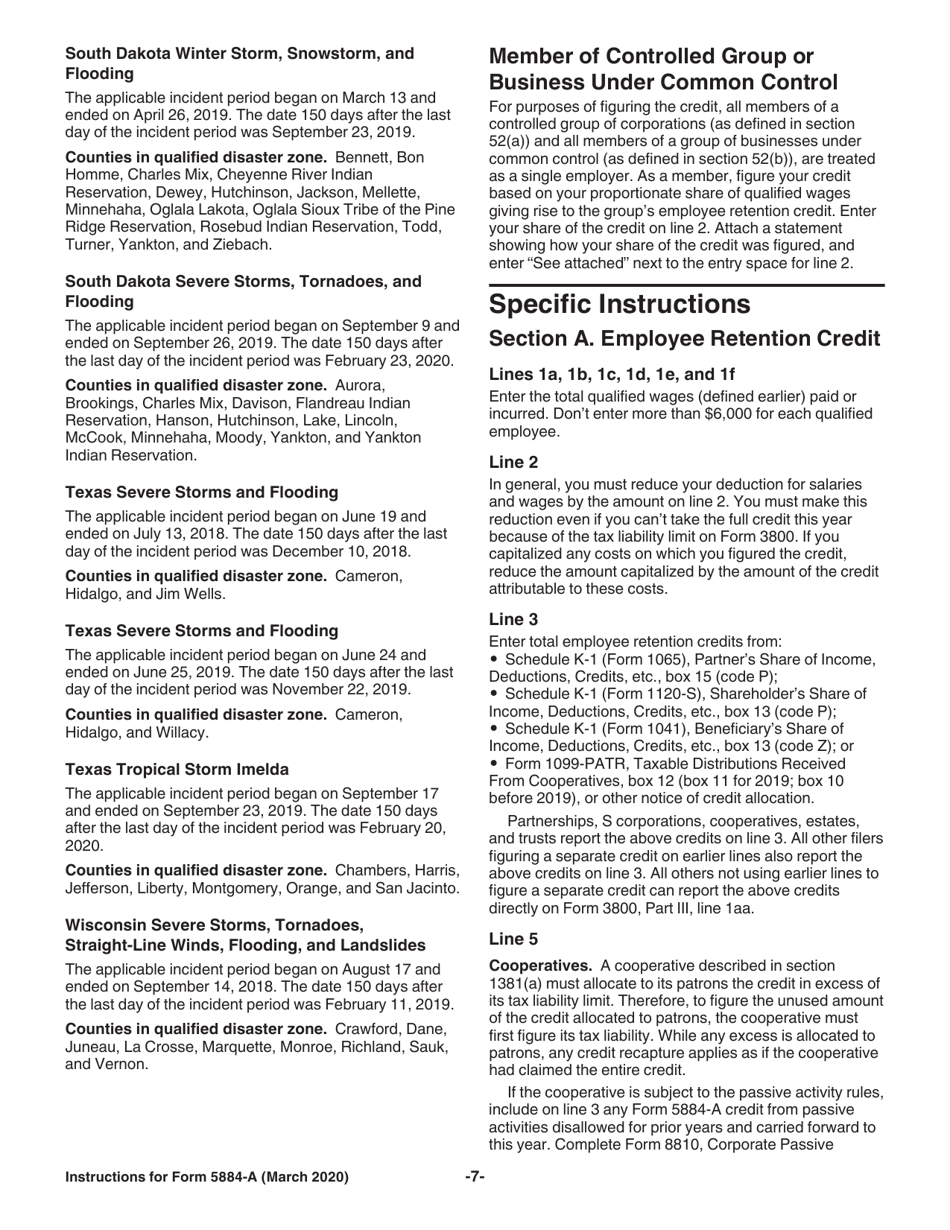

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 5884-A

for the current year.

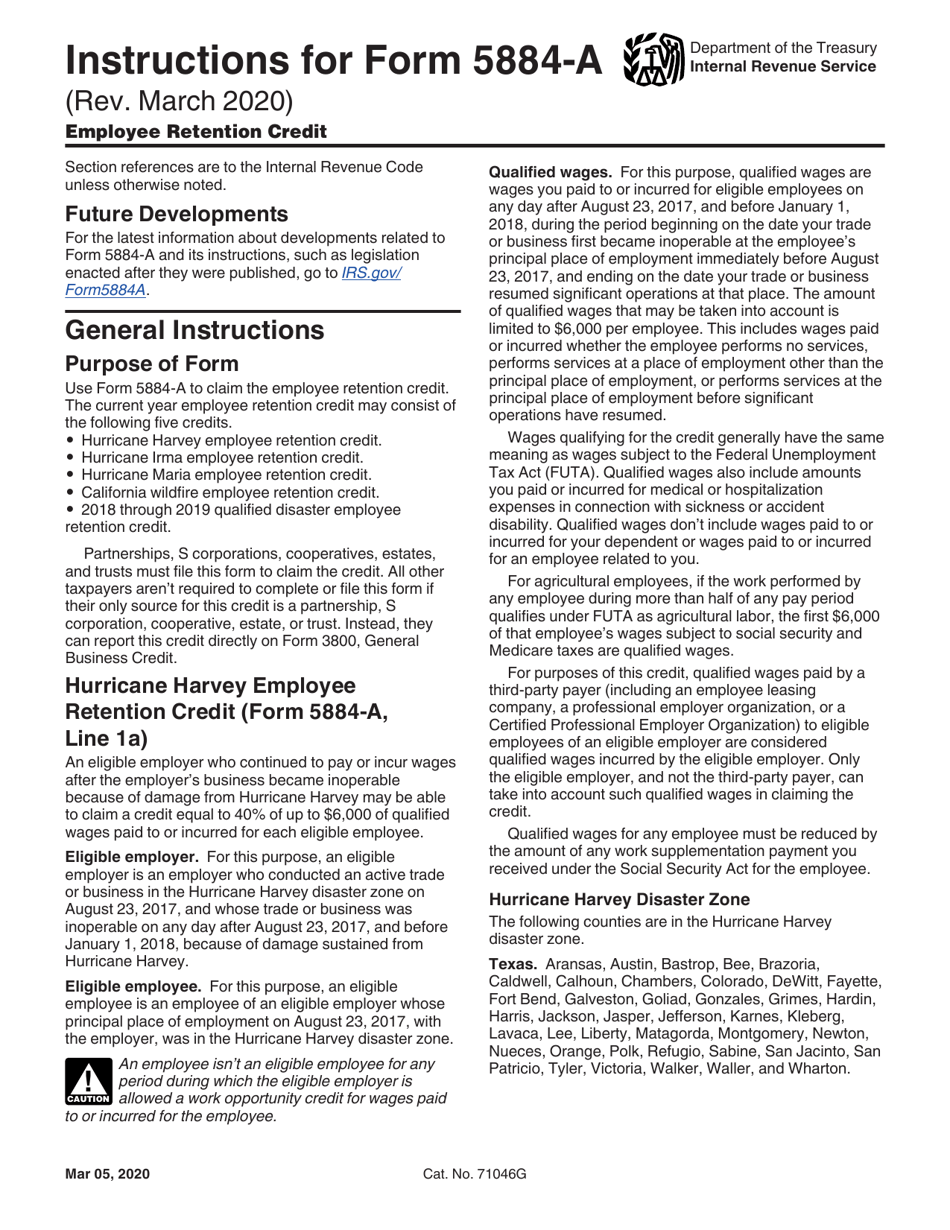

Instructions for IRS Form 5884-A Employee Retention Credit

This document contains official instructions for IRS Form 5884-A , Employee Retention Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 5884-A is available for download through this link.

FAQ

Q: What is IRS Form 5884-A?

A: IRS Form 5884-A is a form used to claim the Employee Retention Credit.

Q: Who is eligible to claim the Employee Retention Credit?

A: Employers who experienced a decline in revenue or were fully or partially shut down due to COVID-19 may be eligible to claim the Employee Retention Credit.

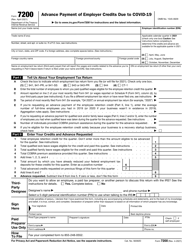

Q: How do I claim the Employee Retention Credit?

A: To claim the Employee Retention Credit, you need to complete and file IRS Form 5884-A.

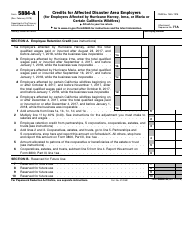

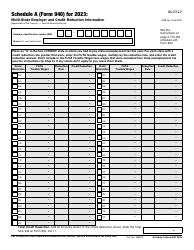

Q: What information is required to complete IRS Form 5884-A?

A: You will need to provide information about your business, including the number of qualified wages paid and the number of full-time employees.

Q: When is the deadline for filing IRS Form 5884-A?

A: The deadline for filing IRS Form 5884-A is the same as your employment tax return, typically the last day of the first quarter following the calendar quarter in which qualified wages were paid.

Q: What is the purpose of the Employee Retention Credit?

A: The Employee Retention Credit is designed to provide financial relief to employers who kept their employees on payroll during the COVID-19 pandemic.

Q: Is there a limit to the amount of the Employee Retention Credit that can be claimed?

A: Yes, the amount of the Employee Retention Credit is limited to a certain percentage of qualified wages paid to each employee.

Q: Can I claim the Employee Retention Credit if I received other COVID-19-related financial assistance?

A: If you received a Paycheck Protection Program loan, you generally cannot claim the Employee Retention Credit for the same wages.

Instruction Details:

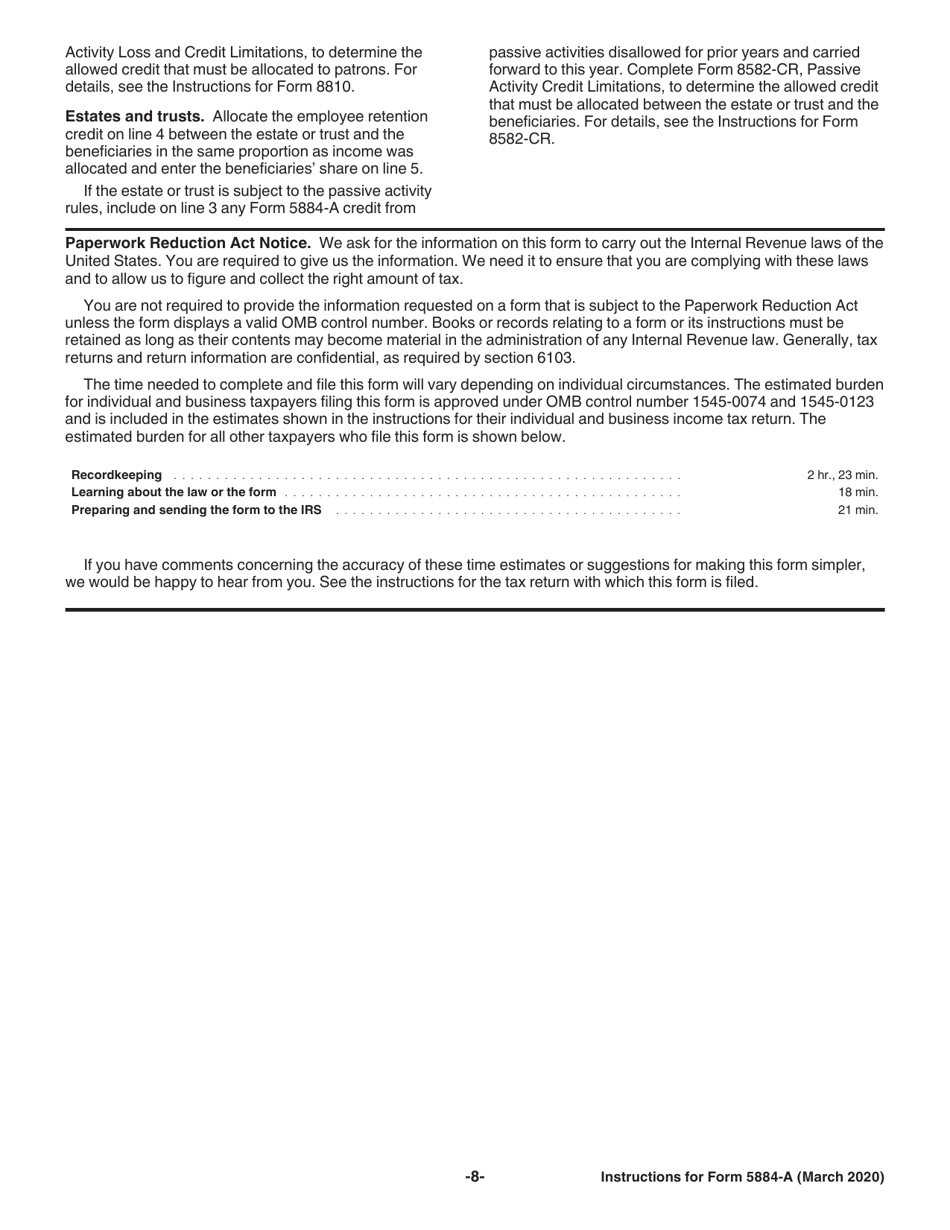

- This 8-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.