This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8995-A

for the current year.

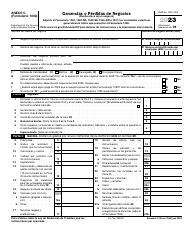

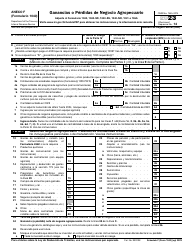

Instructions for IRS Form 8995-A Deduction for Qualified Business Income

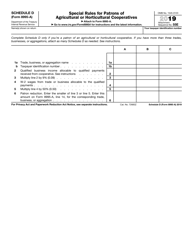

This document contains official instructions for IRS Form 8995-A , Deduction for Qualified Business Income - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8995-A Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 8995-A?

A: IRS Form 8995-A is a tax form used to calculate the deduction for qualified business income.

Q: Who uses Form 8995-A?

A: Form 8995-A is used by taxpayers who have qualified business income and are eligible for the deduction.

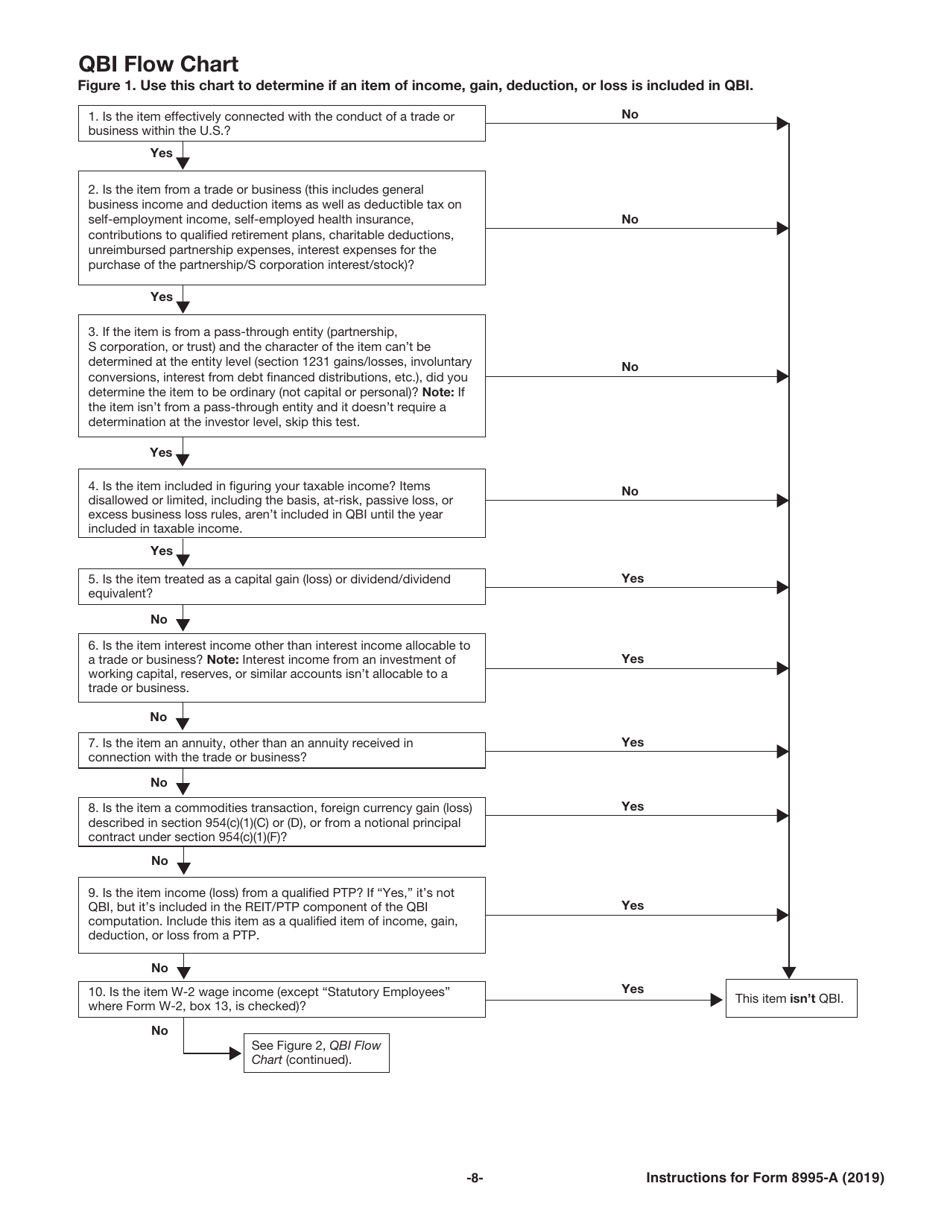

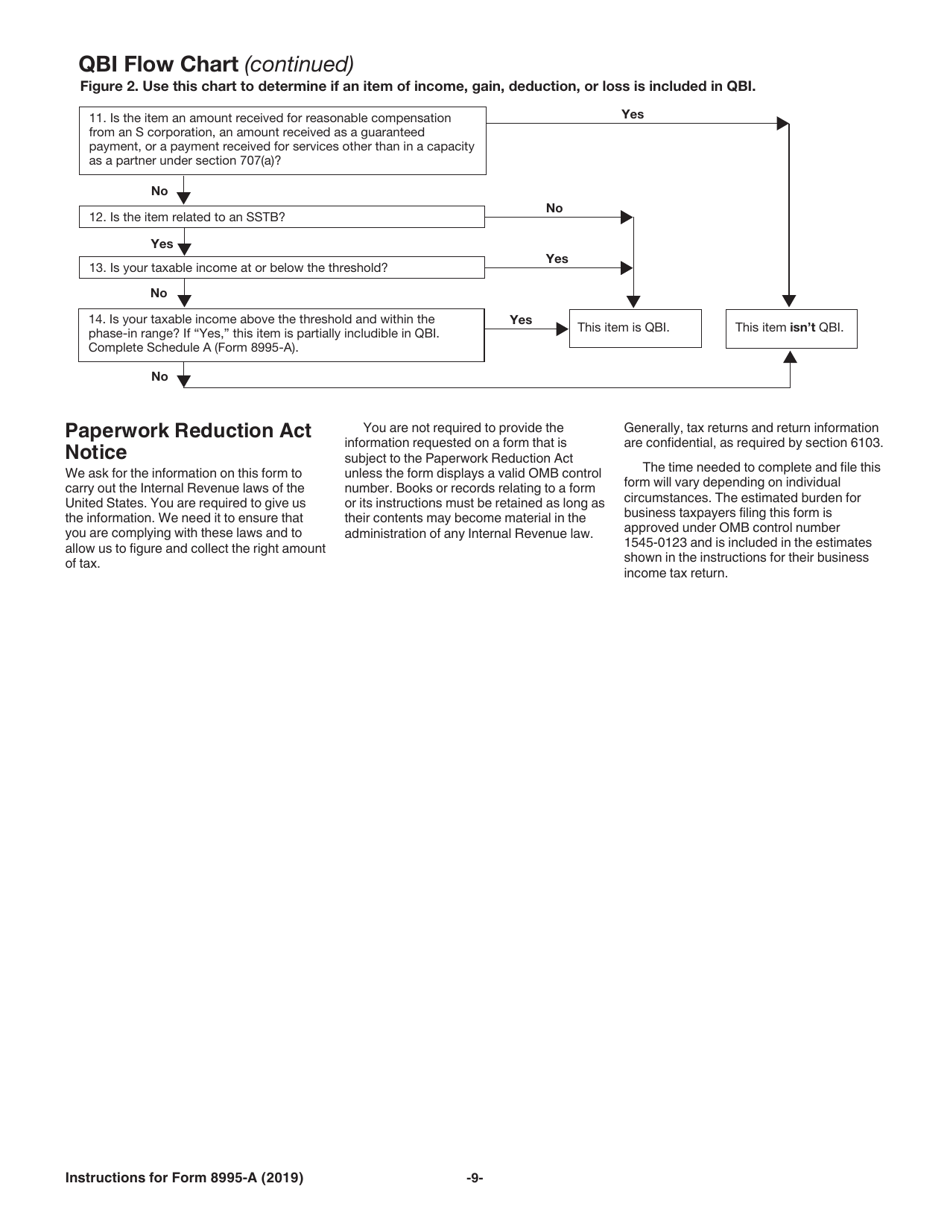

Q: What is qualified business income?

A: Qualified business income is the net income generated from a qualifying trade or business.

Q: What is the deduction for qualified business income?

A: The deduction for qualified business income allows eligible taxpayers to deduct up to 20% of their qualified business income.

Q: Are there any limitations to the deduction?

A: Yes, there are limitations based on the taxpayer's taxable income, type of business, and other factors.

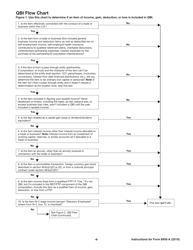

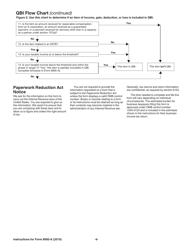

Q: How do I calculate the deduction using Form 8995-A?

A: Form 8995-A provides instructions and worksheets to calculate the deduction based on your specific circumstances.

Q: When is Form 8995-A due?

A: Form 8995-A is typically due on the same date as your individual income tax return, which is usually April 15th.

Q: Do I need to file Form 8995-A if I don't have qualified business income?

A: No, if you don't have qualified business income, you don't need to file Form 8995-A.

Q: Can I e-file Form 8995-A?

A: Yes, you can e-file Form 8995-A if you are filing your individual income tax return electronically.

Instruction Details:

- This 9-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.