This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5500

for the current year.

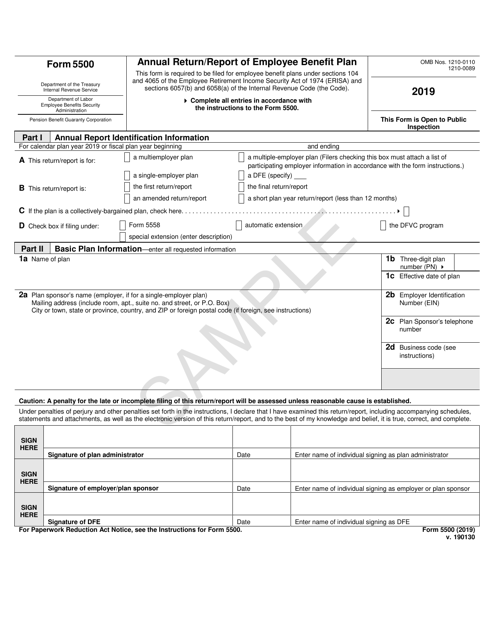

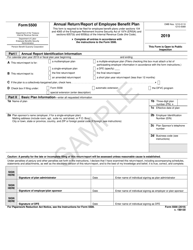

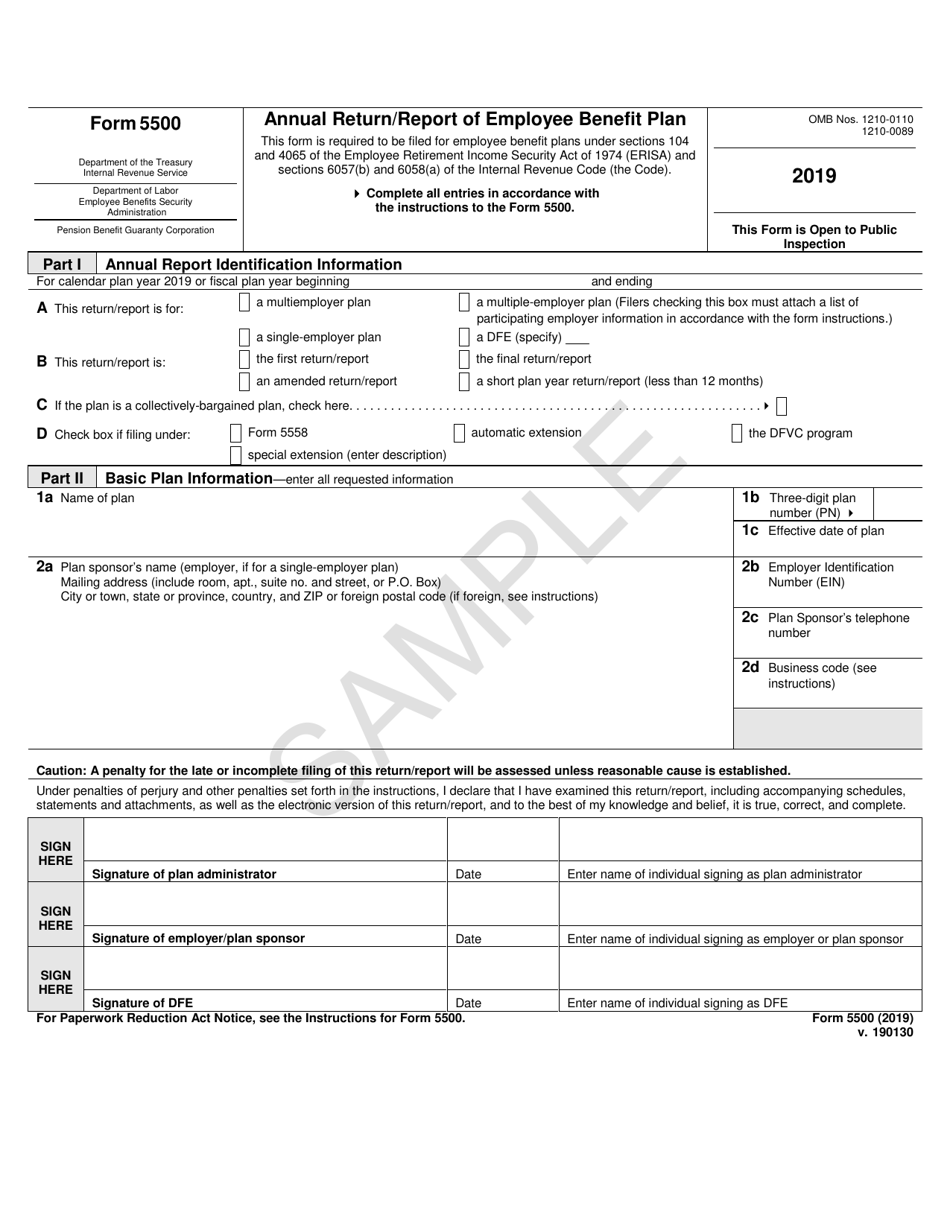

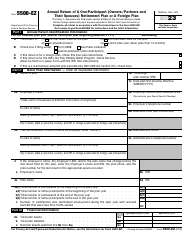

Form 5500 Annual Return / Report of Employee Benefit Plan

What Is Form 5500?

IRS Form 5500, Annual Return/Report of Employee Benefit Plan , is a document used to report information about Direct Filing Entities, or DFEs (investment arrangements that manage funds from various plans), and employee benefit plans. Each sponsor or administrator of an employee benefit plan subject to the Employee Retirement Income Security Act of 1974 (ERISA) has to report information about benefit plans every year. This form is the outcome of cooperation between the Internal Revenue Service (IRS), the Department of Labor (DOL), and the Pension Benefit Guaranty Corporation (PBGC). These agencies consolidated several report forms and returns to reduce the burden of filing for employers and plan administrators.

The latest version of the form was jointly released by the IRS , DOL , and the PBGC in 2019 with all previous editions obsolete. A fillable Form 5500 sample is available for download below.

Unlike many other documents, this form cannot be filed by mail or another delivery service. 5500 Forms are to be filed electronically via the DOL's Employee Retirement Income Security Act Filing Acceptance System, and a Form 5500 mailing address does not exist.

IRS Form 5500 Schedules

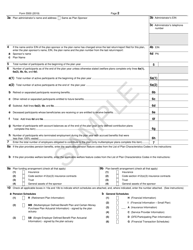

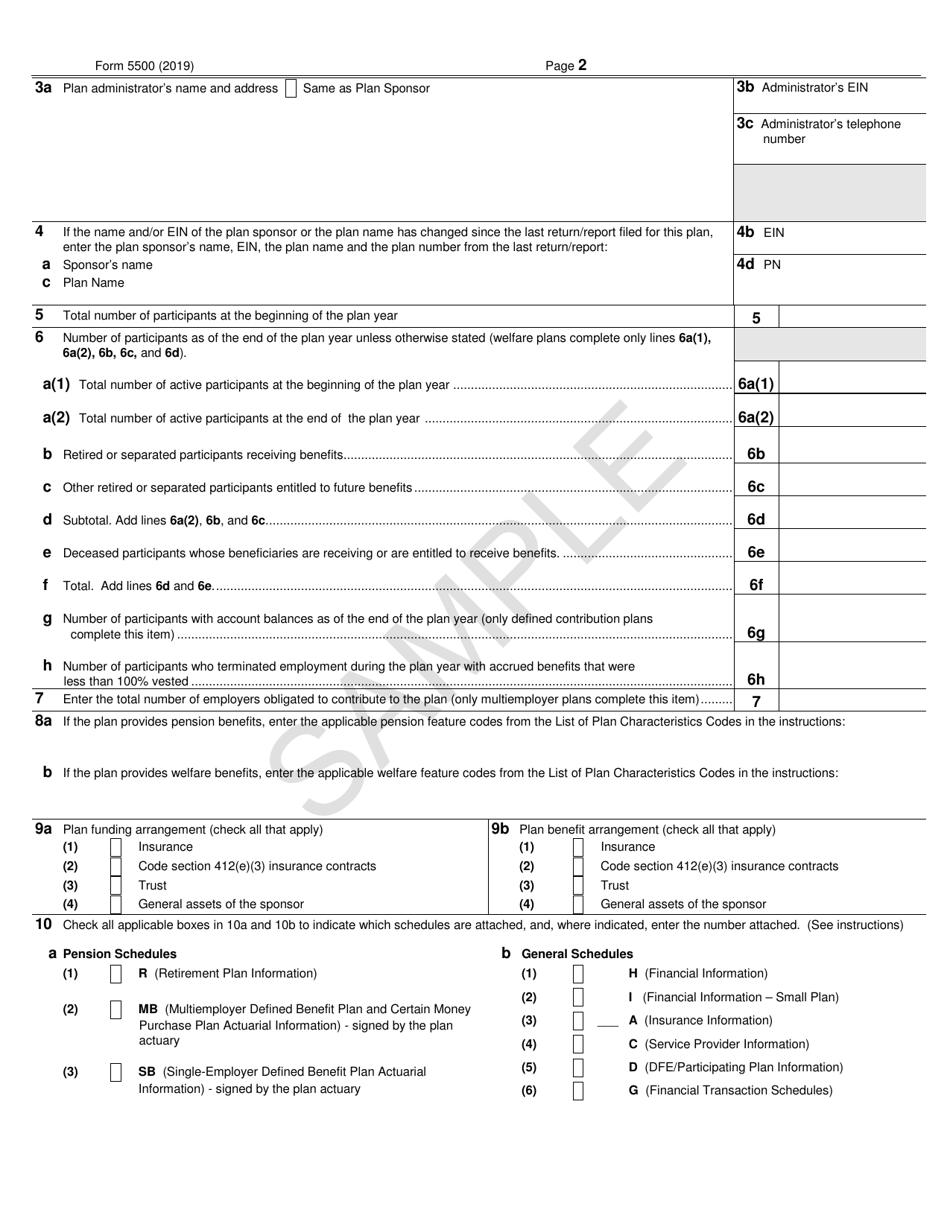

To comply with the IRS Form 5500 filing requirements, you must file it with certain schedules. Schedules depend on whether the form is filed for a «large plan» (100 or more participants at the beginning of the year) or a «small plan» (under 100 participants at the beginning of the year). You need to know what particular plan of the DFE is involved - pension plan, welfare plan, group insurance arrangement (GIA), etc.

Pension Schedules

- Schedule R (Retirement Plan Information) - for a defined pension benefit plan;

- Schedule MB (Multiemployer Defined Benefit Plan and Certain Money Purchase Plan Actuarial Information) - for most multiemployer defined benefit plans and for the defined contribution pension plans;

- Schedule SB (Single-Employer Defined Benefit Plan Actuarial Information) - for most single-employer defined benefit plans.

General Schedules

- Schedule H (Financial Information) - for all DFE filings and for pension and welfare benefit plans, considered «large plans»;

- Schedule I (Financial Information - Small Plan) - for all welfare and benefit plans filed as «small plans»;

- Schedule A (Insurance Information) - for plans that offer employee benefits that an insurance company provides;

- Schedule C (Service Provider Information) - for a large pension or welfare benefit plans, group insurance arrangements (GIA), master trust investment accounts (MTIA), and 103-12 investment entities, or 103-12 IE (these hold the assets of several plans that are not members of a related group of benefit plans);

- Schedule D (DFE/Participating Plan Information) - for plans and DFEs that participated or invested in MTIAs, 103-12 IEs, common/collective trusts, or pooled separate accounts;

- Schedule G (Financial Transaction Schedules) - for large plans, MTIAs, 103-12 IEs, and GIAs.

IRS Form 5500 Instructions

-

Part I - Annual Report Identification:

- Describe the type of plan - a multi-employer, a single-employer, a DFE;

- State if it is a first, amended, final, or a short plan year return/report;

- Indicate if the plan is a collectively-bargained plan;

- Check the appropriate box if you file under Form 5558, automatic extension, or special extension.

-

Part II - Basic Plan Information:

- Enter the formal name of the plan, its number and effective date;

- Write down the plan sponsor's name, employer's identification number, the mailing address, the telephone number, and the business code;

- Sign and date the form, and enter the name of the individual who signs the document (a plan administrator, an employer, a plan sponsor, a DFE);

- Enter the required numbers of participants that meet certain conditions;

- Write down the number of employers obligated to contribute to the plan. Indicate the applicable pension/welfare feature codes;

- State the plan funding and plan benefit arrangements;

- Check the appropriate boxes to show which schedules are attached.

-

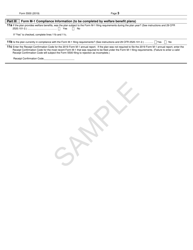

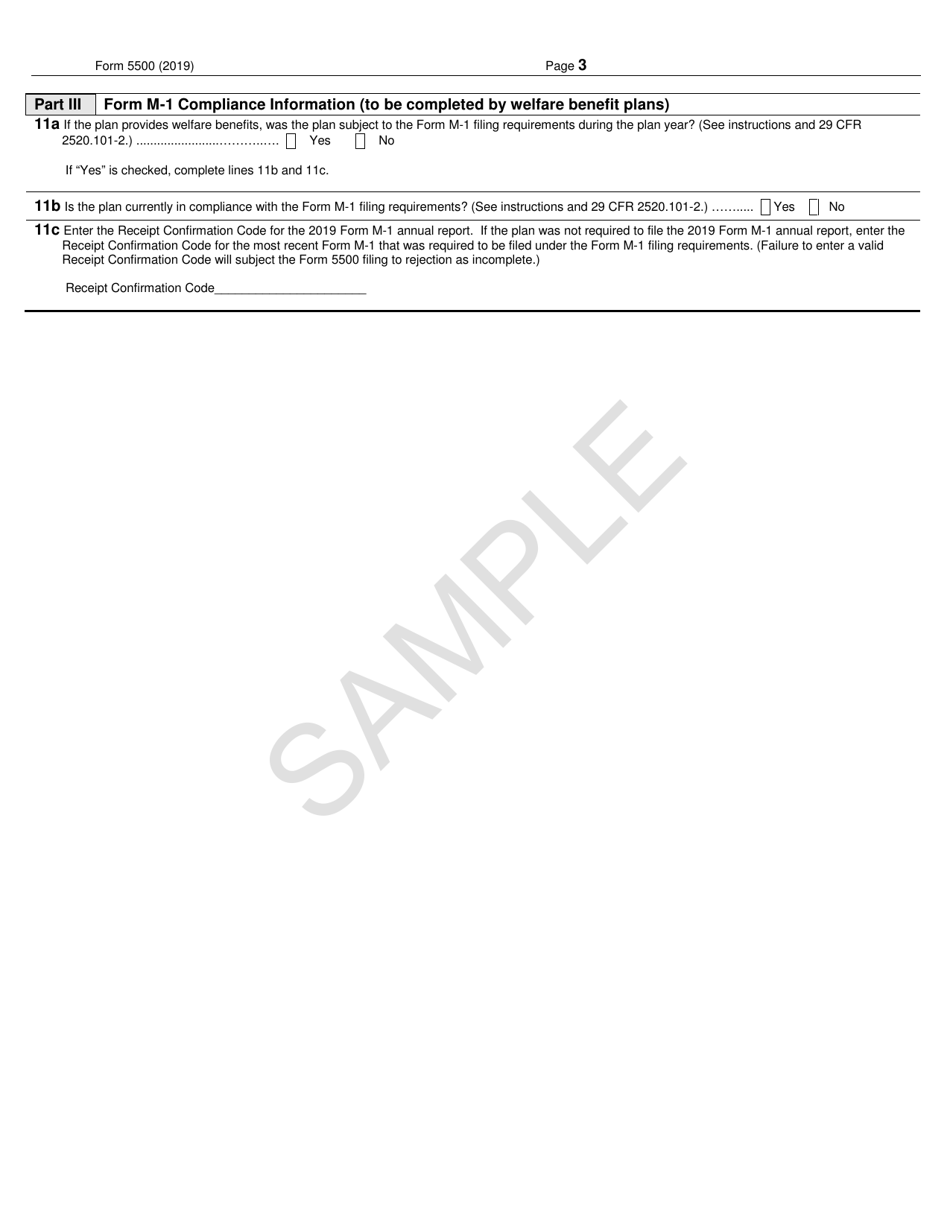

Part III - Form M-1 Compliance Information (for welfare benefit plans):

- State if the plan was subject to the Form M-1 filing requirements if it is in compliance with these requirements;

- Enter the Receipt Confirmation Code for the Form M-1 annual report.

When Is Form 5500 Due?

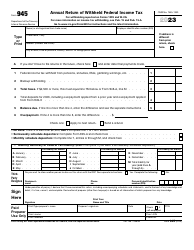

Form 5500 due date is the last day of the seventh month after the end of the plan year. It is possible to extend the deadline by filing a Form 5558, Application for Extension of Time to File Certain Employee Plan Returns, therefore, submitting the report of employee benefit plan 2.5 months later. There is a penalty for late filing from the IRS and the DOL: $25 per day and $1100 per day respectively.

IRS 5500 Related Forms:

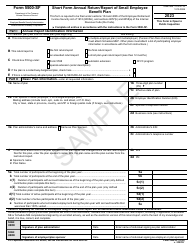

- IRS Form 5500-SF, Short Form Annual Return/Report of Small Employee Benefit Plan, is a related simplified form used by certain small welfare and pension benefit plans. The plan must be small, it cannot be a multiemployer plan or hold employer securities, 100% of its assets must be invested in secure investments with a determinable fair value, and it has to be exempt from the audit by the independent qualified public accountant.

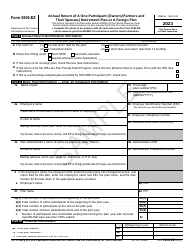

- IRS Form 5500-EZ, Annual Return of a One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign Plan, is a related form used for retirement plans if it is a one-participant plan (a plan that covers only you and your spouse/partner) or a foreign plan (a pension plan maintained outside the U.S. territory for nonresident aliens).