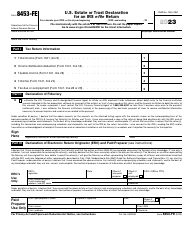

This version of the form is not currently in use and is provided for reference only. Download this version of

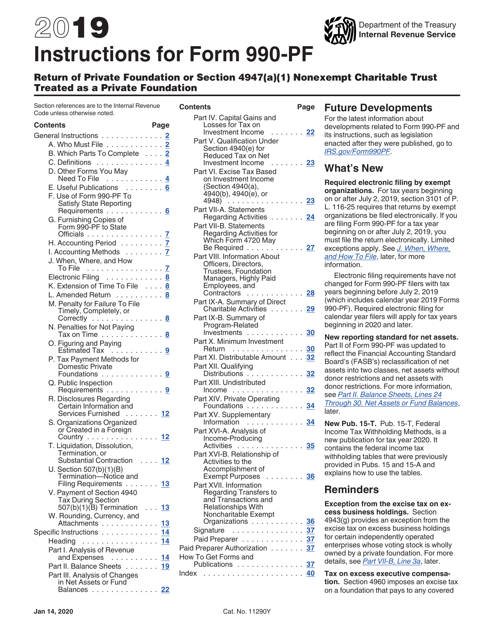

Instructions for IRS Form 990-PF

for the current year.

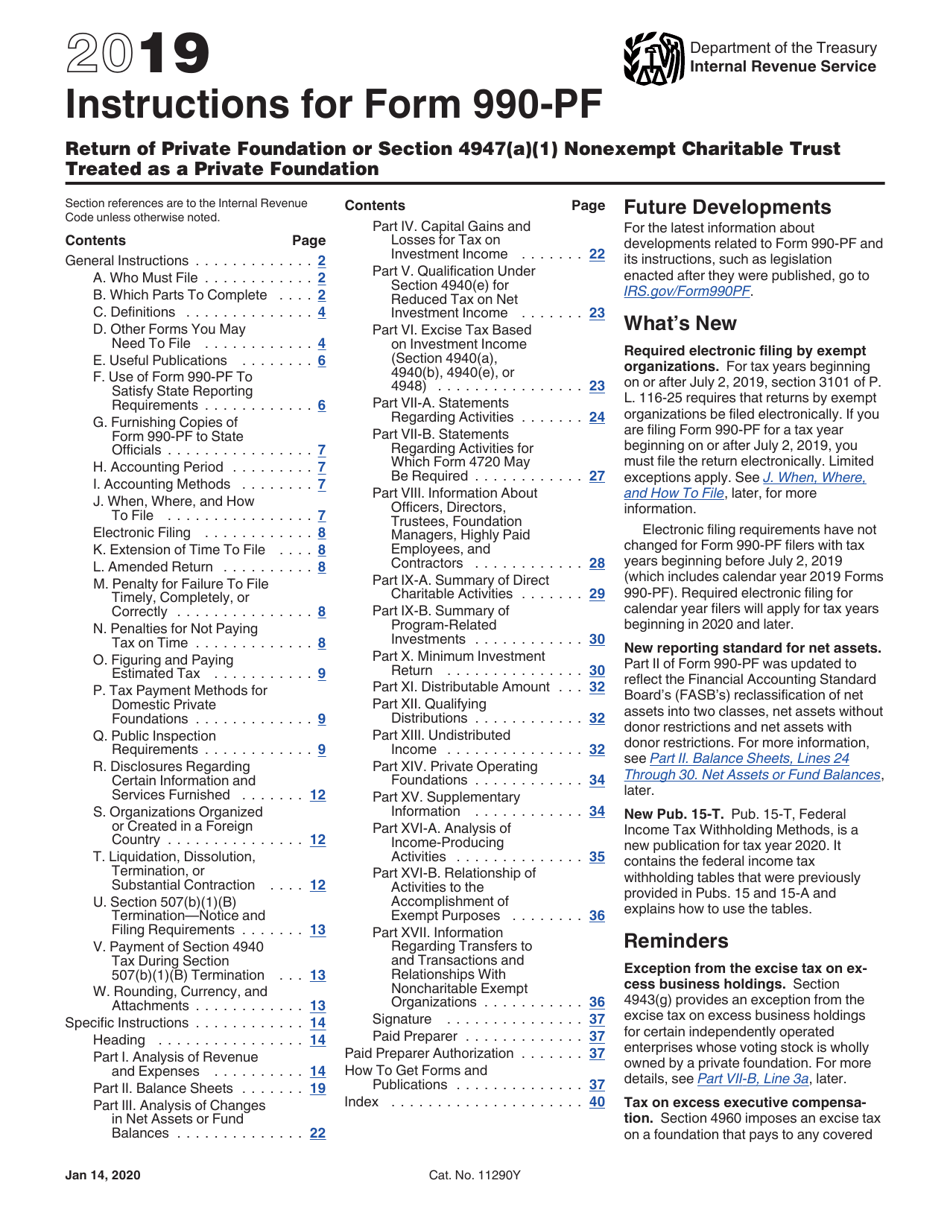

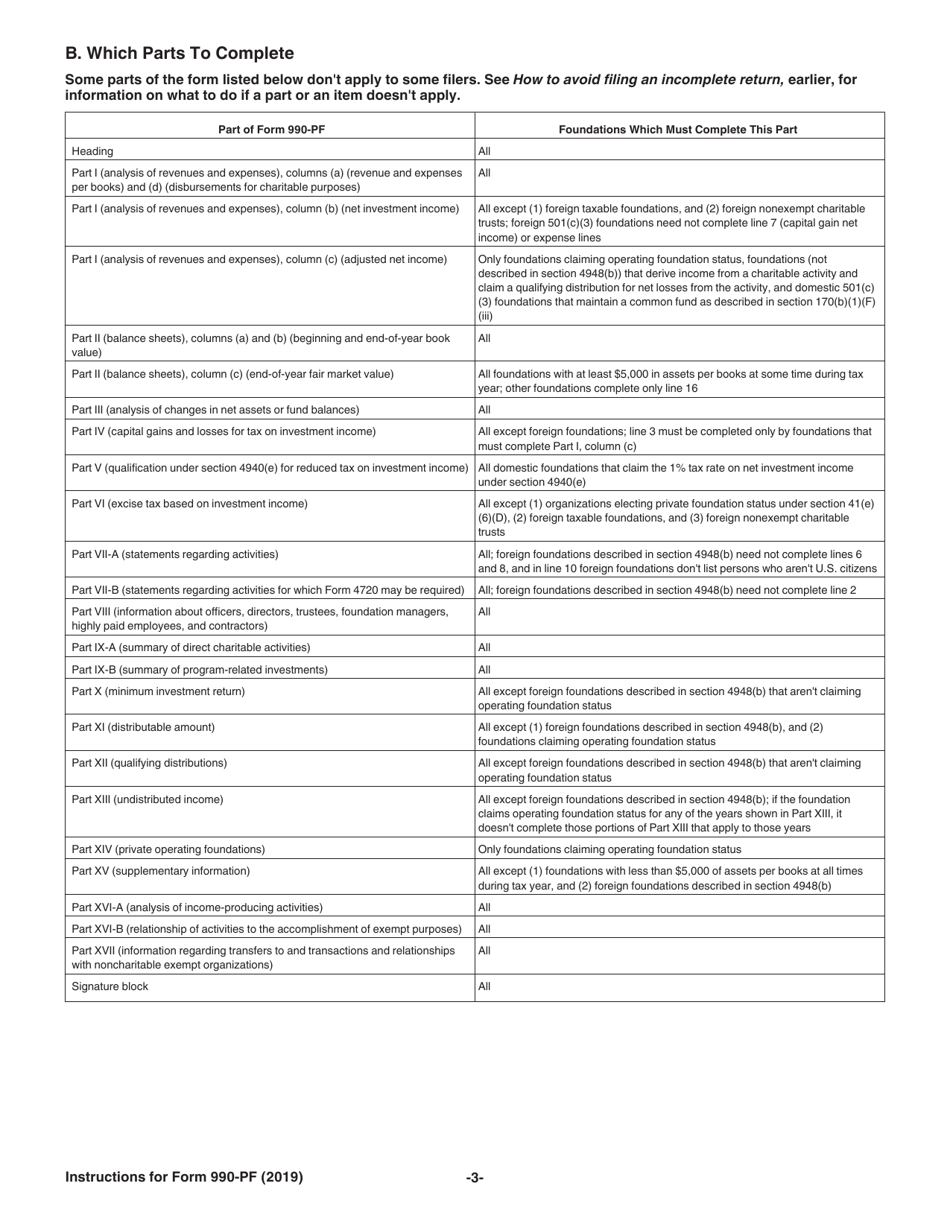

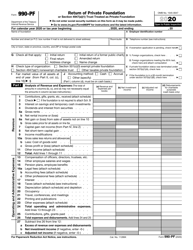

Instructions for IRS Form 990-PF Return of Private Foundation or Section 4947(A)(1) Nonexempt Charitable Trust Treated as a Private Foundation

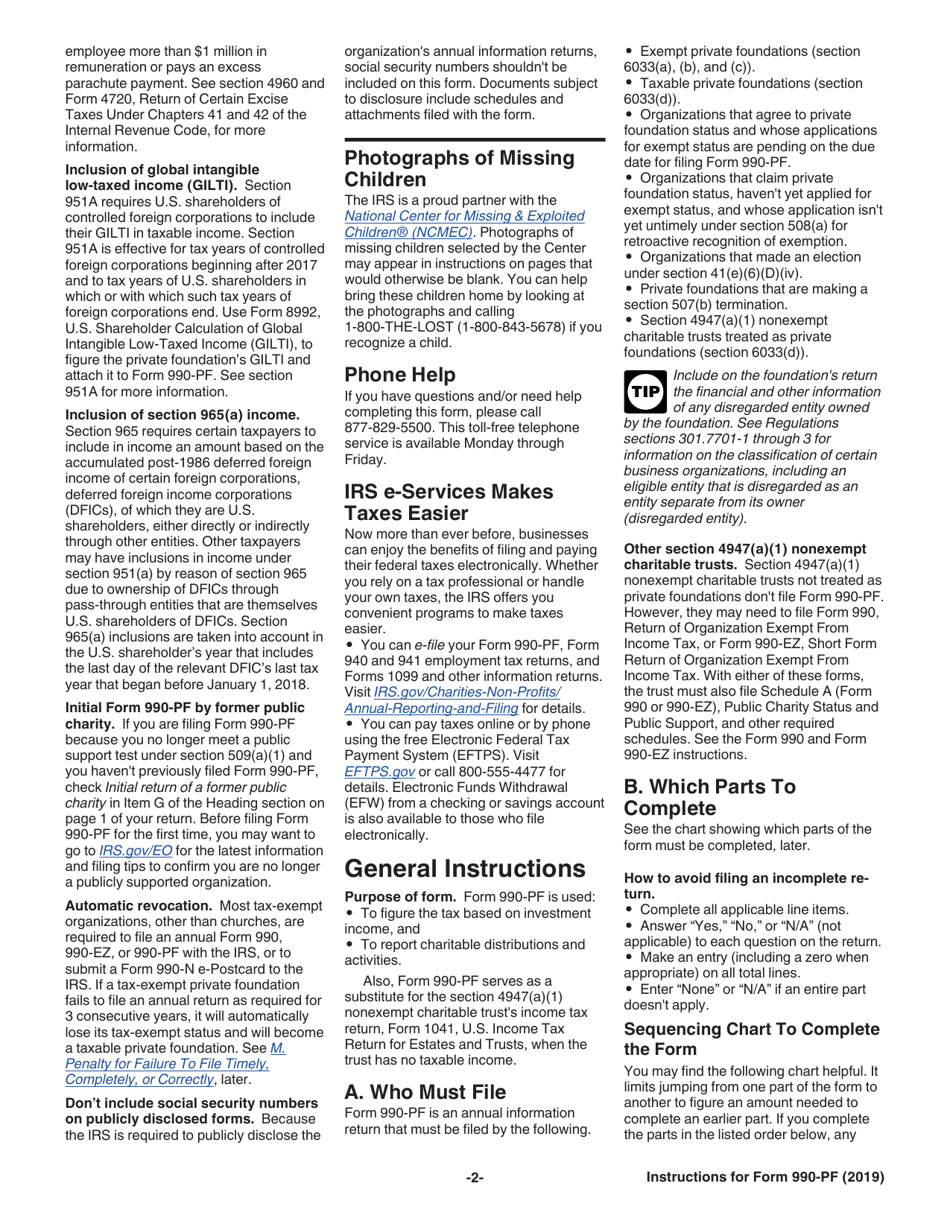

This document contains official instructions for IRS Form 990-PF , Return of Charitable Trust Treated as a Private Foundation - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990-PF is available for download through this link.

FAQ

Q: What information needs to be reported on IRS Form 990-PF?

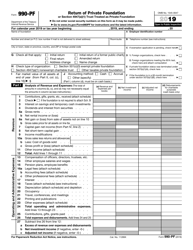

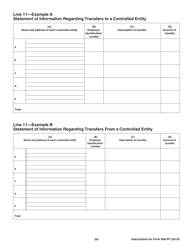

A: IRS Form 990-PF requires reporting of financial information, grants made, investments, expenses, compensation of officers, and other relevant details about the private foundation's activities.

Q: When is the deadline for filing IRS Form 990-PF?

A: Generally, IRS Form 990-PF must be filed by the 15th day of the 5th month after the end of the foundation's fiscal year.

Q: Are there any penalties for not filing IRS Form 990-PF?

A: Yes, there are penalties for not filing IRS Form 990-PF, including fines and potential loss of tax-exempt status for the foundation.

Instruction Details:

- This 40-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.