This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-L

for the current year.

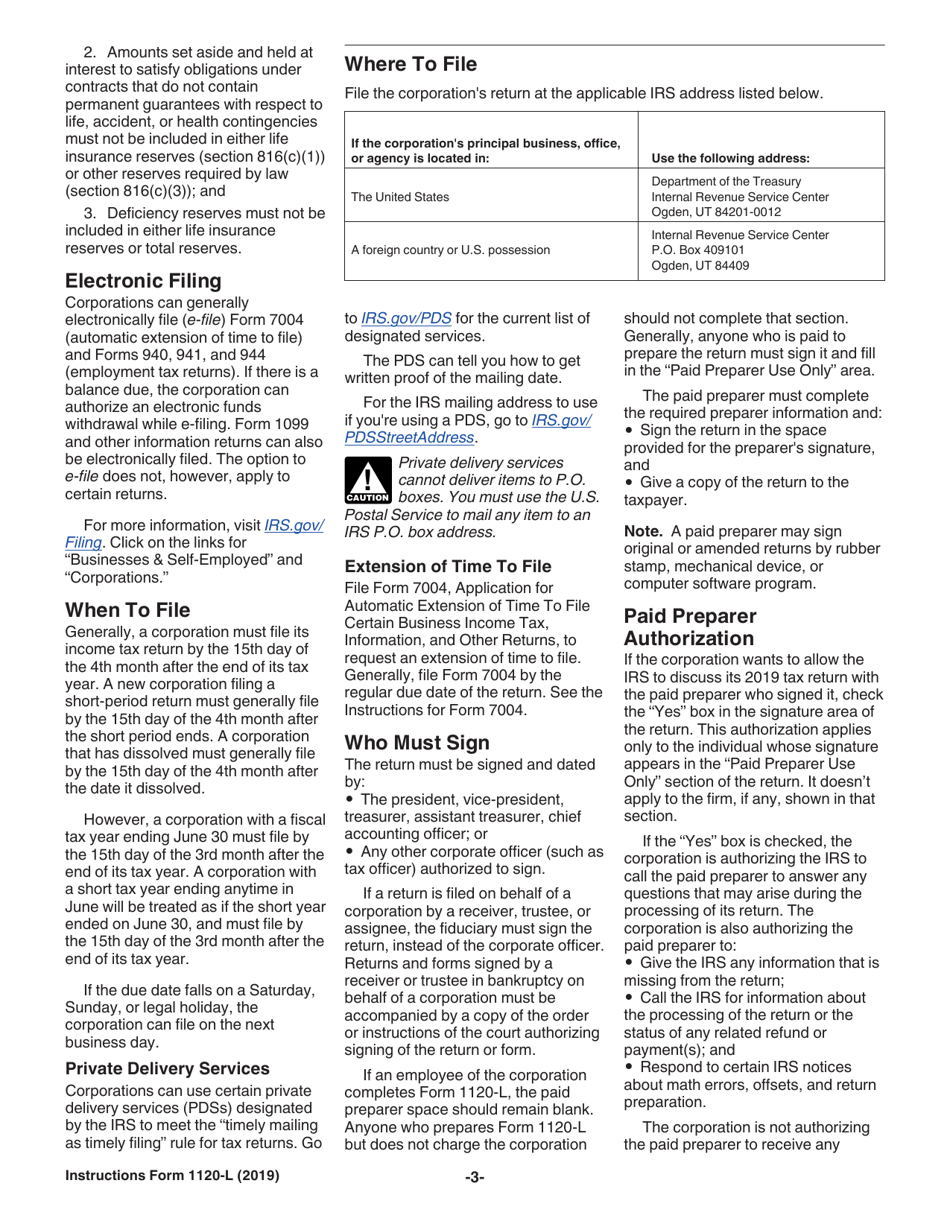

Instructions for IRS Form 1120-L U.S. Life Insurance Company Income Tax Return

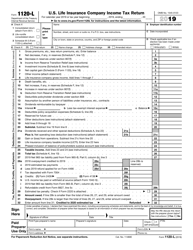

This document contains official instructions for IRS Form 1120-L , U.S. Life Insurance Company Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-L is available for download through this link.

FAQ

Q: What is IRS Form 1120-L?

A: IRS Form 1120-L is the U.S. Life Insurance Company Income Tax Return.

Q: Who needs to file IRS Form 1120-L?

A: U.S. life insurance companies need to file IRS Form 1120-L.

Q: What is the purpose of IRS Form 1120-L?

A: IRS Form 1120-L is used to report income, deductions, gains, losses, and credits of a U.S. life insurance company.

Q: When is the deadline to file IRS Form 1120-L?

A: The deadline to file IRS Form 1120-L is generally on the 15th day of the third month following the end of the tax year.

Q: Are there any penalties for not filing IRS Form 1120-L?

A: Yes, there are penalties for not filing IRS Form 1120-L, including late filing penalties and interest on unpaid taxes.

Q: Can I file IRS Form 1120-L electronically?

A: Yes, you can file IRS Form 1120-L electronically using the IRS e-file system.

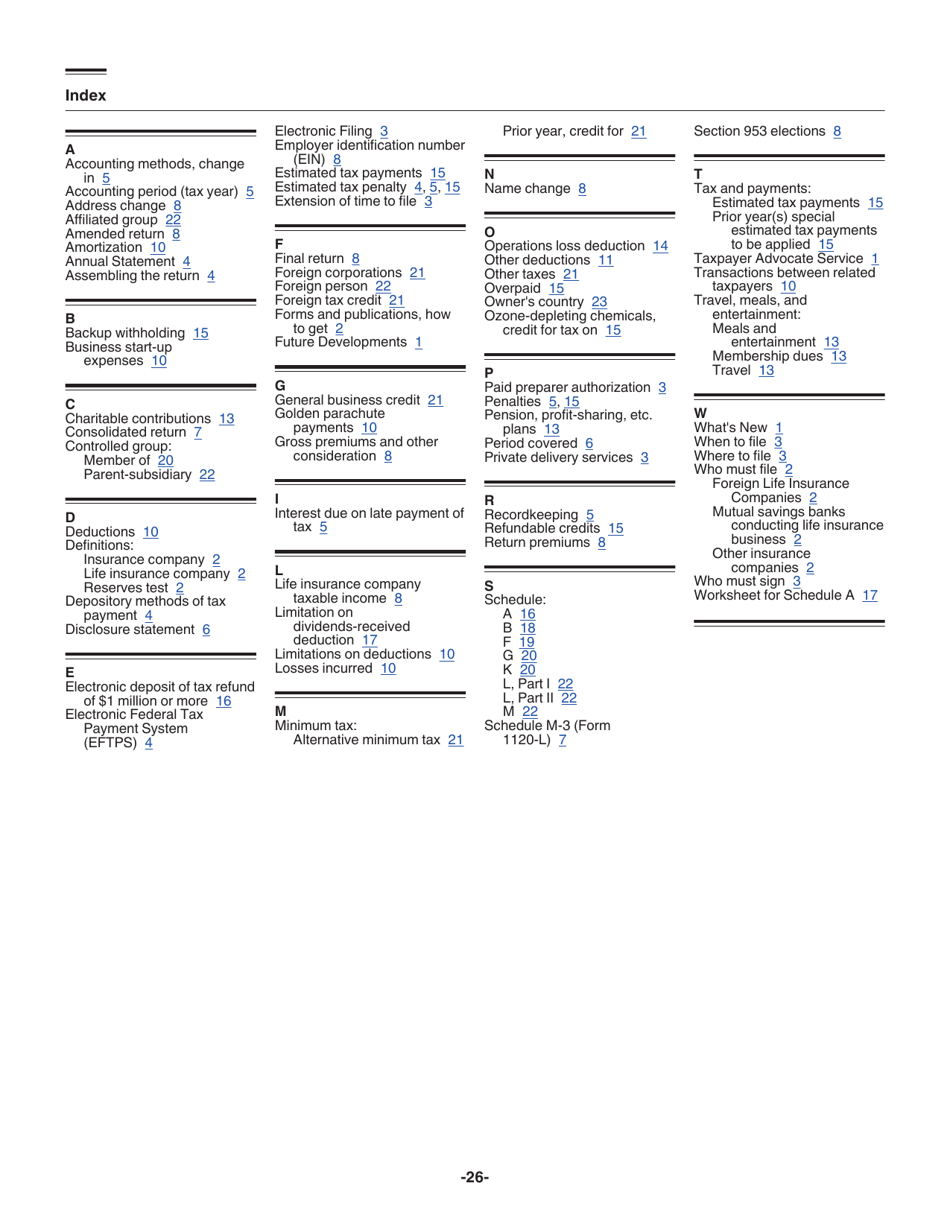

Q: What are some common schedules and forms associated with IRS Form 1120-L?

A: Some common schedules and forms associated with IRS Form 1120-L include Schedule M-1, Schedule M-3, and Form 1125-A.

Q: Do I need to include a payment with IRS Form 1120-L?

A: Yes, if you owe taxes, you need to include the payment with IRS Form 1120-L or make an electronic payment separately.

Q: Can I request an extension to file IRS Form 1120-L?

A: Yes, you can request an extension to file IRS Form 1120-L by filing Form 7004 before the original due date.

Instruction Details:

- This 26-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.