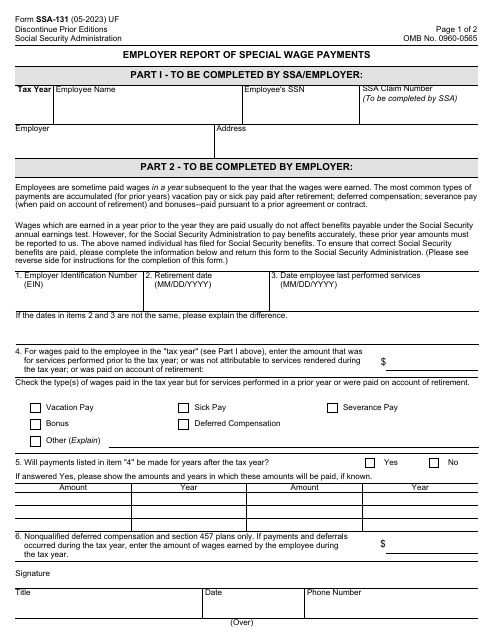

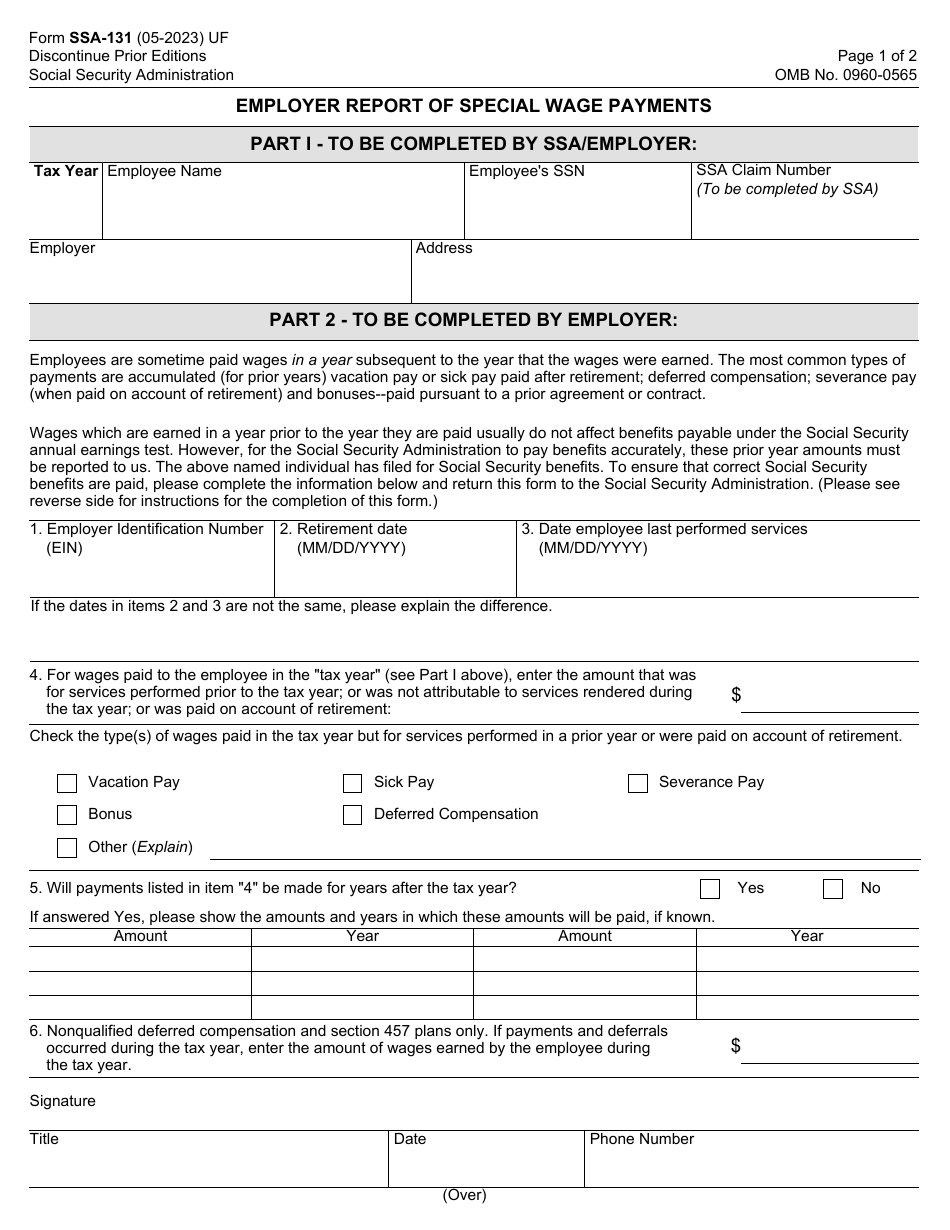

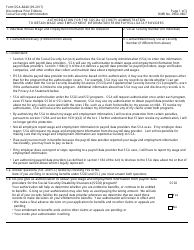

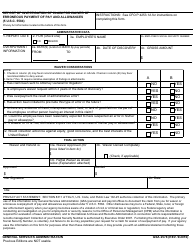

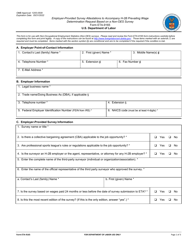

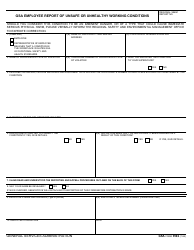

Form SSA-131 Employer Report of Special Wage Payments

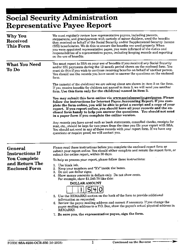

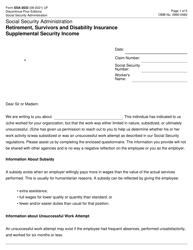

What Is Form SSA-131?

Form SSA-131, Employer Report of Special Wage Payments , is a form used for reporting special wages paid to the employee. The form was issued by the U.S. Social Security Administration (SSA) The latest version of the document was released on May 1, 2023 . The previous editions of the form are obsolete. An SSA-131 fillable form is available for download and digital filing below.

Alternate Names:

- SSA Form 131;

- SSA Special Wage Payment Form.

Special wage payments are amounts paid to employees by employers for the services they performed during a prior year. The person obliged to report to the SSA special wage payments made to current and former employees is an employer. The information provided in the report - previously referred to as the Form SSA-131-OCR - is used by the SSA is to make a decision regarding the amount of Social Security benefits the employee is eligible to.

How to Fill Out Form SSA-131?

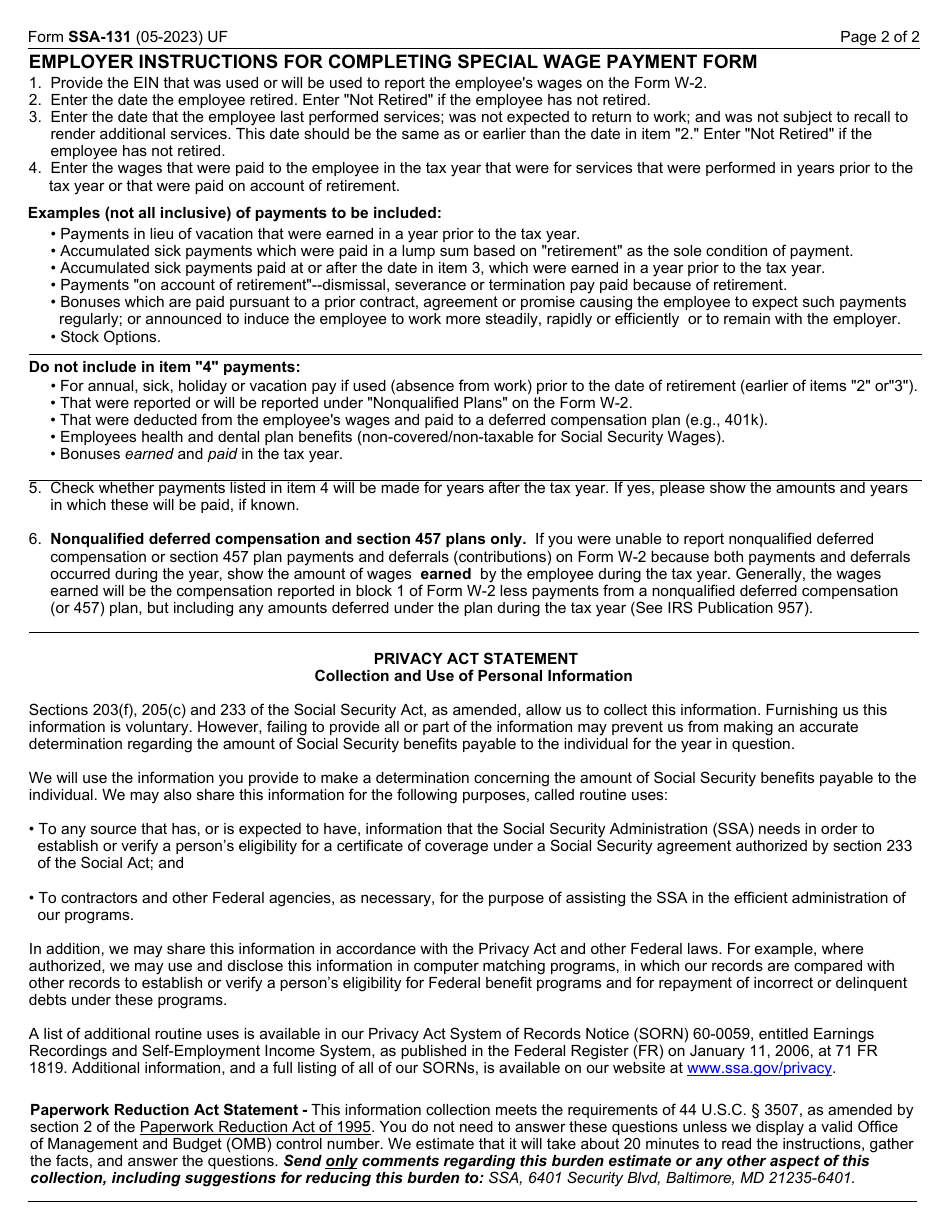

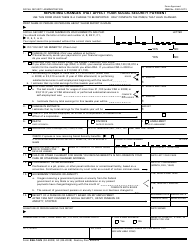

When reporting special wage payments, the employer may refer to the instructions provided on the second page of Form SSA-131. Step-by-step Form SSA-131 instructions can be found below.

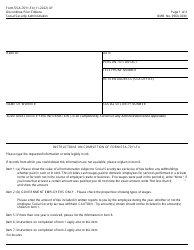

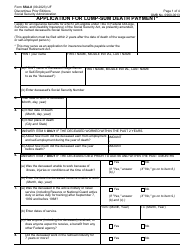

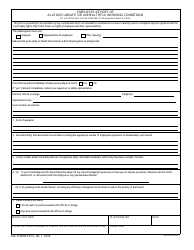

- Part 1 should be filled out by the employer and the SSA official. Indicate the tax year, name and SSN of the employee, name, and address of the employer.

- Provide the Employer Identification Number (EIN) in Item 1. The EIN must be the same as indicated on IRS Form W-2, Wage and Tax Statement, that you used or will use to report the employee's wages.

- Specify the date the employee retired in Item 2. Don't leave this space blank. If the employee is not retired, enter "Not retired."

- Specify the date the employee performed services for the last time in Item 3. Do not leave this part blank either. If the employee is still working, enter "Not retired." If the employee is retired, but the retirement date and the date the employee last performed services are not the same, provide the applicable explanations.

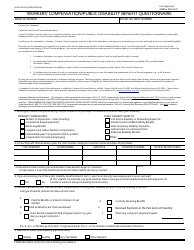

- Provide the wages paid to the employee for the services the employee performed in years prior to the current tax year in Item 4. Alternatively, indicate the amounts that were paid to the employee on account of retirement. Besides, this Item may include the accumulated sick payments, payments in lieu of vacation, bonuses paid pursuant to a prior contract, and stock options. Do not provide in this part holiday, vacation, sick or annual pay if used before the date provided in Items 2 and 3, the payments that can be reported under "Nonqualified Plans" (IRS Form W-2), payments deducted from the employee wages to be paid to a deferred compensation plan, bounces the employee earned in the tax year, health and dental plan benefits.

- If the payments you listed in Item 4 will be made for years after the tax year, check the applicable box in Item 5. Enter the amounts and the years these amounts will be paid.

- Complete Item 6 only if you could not provide nonqualified deferred compensation or section 457 plan payments and contributions on IRS Form W-2 since the payments and contributions occurred during the year. Specify the amount earned by the employee during the tax year.

- Sign the document, indicate your title, phone number, and date you completed the form.

Do I Report Accrued Vacation Time on Form SSA-131?

Do not include accrued vacation time when completing the SSA Special Wage Payment Form. The document may include only the amount paid to your employee in lieu of vacation earned in a year prior to the tax year.

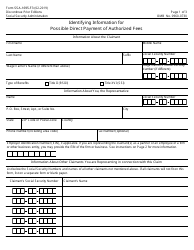

Where to Mail Form SSA-131?

Mail or take the completed and signed Form SSA-131 to the nearest SSA office. You can check up the list of the applicable offices at the official SSA website.