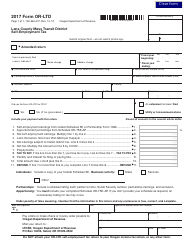

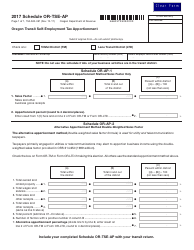

This version of the form is not currently in use and is provided for reference only. Download this version of

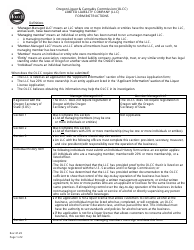

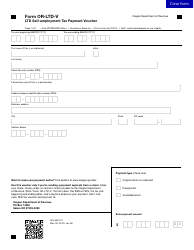

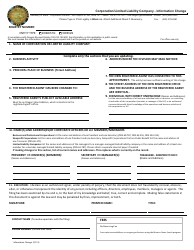

Instructions for Form OR-LTD, 150-560-001

for the current year.

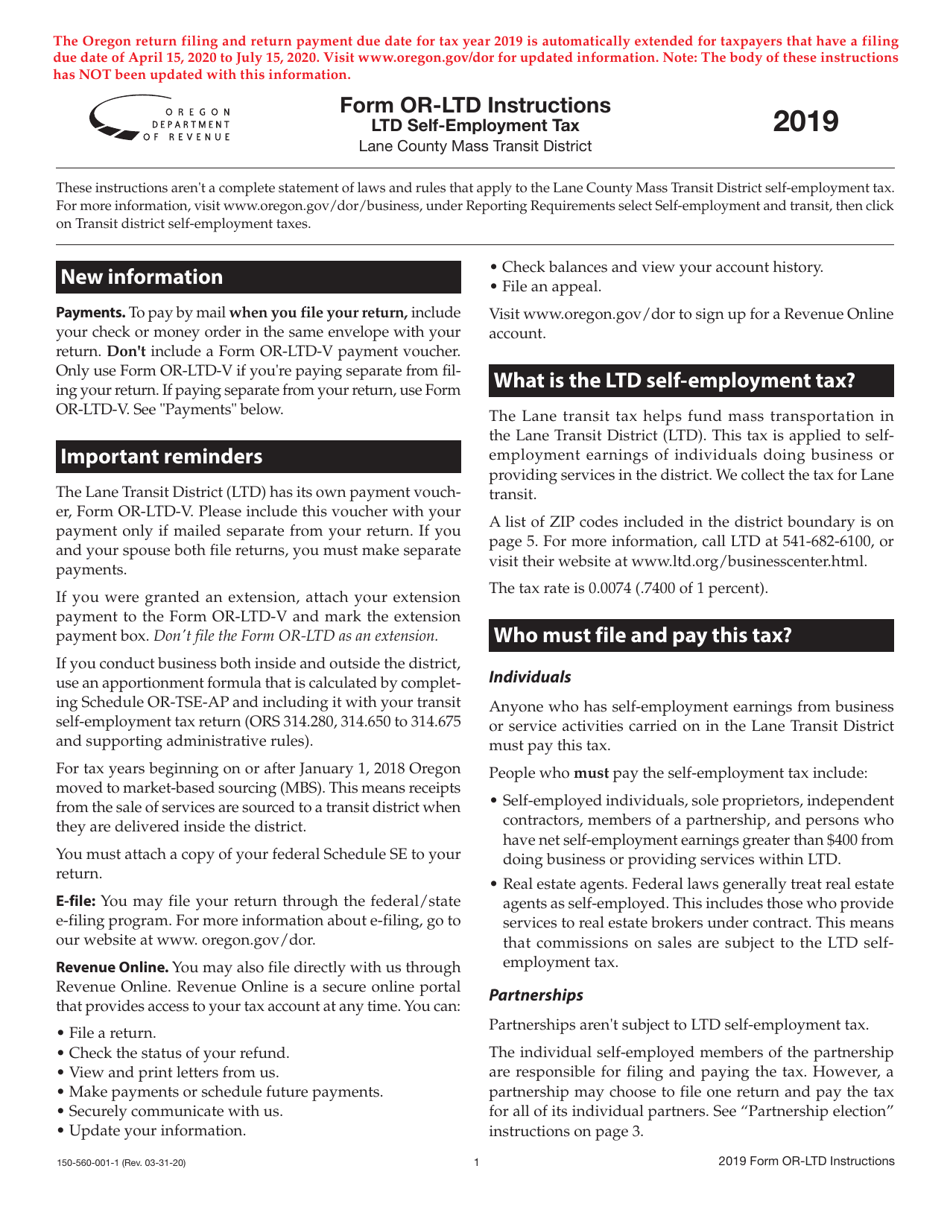

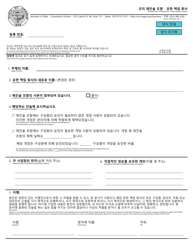

Instructions for Form OR-LTD, 150-560-001 Lane Transit District Self-employment Tax - Oregon

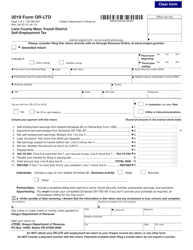

This document contains official instructions for Form OR-LTD , and Form 150-560-001 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-LTD (150-560-001) is available for download through this link.

FAQ

Q: What is Form OR-LTD?

A: Form OR-LTD is a tax form for reporting self-employment income to the Lane Transit District in Oregon.

Q: Who needs to file Form OR-LTD?

A: Anyone with self-employment income who operates within the Lane Transit District in Oregon needs to file Form OR-LTD.

Q: What is self-employment tax?

A: Self-employment tax is a tax on income for individuals who work for themselves and are not considered employees.

Q: How do I fill out Form OR-LTD?

A: You can fill out Form OR-LTD by providing your personal information, income details, and calculating and reporting the amount of self-employment tax owed.

Q: When is the deadline for filing Form OR-LTD?

A: The deadline for filing Form OR-LTD is typically April 15th of each year, or the next business day if it falls on a weekend or holiday.

Q: What happens if I don't file Form OR-LTD?

A: If you fail to file Form OR-LTD, you may face penalties or fines from the Lane Transit District in Oregon.

Q: Is self-employment tax deductible?

A: Yes, self-employment tax is deductible as a business expense when calculating your overall tax liability.

Q: Can I e-file Form OR-LTD?

A: Yes, you can e-file Form OR-LTD if you prefer the convenience and speed of electronic filing.

Q: Do I need to include proof of income with Form OR-LTD?

A: You do not need to include proof of income with Form OR-LTD, but you should keep records in case of an audit.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.