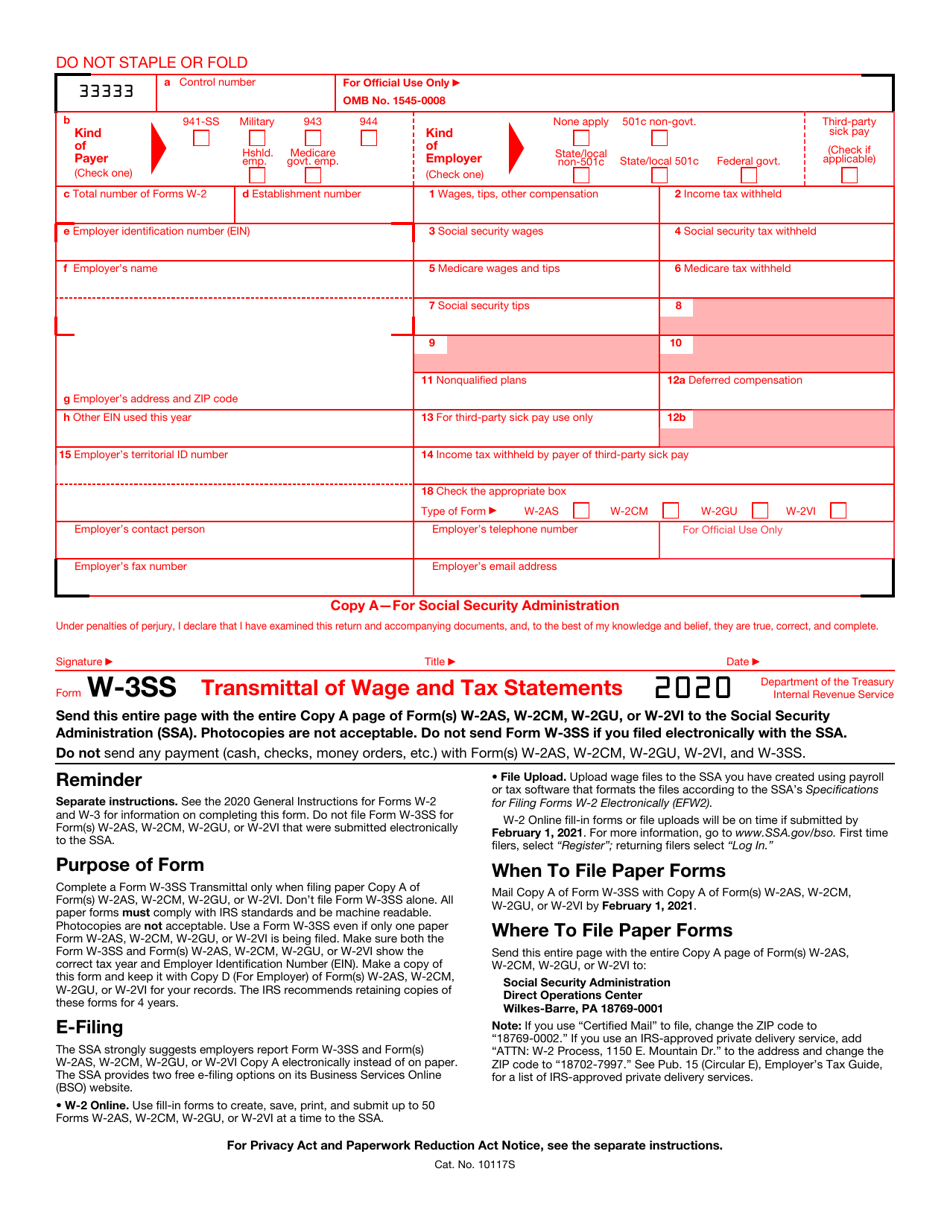

This version of the form is not currently in use and is provided for reference only. Download this version of

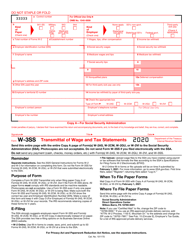

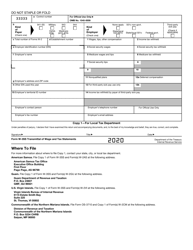

IRS Form W-3SS

for the current year.

IRS Form W-3SS Transmittal of Wage and Tax Statements

What Is IRS Form W-3SS?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

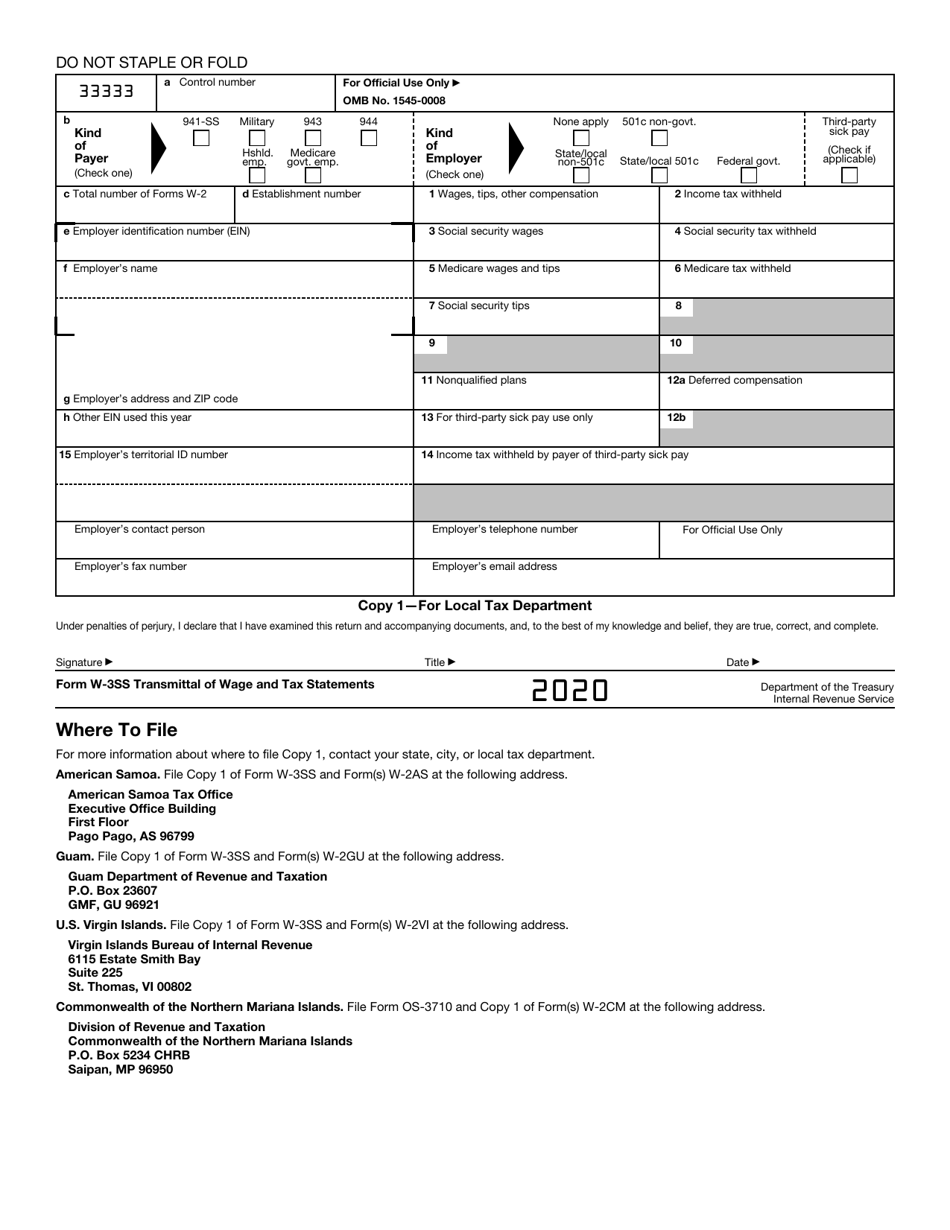

Q: What is IRS Form W-3SS?

A: IRS Form W-3SS is a transmittal form used to report wage and tax statements to the Social Security Administration (SSA).

Q: Who needs to file IRS Form W-3SS?

A: Employers who are required to file wage and tax statements (Forms W-2) for their employees need to file IRS Form W-3SS.

Q: What is the purpose of IRS Form W-3SS?

A: The purpose of IRS Form W-3SS is to summarize and transmit Forms W-2 to the SSA, providing important wage and tax information for employees.

Q: When is IRS Form W-3SS due?

A: IRS Form W-3SS is generally due by the last day of February, or by the last day of March if filed electronically.

Q: What should I do if I made an error on IRS Form W-3SS?

A: If you made an error on IRS Form W-3SS, you should file a corrected form as soon as possible to ensure accurate reporting.

Q: Do I need to send a copy of IRS Form W-3SS to my employees?

A: No, you do not need to send a copy of IRS Form W-3SS to your employees. It is only for filing purposes with the SSA.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a printable version of IRS Form W-3SS through the link below or browse more documents in our library of IRS Forms.