Instructions for IRS Form 1040, 1040-SR Schedule C Profit or Loss From Business (Sole Proprietorship)

This document contains official instructions for IRS Form 1040 Schedule C and IRS Form 1040-SR Schedule C . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 (1040-SR) Schedule C is available for download through this link.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is the U.S. Individual Income Tax Return form.

Q: What is IRS Form 1040-SR?

A: IRS Form 1040-SR is a simplified version of Form 1040 for senior citizens.

Q: What is Schedule C?

A: Schedule C is a form used to report profit or loss from a business conducted as a sole proprietorship.

Q: Who should use Schedule C?

A: Schedule C should be used by individuals who operate a business as a sole proprietor.

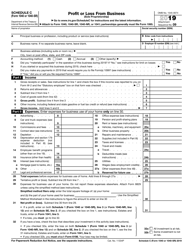

Q: What information is required on Schedule C?

A: Schedule C requires information about the business's income, expenses, and other deductions.

Q: What is the deadline for filing Form 1040?

A: The deadline for filing Form 1040 is usually April 15th, but it may be extended to a later date in certain years.

Q: Can I e-file Form 1040-SR Schedule C?

A: Yes, you can e-file Form 1040-SR Schedule C.

Q: Do I need to attach receipts or other documents when filing Form 1040-SR Schedule C?

A: You generally do not need to attach receipts or other documents when filing Form 1040-SR Schedule C, but you should keep them for your records.

Instruction Details:

- This 18-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.