This version of the form is not currently in use and is provided for reference only. Download this version of

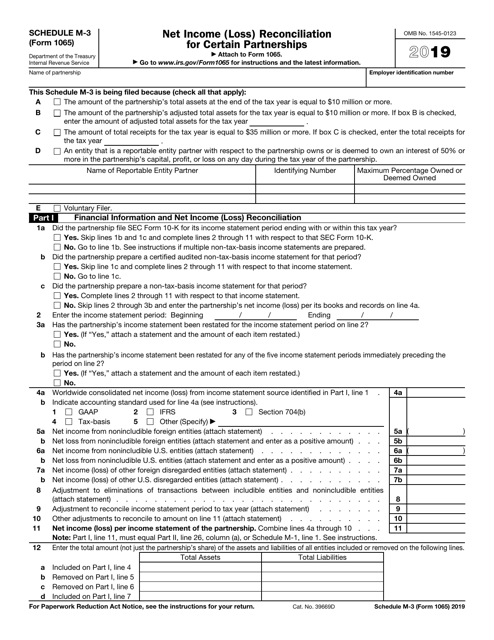

IRS Form 1065 Schedule M-3

for the current year.

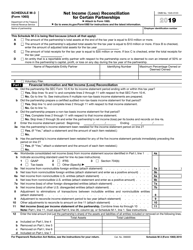

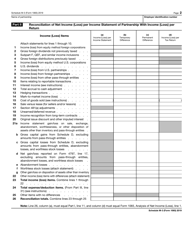

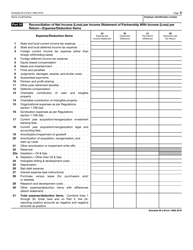

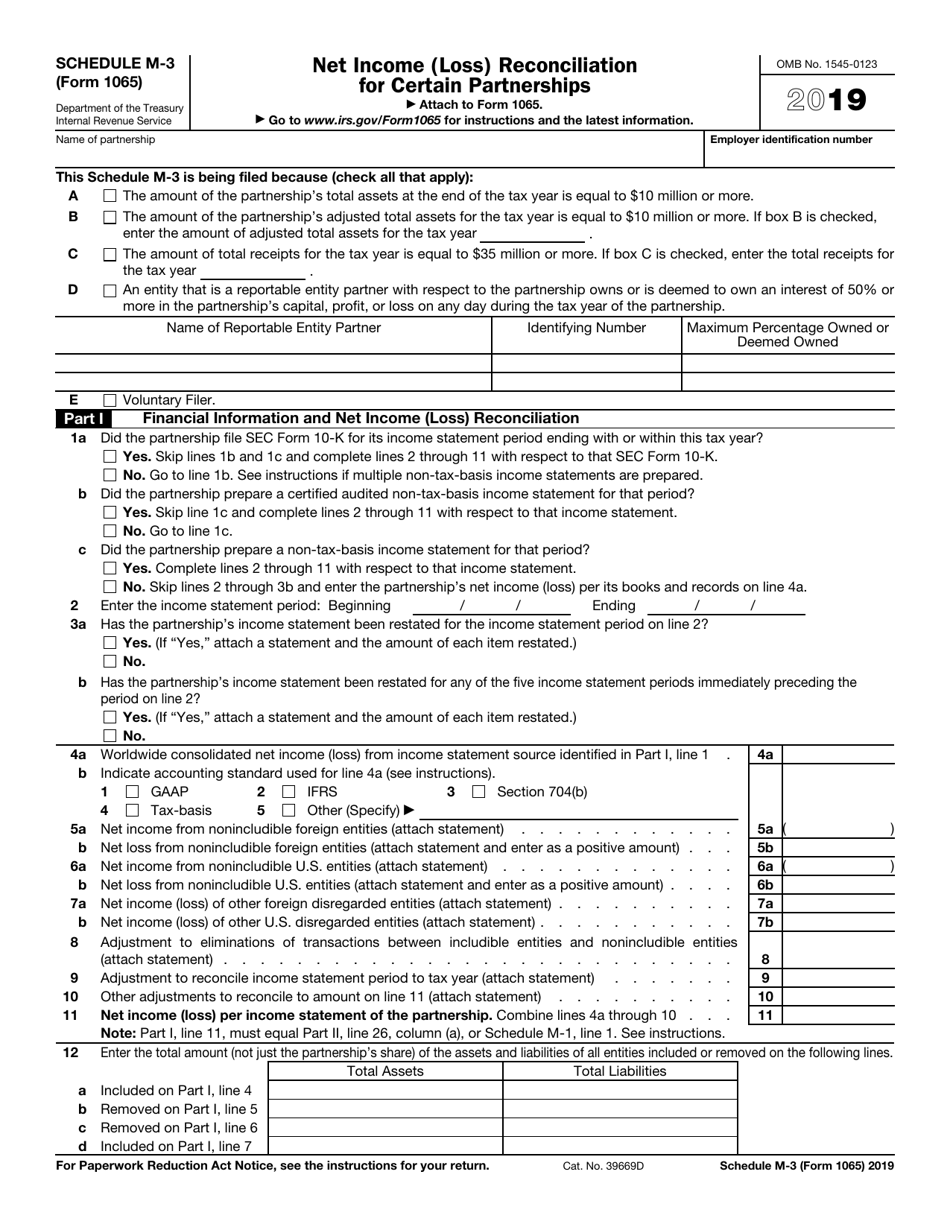

IRS Form 1065 Schedule M-3 Net Income (Loss) Reconciliation for Certain Partnerships

What Is IRS Form 1065 Schedule M-3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1065, U.S. Return of Partnership Income. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1065 Schedule M-3?

A: IRS Form 1065 Schedule M-3 is a form used by partnerships to reconcile the differences between their net income (loss) reported on their tax return and their financial statements.

Q: What is the purpose of Schedule M-3?

A: The purpose of Schedule M-3 is to provide the IRS with more detailed information about the differences between a partnership's tax return and financial statements.

Q: Which partnerships are required to file Schedule M-3?

A: Partnerships with total assets at the end of the tax year that exceed $10 million are generally required to file Schedule M-3.

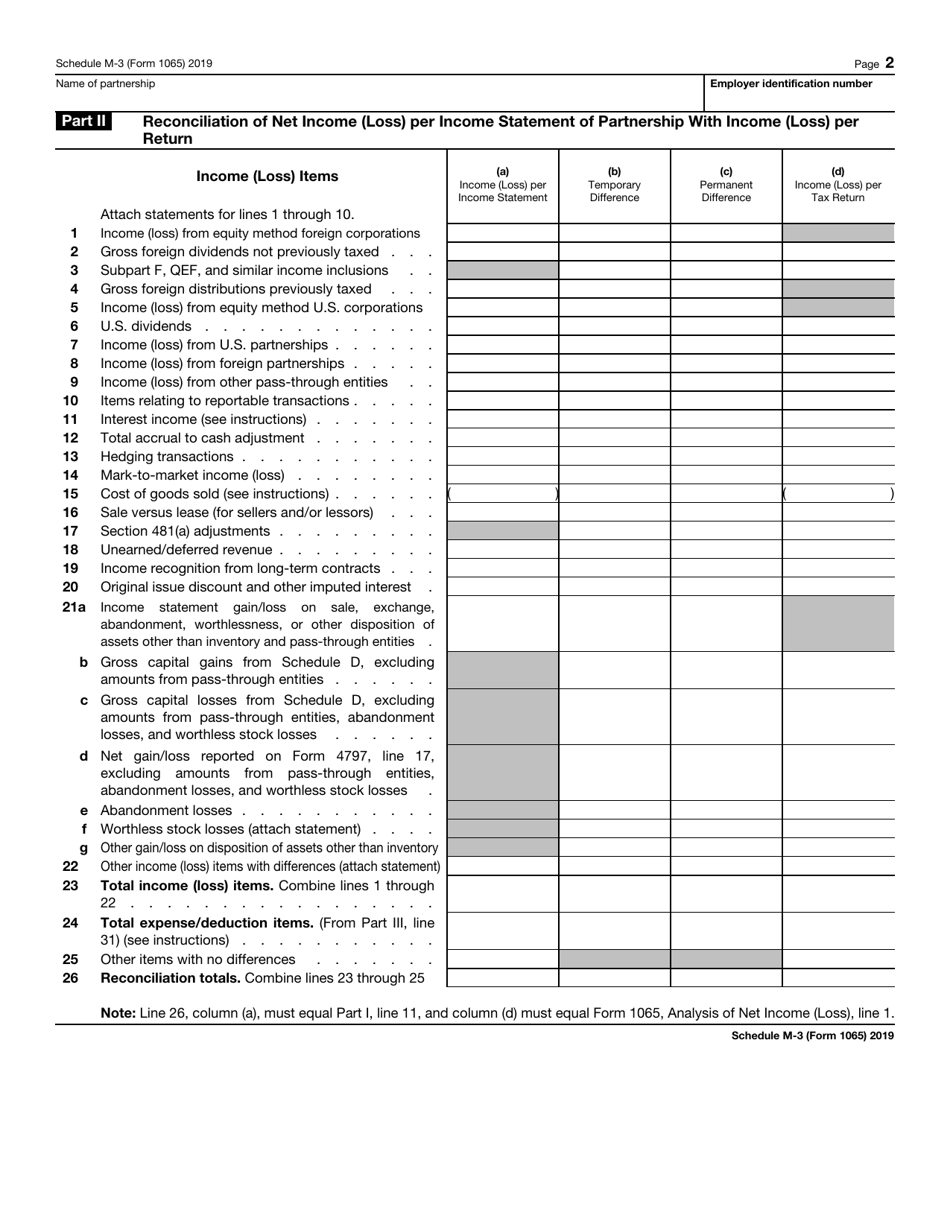

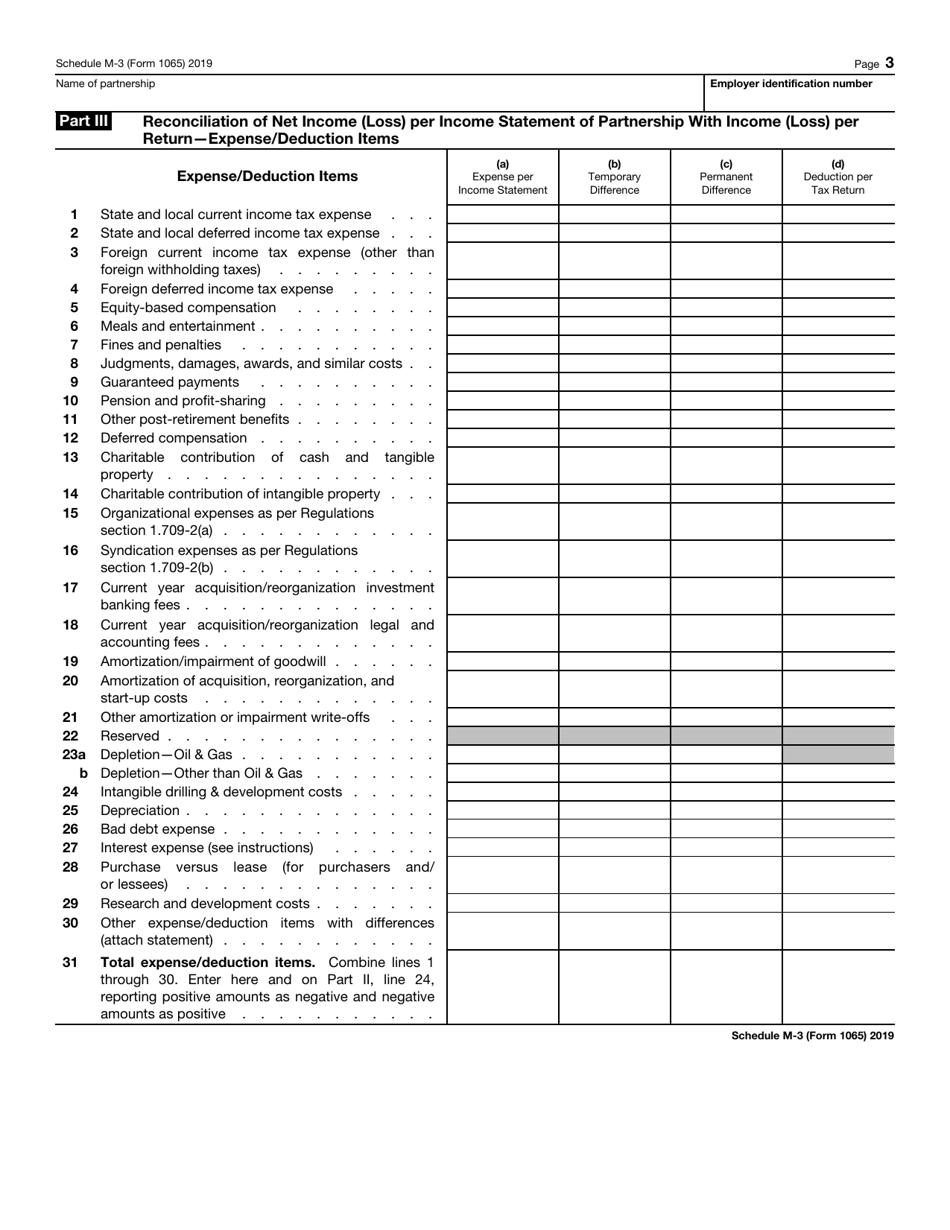

Q: What information is included in Schedule M-3?

A: Schedule M-3 includes detailed information about a partnership's net income (loss), as well as reconciling items such as differences in accounting methods and temporary differences.

Q: When should Schedule M-3 be filed?

A: Schedule M-3 should be filed along with IRS Form 1065, which is typically due on the 15th day of the 3rd month after the end of the partnership's tax year.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1065 Schedule M-3 through the link below or browse more documents in our library of IRS Forms.