This version of the form is not currently in use and is provided for reference only. Download this version of

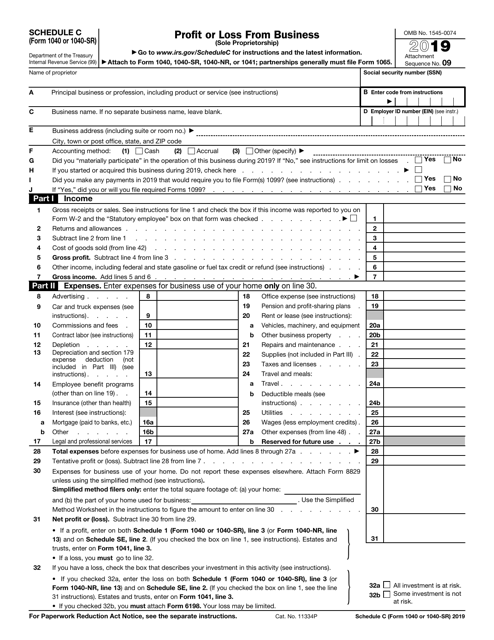

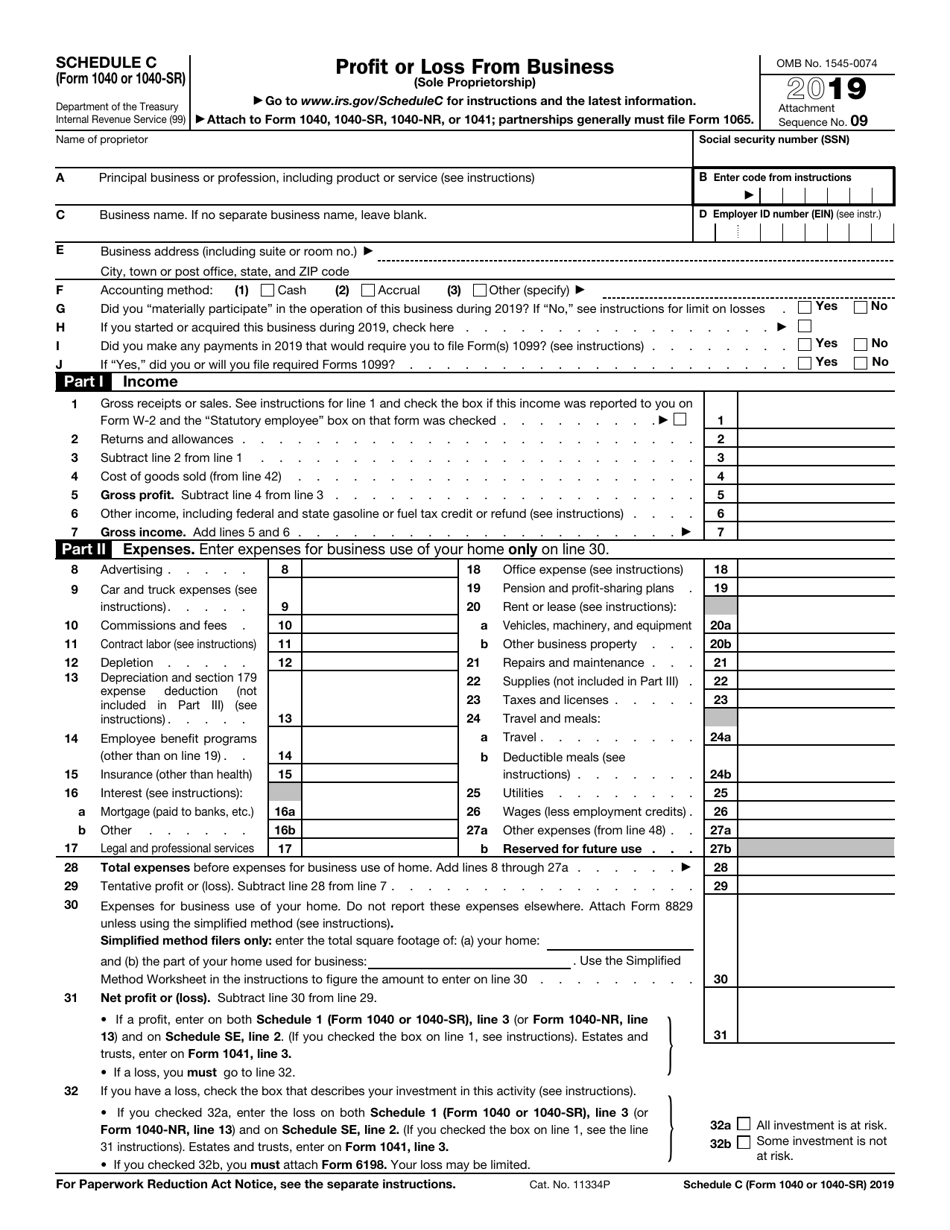

IRS Form 1040 (1040-SR) Schedule C

for the current year.

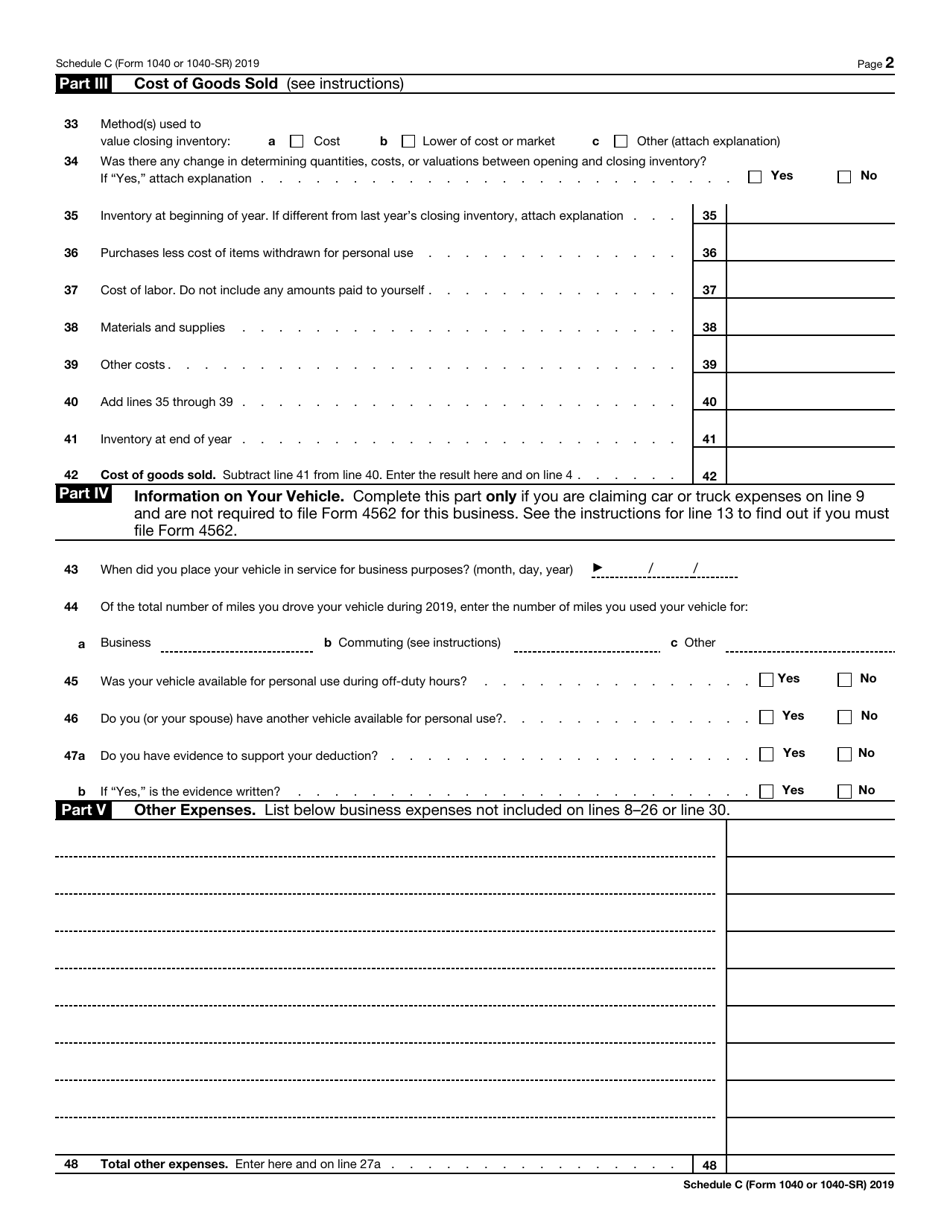

IRS Form 1040 (1040-SR) Schedule C Profit or Loss From Business (Sole Proprietorship)

What Is IRS Form 1040 (1040-SR) Schedule C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, and IRS Form 1040-SR. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is the U.S. Individual Income Tax Return form used to report an individual's income and calculate their tax liability.

Q: What is IRS Form 1040-SR?

A: IRS Form 1040-SR is a simplified version of Form 1040 for individuals who are 65 years or older.

Q: What is Schedule C of Form 1040?

A: Schedule C is used to report profit or loss from a business operated as a sole proprietorship.

Q: Who is eligible to use Schedule C?

A: Sole proprietors, or individuals who operate a business by themselves, can use Schedule C to report their business income and expenses.

Q: What does Schedule C report?

A: Schedule C reports the income or loss from a sole proprietorship and calculates the net profit or loss that is then added to the individual's overall income on Form 1040.

Q: What kind of expenses can be reported on Schedule C?

A: Sole proprietors can report expenses such as business supplies, travel costs, advertising expenses, and other costs directly related to their business operations.

Q: Can I use Schedule C if I have multiple businesses?

A: Yes, if you operate multiple sole proprietorships, you can use separate Schedule C forms to report the income and expenses for each business.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 (1040-SR) Schedule C through the link below or browse more documents in our library of IRS Forms.