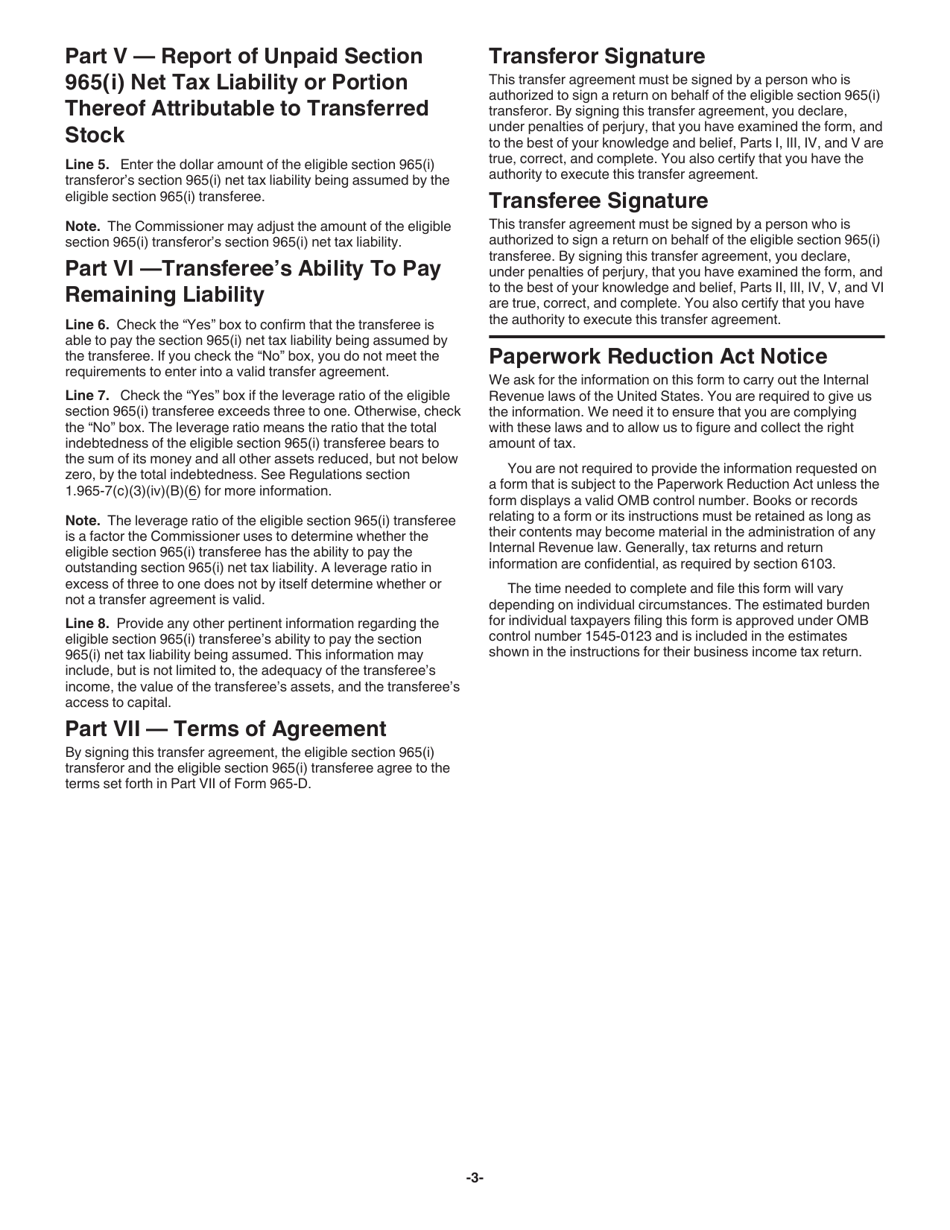

Instructions for IRS Form 965-D Transfer Agreement Under Section 965(I)(2)

This document contains official instructions for IRS Form 965-D , Transfer Agreement Under Section 965(I)(2) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 965-D is available for download through this link.

FAQ

Q: What is IRS Form 965-D?

A: IRS Form 965-D is a transfer agreement used for Section 965(I)(2) purposes.

Q: What is Section 965(I)(2)?

A: Section 965(I)(2) refers to a section of the Internal Revenue Code that addresses the taxation of certain foreign earnings.

Q: Who needs to use IRS Form 965-D?

A: Taxpayers who need to transfer amounts under Section 965(I)(2) are required to use IRS Form 965-D.

Q: What is the purpose of IRS Form 965-D?

A: IRS Form 965-D is used to provide information and agreement related to the transfer of amounts under Section 965(I)(2).

Q: Are there any penalties for not filing IRS Form 965-D?

A: Failure to file IRS Form 965-D or provide accurate information may result in penalties imposed by the IRS.

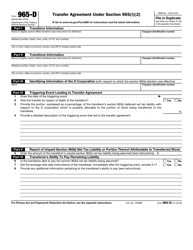

Q: What information is required on IRS Form 965-D?

A: IRS Form 965-D requires information such as the taxpayer's name, address, taxpayer identification number, and details of the transfer.

Q: When is the deadline for filing IRS Form 965-D?

A: The deadline for filing IRS Form 965-D varies and will be specified by the IRS depending on the taxpayer's circumstances.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.