This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990-PF

for the current year.

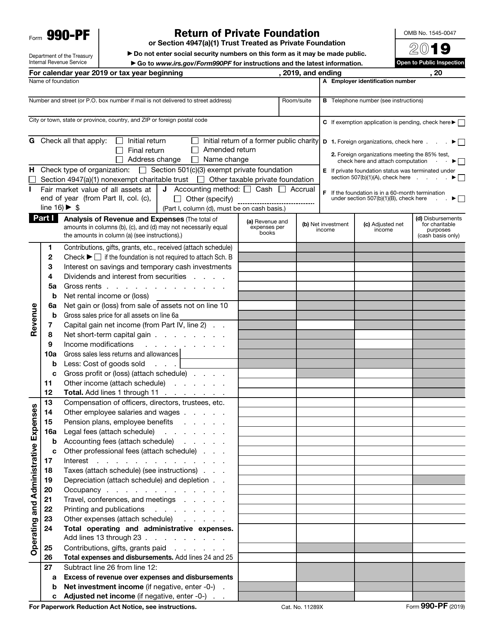

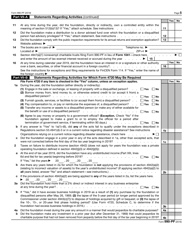

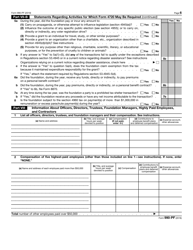

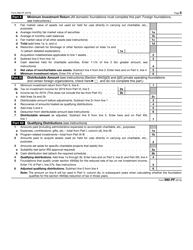

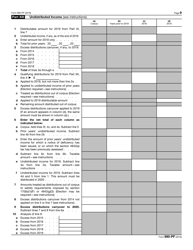

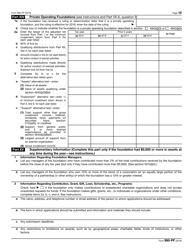

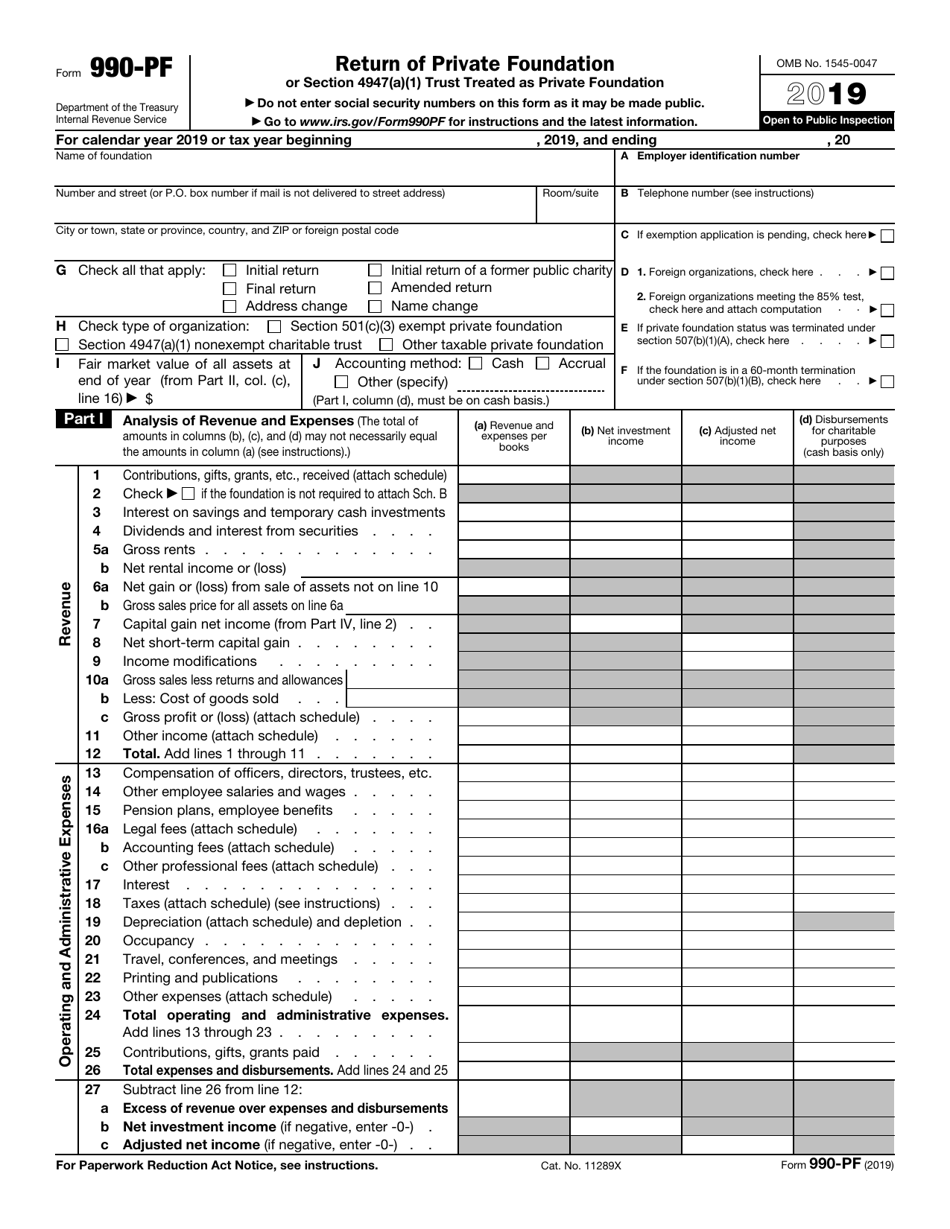

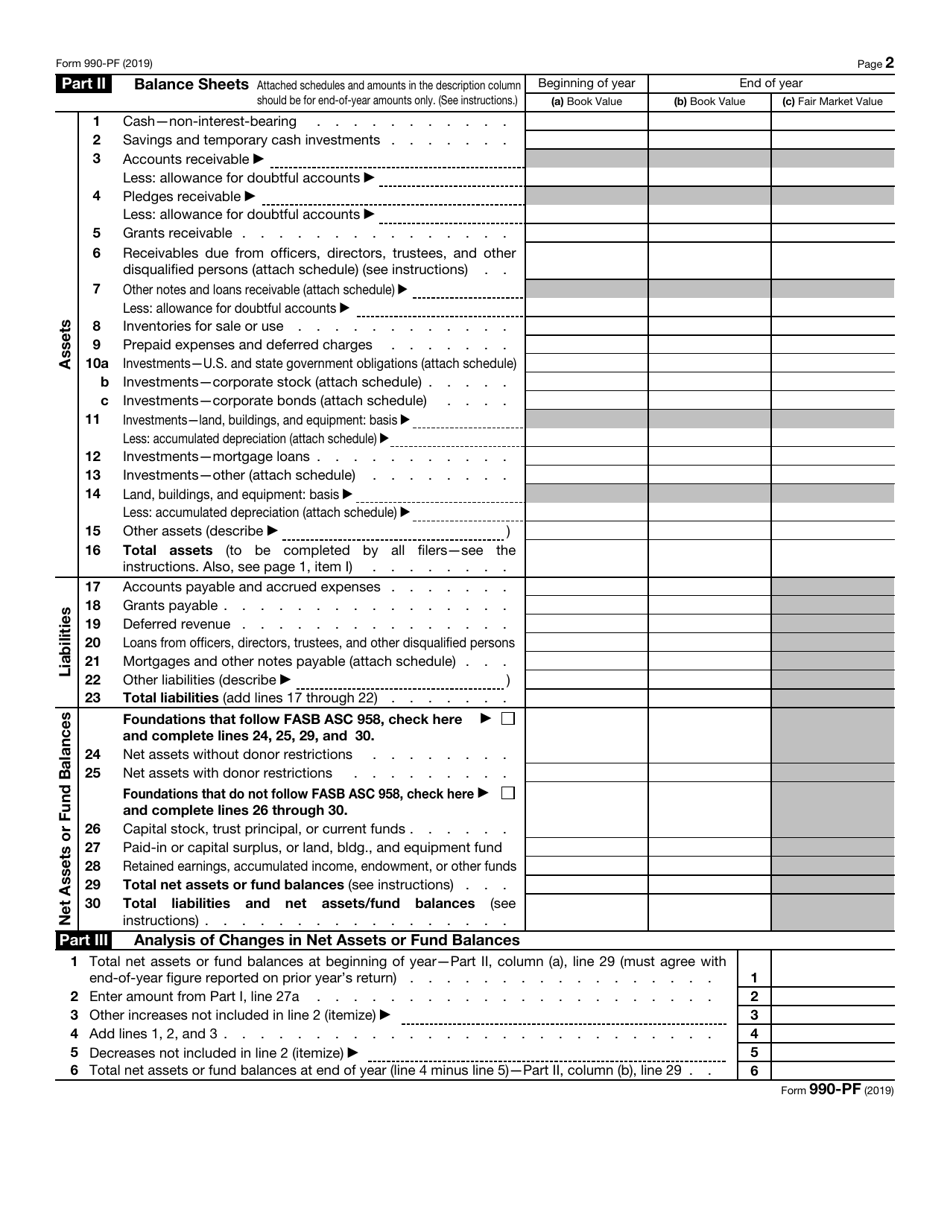

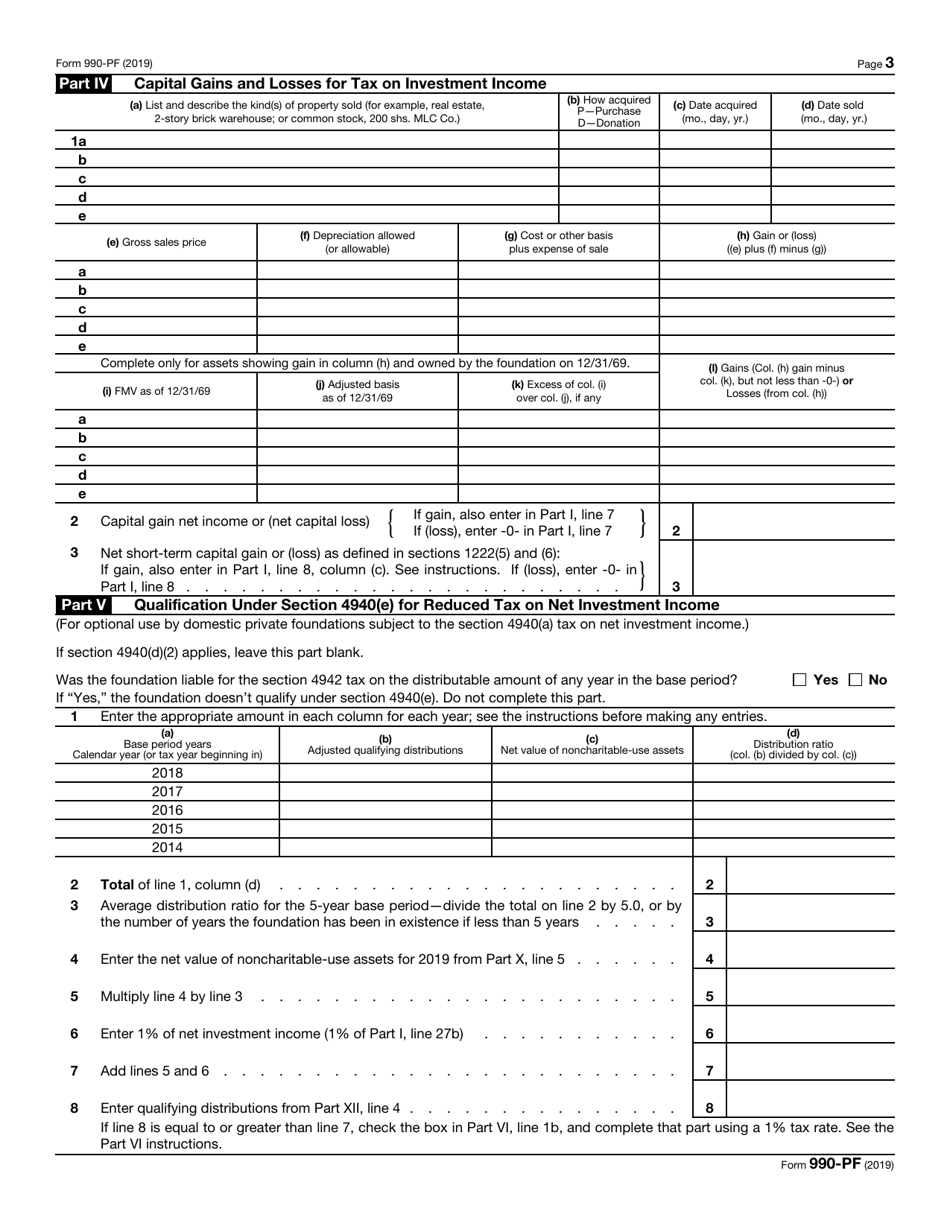

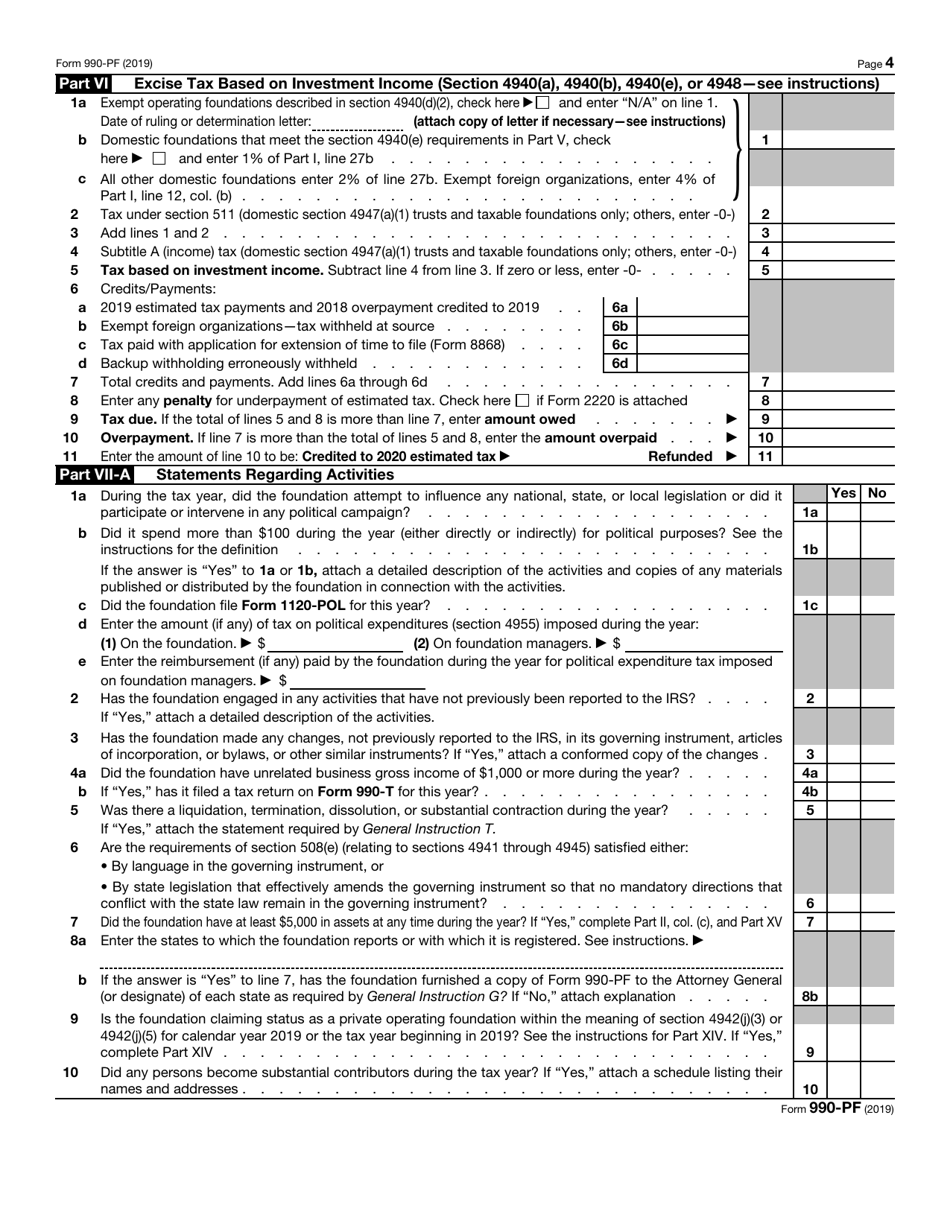

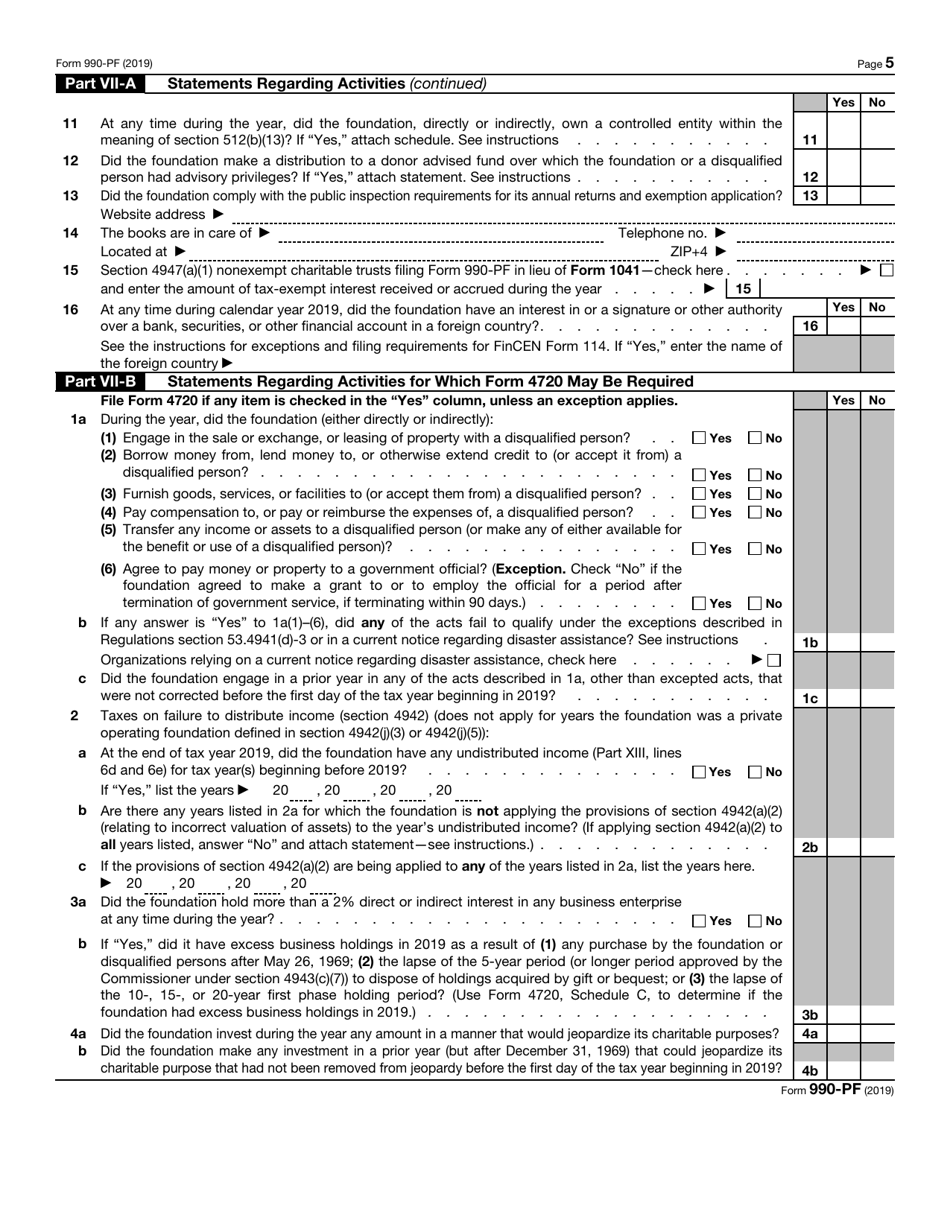

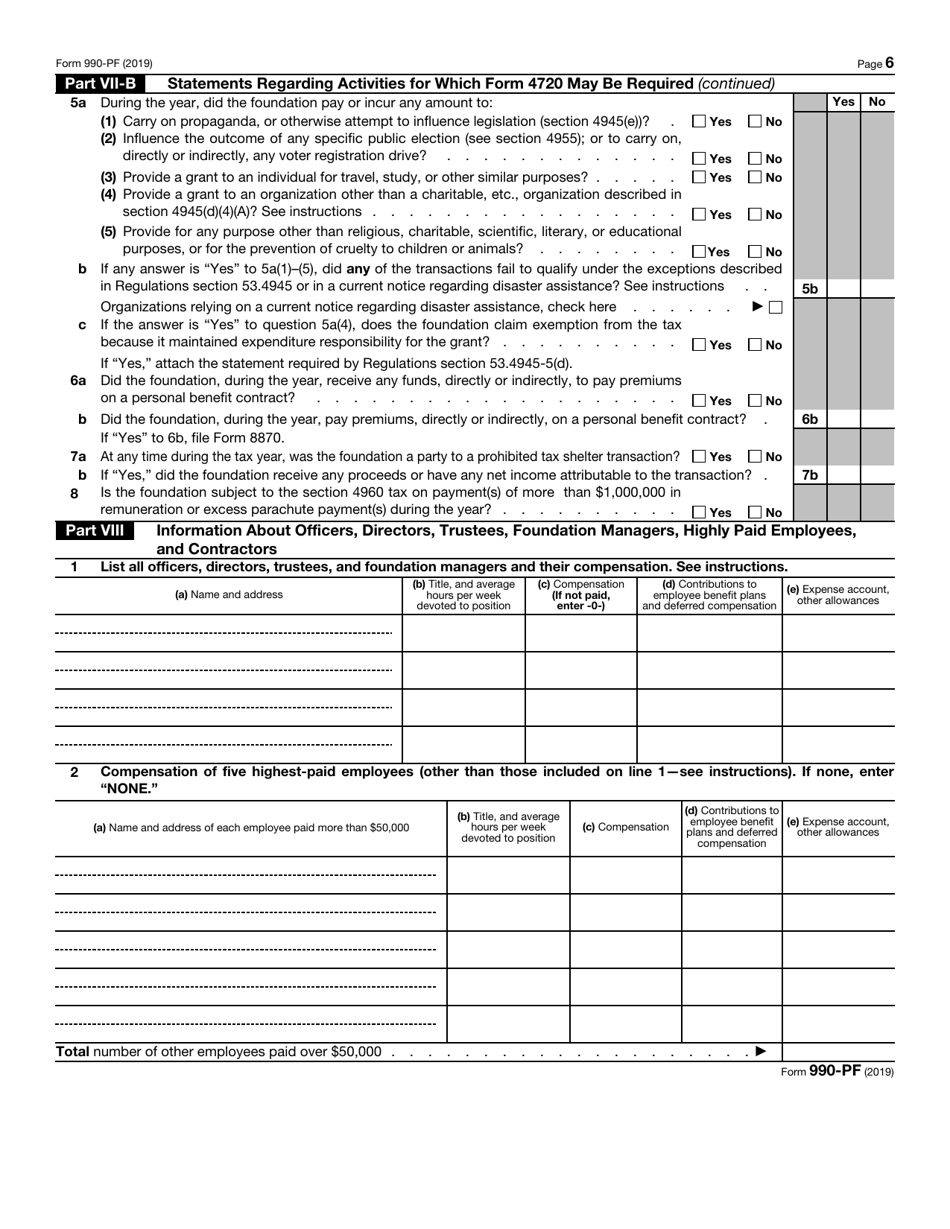

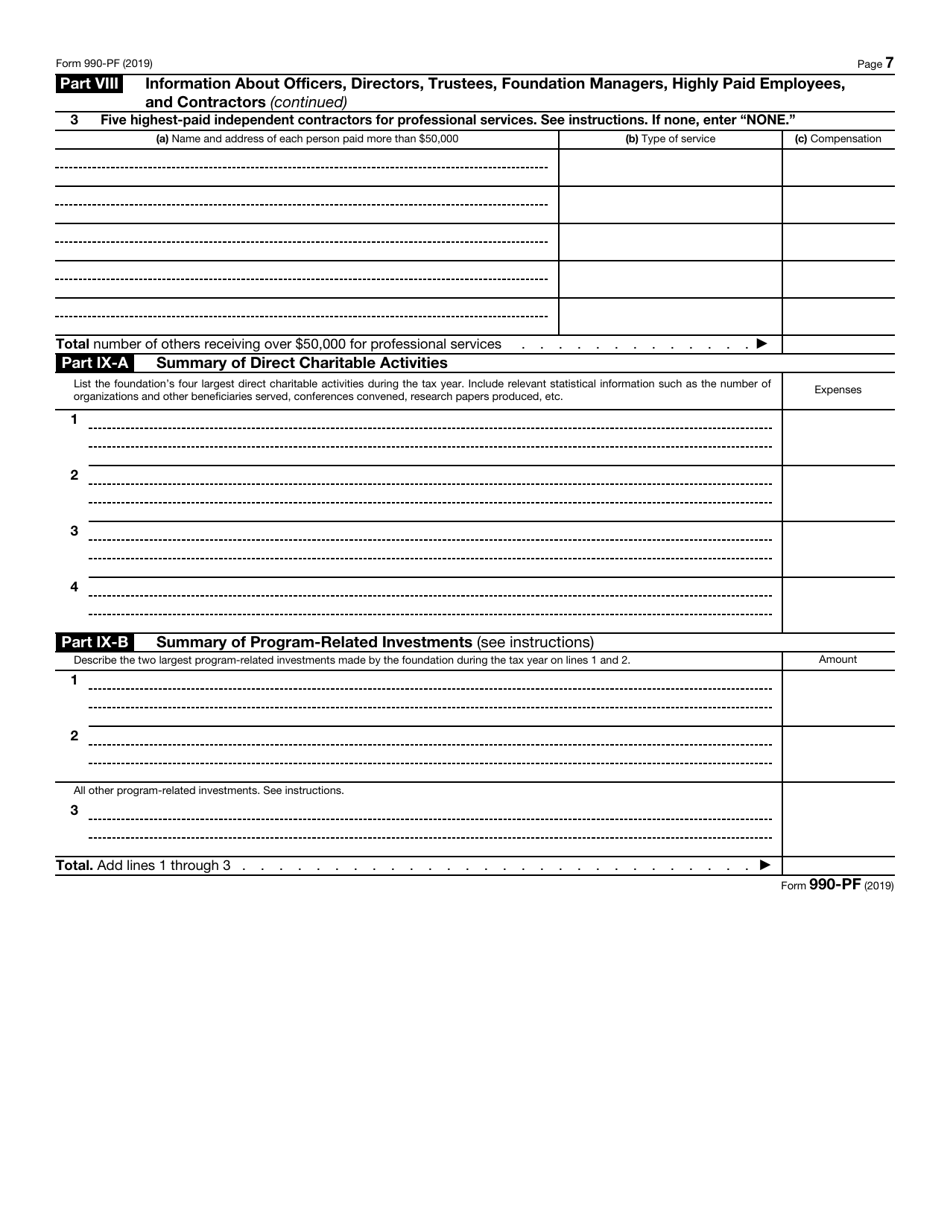

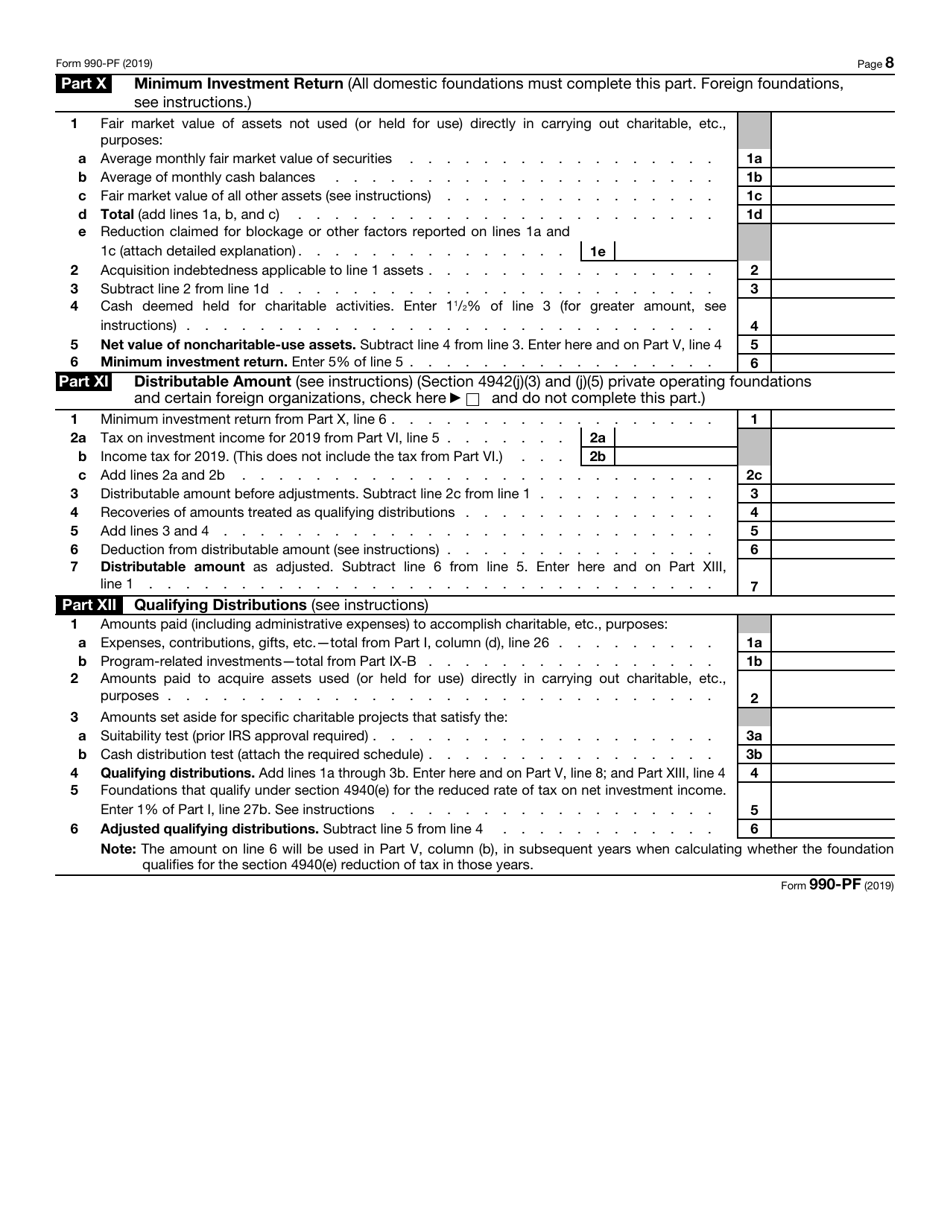

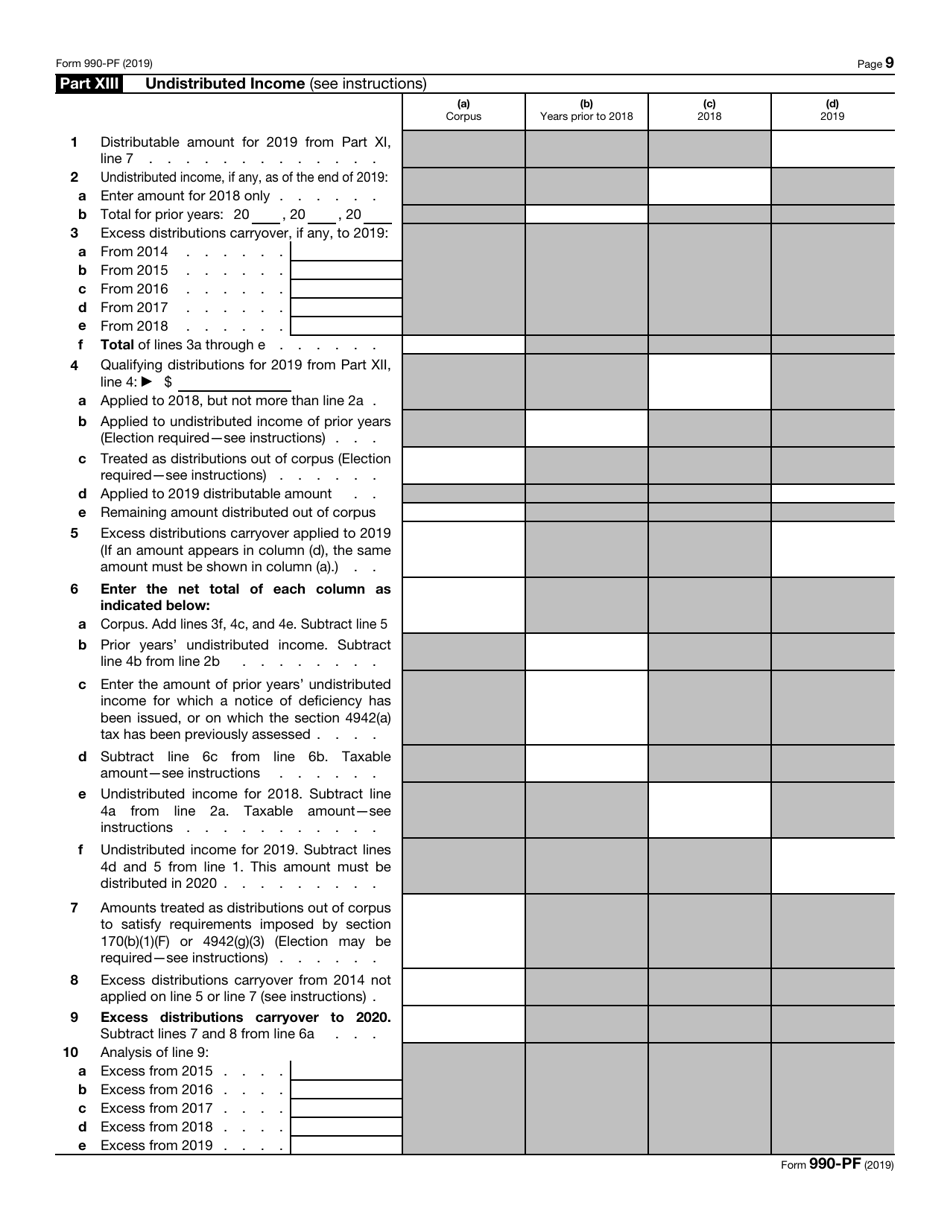

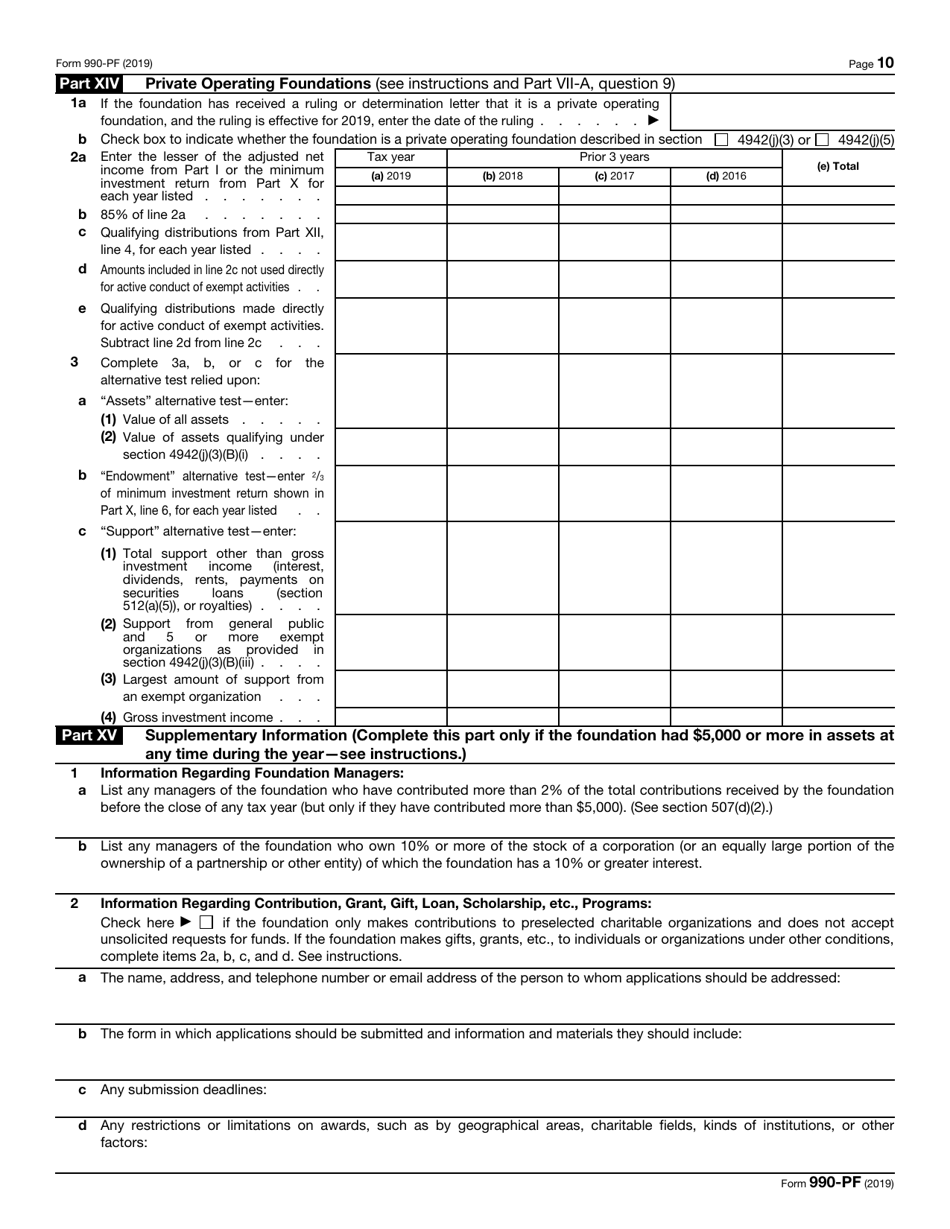

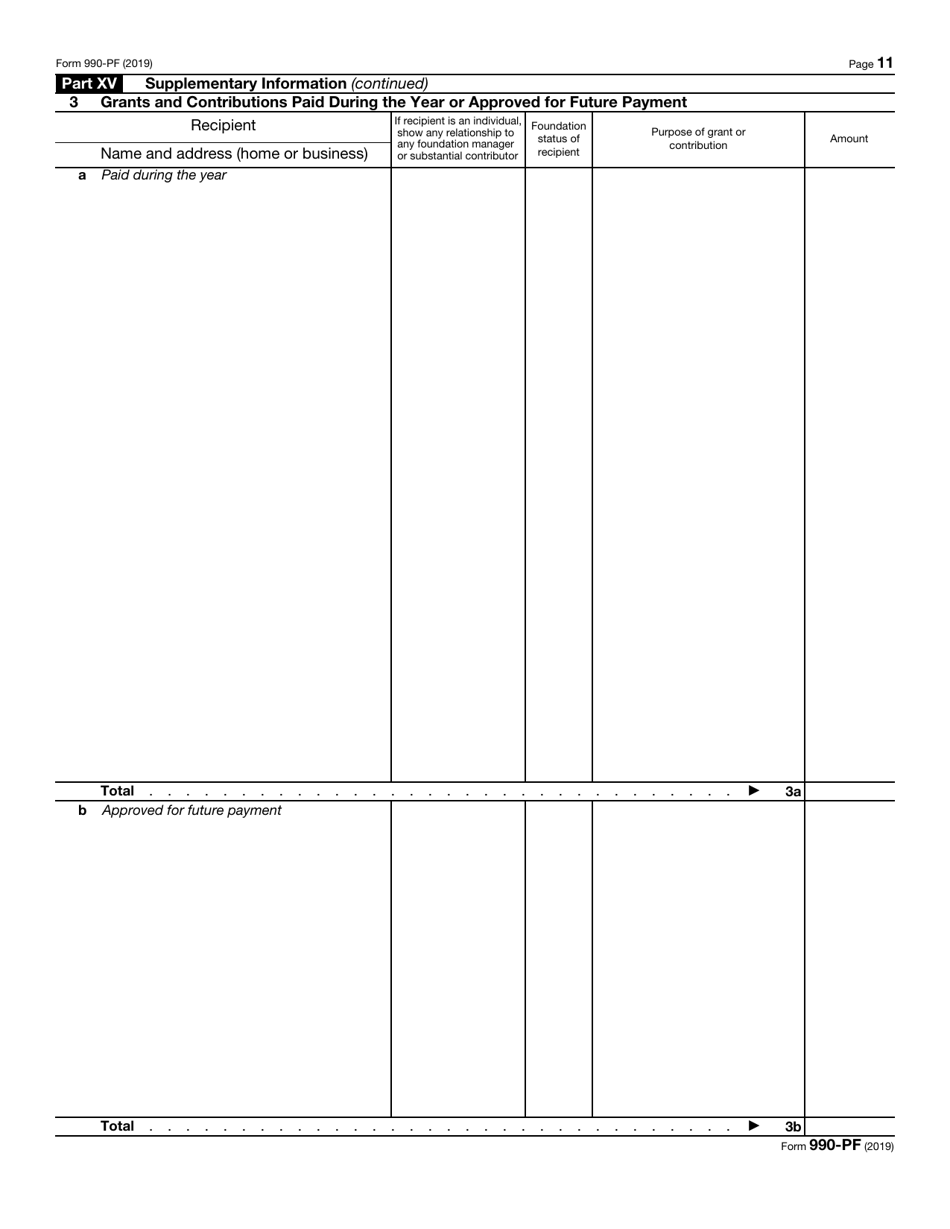

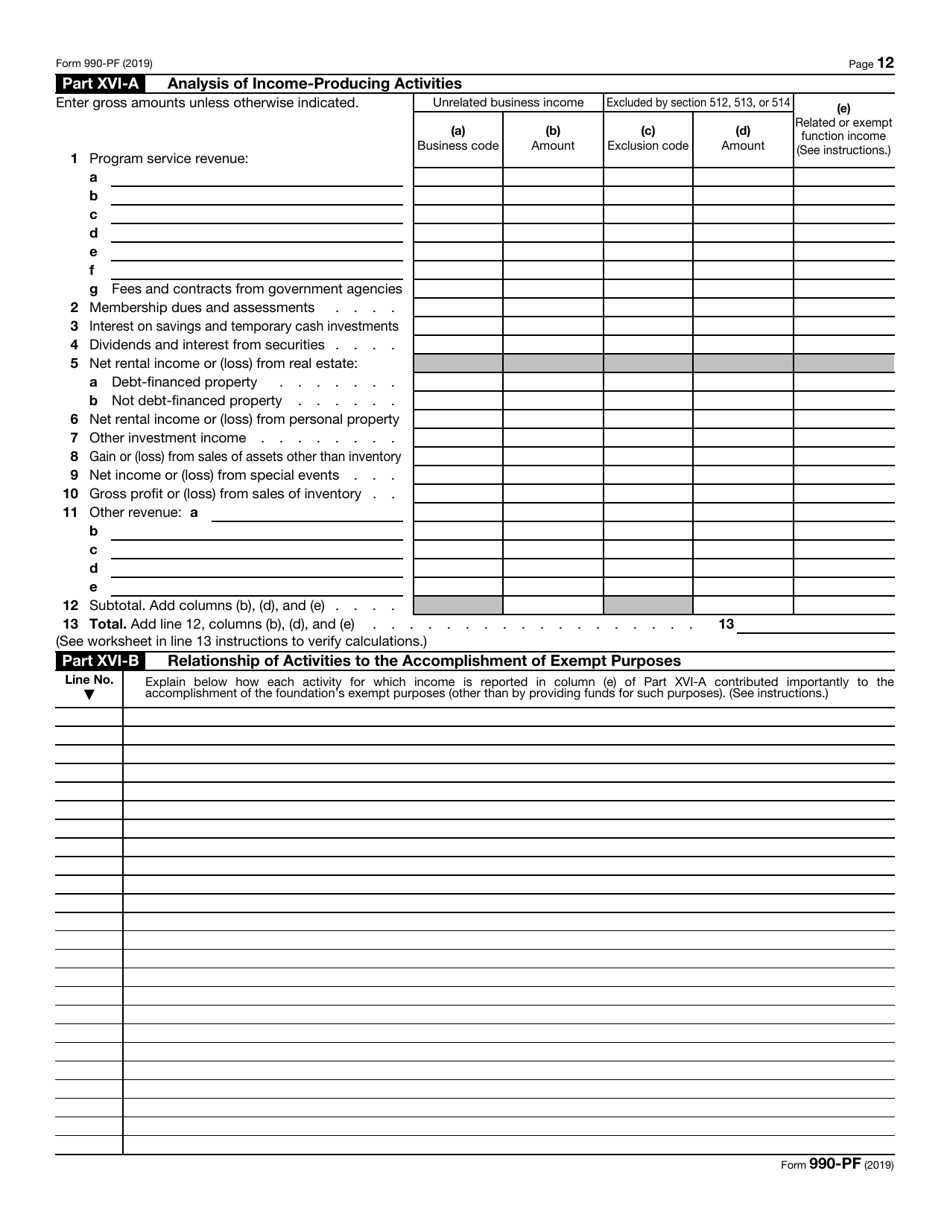

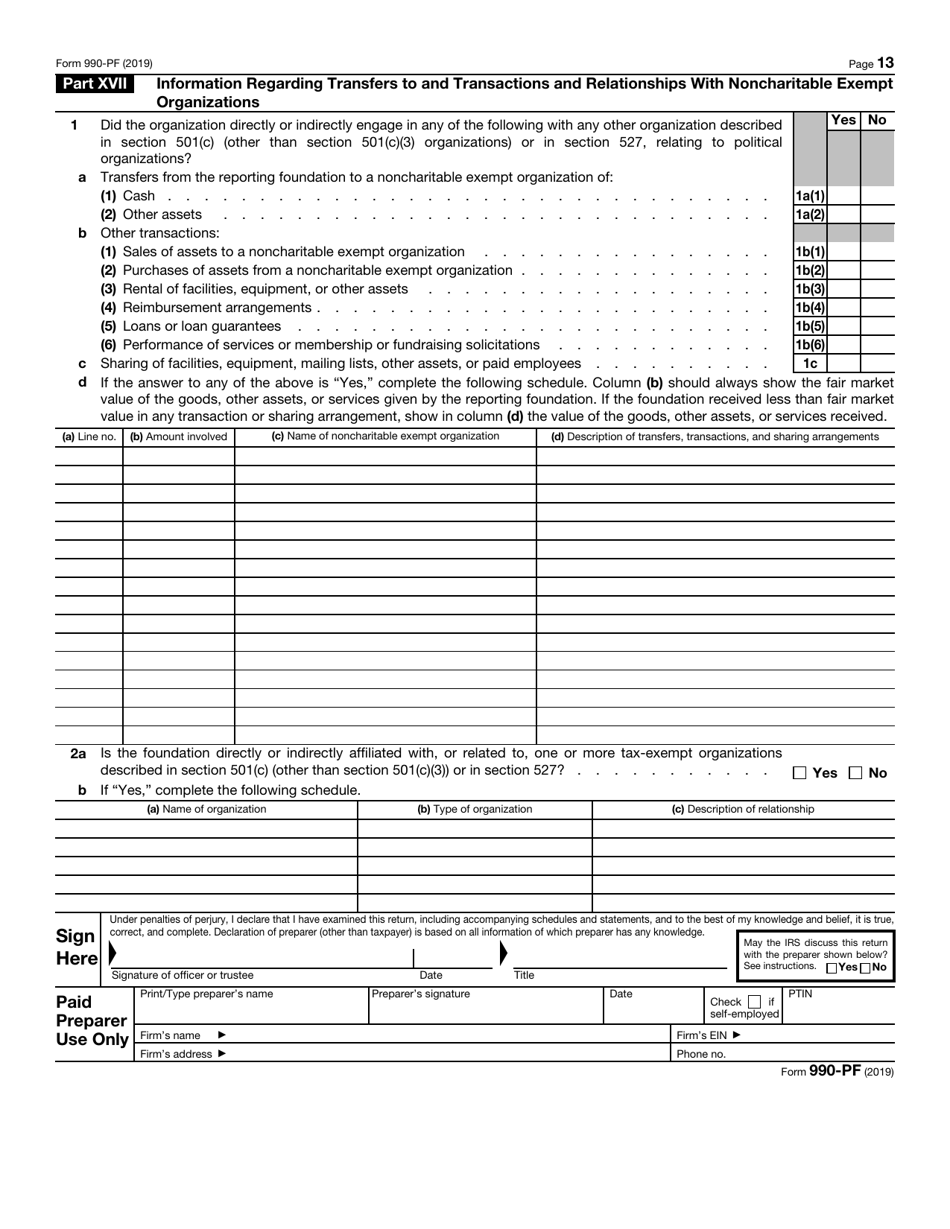

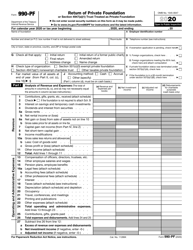

IRS Form 990-PF Return of Private Foundation or Section 4947(A)(1) Trust Treated as Private Foundation

What Is IRS Form 990-PF?

IRS Form 990-PF, Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation , is used to calculate the tax on investment income and to report charitable activities and distributions. This form can also substitute Form 1041, U.S. Income Tax Return for Estates and Trusts, if the trust does not have any taxable income.

Alternate Name:

- Private Foundation Tax Return.

This form was issued by the Internal Revenue Service (IRS) and the last revision of the form was in 2019 . You can find a 990-PF fillable form to download below.

Who Must File Form 990-PF?

An IRS 990-PF Form must be filed by:

- Exempt and taxable private foundations.

- Organizations that agree to private foundation status with pending applications for exempt status.

- Nonexempt charitable trusts under section 4947(a)(1) that are treated as private foundations.

- Organizations that made an election under section 41(e)(6)(D)(iv).

- Private foundations that make a section 507(b) termination.

- Organizations that request private foundation status, haven't claimed exempt status yet, and whose application is eligible for retroactive recognition of exemption.

How to Fill Out Form 990-PF?

Fill out Tax Form 990-PF using the following tips:

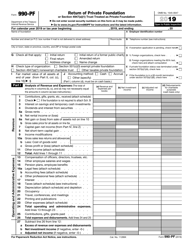

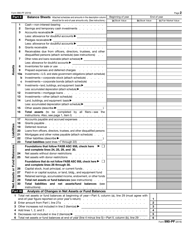

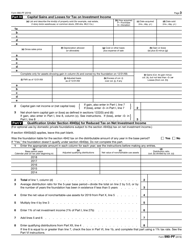

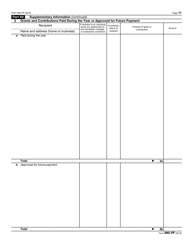

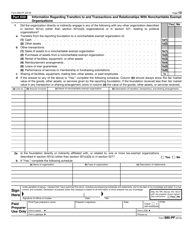

- Fill out all the applicable parts of the form. The required parts for all the organizations are Heading, Part I Column A, Part II Columns A and B, Part III, Part VII-A and B, Part VIII, Part IX A and B, Part XVI-A and B, Part XVII, and Signature Block. Check the chart provided in the instruction file to determine the parts your specific organization must file.

- To avoid filing an incomplete return, answer "Yes," "No," or "N/A" to every question on the form.

- Make an entry on all total lines. If the result is a zero, enter it anyway.

- Report all amounts in U.S. dollars.

- If an entire part does not apply, indicate "None" or "N/A."

- Provide all the information in English only.

IRS Form 990-PF Instructions

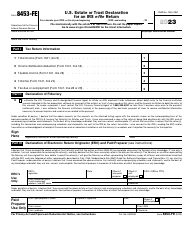

The due date for Form 990-PF falls on the 15th day of the 5th month after the end of the tax year or after a complete liquidation, dissolution, or termination of your foundation. If the deadline falls on a Saturday, Sunday, or a legal holiday, it will be automatically extended to the next business day. If you do not file the IRS Form 990-PF timely and completely, the IRS will charge a $20 penalty for each day you are late. The general amount of penalty for one return form will not exceed $10,000 or 5% of the organization's yearly gross receipts, whichever is less.

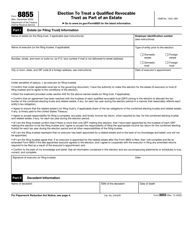

However, if your organization is considered as large (the gross receipts exceed $1,046,500 for the tax year), you will have to pay $100 for every day you fail to file the form. The maximum amount, in this case, will go up to $52,000. You can use Form 8868 to apply for an extension to file. The extension will be provided if you complete the form, submit it, and pay the balance due by the filing deadline.

You can file an IRS 990-PF Form by private delivery, mail, or electronically. At the same time, if you file at least 250 returns during the calendar year, you can only file your forms electronically. You can find more detailed instructions for Form 990-PF here or on the IRS website. The instruction file contains a detailed filling out guide, examples, and mailing addresses.

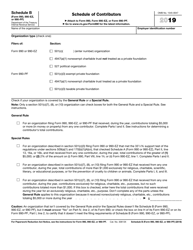

IRS 990-PF Related Forms:

- Form 990, Return of Organization Exempt from Income Tax;

- Form 990-EZ, Short Form Return of Organization Exempt from Income Tax;

- Form 990-N, Electronic Notice (e-Postcard);

- Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax under section 6033(e));

- Form 990-W, Estimated Tax on Unrelated Business Taxable Income for Tax-Exempt Organizations;

- Form 1041, U.S. Income Tax Return for Estates and Trusts;

- Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes;

- Form 1099-INT, Interest Income;

- Form 1099-MISC, Miscellaneous Income;

- Form 1099-OID, Original Issue Discount.