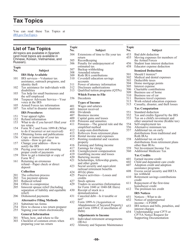

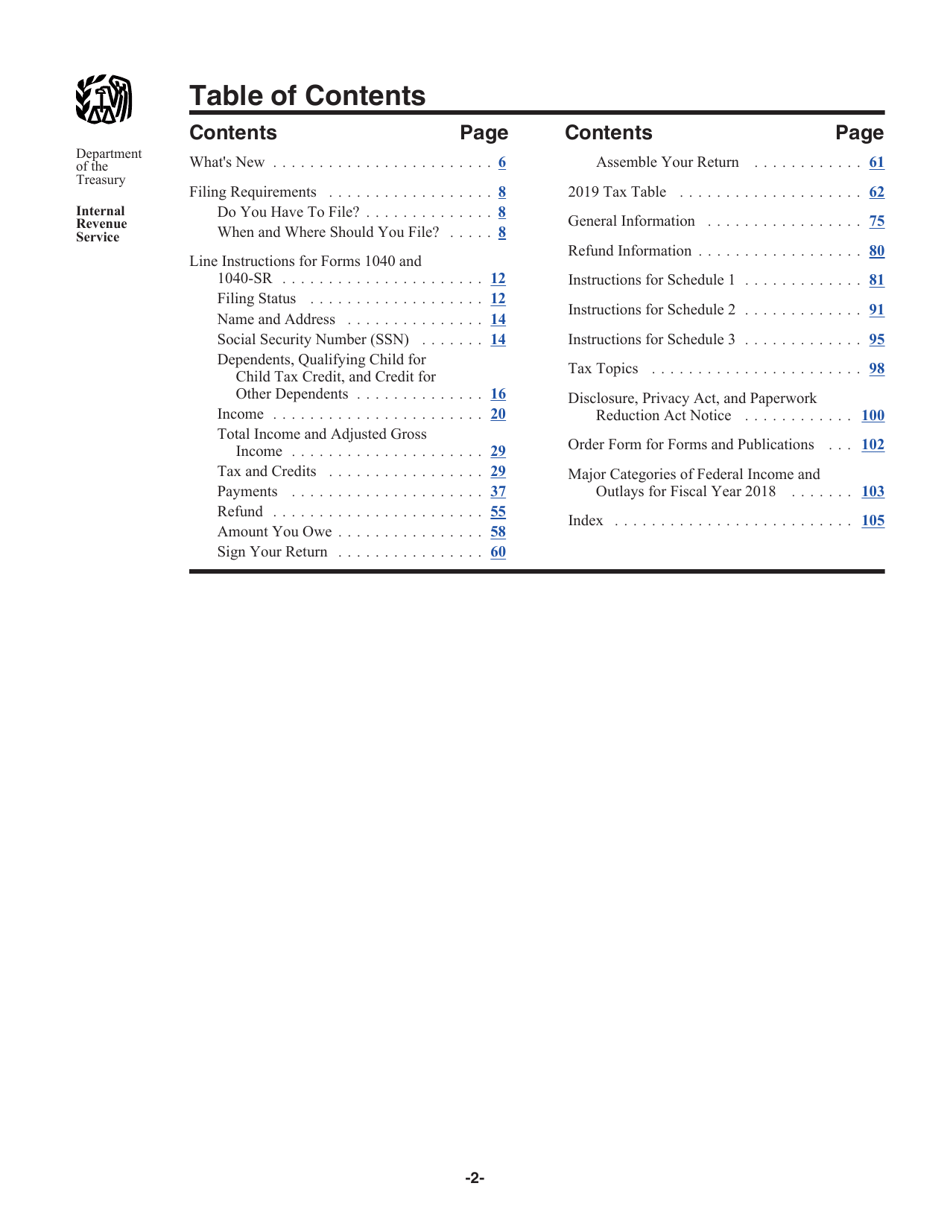

Instructions for IRS Form 1040, 1040-SR

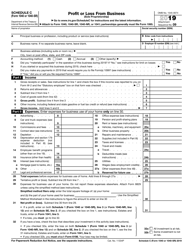

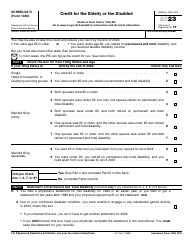

This document contains official instructions for IRS Form 1040 , and IRS Form 1040-SR . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 (1040-SR) Schedule C is available for download through this link.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is the individual income tax return form for U.S. taxpayers.

Q: What is IRS Form 1040-SR?

A: IRS Form 1040-SR is a simplified tax return form for seniors, age 65 or older, with larger print and bigger spaces to fill out.

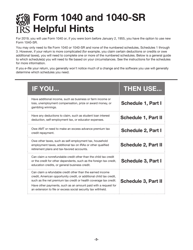

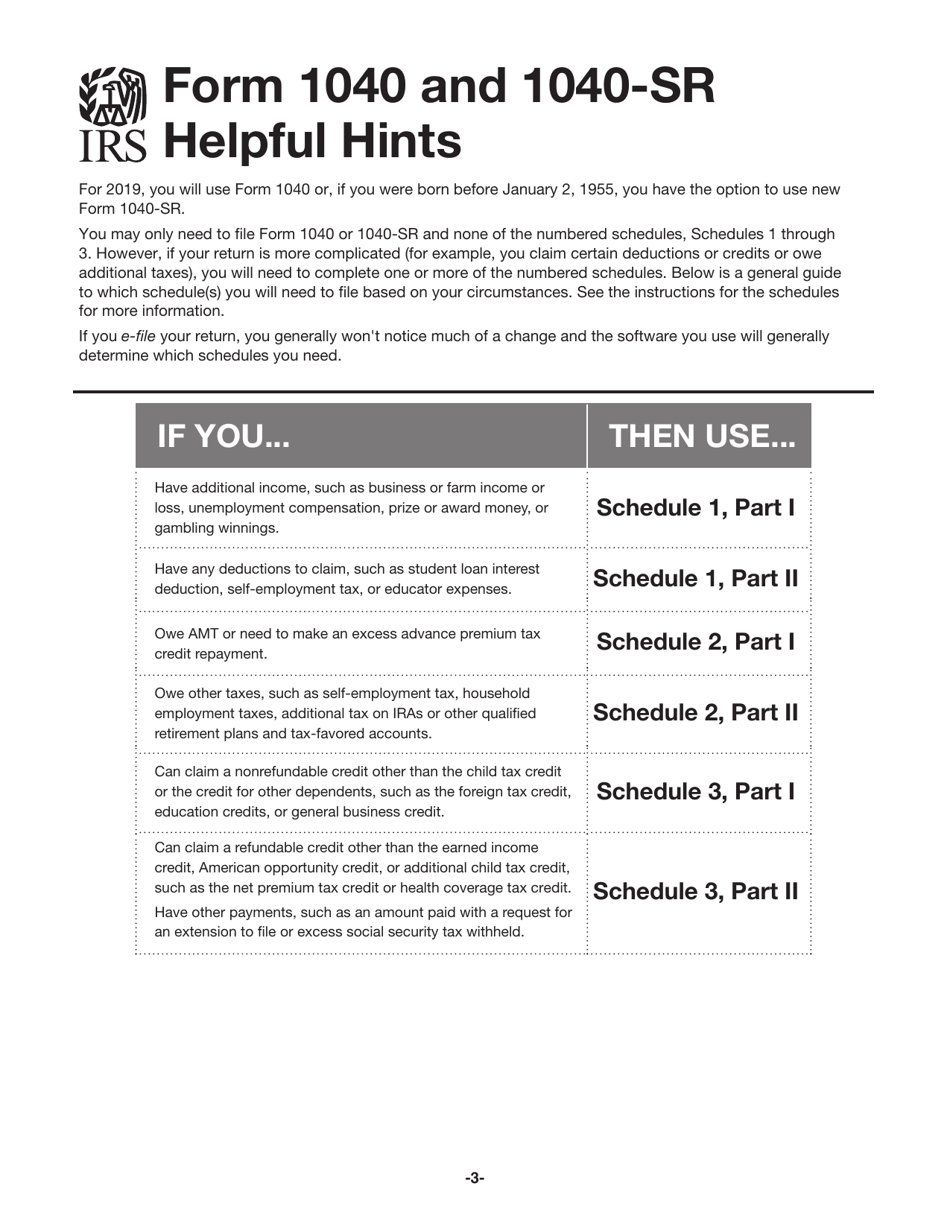

Q: What information do I need to fill out IRS Form 1040 and 1040-SR?

A: You will need information such as your income, deductions, credits, and personal details to fill out Form 1040 and 1040-SR.

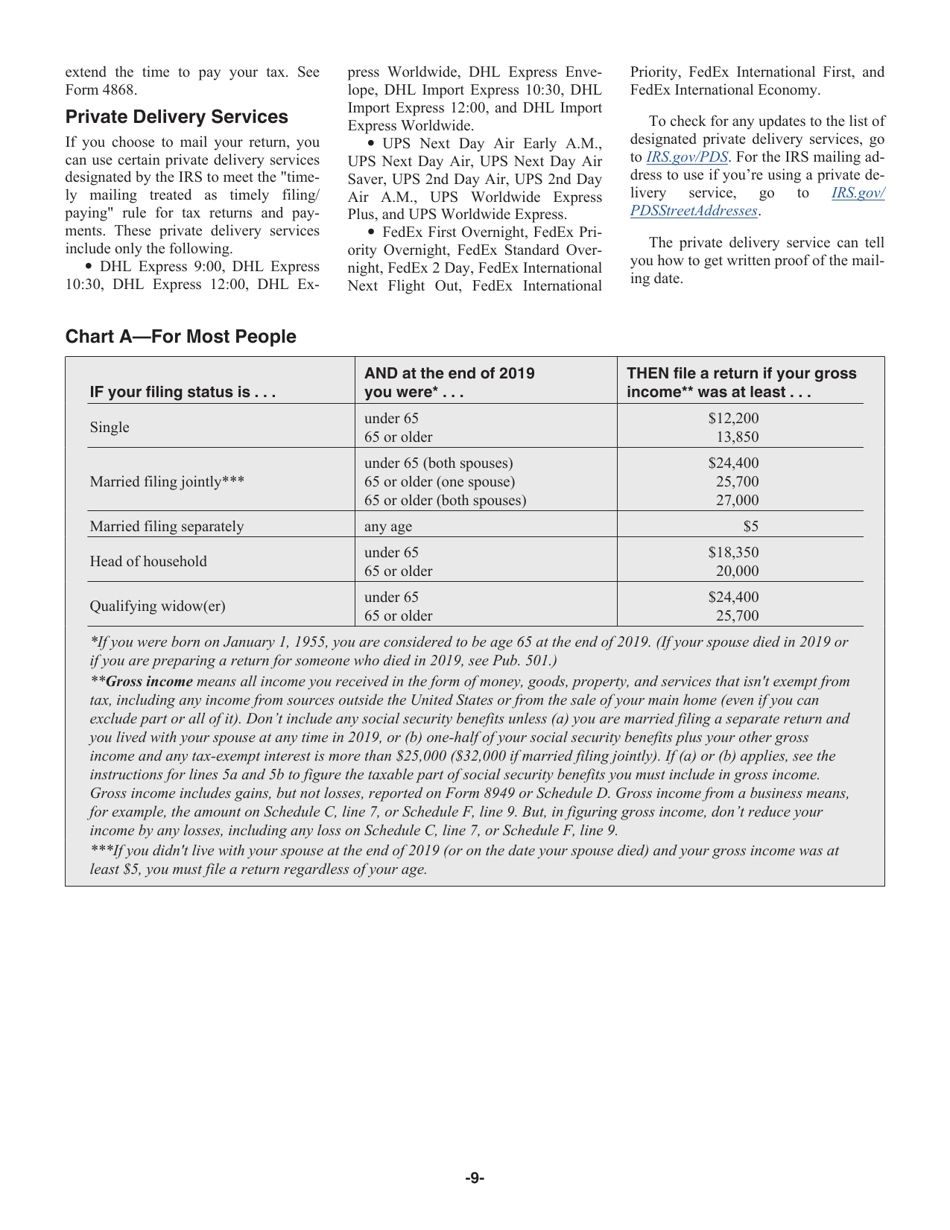

Q: When is the deadline to file IRS Form 1040 and 1040-SR?

A: The deadline to file IRS Form 1040 and 1040-SR is typically April 15th, unless it falls on a weekend or holiday.

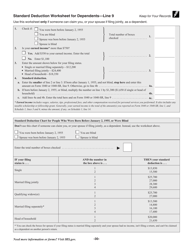

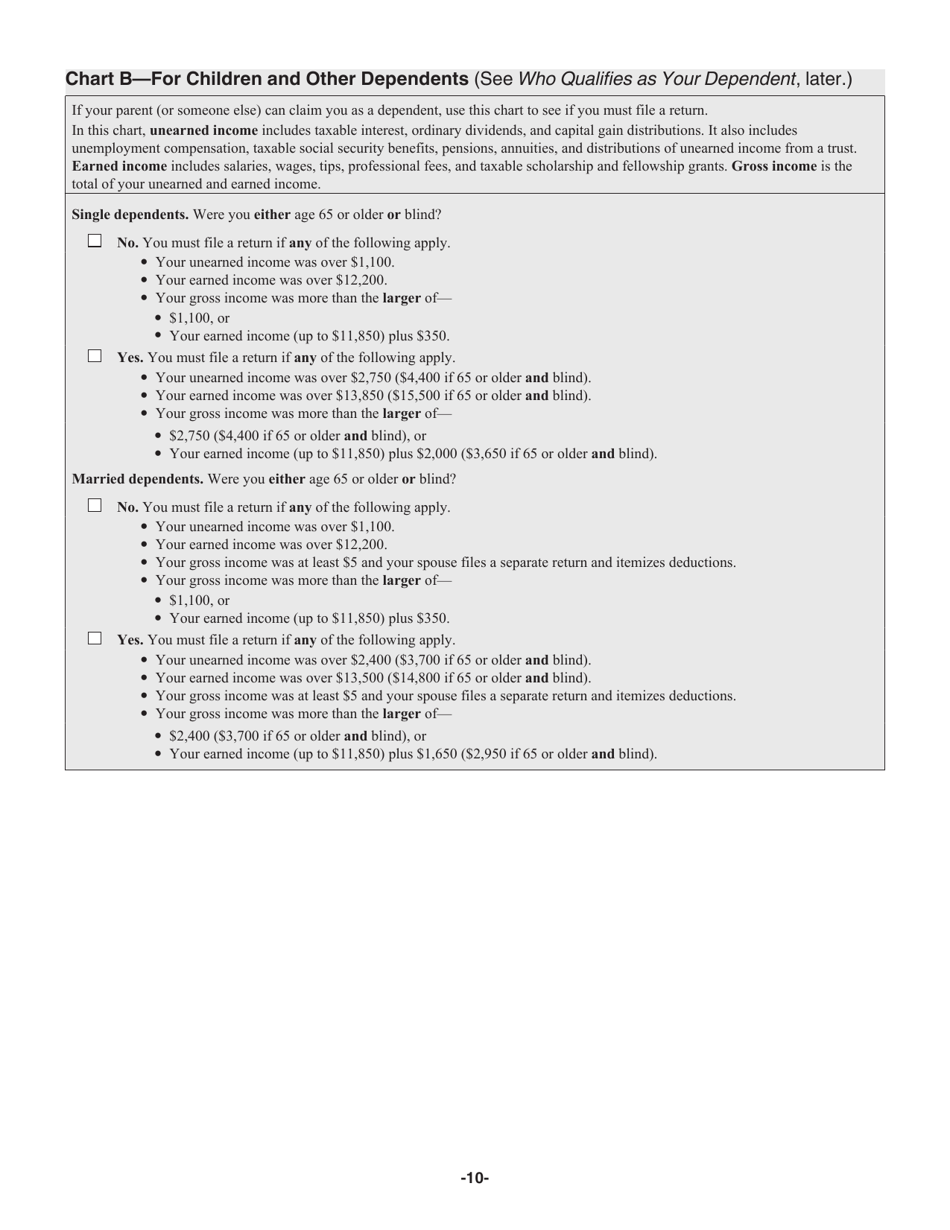

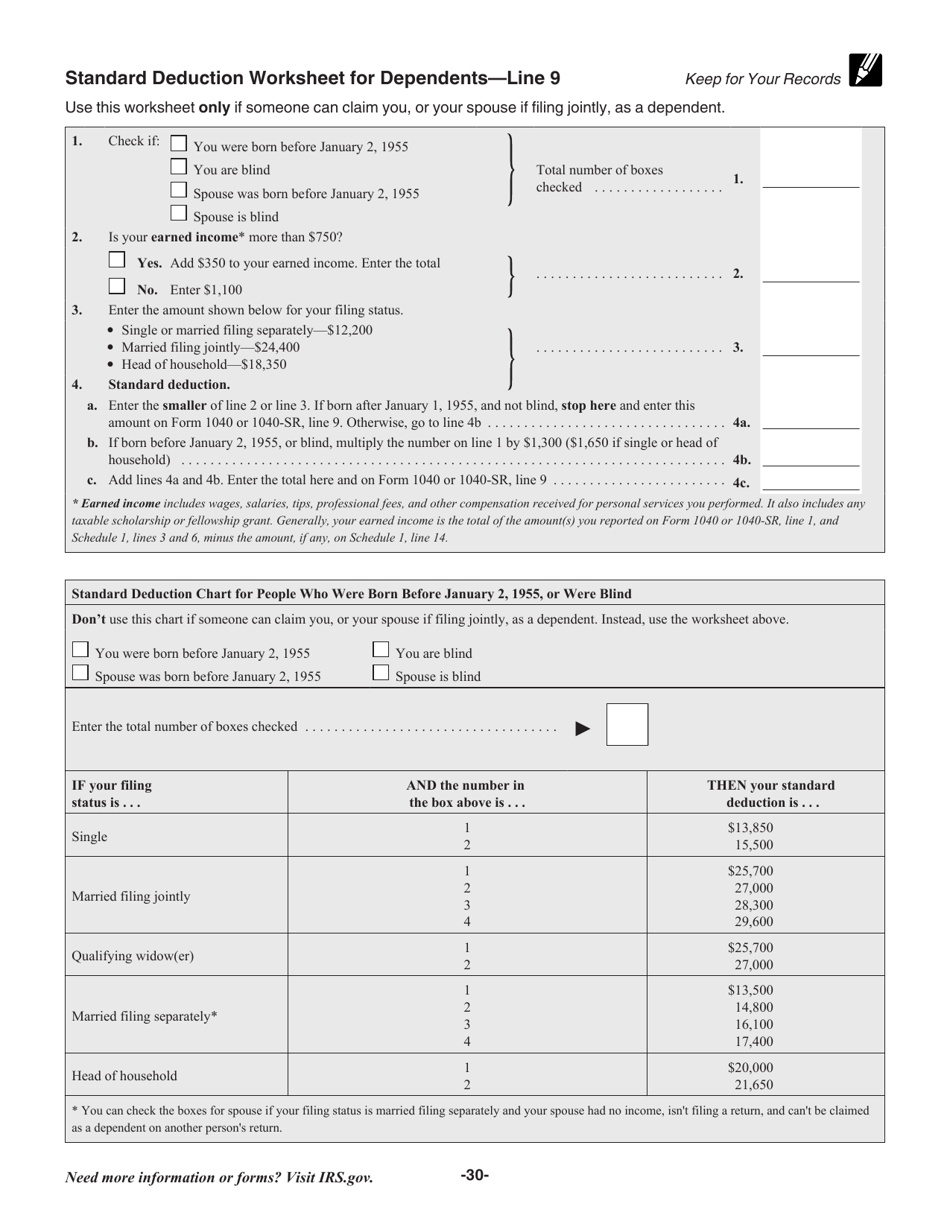

Q: Are there any special rules or deductions for seniors on IRS Form 1040-SR?

A: IRS Form 1040-SR allows seniors to claim additional standard deduction amounts and includes specific lines for reporting retirement income.

Q: What should I do if I need help filling out IRS Form 1040 and 1040-SR?

A: If you need assistance, you can seek help from a tax professional, utilize the IRS free tax filing assistance programs, or call the IRS helpline for support.

Instruction Details:

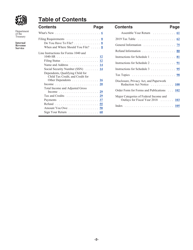

- This 108-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.