This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1065 Schedule M-3

for the current year.

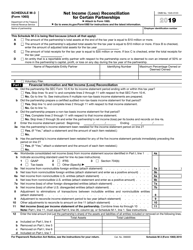

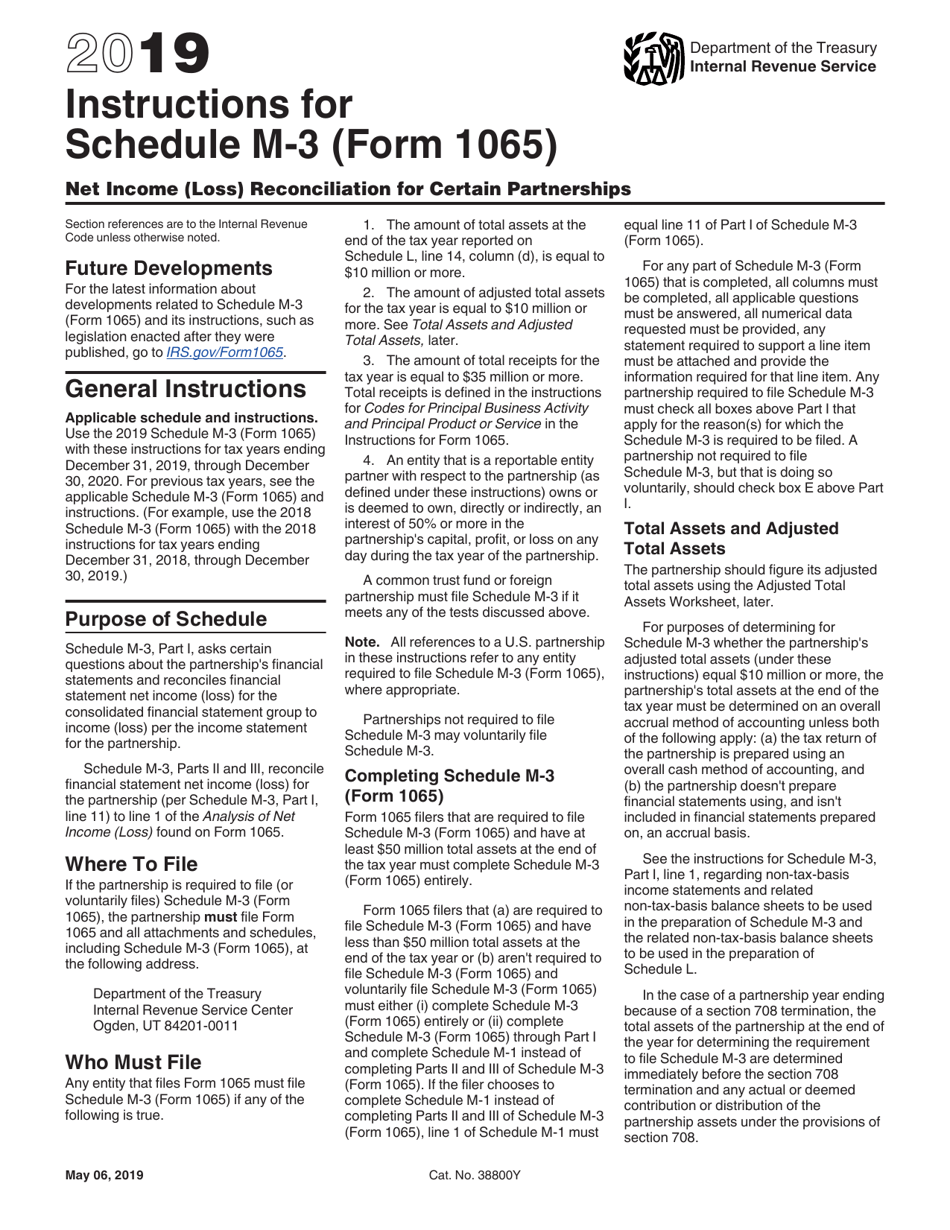

Instructions for IRS Form 1065 Schedule M-3 Net Income (Loss) Reconciliation for Certain Partnerships

This document contains official instructions for IRS Form 1065 Schedule M-3, Net Income (Loss) Reconciliation for Certain Partnerships - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1065 Schedule M-3 is available for download through this link.

FAQ

Q: What is IRS Form 1065 Schedule M-3?

A: IRS Form 1065 Schedule M-3 is a form used by certain partnerships to reconcile their net income or loss for tax purposes.

Q: What is the purpose of Schedule M-3?

A: The purpose of Schedule M-3 is to provide a detailed reconciliation of the partnership's financial accounting net income or loss to its taxable income or loss.

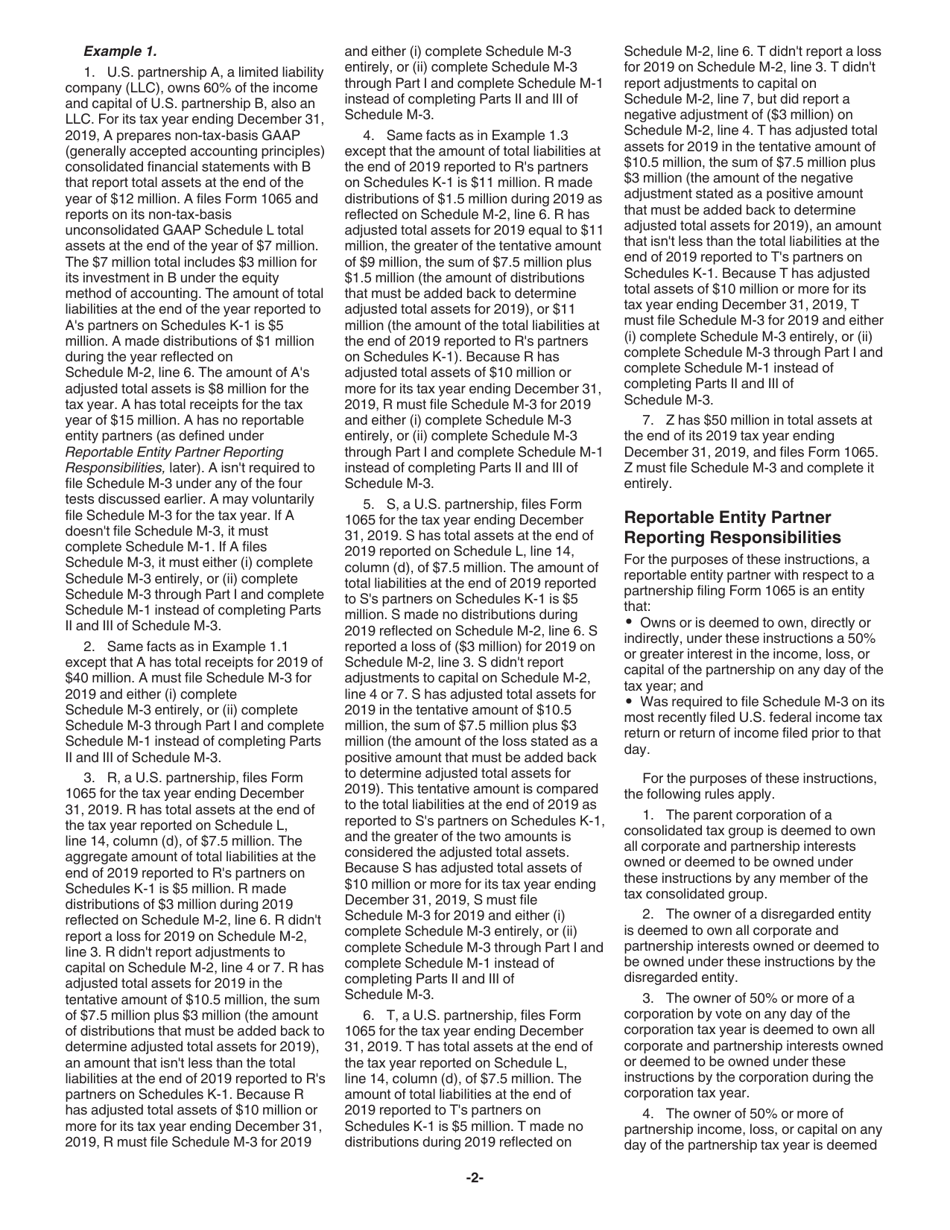

Q: Who needs to file Schedule M-3?

A: Certain partnerships, specifically those meeting certain thresholds, are required to file Schedule M-3.

Q: What information is required on Schedule M-3?

A: Schedule M-3 requires information regarding the partnership's financial statement net income or loss, as well as adjustments made for tax purposes.

Q: How do I complete Schedule M-3?

A: To complete Schedule M-3, you'll need to refer to the partnership's financial statements and make appropriate adjustments for tax purposes.

Q: When is Schedule M-3 due?

A: Schedule M-3 is generally due when the partnership's tax return, Form 1065, is filed.

Q: Are there any penalties for not filing Schedule M-3?

A: Yes, there may be penalties for not filing Schedule M-3 when required.

Q: Can I file Schedule M-3 electronically?

A: Yes, Schedule M-3 can be filed electronically.

Q: Is Schedule M-3 required for all partnerships?

A: No, Schedule M-3 is only required for certain partnerships meeting certain thresholds.

Instruction Details:

- This 19-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.