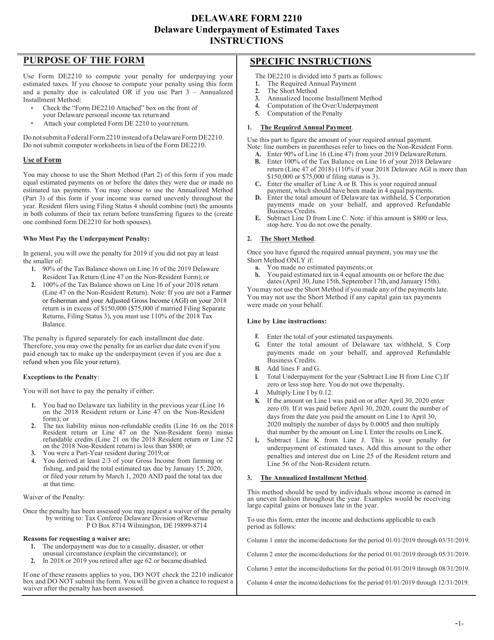

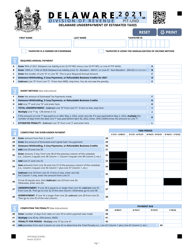

Instructions for Form DE2210 Delaware Underpayment of Estimated Taxes - Delaware

This document contains official instructions for Form DE2210 , Delaware Underpayment of Estimated Taxes - a form released and collected by the Delaware Department of Finance - Division of Revenue.

FAQ

Q: What is Form DE2210?

A: Form DE2210 is the Delaware Underpayment of Estimated Taxes form.

Q: When should I use Form DE2210?

A: You should use Form DE2210 if you underpaid your estimated taxes in Delaware.

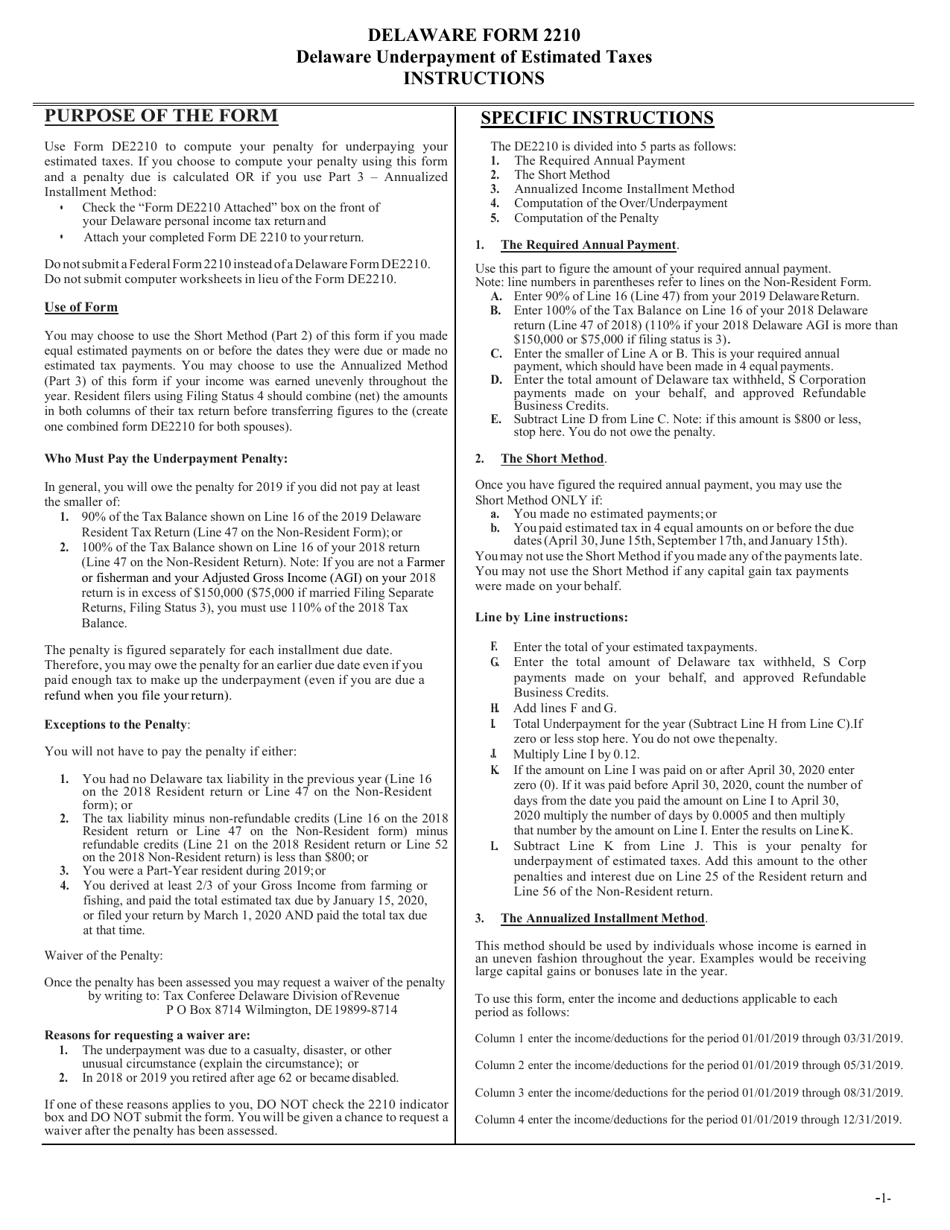

Q: What information do I need to complete Form DE2210?

A: You will need information about your estimated tax payments and the dates they were made.

Q: Are there any penalties for underpaying estimated taxes in Delaware?

A: Yes, there may be penalties for underpaying estimated taxes. Refer to the instructions on Form DE2210 for more information.

Q: Are there any exceptions or exemptions to the underpayment penalties?

A: Yes, there are exceptions and exemptions to the underpayment penalties. Refer to the instructions on Form DE2210 for more information.

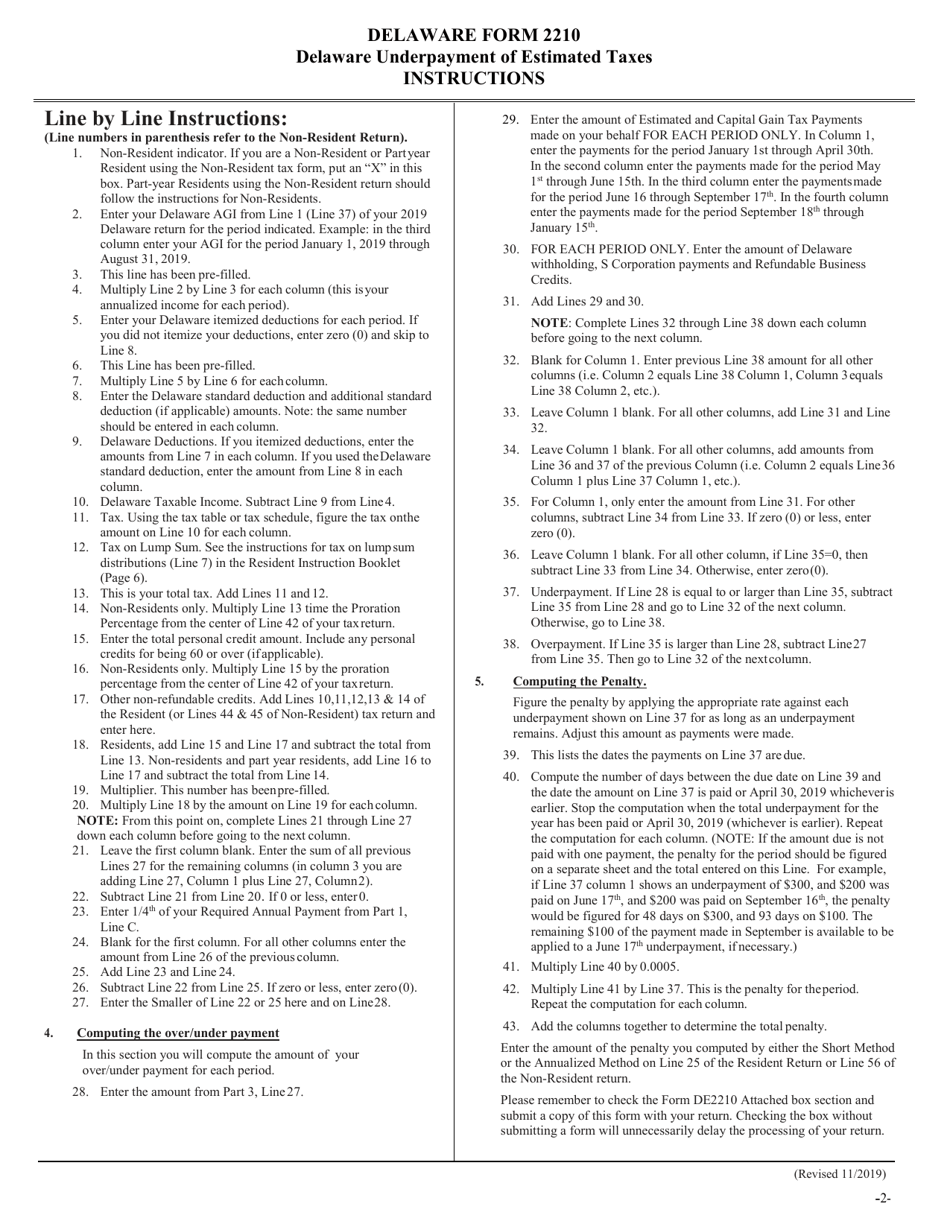

Q: Is Form DE2210 only for individuals?

A: No, Form DE2210 can be used by both individuals and businesses in Delaware.

Q: Can I amend my Form DE2210 if I made a mistake?

A: Yes, you can amend your Form DE2210 if you made a mistake. File an amended Form DE2210 to correct any errors.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Delaware Department of Finance - Division of Revenue.