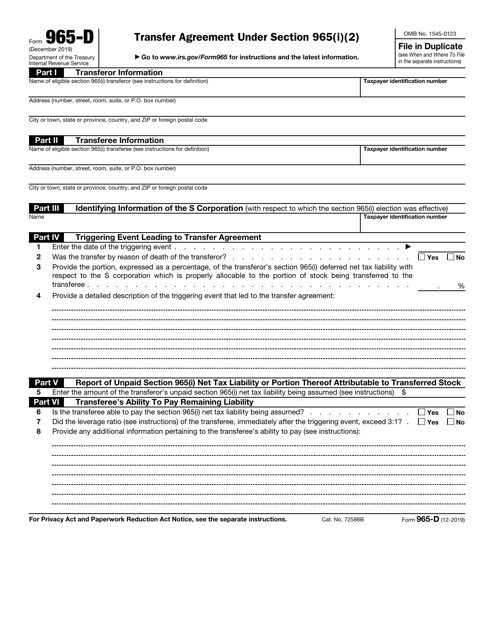

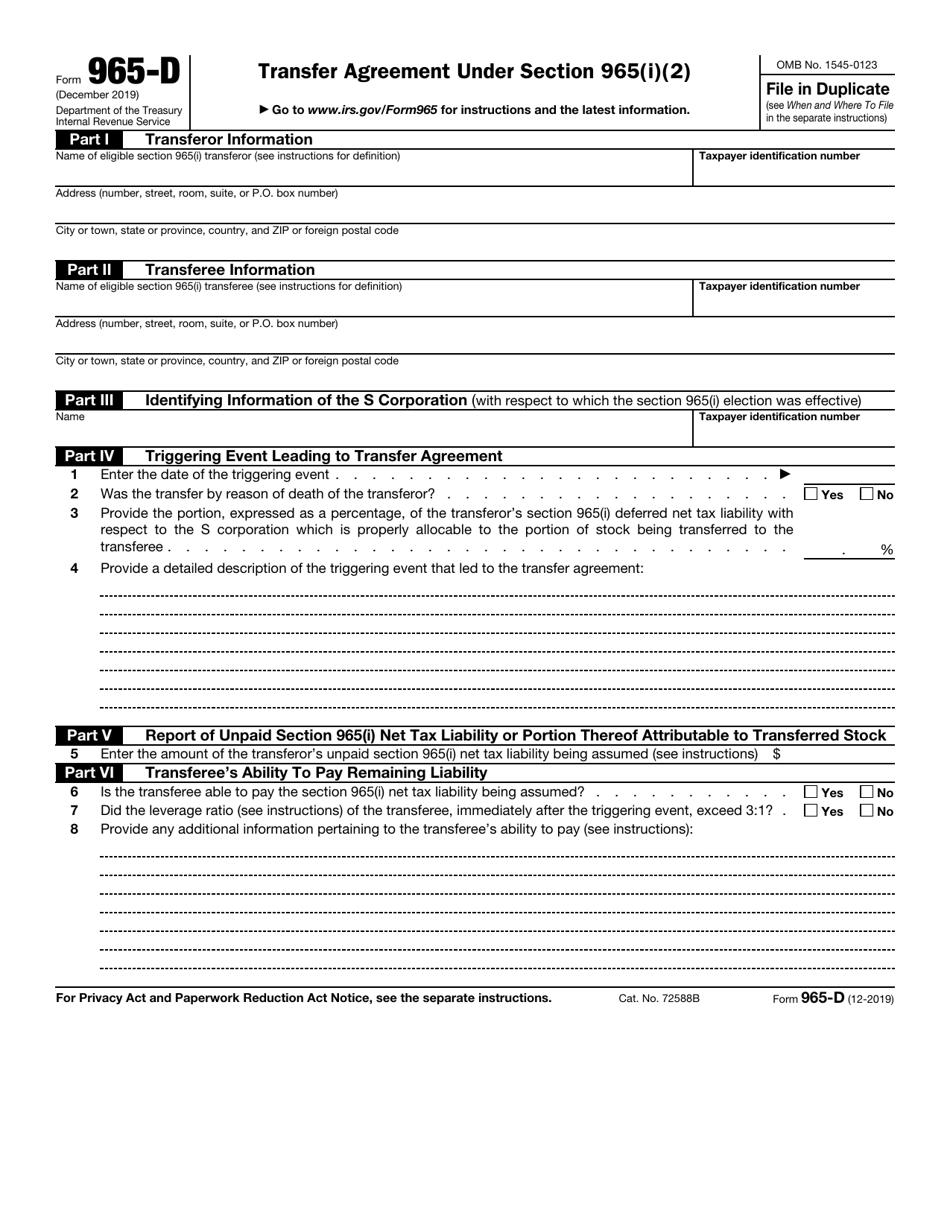

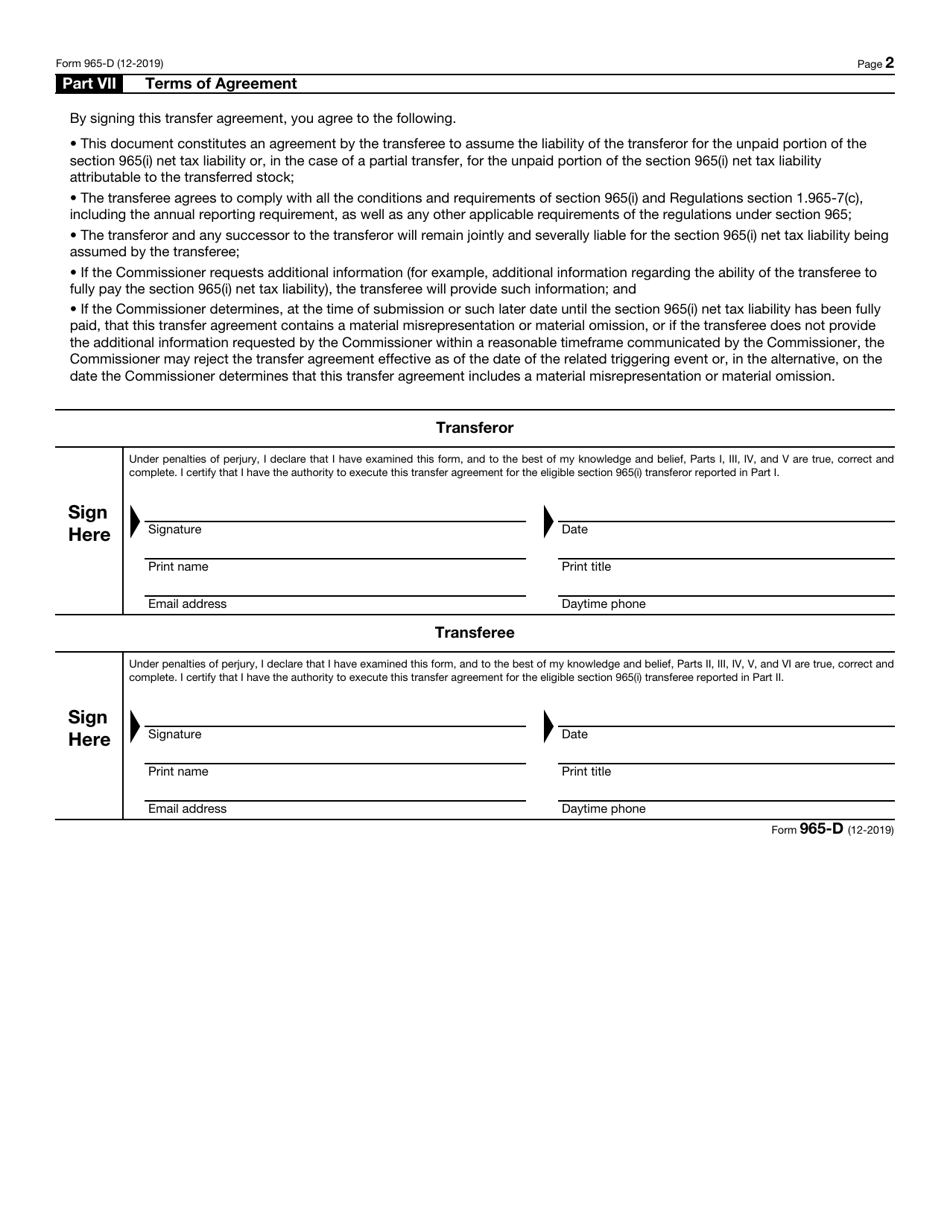

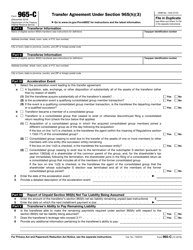

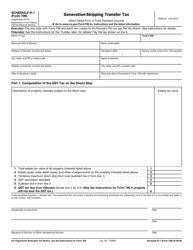

IRS Form 965-D Transfer Agreement Under Section 965(I)(2)

What Is IRS Form 965-D?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is the IRS Form 965-D?

A: The IRS Form 965-D is a transfer agreement under section 965(I)(2).

Q: What does the IRS Form 965-D entail?

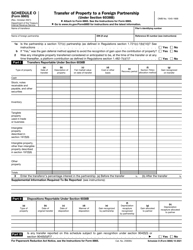

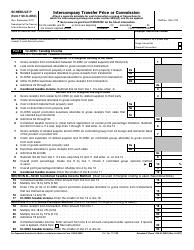

A: The IRS Form 965-D is used to report the transfer of property or obligations in connection with the transition tax imposed under section 965.

Q: Who needs to file the IRS Form 965-D?

A: Any taxpayer who is subject to the transition tax under section 965 may need to file the IRS Form 965-D.

Q: What is the purpose of the transfer agreement?

A: The transfer agreement is used to identify and report the transfer of assets or obligations, which may affect the calculation of the transition tax.

Form Details:

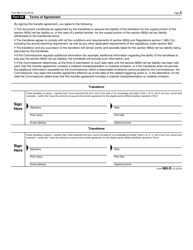

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 965-D through the link below or browse more documents in our library of IRS Forms.