This version of the form is not currently in use and is provided for reference only. Download this version of

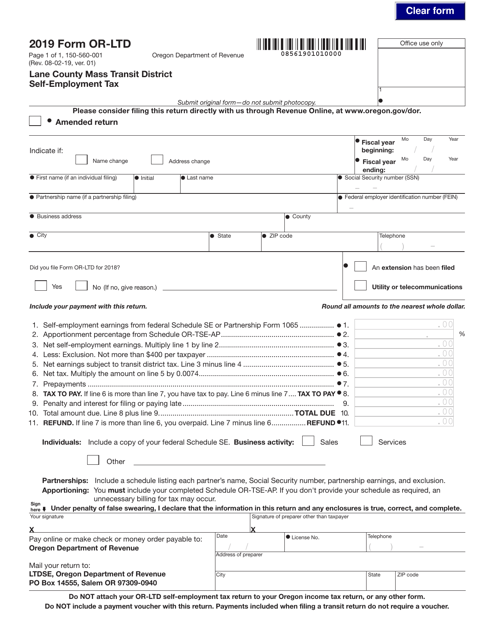

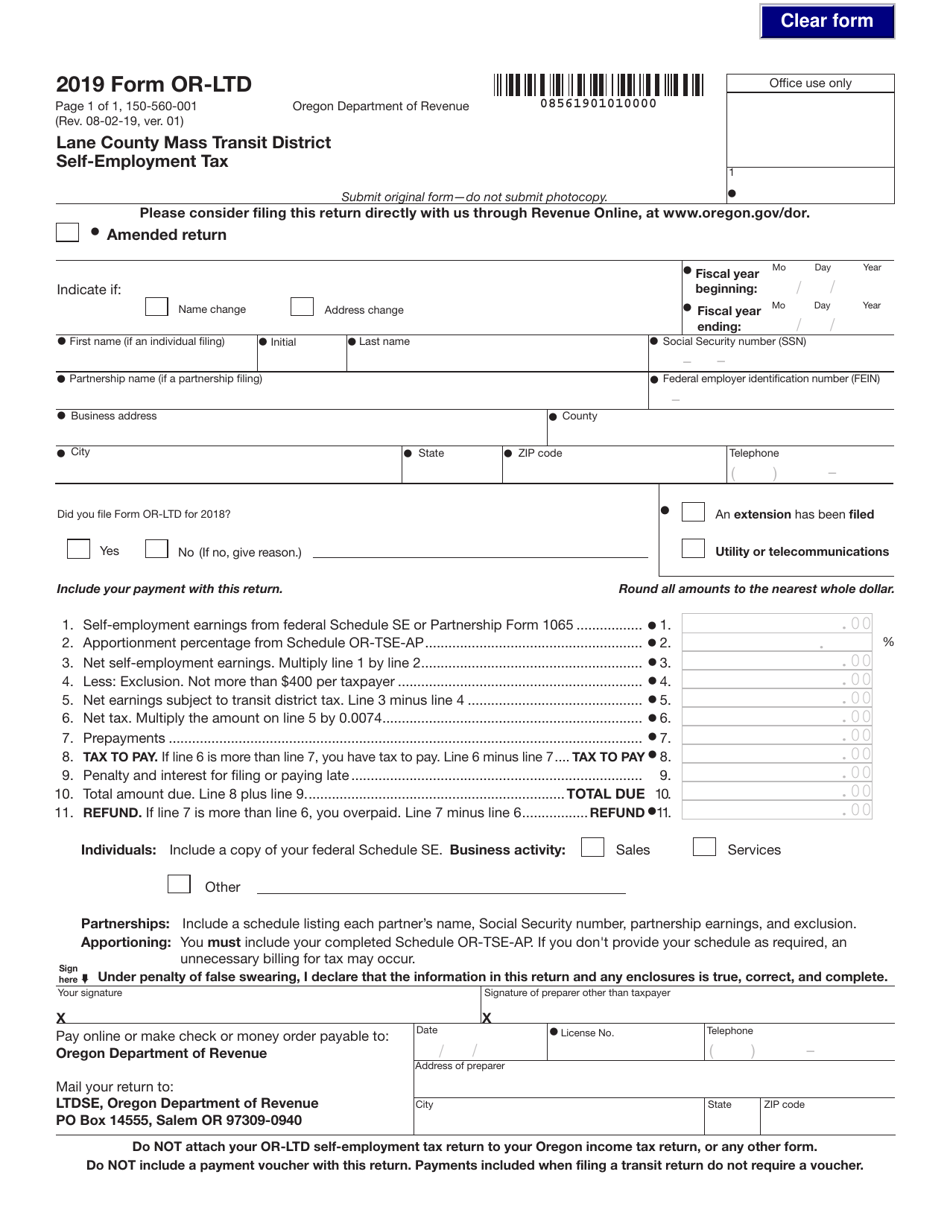

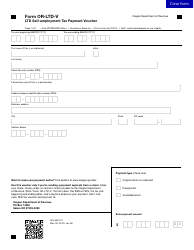

Form OR-LTD (150-560-001)

for the current year.

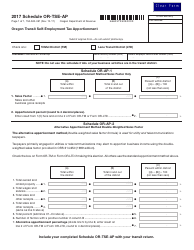

Form OR-LTD (150-560-001) Lane County Mass Transit District Self-employment Tax - Oregon

What Is Form OR-LTD (150-560-001)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-LTD (150-560-001)?

A: Form OR-LTD (150-560-001) is a tax form used for reporting self-employment tax for the Lane County Mass Transit District in Oregon.

Q: What is self-employment tax?

A: Self-employment tax is a tax imposed on individuals who work for themselves and are not typically covered by an employer's payroll taxes.

Q: Who needs to file Form OR-LTD (150-560-001)?

A: Individuals engaged in self-employment activities within the Lane County Mass Transit District in Oregon need to file Form OR-LTD (150-560-001).

Q: What is the Lane County Mass Transit District?

A: The Lane County Mass Transit District is a public transportation agency that provides bus service in Lane County, Oregon.

Q: What is the deadline for filing Form OR-LTD (150-560-001)?

A: The deadline for filing Form OR-LTD (150-560-001) is typically April 15th of the following year.

Q: Are there any penalties for late filing of Form OR-LTD (150-560-001)?

A: Yes, there may be penalties for late filing, so it is important to submit the form by the deadline.

Q: Is self-employment tax deductible?

A: Yes, self-employment tax is generally deductible as a business expense on your federal income tax return.

Q: Are there any exemptions from self-employment tax?

A: There are certain exemptions and deductions available that may reduce the amount of self-employment tax you owe. Consult a tax professional for more information.

Form Details:

- Released on August 2, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-LTD (150-560-001) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.