This version of the form is not currently in use and is provided for reference only. Download this version of

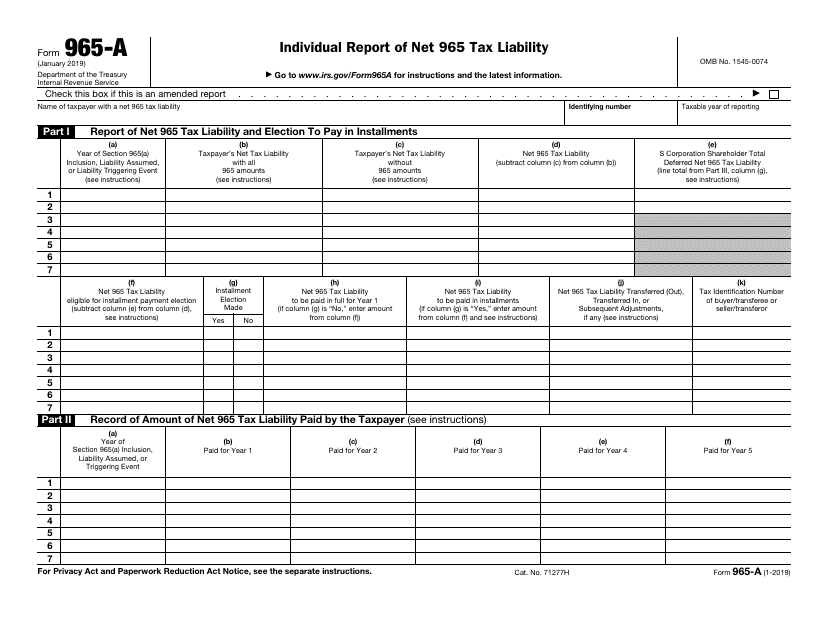

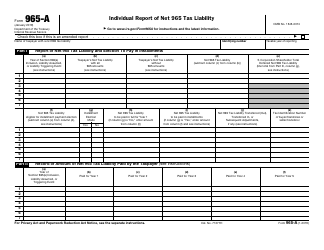

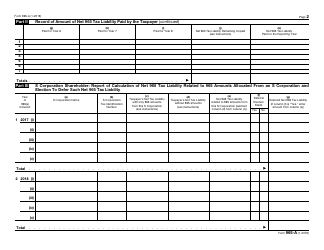

IRS Form 965-A

for the current year.

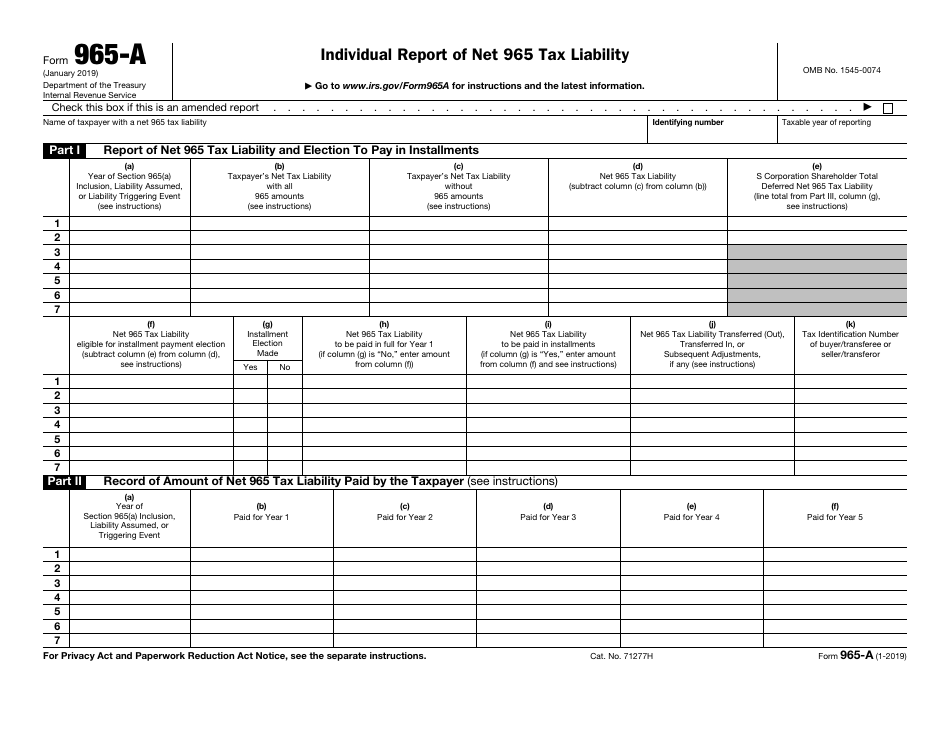

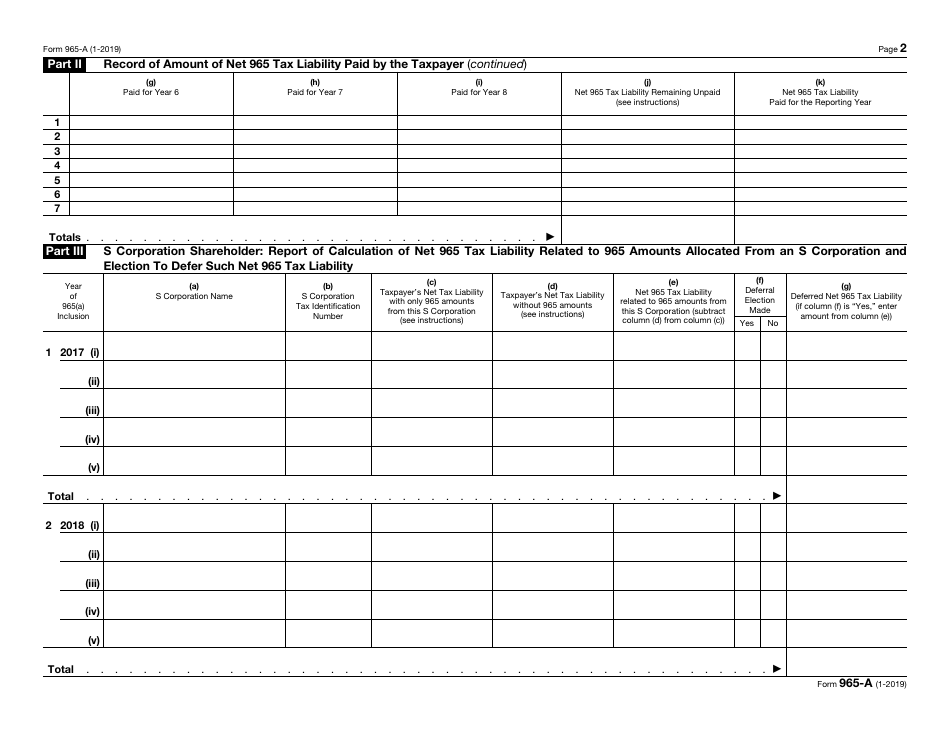

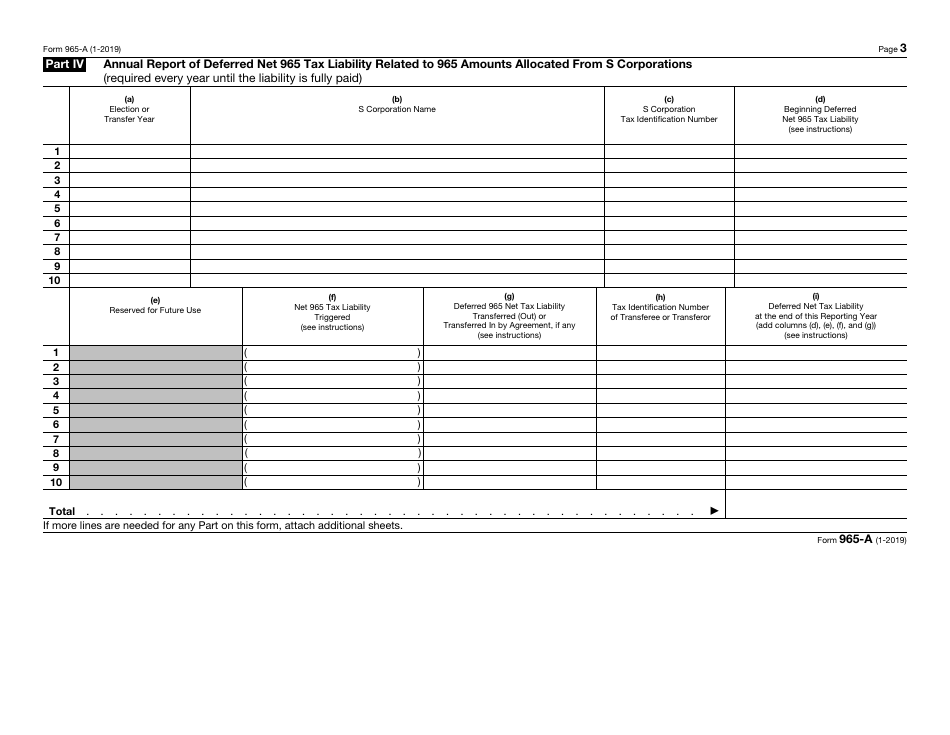

IRS Form 965-A Individual Report of Net 965 Tax Liability

What Is IRS Form 965-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 965-A?

A: IRS Form 965-A is the Individual Report of Net 965 Tax Liability.

Q: Who needs to file Form 965-A?

A: Individuals who have a net 965 tax liability must file Form 965-A.

Q: What is net 965 tax liability?

A: Net 965 tax liability refers to the tax owed under section 965 of the Internal Revenue Code.

Q: What is the purpose of Form 965-A?

A: The purpose of Form 965-A is to report and calculate the net 965 tax liability for individuals.

Q: When is the deadline to file Form 965-A?

A: The deadline to file Form 965-A is generally the same as the individual income tax return deadline, which is April 15th.

Q: Are there any penalties for not filing Form 965-A?

A: Yes, there may be penalties for failing to file Form 965-A or for filing it late. It's important to timely and accurately file the form to avoid penalties.

Q: Is Form 965-A specific to the United States?

A: Yes, Form 965-A is specific to the United States and its tax laws.

Q: Do I need to file Form 965-A if I don't have a net 965 tax liability?

A: No, you only need to file Form 965-A if you have a net 965 tax liability.

Q: Can I file Form 965-A electronically?

A: Yes, Form 965-A can be filed electronically using the IRS e-file system.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 965-A through the link below or browse more documents in our library of IRS Forms.