This version of the form is not currently in use and is provided for reference only. Download this version of

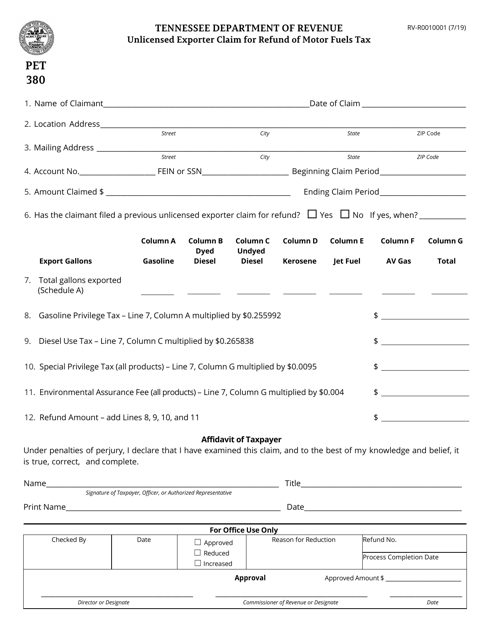

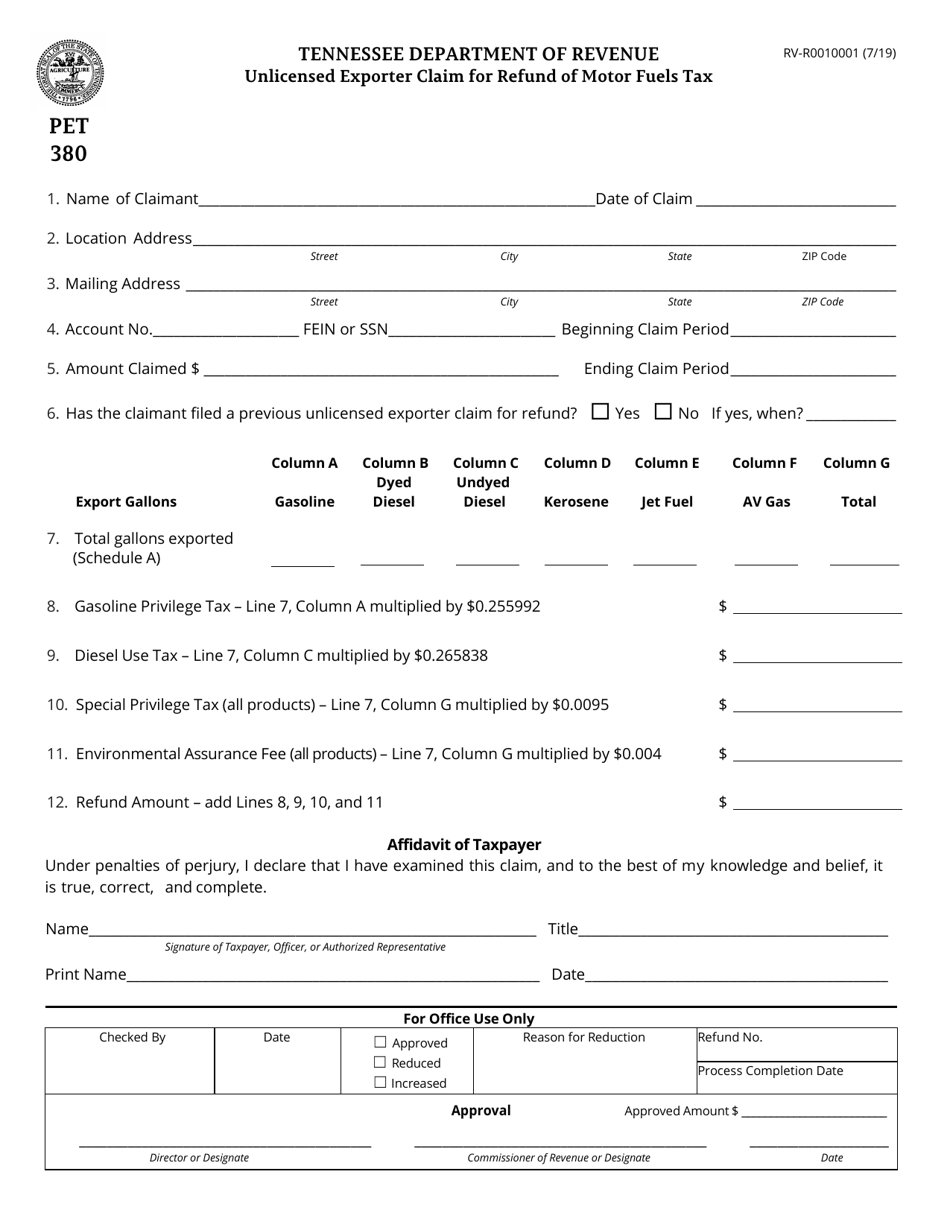

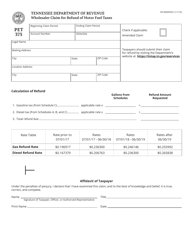

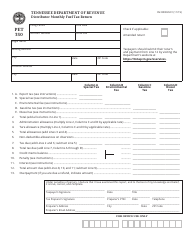

Form PET380 (RV-R0010001)

for the current year.

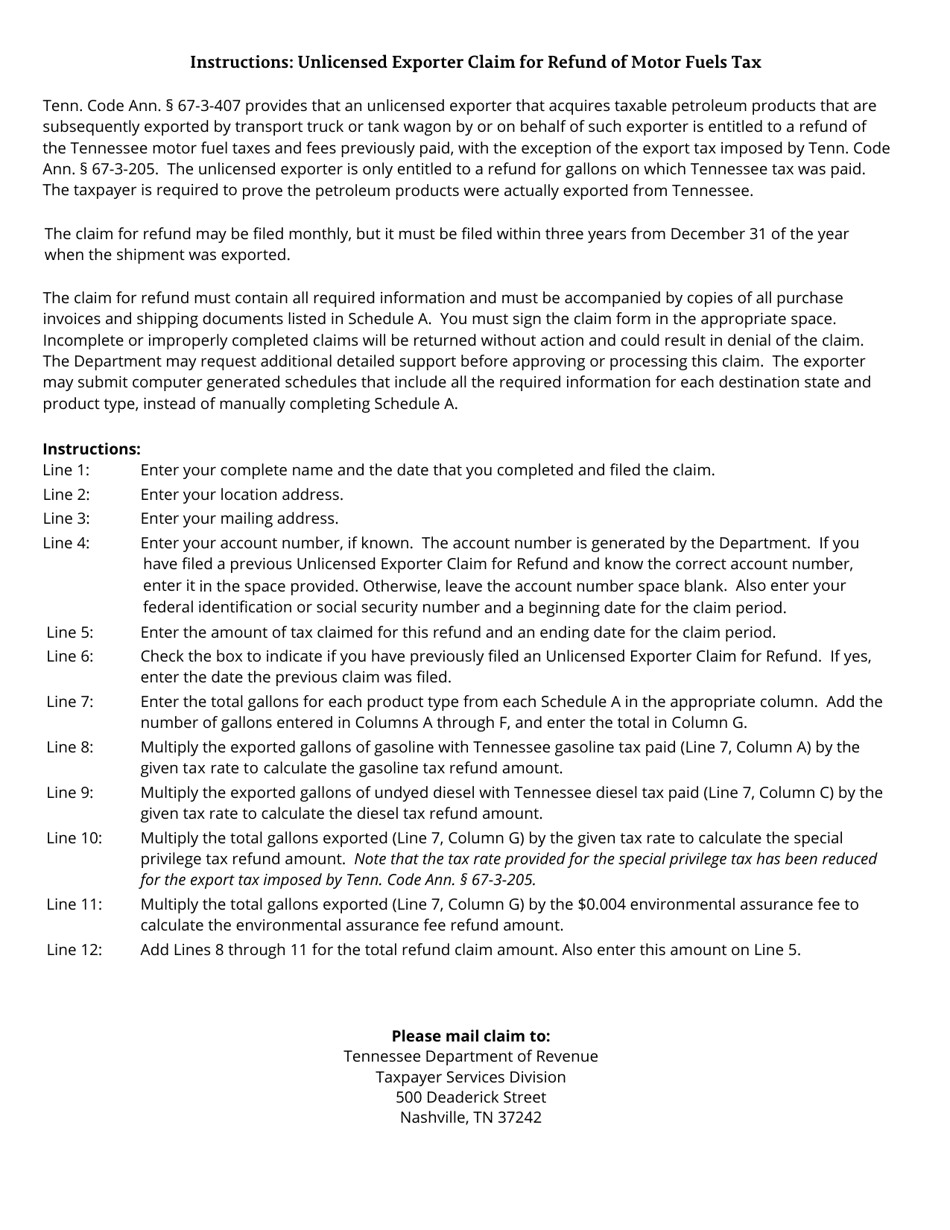

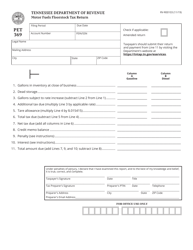

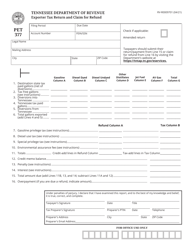

Form PET380 (RV-R0010001) Unlicensed Exporter Claim for Refund of Motor Fuels Tax - Tennessee

What Is Form PET380 (RV-R0010001)?

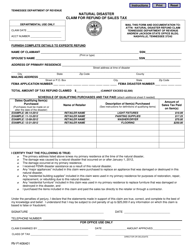

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PET380?

A: Form PET380 is the Unlicensed Exporter Claim for Refund of Motor Fuels Tax - Tennessee.

Q: Who can use Form PET380?

A: Unlicensed exporters of motor fuels in Tennessee can use Form PET380.

Q: What is the purpose of Form PET380?

A: The purpose of Form PET380 is to claim a refund of motor fuels tax paid on fuels exported out of Tennessee.

Q: Is a license required to use Form PET380?

A: No, unlicensed exporters can use Form PET380.

Q: Is there a deadline for filing Form PET380?

A: Yes, Form PET380 must be filed within 90 days from the date of export.

Q: What documentation should be included with Form PET380?

A: Supporting documentation, such as bills of lading and export certificates, should be included with Form PET380.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PET380 (RV-R0010001) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.