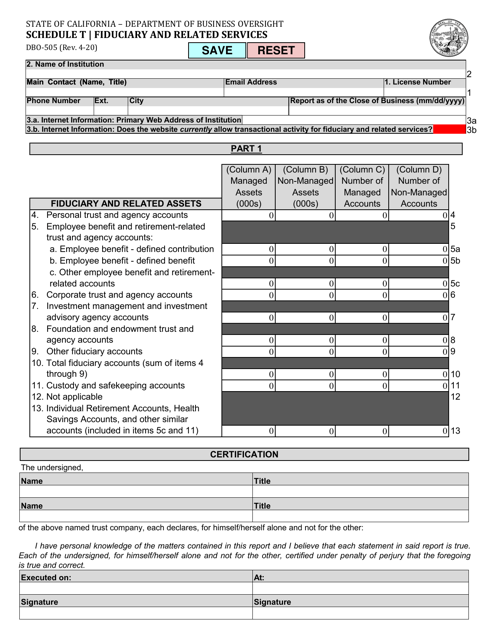

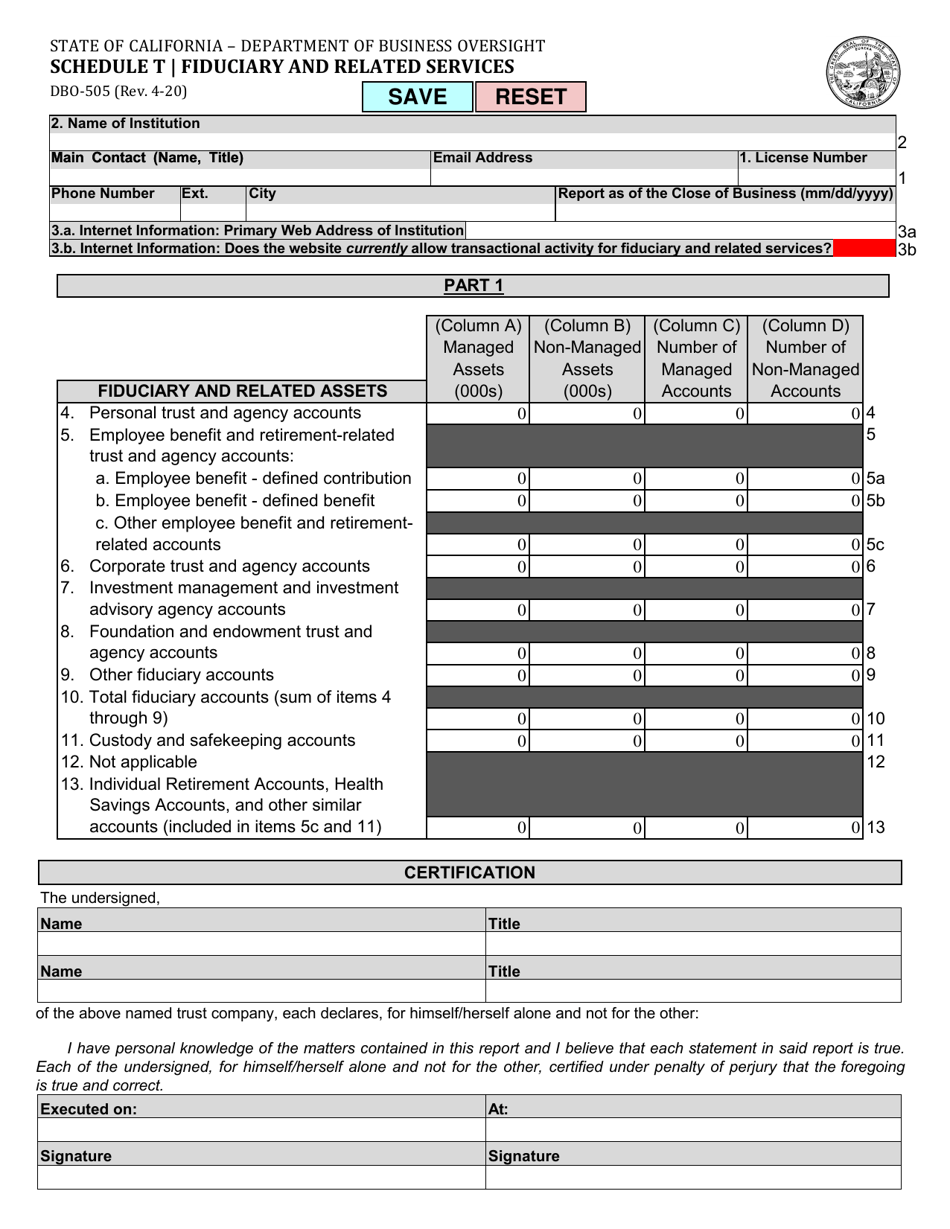

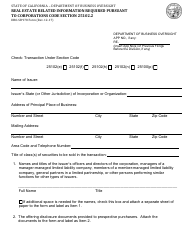

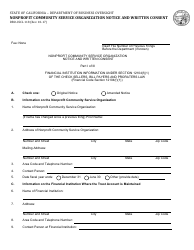

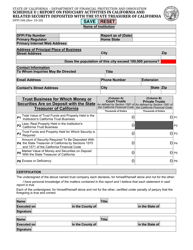

Form DBO-505 Schedule T Fiduciary and Related Services - California

What Is Form DBO-505 Schedule T?

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DBO-505 Schedule T?

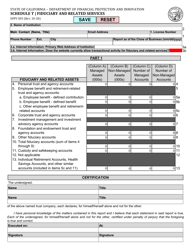

A: Form DBO-505 Schedule T is a form used in California for reporting fiduciary and related services.

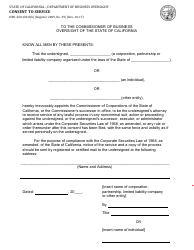

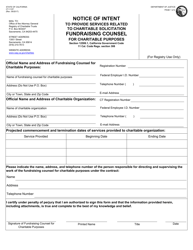

Q: Who is required to file Form DBO-505 Schedule T?

A: Fiduciaries and entities providing fiduciary and related services in California are required to file Form DBO-505 Schedule T.

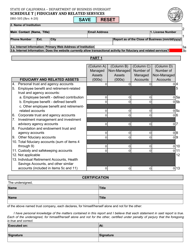

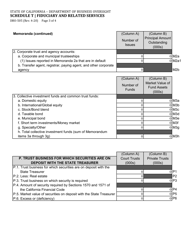

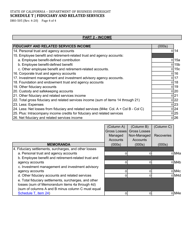

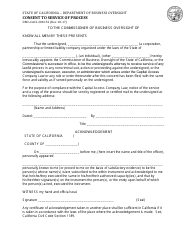

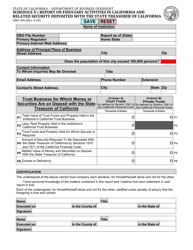

Q: What information is required on Form DBO-505 Schedule T?

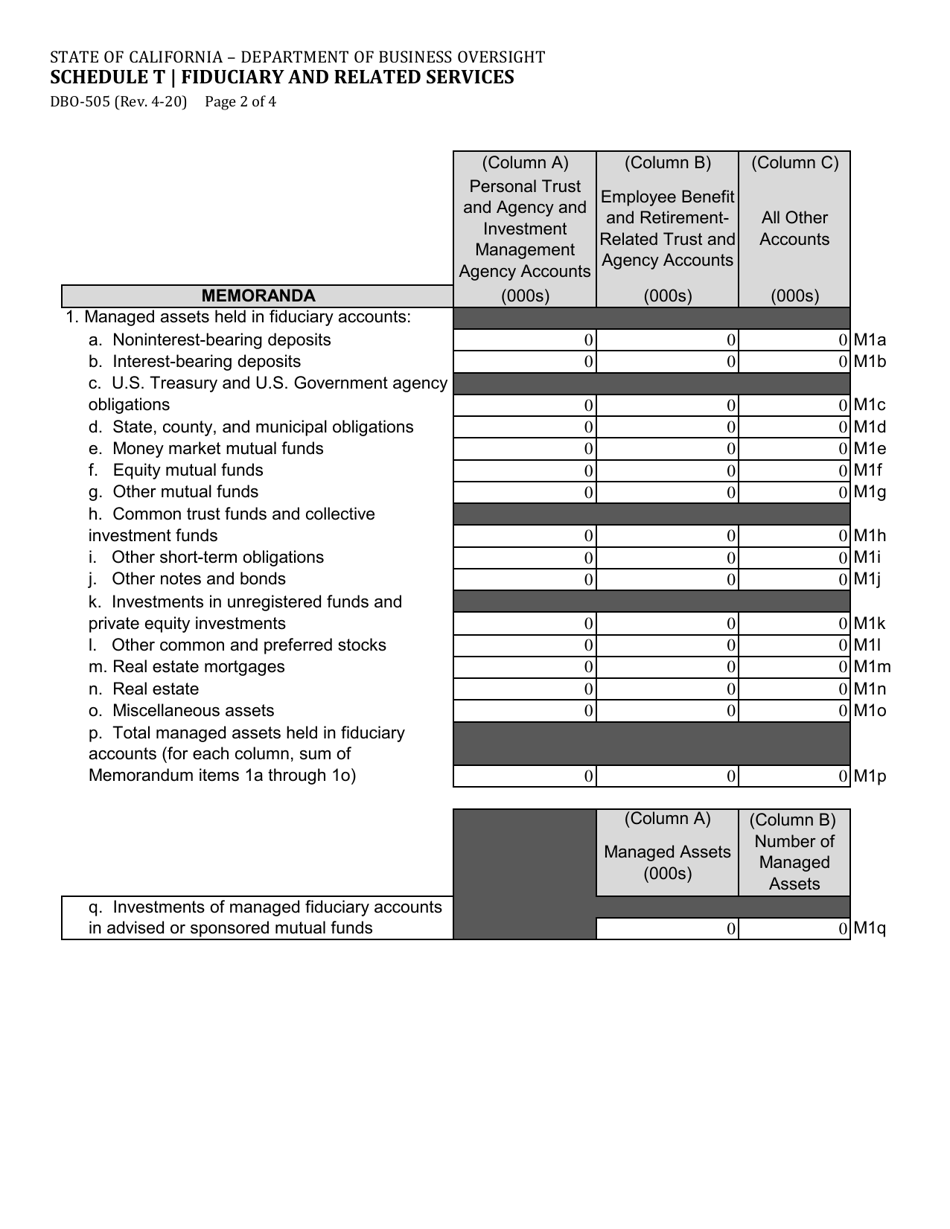

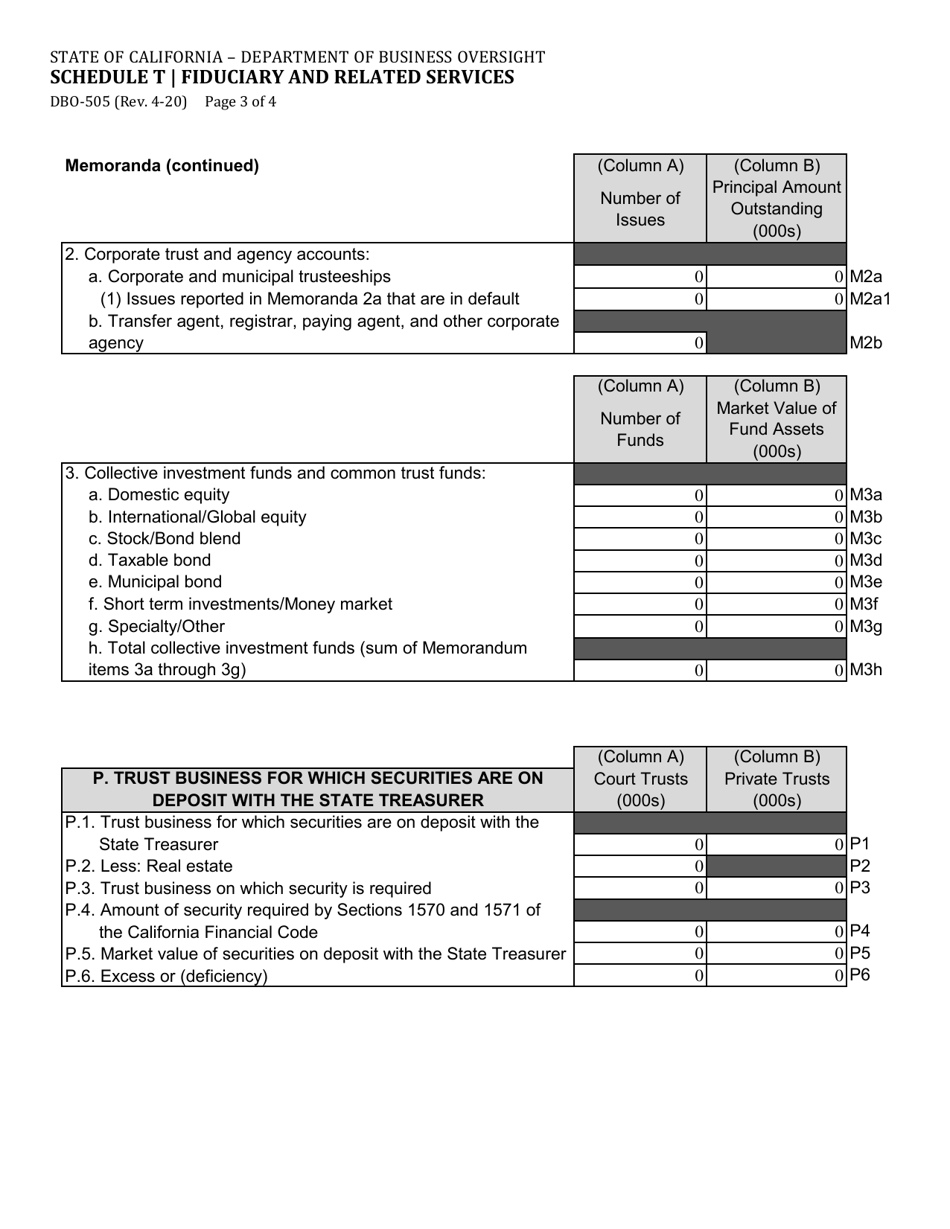

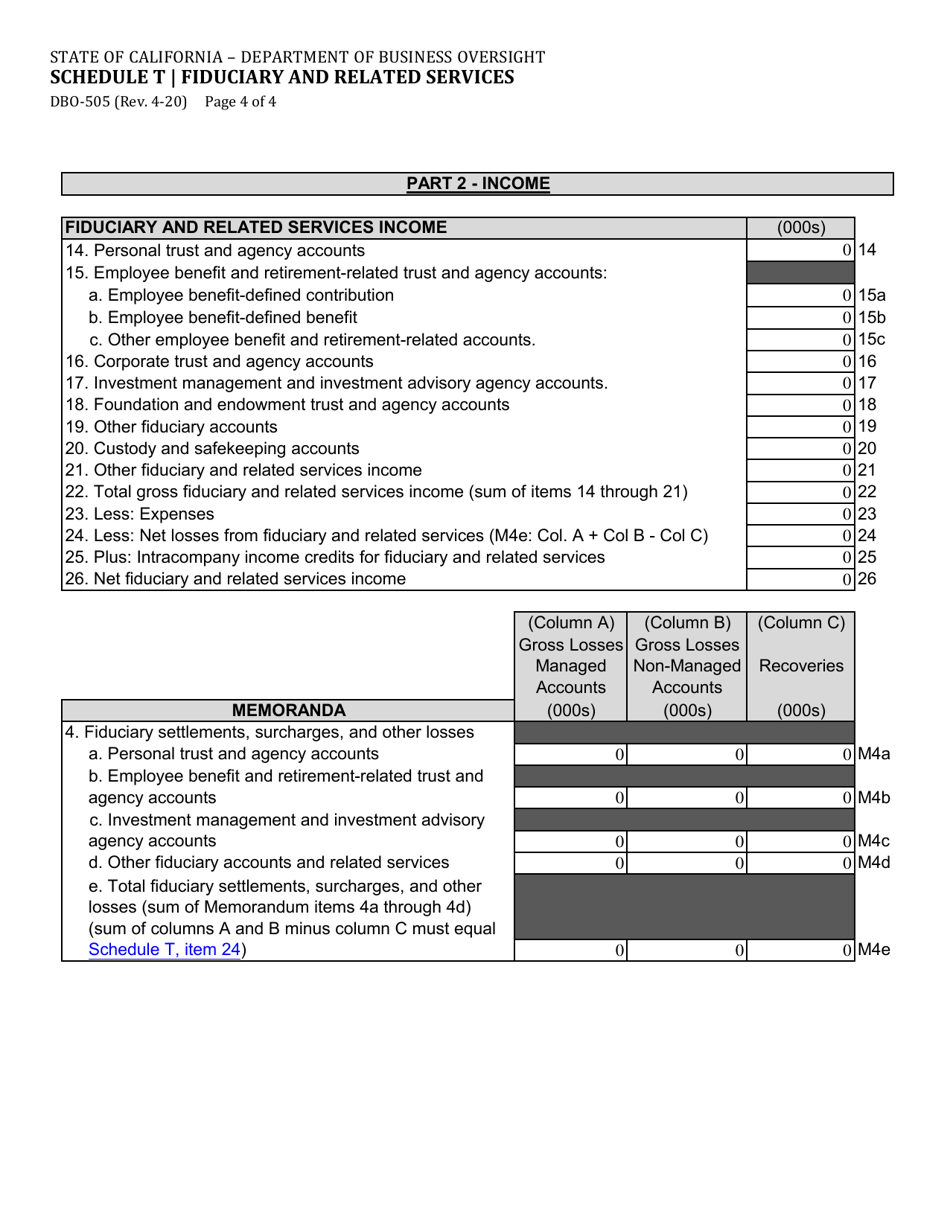

A: Form DBO-505 Schedule T requires information about the fiduciary and related services provided, such as the type of services, number of accounts, and fees received.

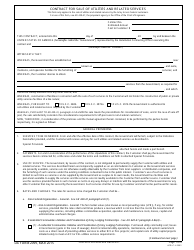

Q: When is Form DBO-505 Schedule T due?

A: Form DBO-505 Schedule T is generally due on or before March 31st of each year.

Q: Are there any penalties for not filing Form DBO-505 Schedule T?

A: Yes, there may be penalties for failure to file Form DBO-505 Schedule T, including monetary fines and other enforcement actions.

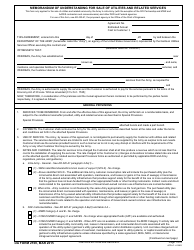

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DBO-505 Schedule T by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.