This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1120-L

for the current year.

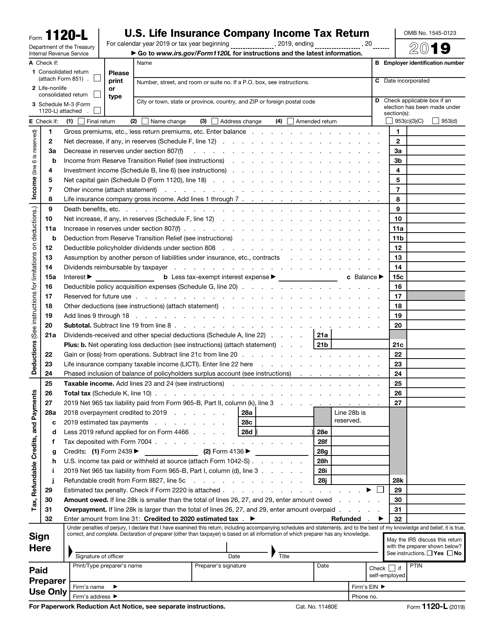

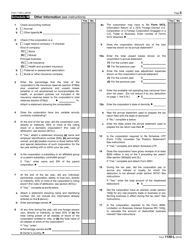

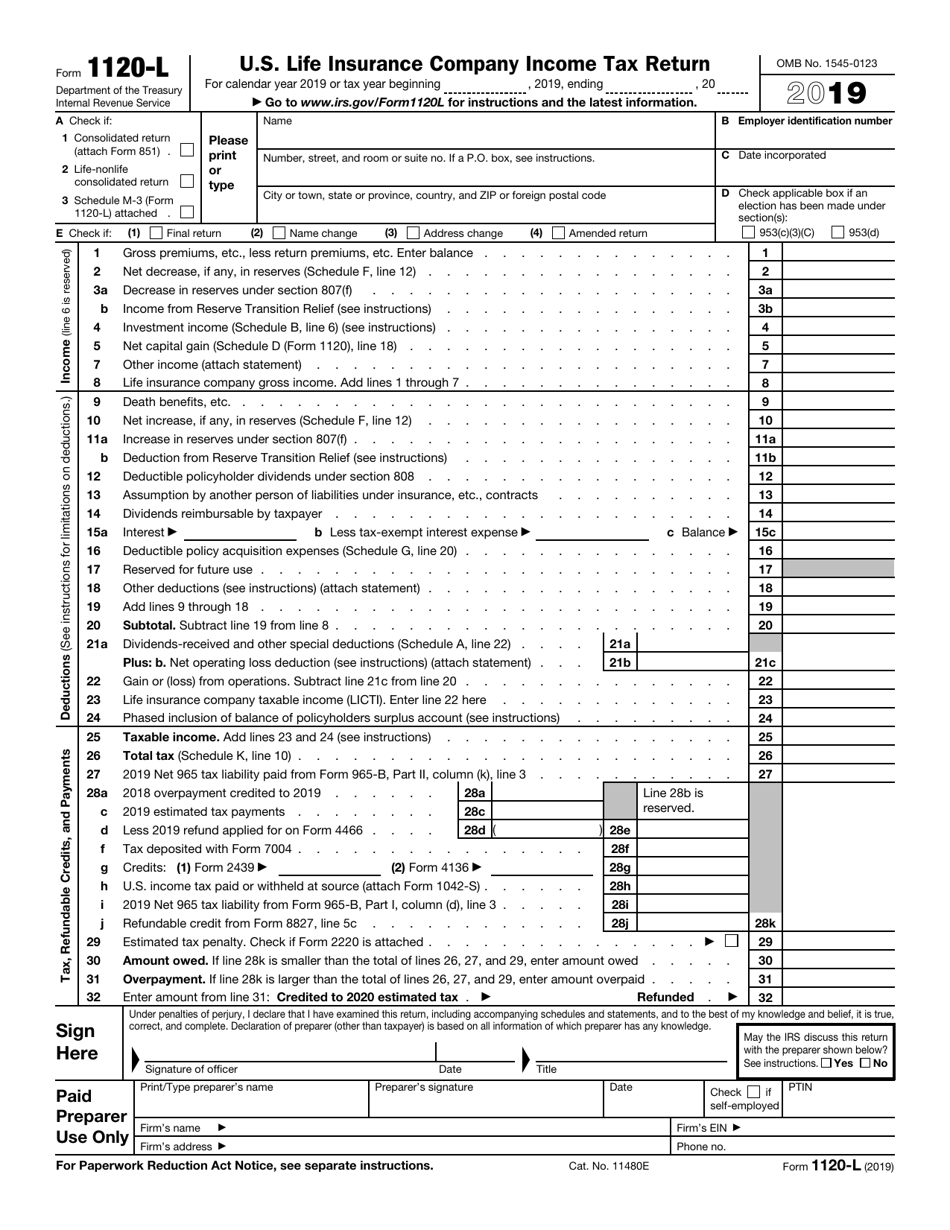

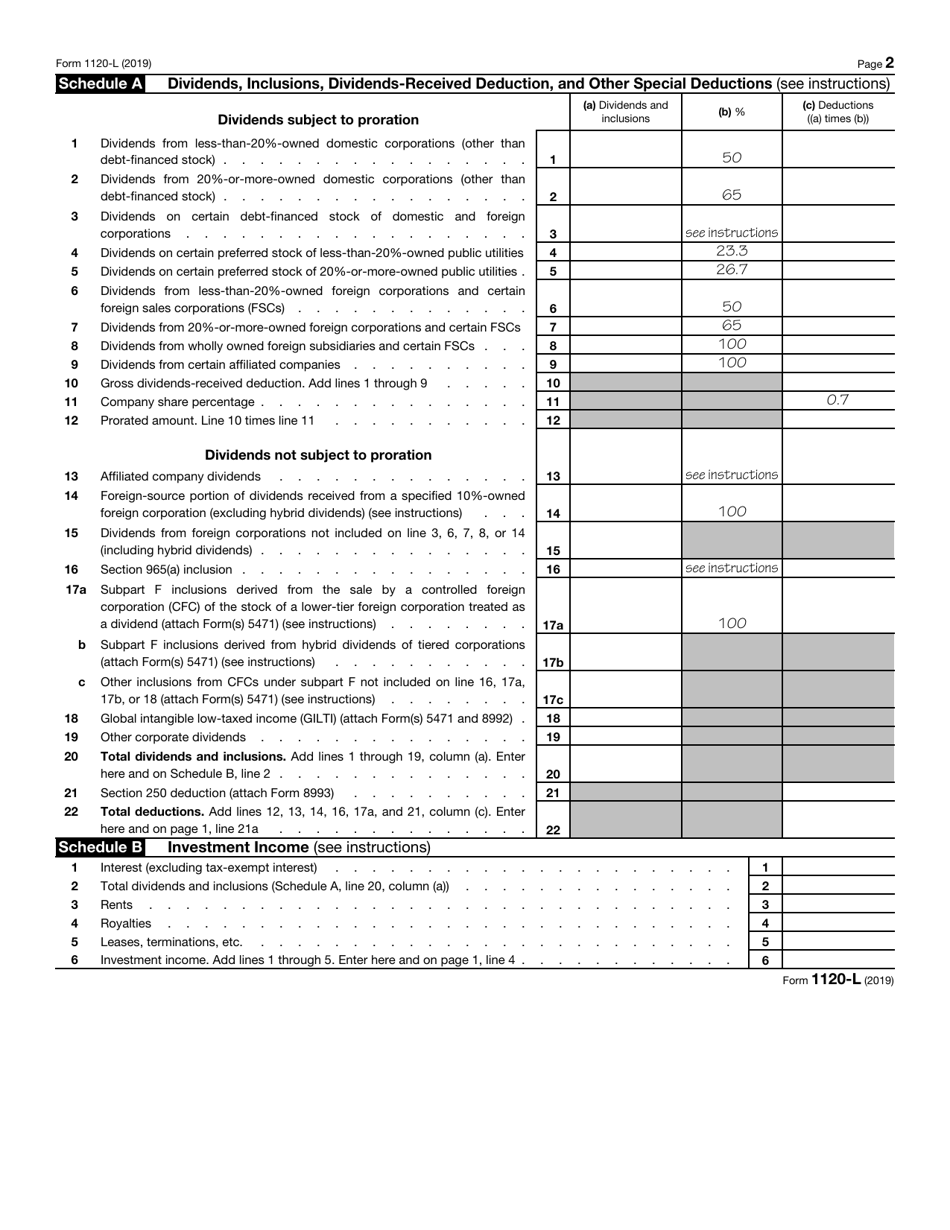

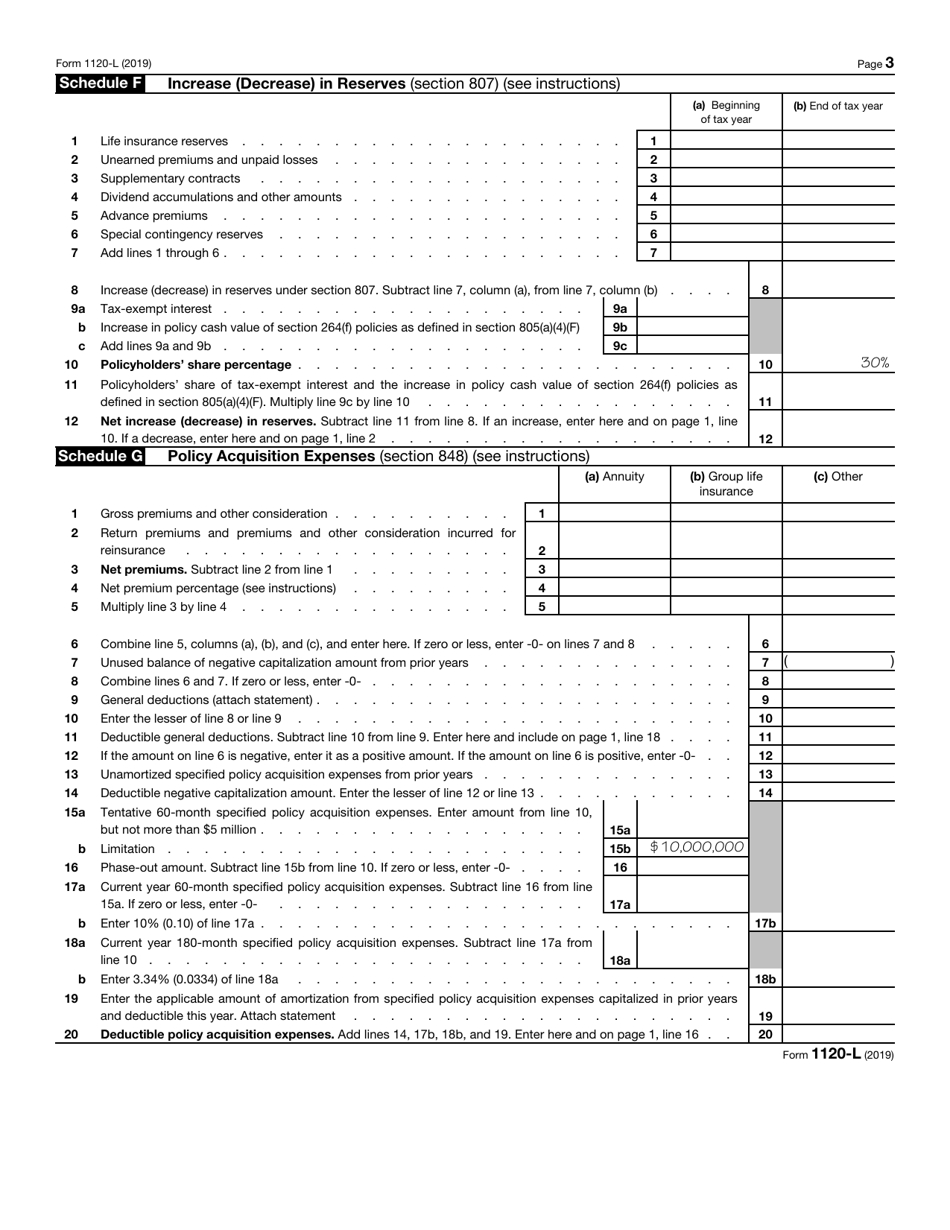

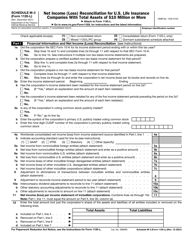

IRS Form 1120-L U.S. Life Insurance Company Income Tax Return

What Is IRS Form 1120-L?

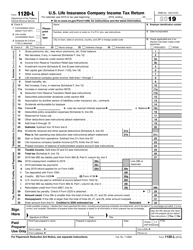

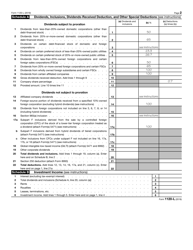

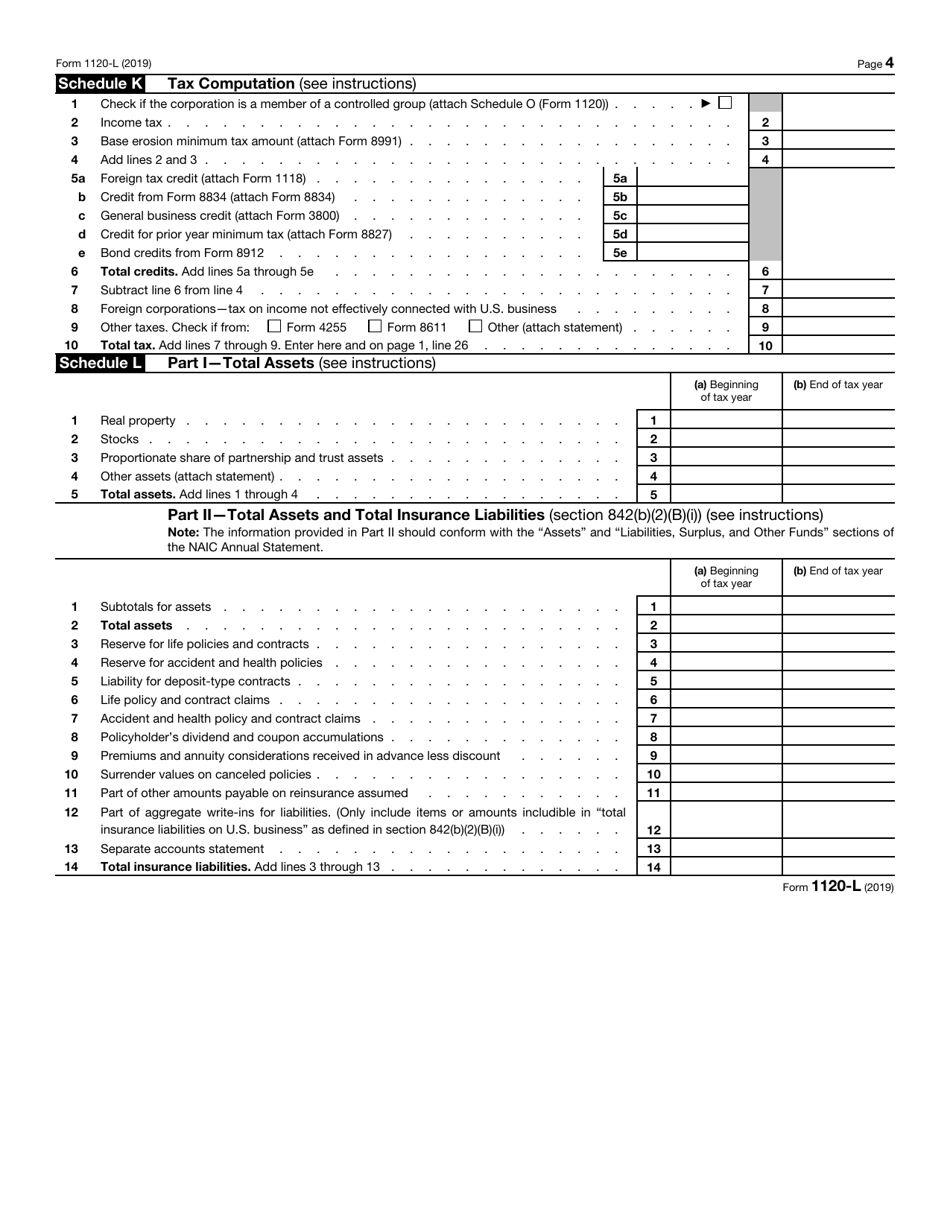

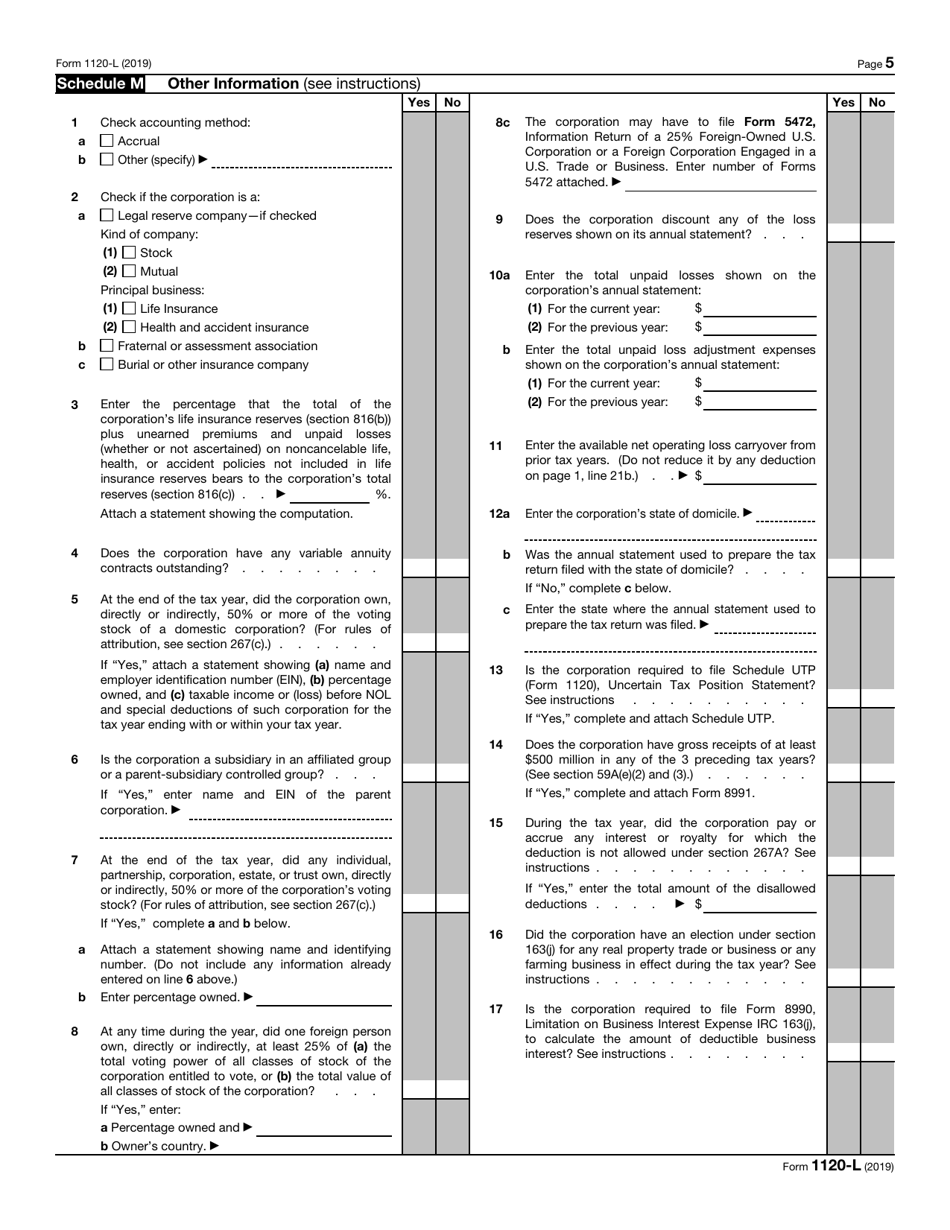

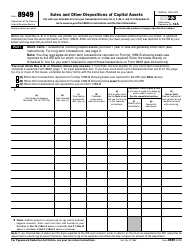

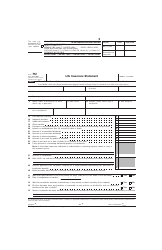

IRS Form 1120-L, U.S. Life Insurance Company Income Tax Return , is a form that domestic life insurance companies file with the Internal Revenue Service (IRS) in order to report their income, gains, losses, deductions, and credits for the tax year, as well as to figure their income tax liability. The form was last revised in 2019 . Corporations may use the IRS fillable Form 1120-L available below.

Alternate Name:

- Life Insurance Company Tax Return.

The applicable address for domestic corporations to send their Life Insurance Company Tax Return is the Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201-0012, while foreign corporations must send their forms to the Internal Revenue Service Center, PO Box 409101, Ogden, UT 84409.

IRS Form 1120-L Instructions

IRS 1120-L Form must be filed by all domestic life insurance companies of the United States, as well as any foreign corporation that would qualify as such if it were a United States corporation. The form must be signed and dated by the corporation's president, vice president, chief accounting officer, treasurer, assistant treasurer, or any corporate officer authorized to sign.

Generally, this income tax return must be filed by the 15th day of the 4th month after the end of the corporation's tax year. However, if the corporation is new and is filing for a short-period return, if it is dissolved, or its tax year ends in June, the dates may differ. If the due date falls on a weekend, or a legal holiday, the return is due on the next business day.

Should a corporation fail to file its income tax return by the due date, including extensions, it may be imposed a penalty of 5% of the unpaid tax for each month or day the return is late, and up to a maximum of 25%. The minimum penalty for a return that is 60 days late or more is the tax due or $210, whichever is smaller. If the corporation is able to demonstrate that their failure to file Form 1120-L on time was due to a reasonable cause, the penalty can be avoided.

IRS 1120-L Related Forms:

- 1120, U.S. Corporation Income Tax Return. Domestic corporations use this form in order to report their income, deductions, and credits, and to figure their income tax liability;

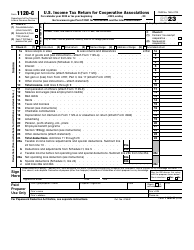

- 1120-C, U.S. Income Tax Return for Cooperative Associations. Corporations that operate on a cooperative basis use this form to report their income, deductions, and credits, and to сalculate their income tax liability;

- 1120-F, U.S. Income Tax Return of a Foreign Corporation. This form is filed by foreign corporations to report their income, deductions, and credits, and to figure their U.S. income tax liability;

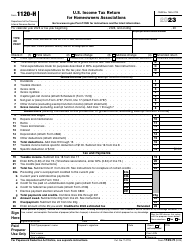

- 1120-H, U.S. Income Tax Return for Homeowners Associations. A homeowners association files this form to exclude the Exempt Function Income from its gross income;

- 1120-S, U.S. Income Tax Return for an S Corporation. This is a form used to report the income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation;

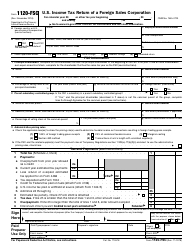

- 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation. Foreign Sales Corporation (FSC) or small FSC use this form to report their income, deductions, losses, gains, credits, and income tax liability;

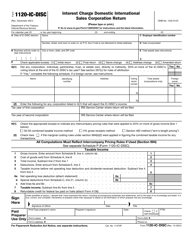

- 1120-IC-DISC, Interest Charge Domestic International Sales Corporation Return. This form is used by interest charge domestic international sales corporations (IC-DISCs), former DISCs, and former IC-DISCs;

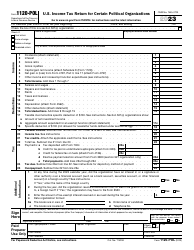

- 1120-POL, U.S. Income Tax Return for Certain Political Organizations. This form is filed by political organizations and certain exempt organizations to report their political organization taxable income and income tax liability Section 527;

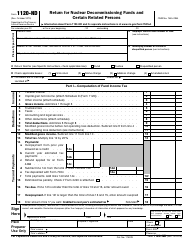

- 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons. Nuclear decommissioning funds file this form to report income earned, the administrative expenses of fund operation, the tax on modified gross income, and the Section 4951 initial taxes;

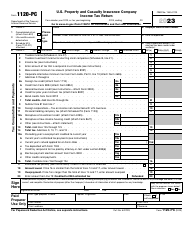

- 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return. This form is filed to report the income, deductions, and credits, and to figure the income tax liability of insurance companies, apart from life insurance companies;

- 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts. Corporation, trusts, and associations electing to be treated as Real Estate Investment Trusts file this form to report their income, deductions, losses, certain penalties, and income tax liability;

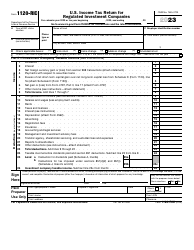

- 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies. Regulated investment companies (RIC) file this form to report their income, losses, credits, and to calculate their income tax liability;

- 1120-SF, U.S. Income Tax Return for Settlement Funds (under Section 468B). Qualified settlement funds file this form to report transfers received, income earned, deductions claimed, distributions made, and a designated or qualified settlement fund income tax liability;

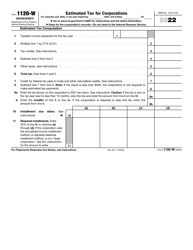

- 1120-W, Estimated Tax for Corporations. Corporations use this form to estimate their tax liability and to figure the amount of their estimated tax payments;

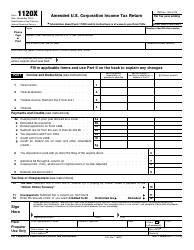

- 1120-X, Amended U.S. Corporation Income Tax Return. This form is used by corporations to correct Form 1120 (or Form 1120-A), a claim for refund, or an examination, and also, to make certain elections after the prescribed deadline;