This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 2848

for the current year.

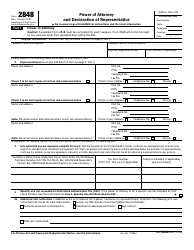

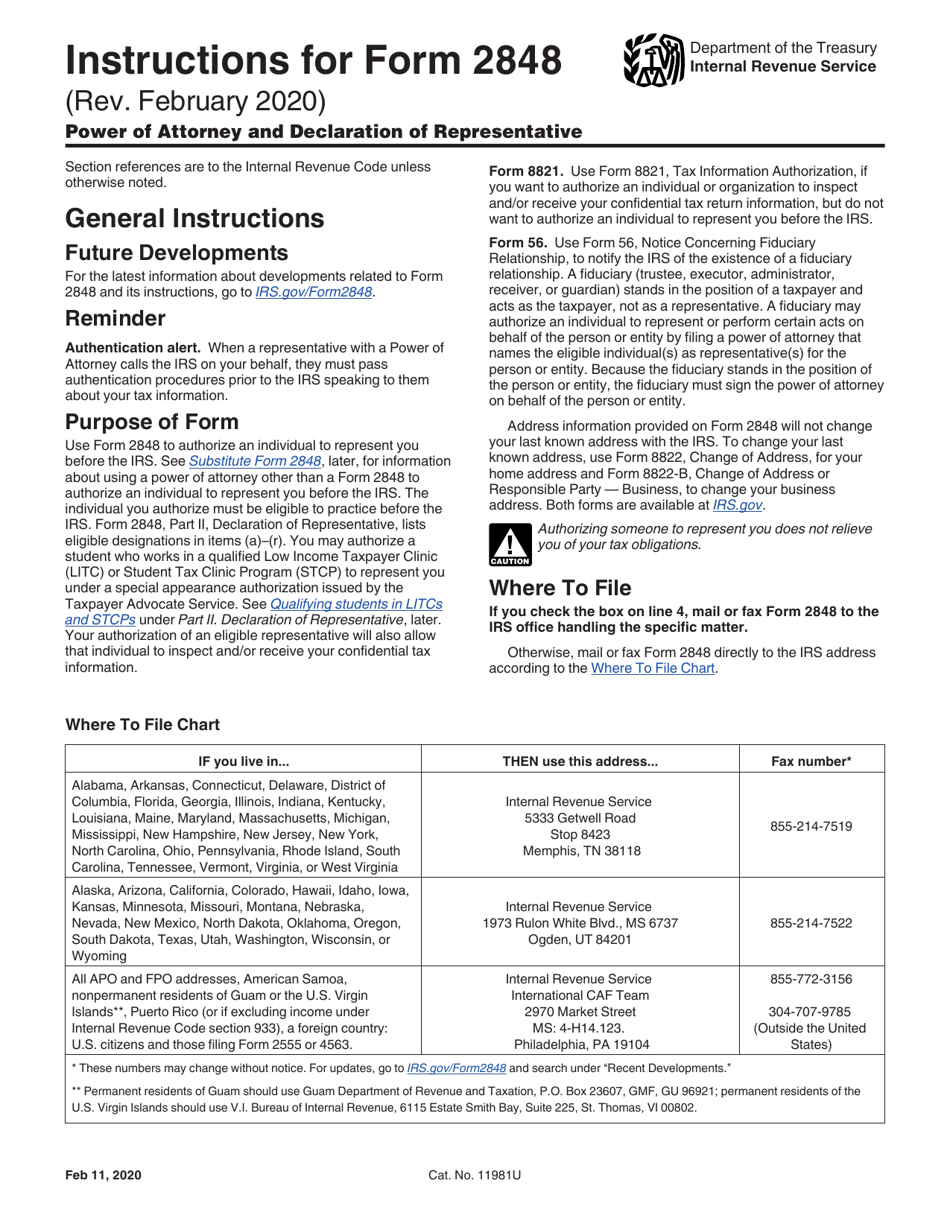

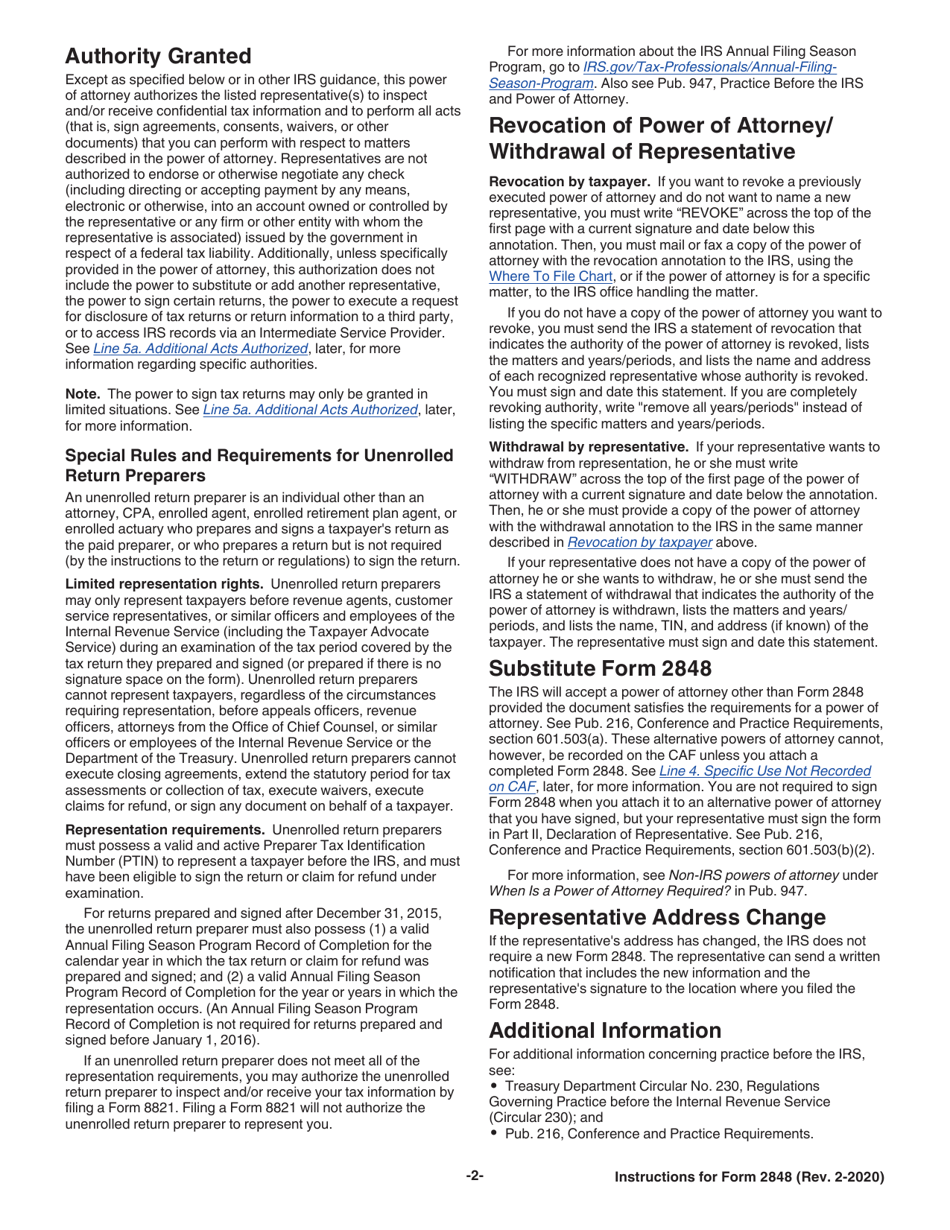

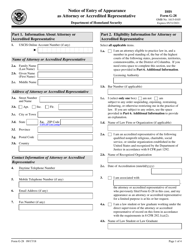

Instructions for IRS Form 2848 Power of Attorney and Declaration of Representative

This document contains official instructions for IRS Form 2848 , Power of Attorney and Declaration of Representative - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2848 is available for download through this link.

FAQ

Q: What is IRS Form 2848?

A: IRS Form 2848 is the Power of Attorney and Declaration of Representative form.

Q: What is the purpose of Form 2848?

A: The purpose of Form 2848 is to authorize someone to represent you before the IRS.

Q: Who can use Form 2848?

A: Any individual or business entity can use Form 2848 to authorize a representative.

Q: How do I fill out Form 2848?

A: You need to provide information about yourself, your representative, and the specific tax matters you are authorizing the representative to handle.

Q: Is there a fee for using Form 2848?

A: No, there is no fee for using Form 2848.

Q: How long does Form 2848 stay in effect?

A: Form 2848 generally stays in effect until it is revoked or a specific expiration date is stated.

Q: Can I revoke a Form 2848?

A: Yes, you can revoke a Form 2848 by submitting a written statement to the IRS.

Q: Can I authorize more than one representative on Form 2848?

A: Yes, you can authorize multiple representatives by attaching a separate Form 2848 for each representative.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.