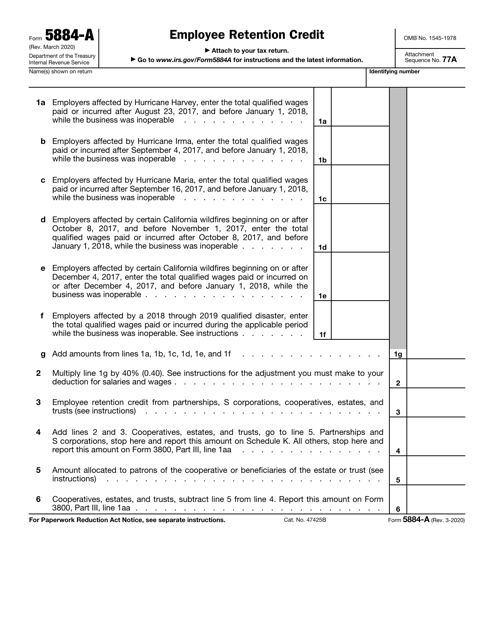

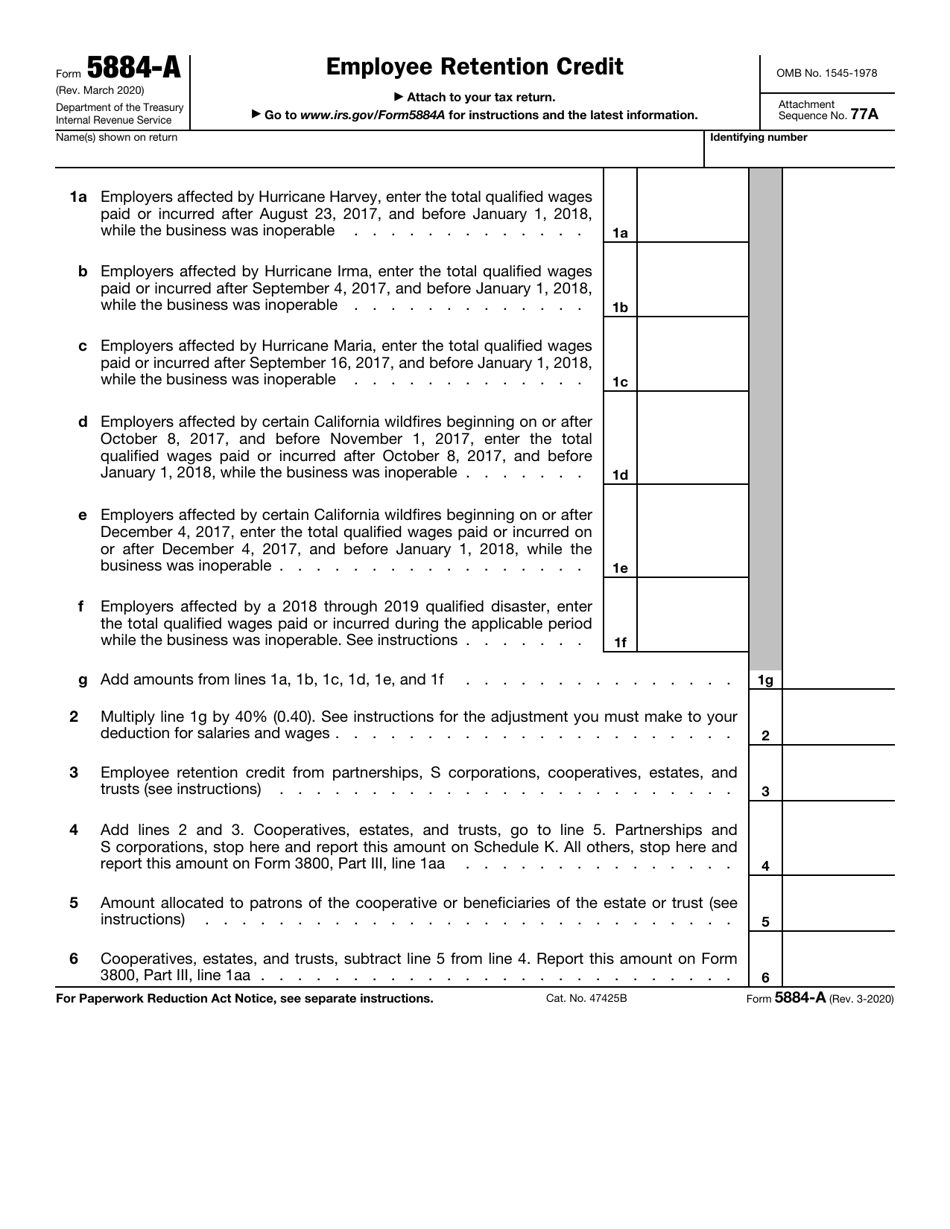

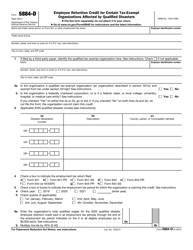

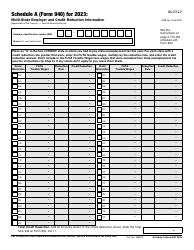

This version of the form is not currently in use and is provided for reference only. Download this version of

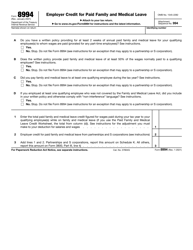

IRS Form 5884-A

for the current year.

IRS Form 5884-A Employee Retention Credit

What Is IRS Form 5884-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 5884-A?

A: IRS Form 5884-A is a form used to claim the Employee Retention Credit.

Q: What is the Employee Retention Credit?

A: The Employee Retention Credit is a tax incentive provided to businesses to encourage them to retain their employees during the COVID-19 pandemic.

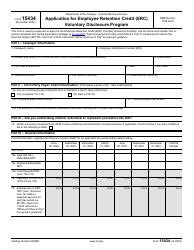

Q: Who is eligible to claim the Employee Retention Credit?

A: Businesses that were either fully or partially suspended due to a government-ordered shutdown or experienced a significant decline in revenue can be eligible to claim the credit.

Q: How much is the Employee Retention Credit?

A: The credit is equal to 50% of qualified wages paid to eligible employees, up to a maximum of $5,000 per employee.

Q: Are self-employed individuals eligible for the Employee Retention Credit?

A: No, self-employed individuals cannot claim the Employee Retention Credit.

Q: How do I claim the Employee Retention Credit?

A: You can claim the credit by filling out IRS Form 5884-A and including it with your tax return for the applicable year.

Q: Is there a deadline to claim the Employee Retention Credit?

A: Yes, the deadline to claim the credit for the 2020 tax year is April 15, 2022.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5884-A through the link below or browse more documents in our library of IRS Forms.