This version of the form is not currently in use and is provided for reference only. Download this version of

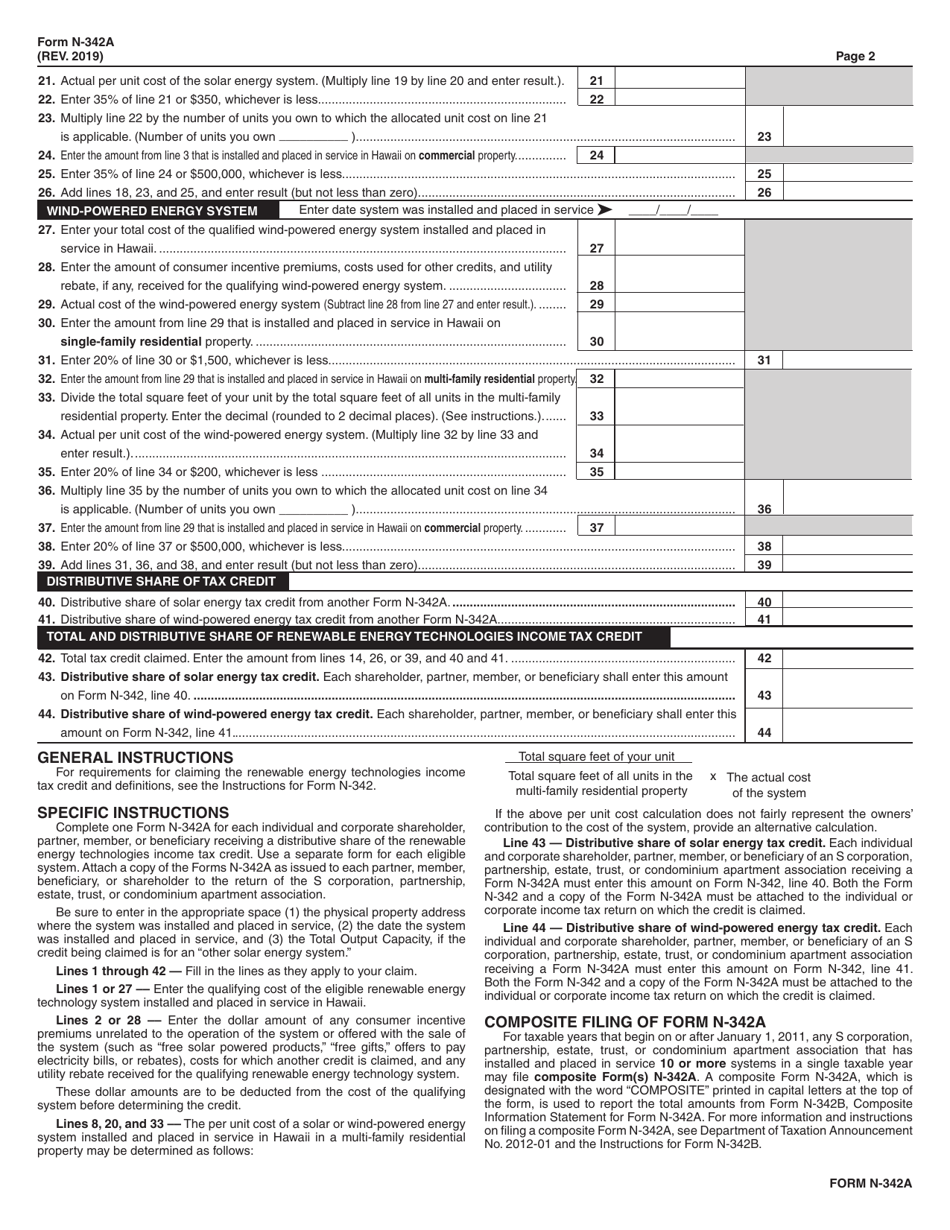

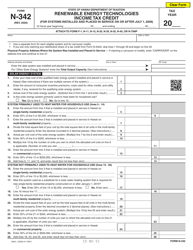

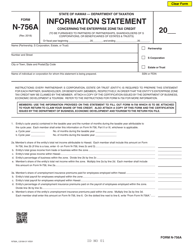

Form N-342A

for the current year.

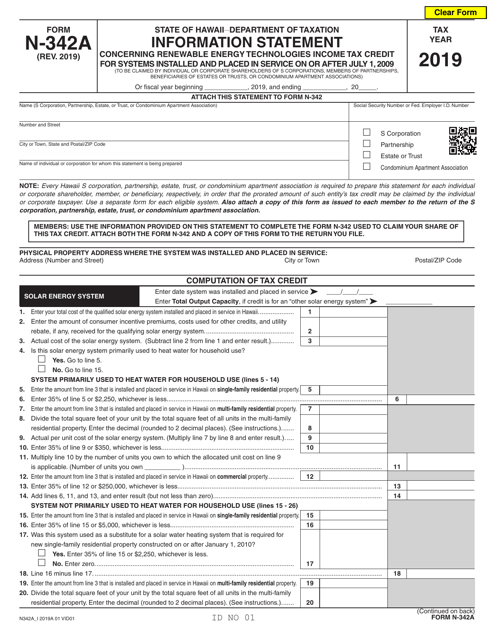

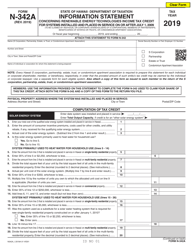

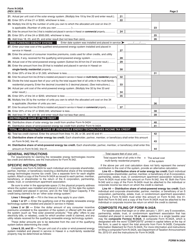

Form N-342A Information Statement Concerning Renewable Energy Technologies Income Tax Credit for Systems Installed and Place in Service on or After July 1, 2009 - Hawaii

What Is Form N-342A?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-342A?

A: Form N-342A is an Information Statement concerning the Renewable Energy Technologies Income Tax Credit.

Q: What does Form N-342A allow for?

A: Form N-342A allows individuals to claim an income tax credit for renewable energy systems installed and placed in service in Hawaii.

Q: When does Form N-342A apply?

A: Form N-342A applies to systems installed and placed in service on or after July 1, 2009.

Q: What is the purpose of the Renewable Energy Technologies Income Tax Credit?

A: The purpose of the credit is to encourage the use of renewable energy sources in Hawaii.

Q: What is the deadline for filing Form N-342A?

A: The deadline for filing Form N-342A is the same as the deadline for filing the individual income tax return, usually April 20.

Q: What information is required on Form N-342A?

A: The form requires information about the taxpayer, their renewable energy system, and the expenses incurred.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-342A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.