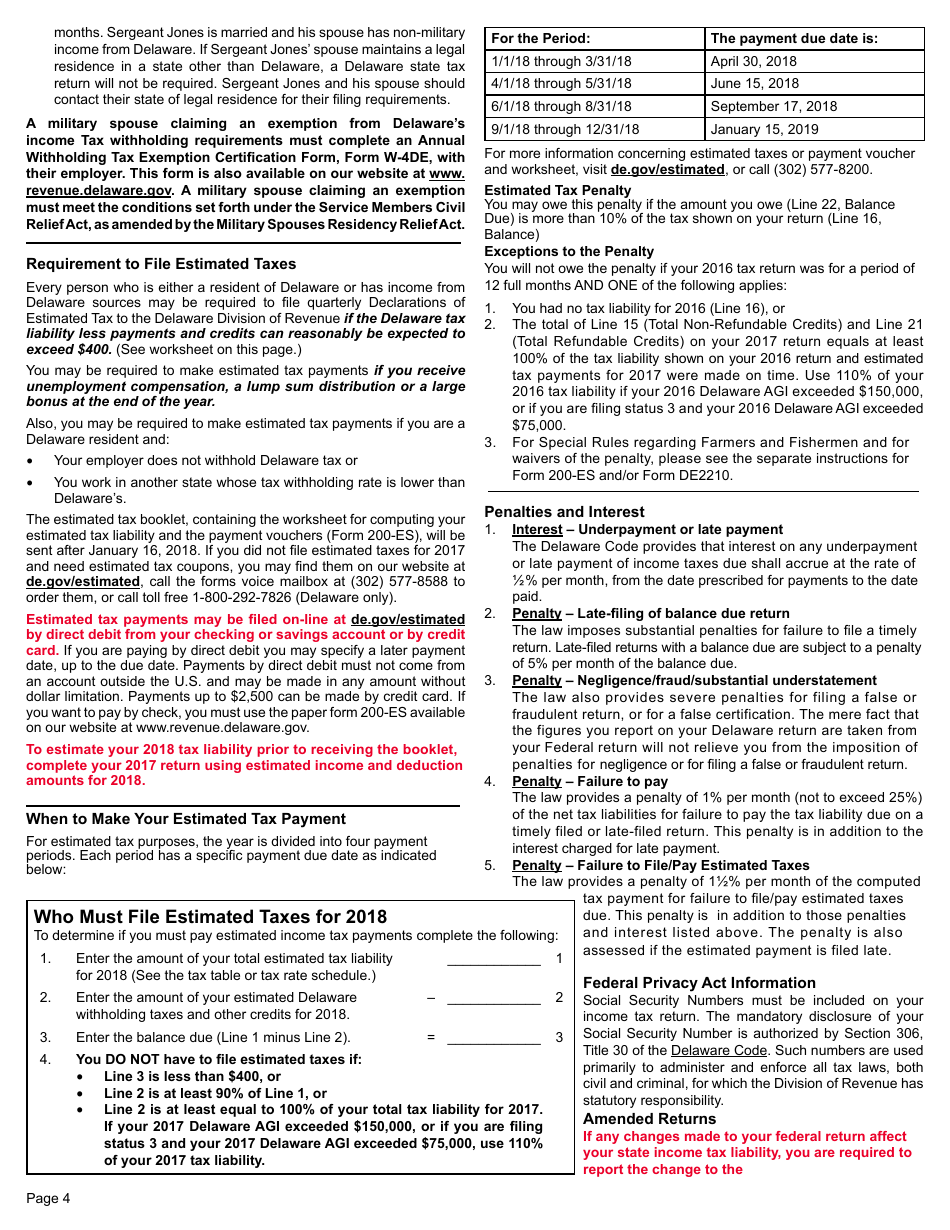

Q: When is the deadline for filing Form 200-01?

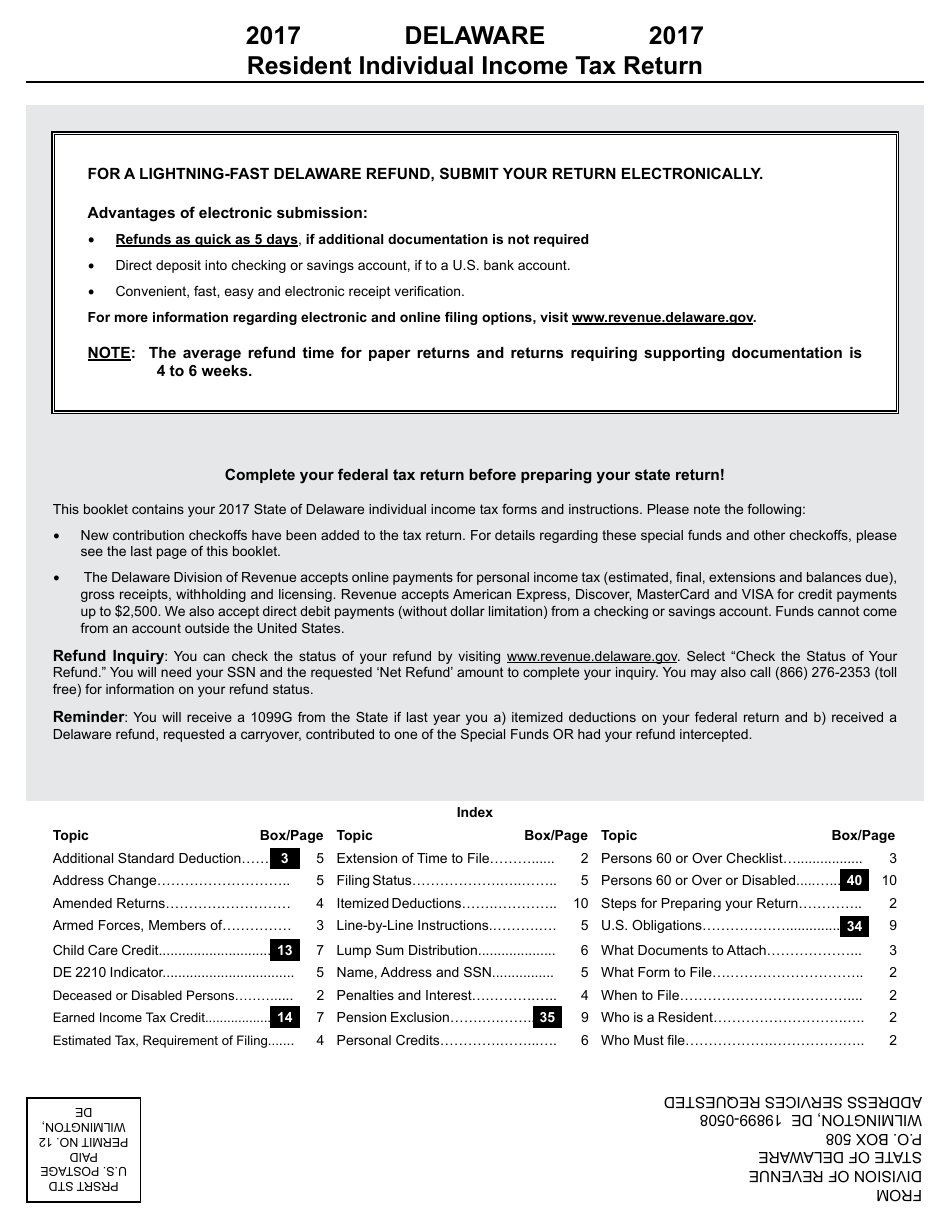

A: Form 200-01 must be filed by April 30th of each year, or by the same deadline as the federal income tax return if granted an extension.

Q: Are there any penalties for filing Form 200-01 late?

A: Yes, if you fail to file Form 200-01 by the deadline, you may be subject to penalties and interest on the tax balance owed.

Q: Is Form 200-01 only for state income tax purposes?

A: Yes, Form 200-01 is specifically for reporting and calculating Delaware state income tax owed by residents.

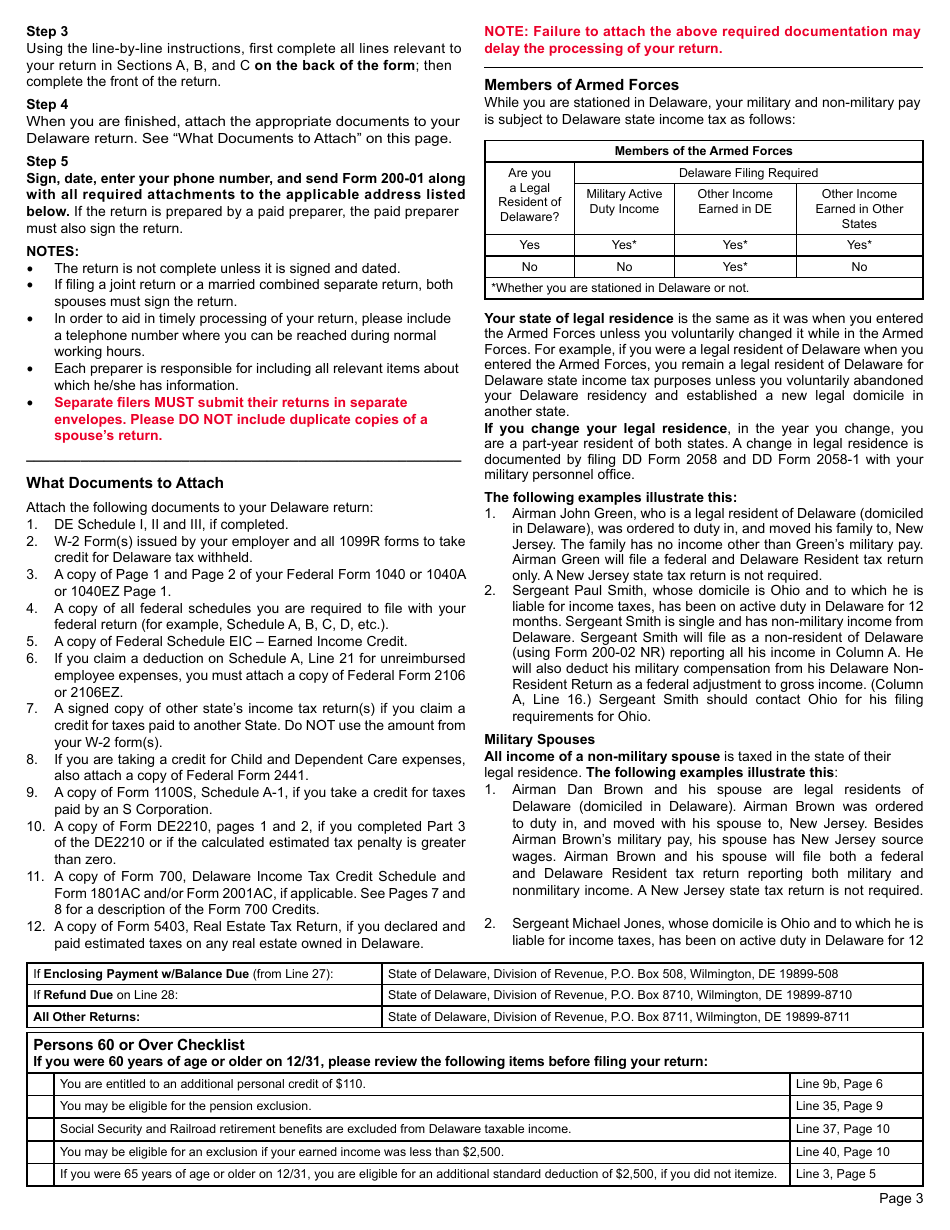

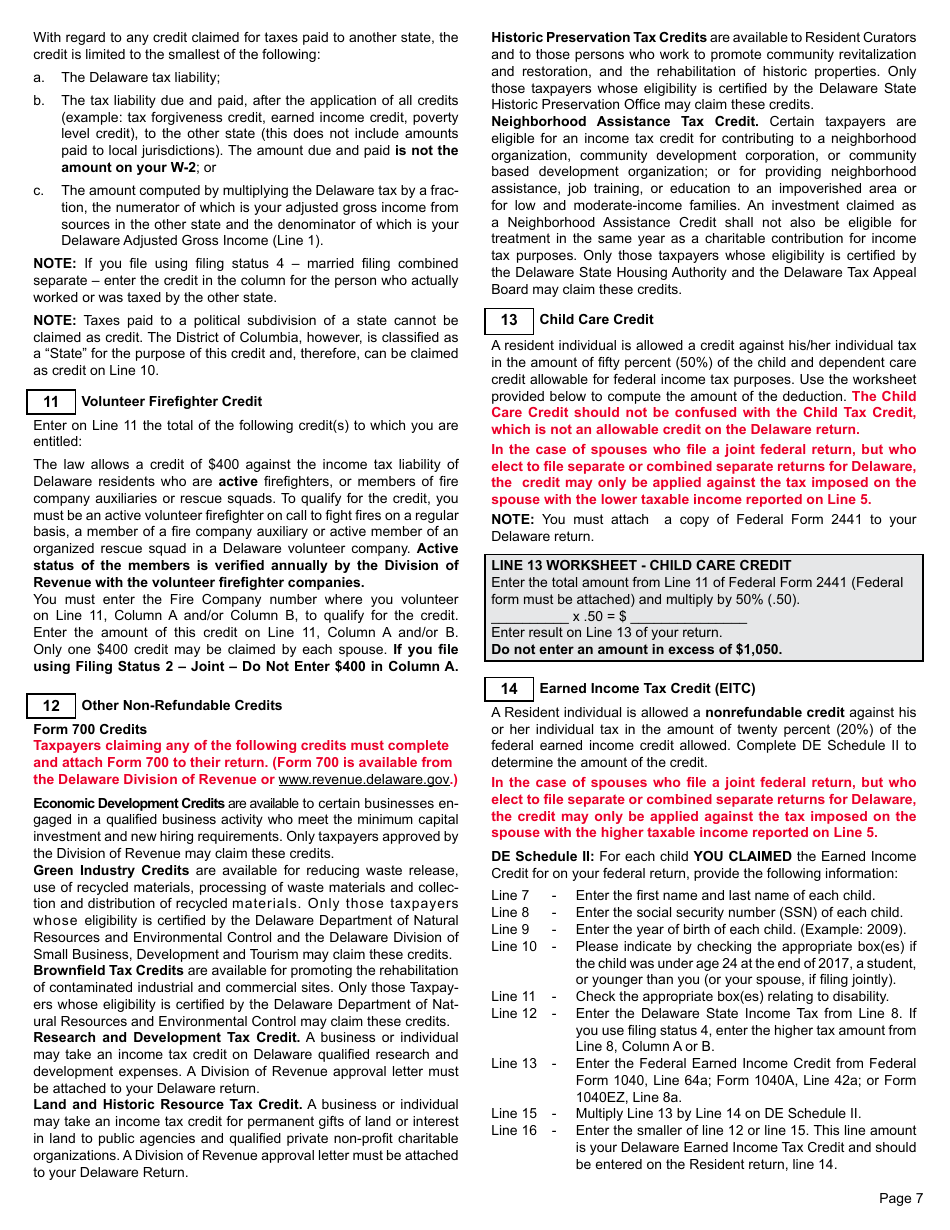

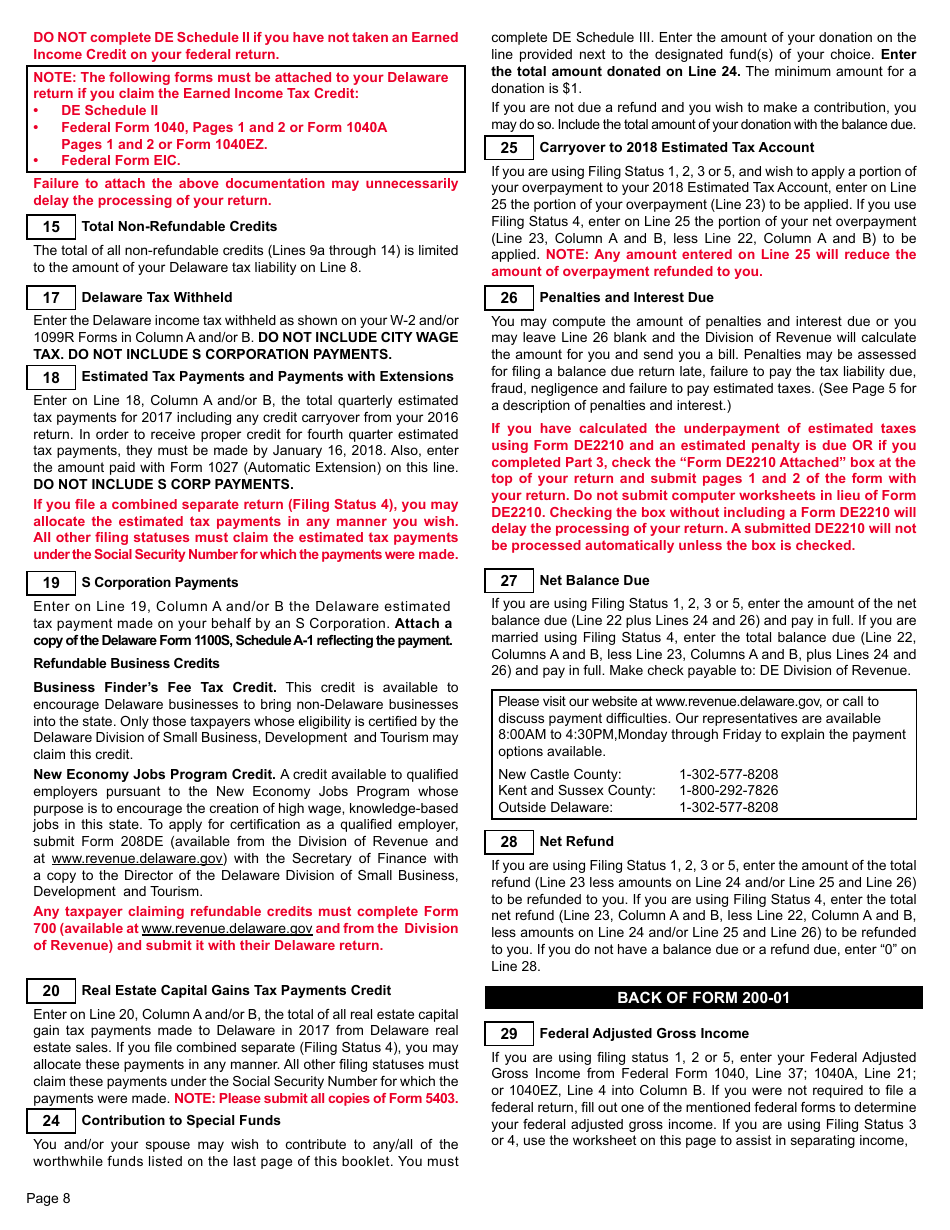

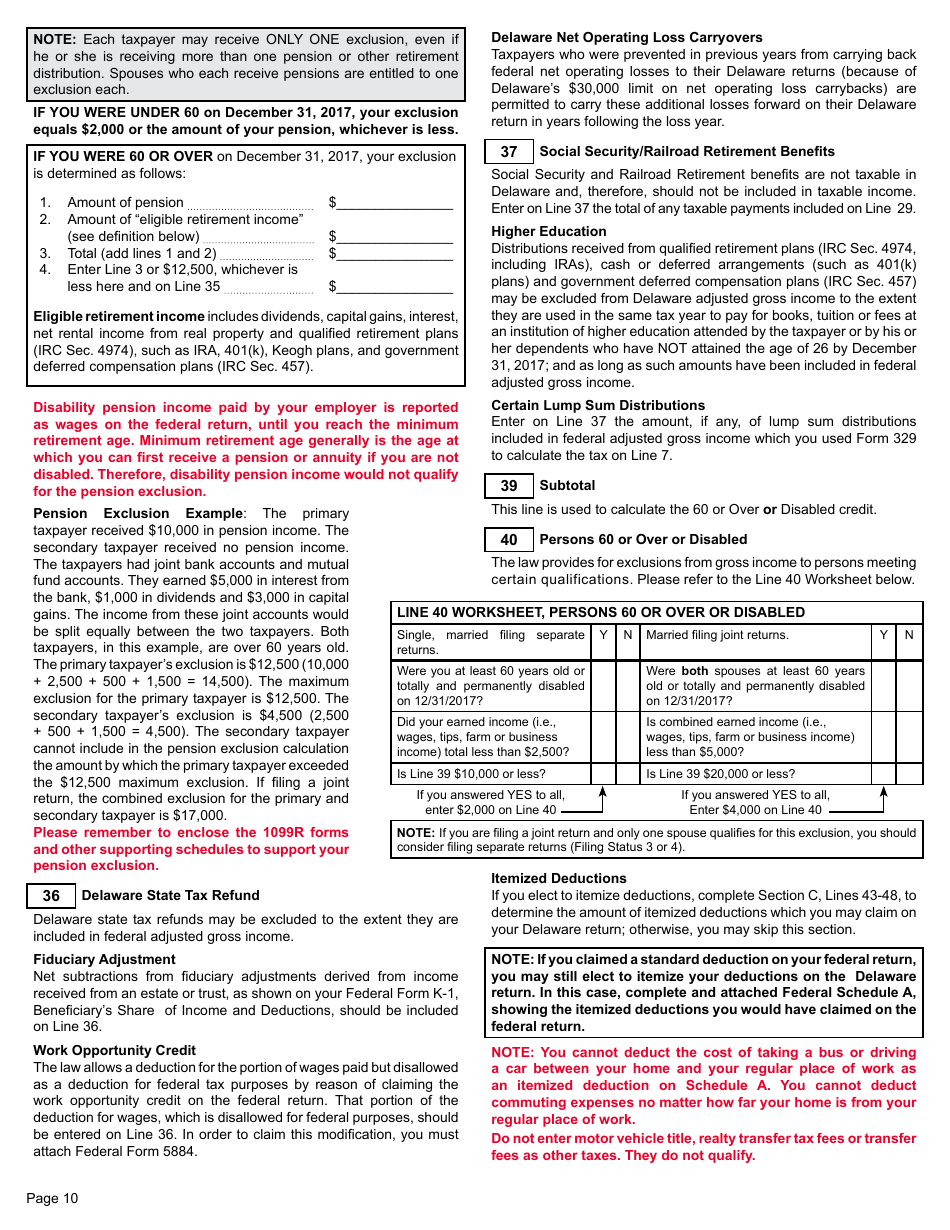

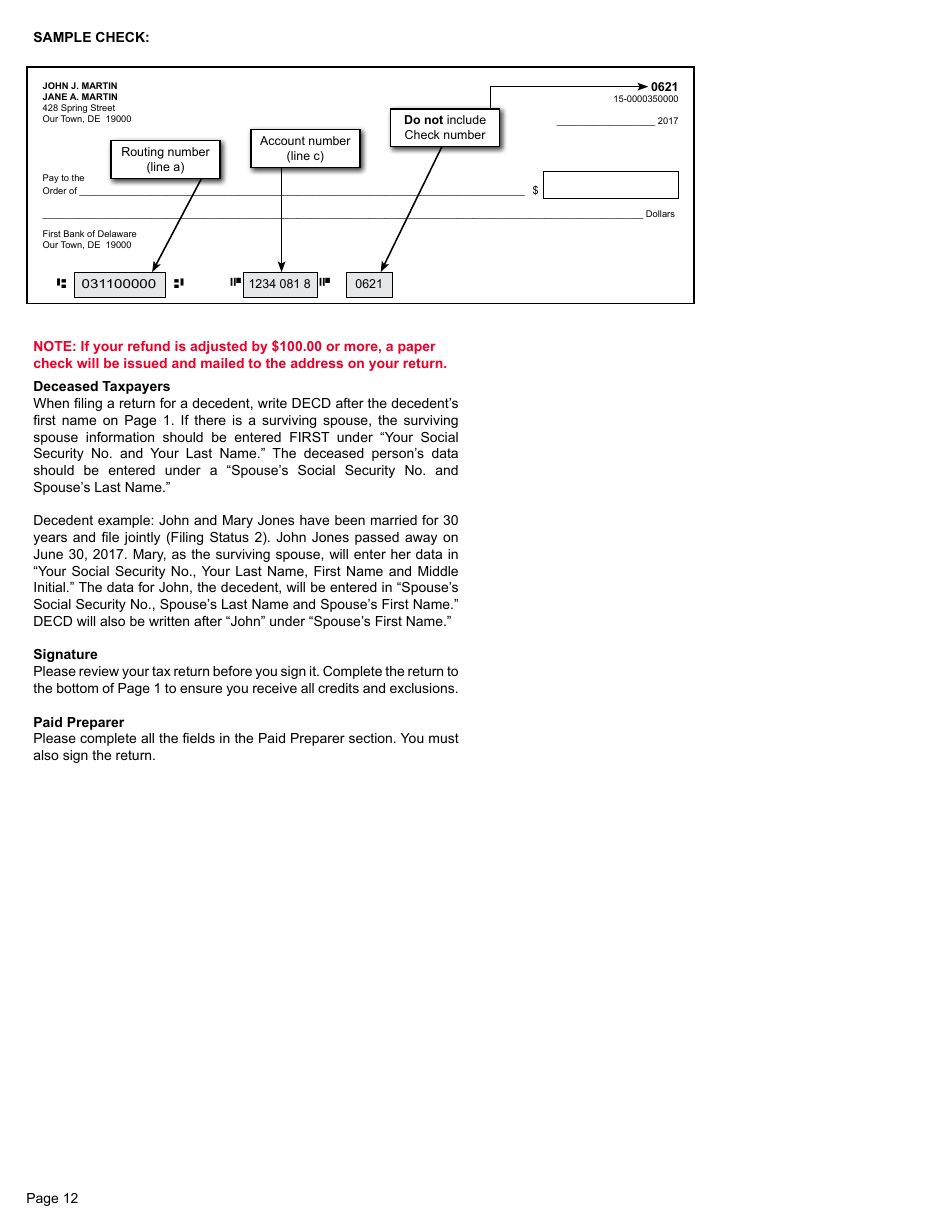

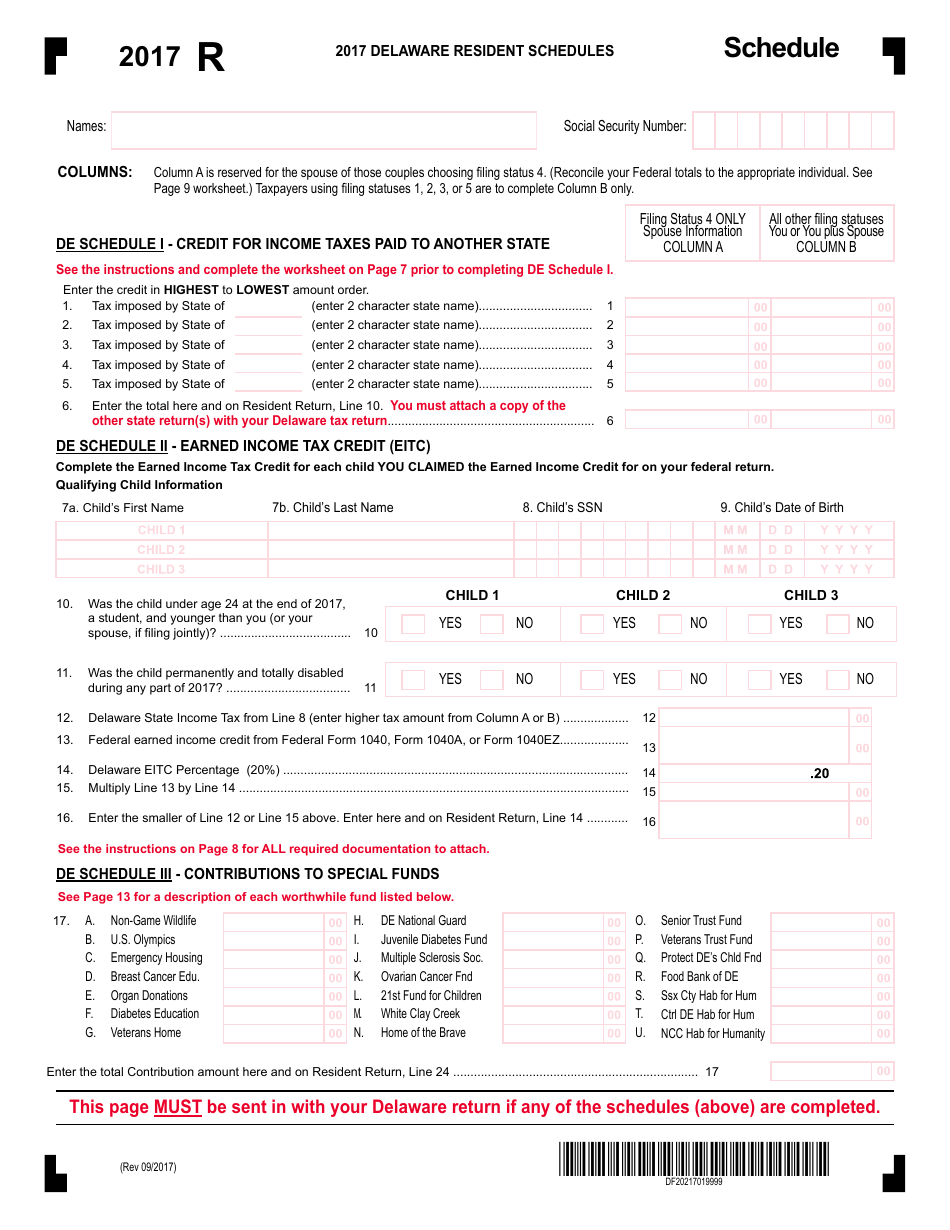

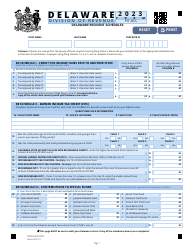

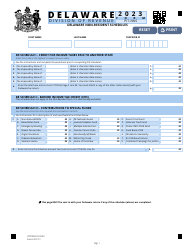

Q: Are there any additional forms or schedules that need to be included with Form 200-01?

A: Depending on your individual tax situation, you may need to include additional forms or schedules with Form 200-01. Be sure to carefully review the instructions provided with the form.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Delaware Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 200-01 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance.