This version of the form is not currently in use and is provided for reference only. Download this version of

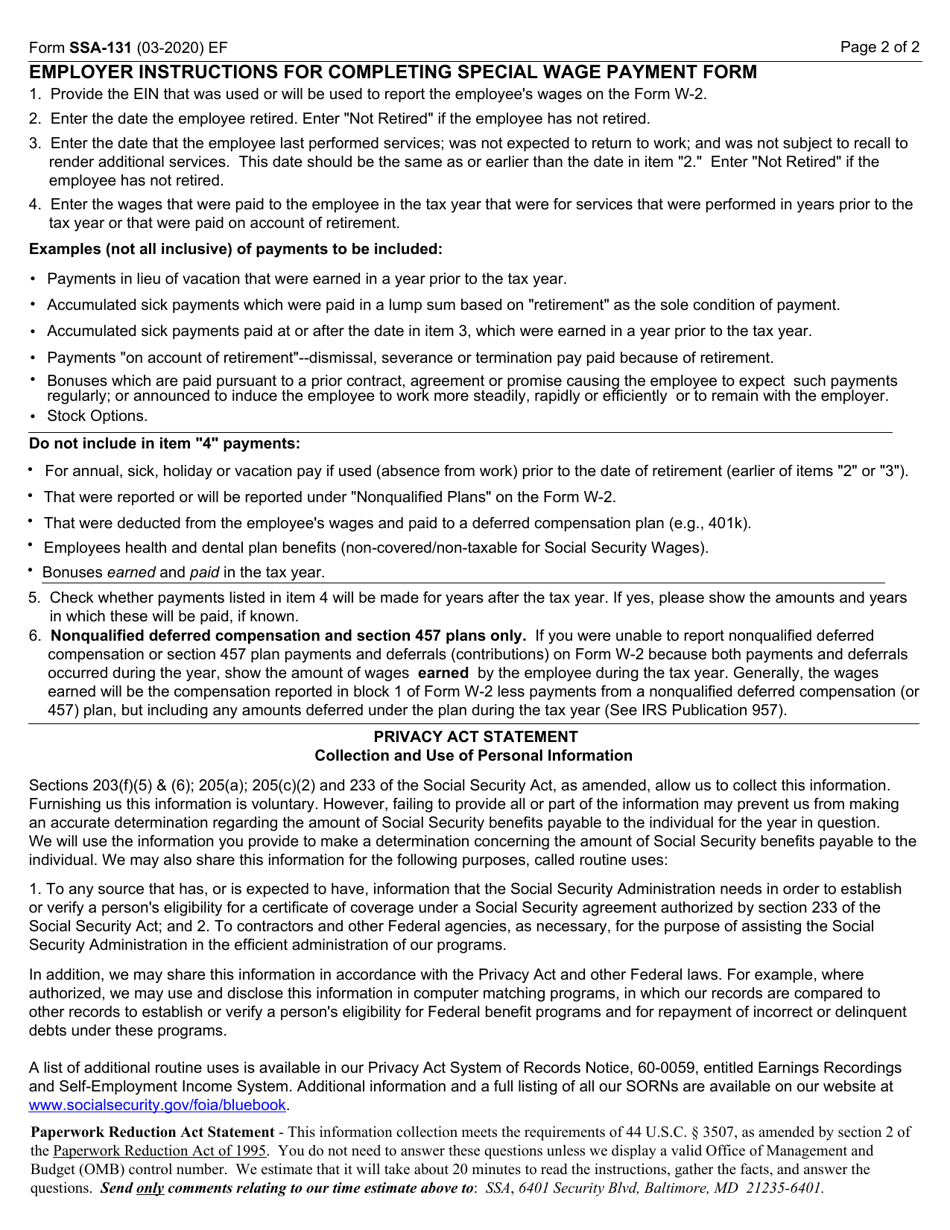

Form SSA-131

for the current year.

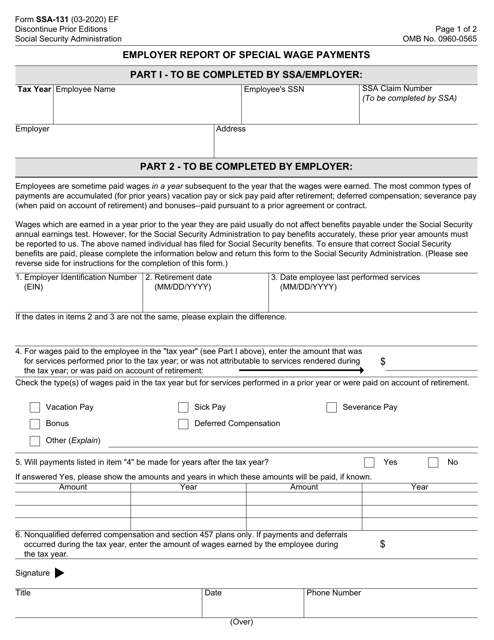

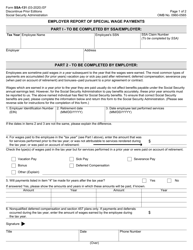

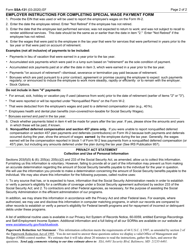

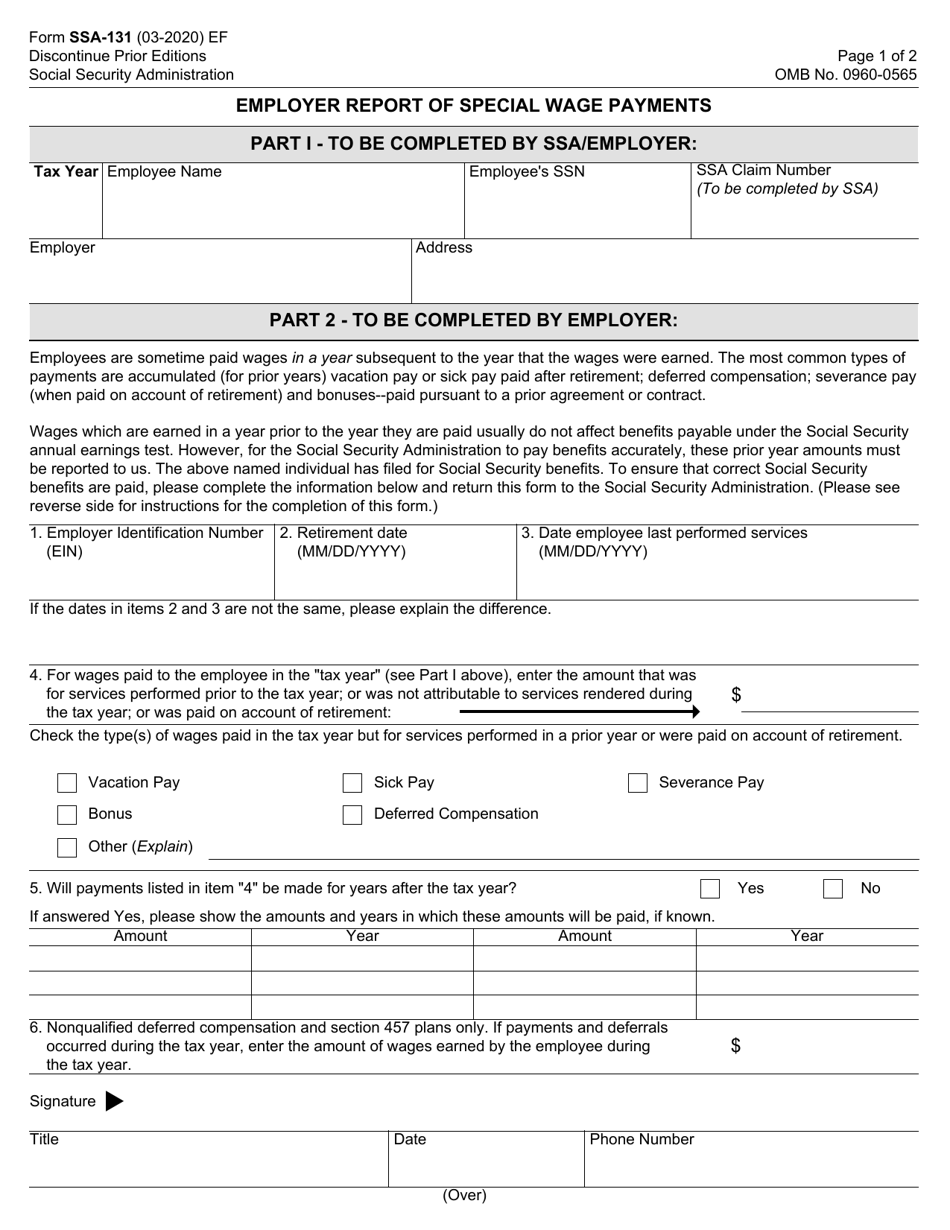

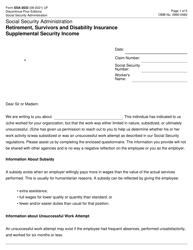

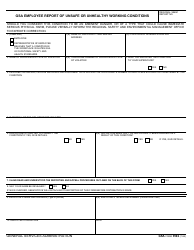

Form SSA-131 Employer Report of Special Wage Payments

What Is Form SSA-131?

This is a legal form that was released by the U.S. Social Security Administration on March 1, 2020 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SSA-131?

A: Form SSA-131 is the Employer Report of Special Wage Payments.

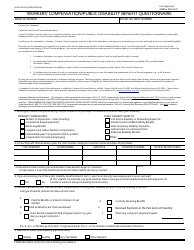

Q: Who needs to file Form SSA-131?

A: Employers who are reporting special wage payments made to their employees need to file Form SSA-131.

Q: What are special wage payments?

A: Special wage payments are payments made to employees that are not regular wages, such as bonuses or severance pay.

Q: When should Form SSA-131 be filed?

A: Form SSA-131 should be filed by the employer on an annual basis, by January 31st of the year following the calendar year in which the special wage payments were made.

Form Details:

- Released on March 1, 2020;

- The latest available edition released by the U.S. Social Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SSA-131 by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.