This version of the form is not currently in use and is provided for reference only. Download this version of

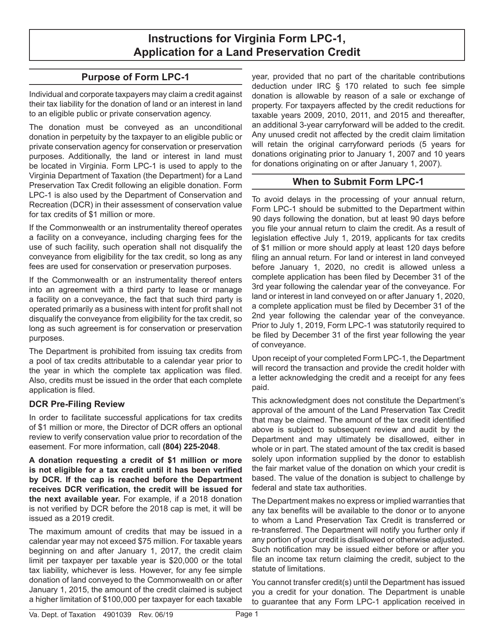

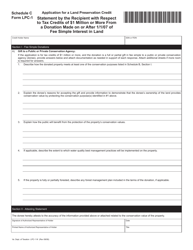

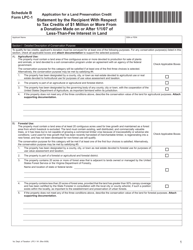

Instructions for Form LPC-1

for the current year.

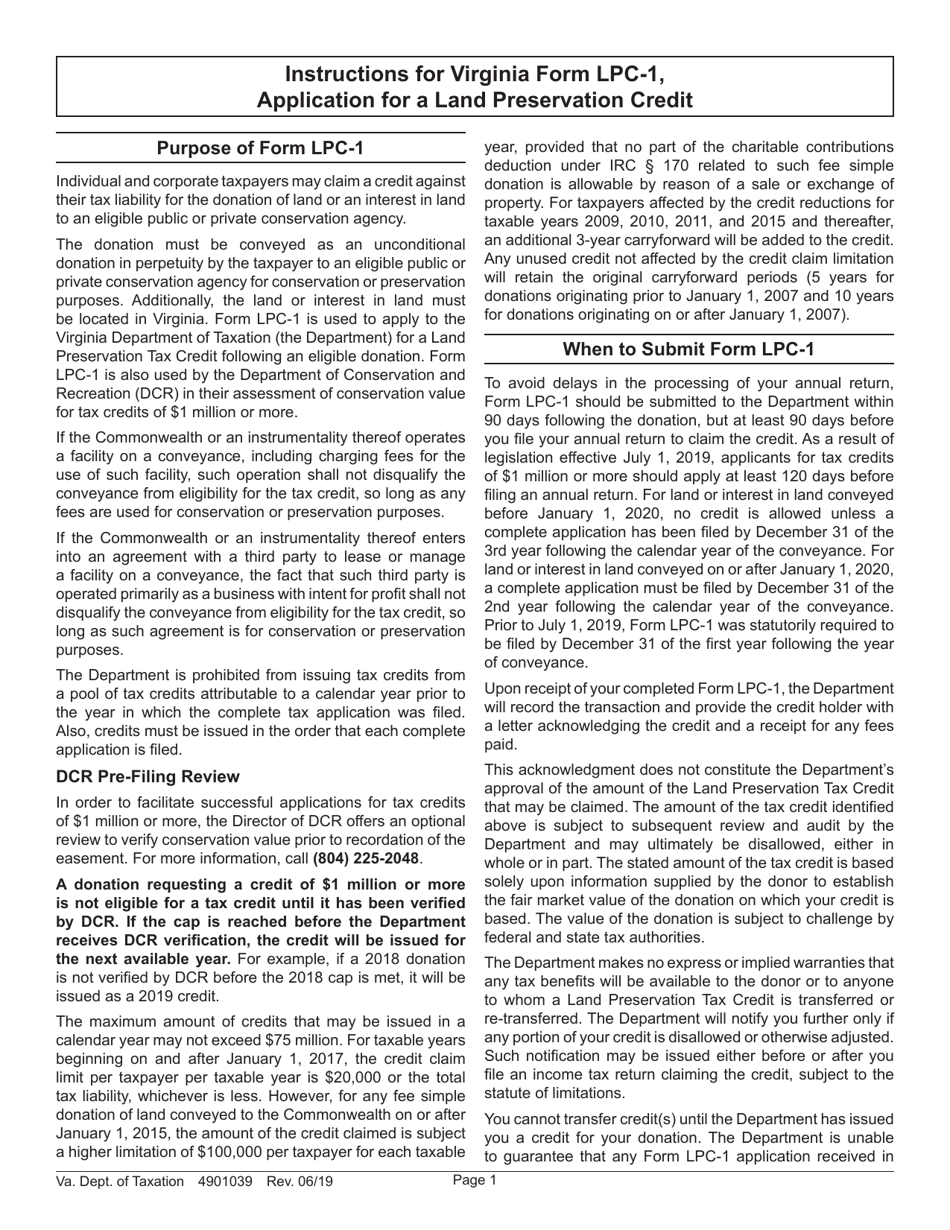

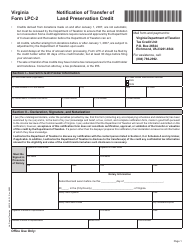

Instructions for Form LPC-1 Application for a Land Preservation Tax Credit - Virginia

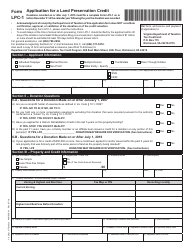

This document contains official instructions for Form LPC-1 , Application for a Land Preservation Tax Credit - a form released and collected by the Virginia Department of Taxation. An up-to-date fillable Form LPC-1 is available for download through this link.

FAQ

Q: What is Form LPC-1?

A: Form LPC-1 is an application for a Land PreservationTax Credit in Virginia.

Q: What is the purpose of the Land Preservation Tax Credit?

A: The purpose of the Land Preservation Tax Credit is to encourage the preservation of open space and natural resources in Virginia.

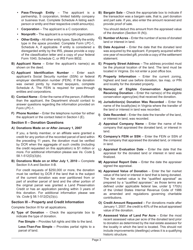

Q: Who can apply for the Land Preservation Tax Credit?

A: Landowners who have placed a conservation easement on their property may apply for the Land Preservation Tax Credit.

Q: What is a conservation easement?

A: A conservation easement is a legal agreement between a landowner and a qualified organization that permanently limits the development and use of the property to protect its conservation values.

Q: What are the requirements for qualifying for the Land Preservation Tax Credit?

A: To qualify for the Land Preservation Tax Credit, the conservation easement must meet certain criteria, such as being perpetual, enforceable, and providing significant public benefits.

Q: How is the Land Preservation Tax Credit calculated?

A: The Land Preservation Tax Credit is calculated based on the value of the conservation easement and the applicable tax credit rate.

Q: How can I submit my application for the Land Preservation Tax Credit?

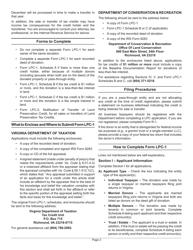

A: You can submit your application for the Land Preservation Tax Credit to the Virginia Department of Taxation.

Q: Are there any deadlines for submitting the application?

A: Yes, the application for the Land Preservation Tax Credit must be filed by December 31st of the tax year following the year in which the conservation easement was donated.

Q: Are there any fees associated with the application?

A: Yes, there is an application fee that must be paid at the time of filing the Form LPC-1.

Q: Is there any assistance available for completing the application?

A: Yes, the Virginia Department of Taxation provides resources and assistance for completing the application for the Land Preservation Tax Credit.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.