This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 965-A

for the current year.

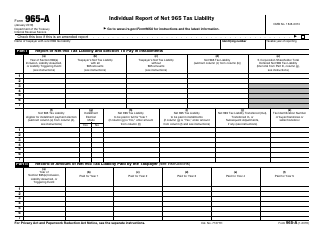

Instructions for IRS Form 965-A Individual Report of Net 965 Tax Liability

This document contains official instructions for IRS Form 965-A , Individual Report of Net 965 Tax Liability - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 965-A is available for download through this link.

FAQ

Q: What is IRS Form 965-A?

A: IRS Form 965-A is a form used to report the net 965 tax liability of an individual.

Q: Who needs to file IRS Form 965-A?

A: Individuals who have a net 965 tax liability need to file IRS Form 965-A.

Q: What is net 965 tax liability?

A: Net 965 tax liability is the amount of tax owed under Section 965 of the Internal Revenue Code.

Q: What is Section 965 of the Internal Revenue Code?

A: Section 965 of the Internal Revenue Code deals with the transition tax on untaxed foreign earnings.

Q: When is IRS Form 965-A due?

A: IRS Form 965-A is typically due on the due date of the individual's income tax return.

Q: Is IRS Form 965-A the only form I need to file?

A: No, in addition to IRS Form 965-A, you may need to file other forms depending on your specific tax situation.

Q: Do I need to include payment with IRS Form 965-A?

A: Yes, if you have a net 965 tax liability, you will need to include payment with IRS Form 965-A.

Q: What if I need more time to file IRS Form 965-A?

A: You can request an extension to file IRS Form 965-A by filing Form 4868.

Q: What should I do if I make a mistake on IRS Form 965-A?

A: If you make a mistake on IRS Form 965-A, you should correct it as soon as possible by filing an amended return.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.