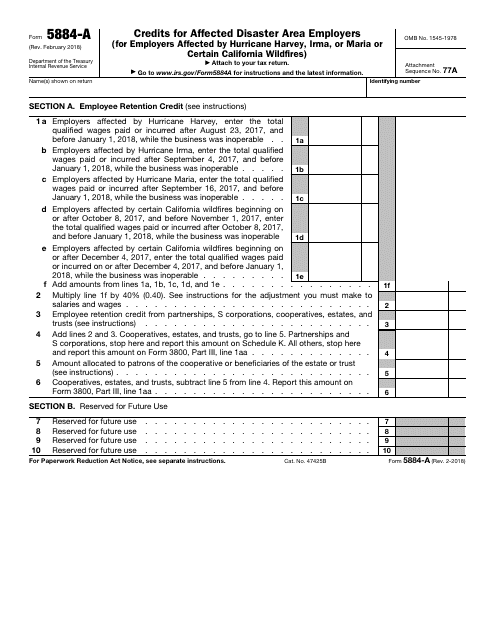

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 5884-A

for the current year.

IRS Form 5884-A Credits for Affected Disaster Area Employers (For Employers Affected by Hurricane Harvey, Irma, or Maria or Certain California Wildfires)

What Is IRS Form 5884-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 5884-A?

A: IRS Form 5884-A is a form used by employers affected by Hurricane Harvey, Irma, Maria, or certain California wildfires to claim tax credits.

Q: Who can use IRS Form 5884-A?

A: Employers in areas affected by the mentioned disasters can use IRS Form 5884-A to claim tax credits.

Q: What are the tax credits available through IRS Form 5884-A?

A: IRS Form 5884-A provides tax credits for employers affected by Hurricane Harvey, Irma, Maria, or certain California wildfires.

Q: How can I claim tax credits using IRS Form 5884-A?

A: You can claim tax credits by completing and filing IRS Form 5884-A according to the instructions provided by the IRS.

Q: Am I eligible to claim tax credits using IRS Form 5884-A if I wasn't affected by the mentioned disasters?

A: No, IRS Form 5884-A is specifically for employers affected by Hurricane Harvey, Irma, Maria, or certain California wildfires.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5884-A through the link below or browse more documents in our library of IRS Forms.