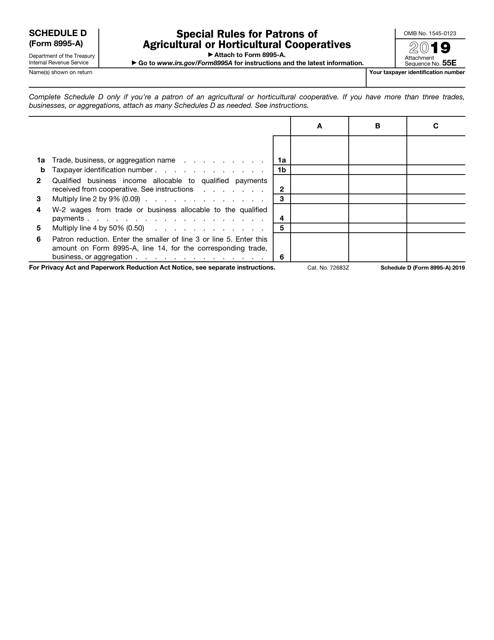

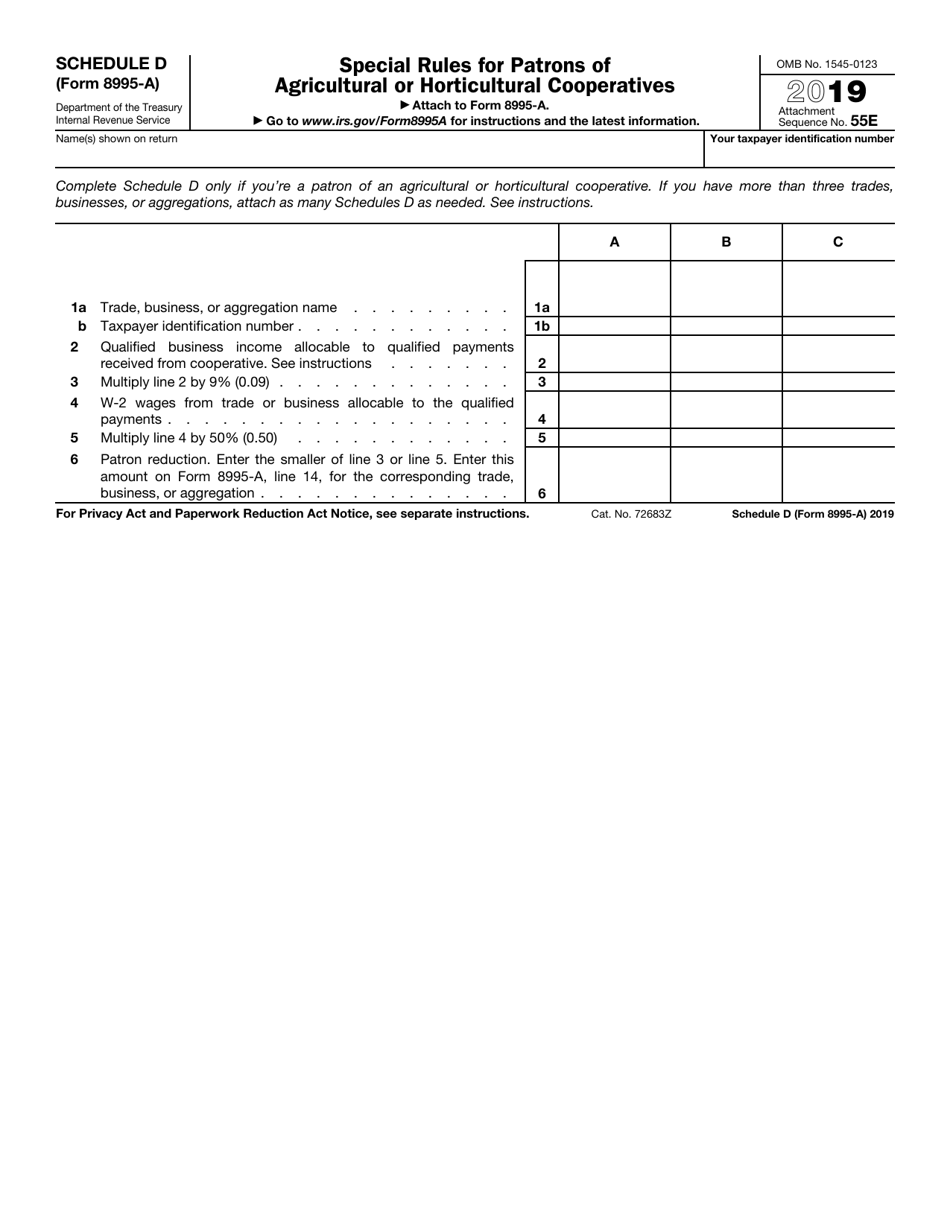

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8995-A Schedule D

for the current year.

IRS Form 8995-A Schedule D Special Rules for Patrons of Agricultural or Horticultural Cooperatives

What Is IRS Form 8995-A Schedule D?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 8995-A, Qualified Business Income Deduction. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8995-A?

A: IRS Form 8995-A is a schedule used to report special rules for patrons of agricultural or horticultural cooperatives.

Q: Who needs to file IRS Form 8995-A?

A: Individuals who are patrons of agricultural or horticultural cooperatives and meet certain criteria need to file IRS Form 8995-A.

Q: What are the special rules for patrons of agricultural or horticultural cooperatives?

A: The special rules include the deduction for qualified business income, qualified cooperative dividends, and the cooperative patron's adjusted basis in the cooperative.

Q: Are there any eligibility requirements to file IRS Form 8995-A?

A: Yes, individuals must meet certain criteria to be eligible to file IRS Form 8995-A as a patron of an agricultural or horticultural cooperative.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8995-A Schedule D through the link below or browse more documents in our library of IRS Forms.