This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 5884-A

for the current year.

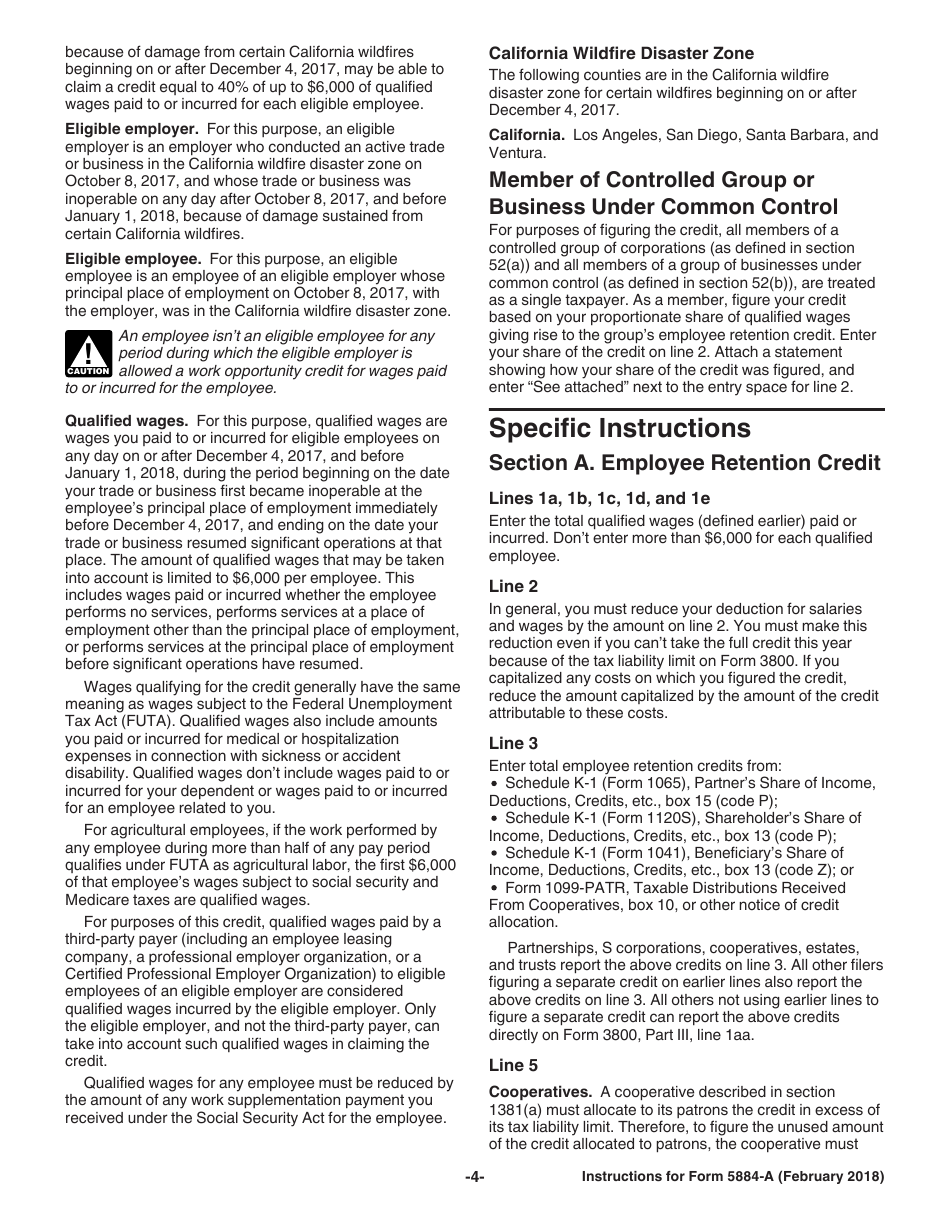

Instructions for IRS Form 5884-A Credits for Affected Disaster Area Employers (For Employers Affected by Hurricane Harvey, Irma, or Maria or Certain California Wildfires)

This document contains official instructions for IRS Form 5884-A , Credits for Affected Disaster Area Employers (For Employers Affected by Hurricane Harvey, Irma, or Maria or Certain California Wildfires) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 5884-A is available for download through this link.

FAQ

Q: What is IRS Form 5884-A?

A: IRS Form 5884-A is a form used by employers affected by disasters to claim tax credits.

Q: Who can use IRS Form 5884-A?

A: Employers affected by Hurricane Harvey, Irma, or Maria or certain California wildfires can use IRS Form 5884-A.

Q: What are the tax credits available with Form 5884-A?

A: Form 5884-A provides tax credits for employers affected by eligible disasters, including employee retention credits and employee leave credits.

Q: How can I claim the tax credits?

A: To claim the tax credits, employers must complete IRS Form 5884-A and attach it to their annual tax return.

Q: Are there any specific eligibility requirements?

A: Yes, employers must meet certain criteria to be eligible for the tax credits, such as being located in a designated disaster area and having a significant business interruption.

Q: Is there a deadline to file Form 5884-A?

A: Yes, employers must file Form 5884-A by the due date of their tax return, including any extensions.

Q: Can Form 5884-A be filed electronically?

A: No, Form 5884-A cannot be filed electronically and must be submitted as a paper form with the employer's tax return.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.