This version of the form is not currently in use and is provided for reference only. Download this version of

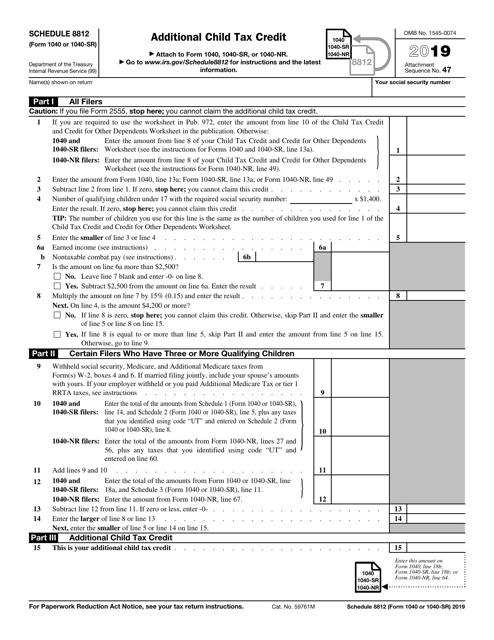

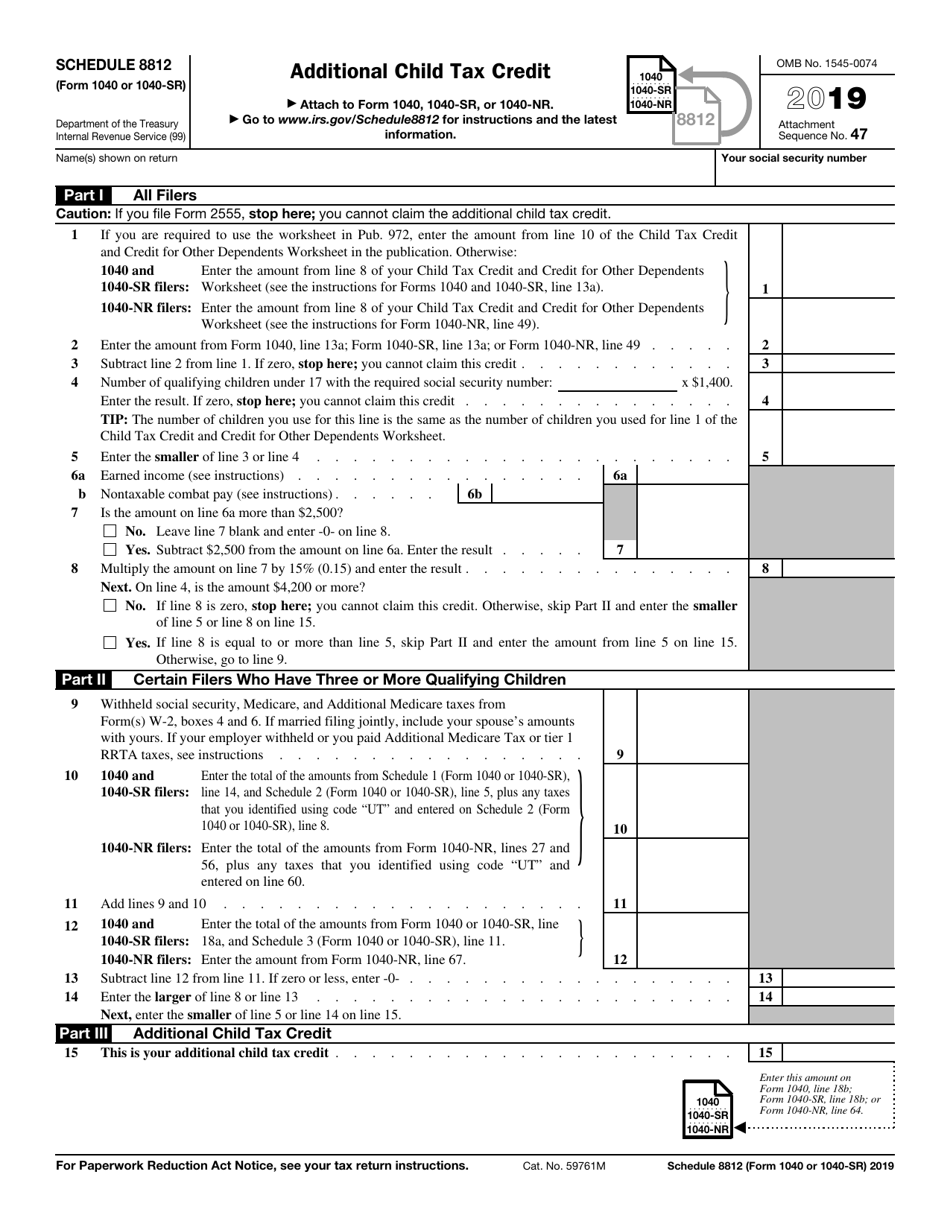

IRS Form 1040 (1040-SR) Schedule 8812

for the current year.

IRS Form 1040 (1040-SR) Schedule 8812 Additional Child Tax Credit

What Is IRS Form 1040 (1040-SR) Schedule 8812?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, and IRS Form 1040-SR. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is the individual tax return form used by most taxpayers in the United States to file their annual income tax return.

Q: What is Form 1040-SR?

A: Form 1040-SR is a simplified version of Form 1040 specifically designed for taxpayers who are 65 years or older.

Q: What is Schedule 8812?

A: Schedule 8812 is a form used to claim the Additional Child Tax Credit.

Q: What is the Additional Child Tax Credit?

A: The Additional Child Tax Credit is a refundable tax credit that may be available to taxpayers who have at least one qualifying child and are not able to fully claim the Child Tax Credit.

Q: Who is eligible to claim the Additional Child Tax Credit?

A: Taxpayers who have at least one qualifying child, meet certain income requirements, and have a certain amount of earned income may be eligible to claim the Additional Child Tax Credit.

Q: How do I file Schedule 8812?

A: Schedule 8812 is filed along with your Form 1040 or 1040-SR. You will need to fill out the necessary information regarding your qualifying child and calculate the amount of the credit you are eligible for.

Q: Is the Additional Child Tax Credit refundable?

A: Yes, the Additional Child Tax Credit is a refundable tax credit, which means if the credit exceeds your tax liability, you may receive a refund of the difference.

Q: What is a qualifying child?

A: A qualifying child is a dependent who meets certain criteria, including being under the age of 17, being related to you, and living with you for at least half of the year.

Q: What is earned income?

A: Earned income is income that is earned through employment or self-employment, such as wages, salaries, tips, and net earnings from self-employment.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 (1040-SR) Schedule 8812 through the link below or browse more documents in our library of IRS Forms.