This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1041-N

for the current year.

Instructions for IRS Form 1041-N U.S. Income Tax Return for Electing Alaska Native Settlement Trusts

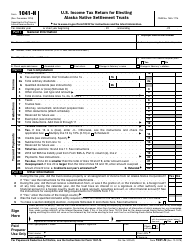

This document contains official instructions for IRS Form 1041-N , U.S. Income Tax Return for Electing Alaska Native Settlement Trusts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1041-N is available for download through this link.

FAQ

Q: What is IRS Form 1041-N?

A: IRS Form 1041-N is the U.S. Income Tax Return for Electing Alaska Native Settlement Trusts.

Q: Who needs to file IRS Form 1041-N?

A: Alaska Native Settlement Trusts that have made an election under section 646 of the Internal Revenue Code.

Q: What is the purpose of filing IRS Form 1041-N?

A: The purpose of filing IRS Form 1041-N is to report the income, deductions, and credits of an electing Alaska Native Settlement Trust.

Q: When is the deadline for filing IRS Form 1041-N?

A: The deadline for filing IRS Form 1041-N is April 15th of the year following the close of the trust's tax year.

Q: Are there any penalties for not filing IRS Form 1041-N?

A: Yes, there can be penalties for not filing IRS Form 1041-N, including a failure to file penalty and a failure to pay penalty.

Q: Do electing Alaska Native Settlement Trusts need to pay taxes?

A: Yes, electing Alaska Native Settlement Trusts are subject to income tax and must pay taxes on their taxable income.

Q: What if I need help with IRS Form 1041-N?

A: If you need help with IRS Form 1041-N, you can seek assistance from a tax professional or contact the IRS directly.

Instruction Details:

- This 10-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.