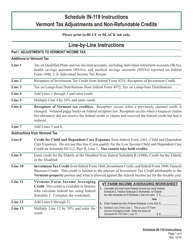

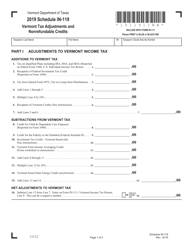

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Schedule IN-112

for the current year.

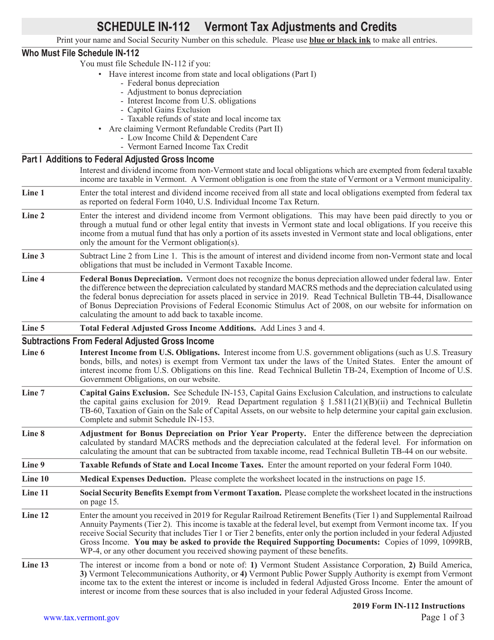

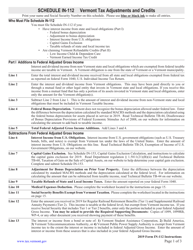

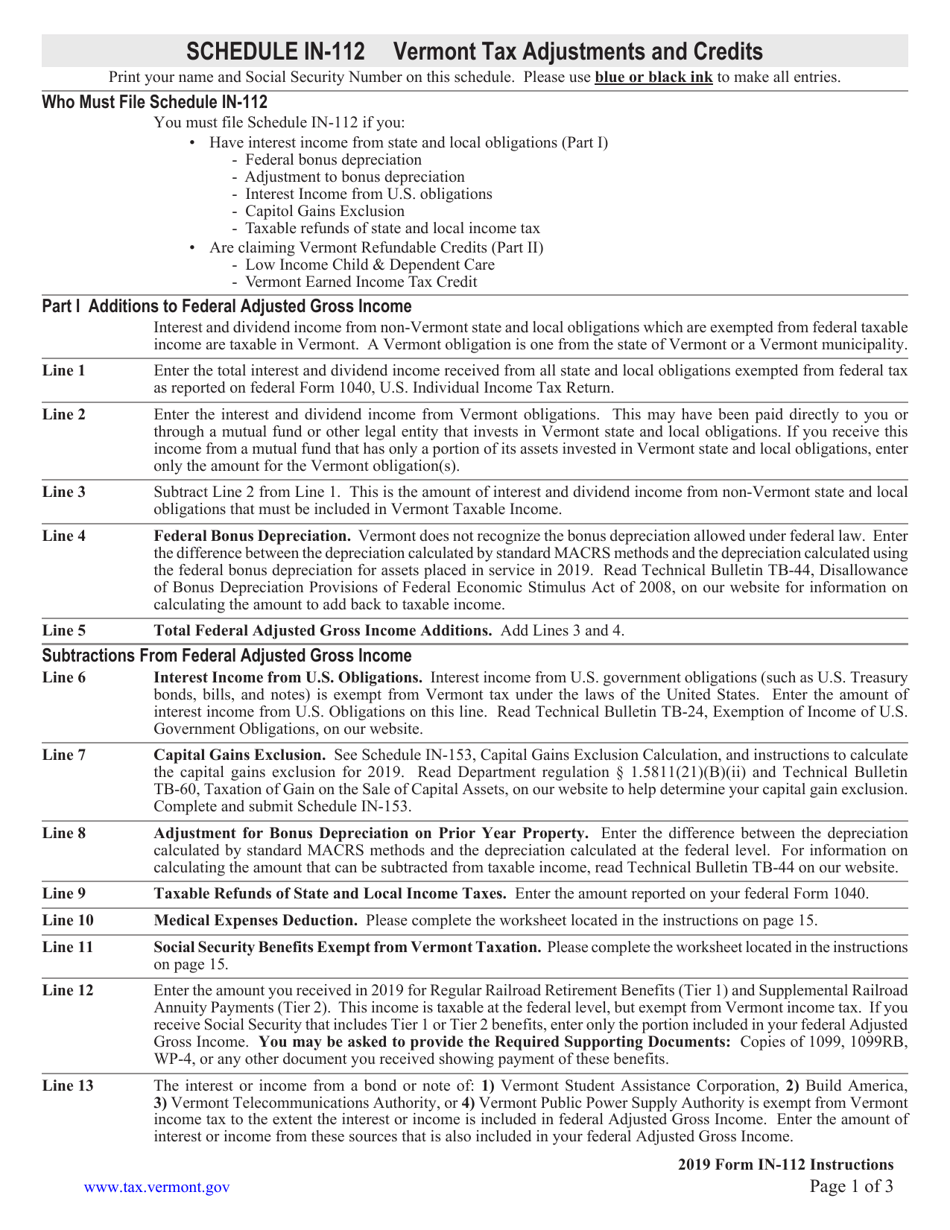

Instructions for Schedule IN-112 Vermont Tax Adjustments and Credits - Vermont

This document contains official instructions for Schedule IN-112 , Vermont Tax Adjustments and Credits - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule IN-112?

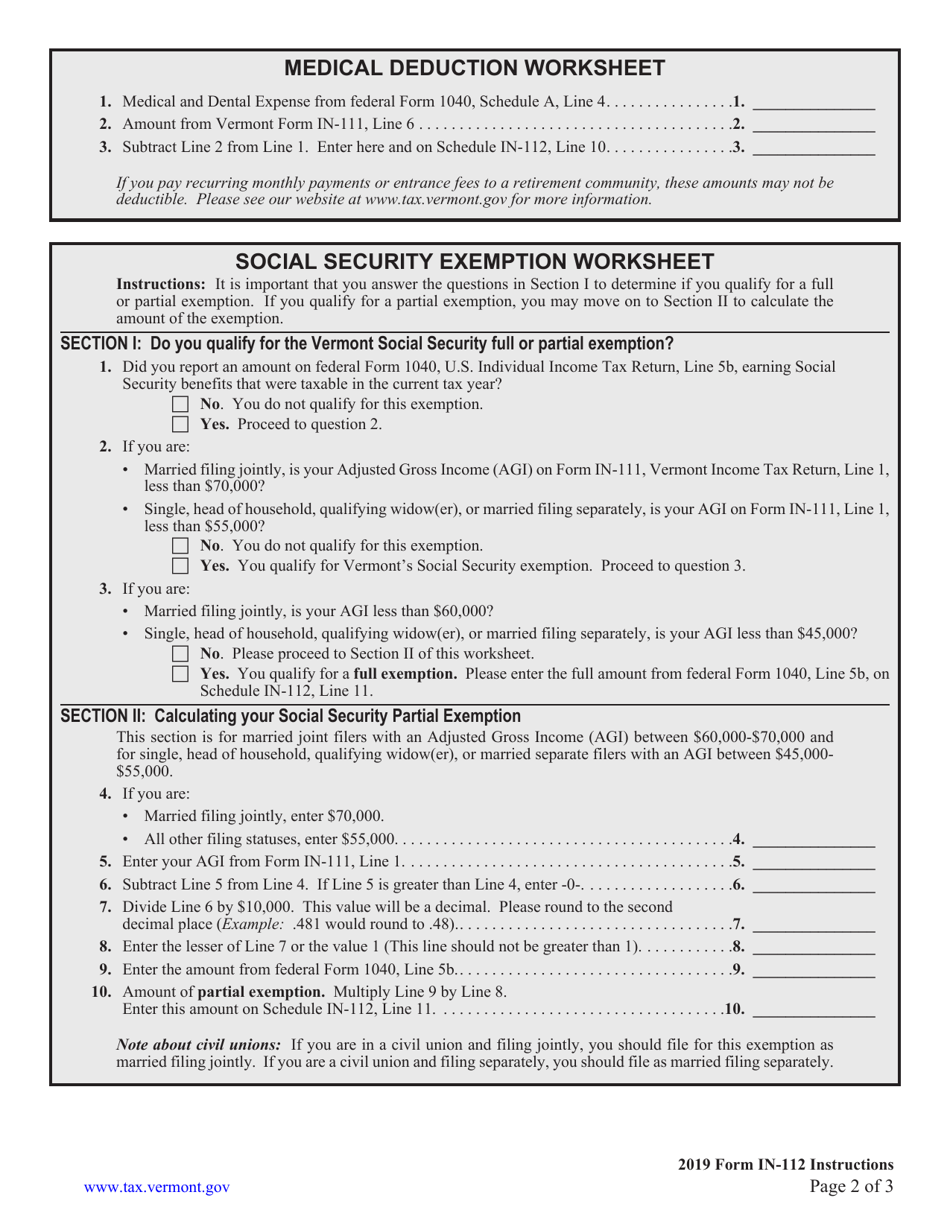

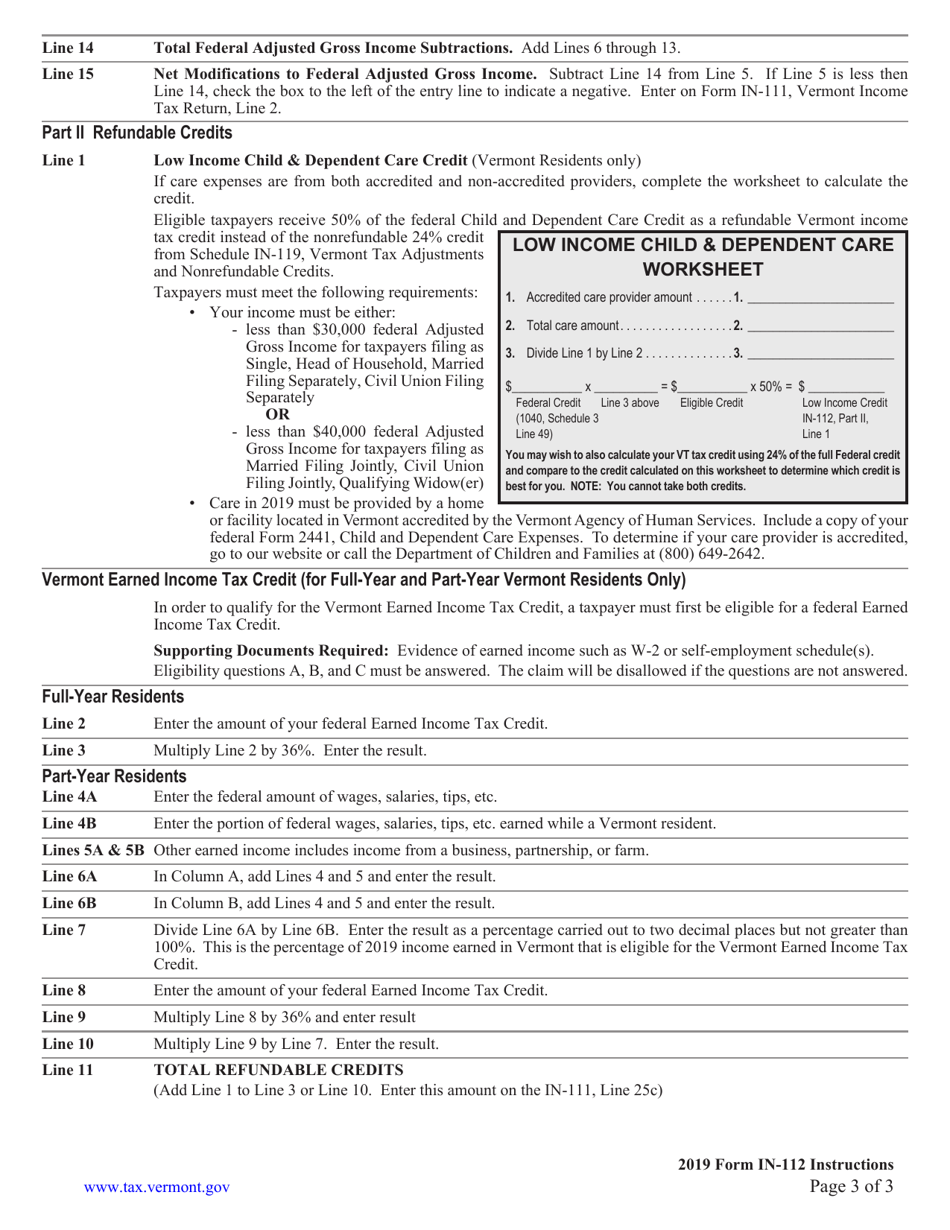

A: Schedule IN-112 is a form used to calculate and claim adjustments and credits on your Vermont state tax return.

Q: What types of adjustments and credits can be claimed on Schedule IN-112?

A: You can claim adjustments and credits related to various expenses such as education expenses, retirement contributions, health insurance premiums, and child care expenses.

Q: Do I need to fill out Schedule IN-112 if I don't have any adjustments or credits to claim?

A: If you don't have any adjustments or credits to claim, you don't need to fill out Schedule IN-112.

Q: How should I complete Schedule IN-112?

A: You should follow the instructions provided on the form and enter the required information accurately. If you are unsure, you may consider seeking assistance from a tax professional.

Q: When is the deadline to file Schedule IN-112?

A: Schedule IN-112 is generally due on the same date as your Vermont state tax return, which is typically April 15th. However, it is recommended to check the current year's tax filing deadlines.

Q: Can I e-file Schedule IN-112?

A: Yes, you can e-file Schedule IN-112 if you are filing your Vermont state tax return electronically.

Q: Is there a fee to file Schedule IN-112?

A: No, there is no fee to file Schedule IN-112. However, you may need to pay any additional taxes owed based on the adjustments and credits claimed.

Q: What supporting documents do I need to include with Schedule IN-112?

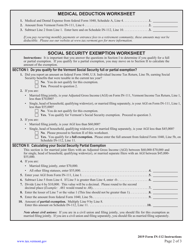

A: You may need to attach copies of relevant documentation such as receipts, forms, or statements to support the adjustments and credits claimed on Schedule IN-112. Refer to the instructions on the form for specific requirements.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.