This version of the form is not currently in use and is provided for reference only. Download this version of

Form E-588SC

for the current year.

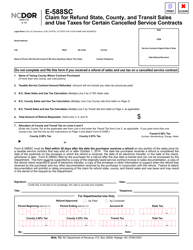

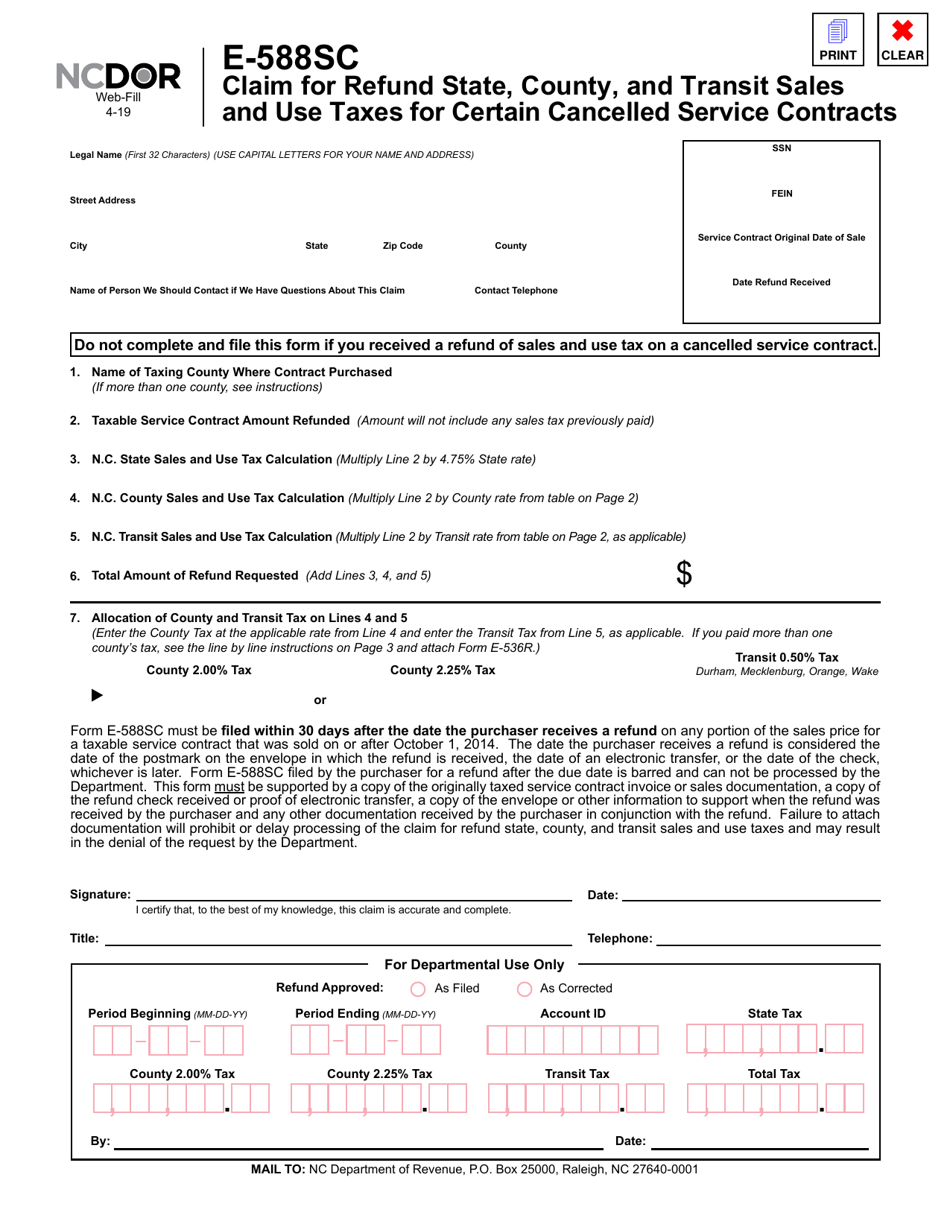

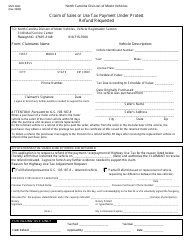

Form E-588SC Claim for Refund State, County, and Transit Sales and Use Taxes for Certain Cancelled Service Contracts - North Carolina

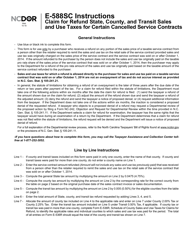

What Is Form E-588SC?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form E-588SC?

A: Form E-588SC is a claim for refund for state, county, and transit sales and use taxes for certain cancelled service contracts in North Carolina.

Q: What is the purpose of Form E-588SC?

A: The purpose of Form E-588SC is to claim a refund for sales and use taxes paid on cancelled service contracts.

Q: Who can use Form E-588SC?

A: Form E-588SC can be used by individuals or businesses who have paid sales and use taxes on cancelled service contracts in North Carolina.

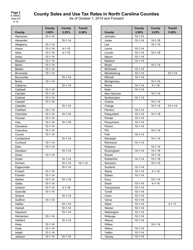

Q: What taxes does Form E-588SC cover?

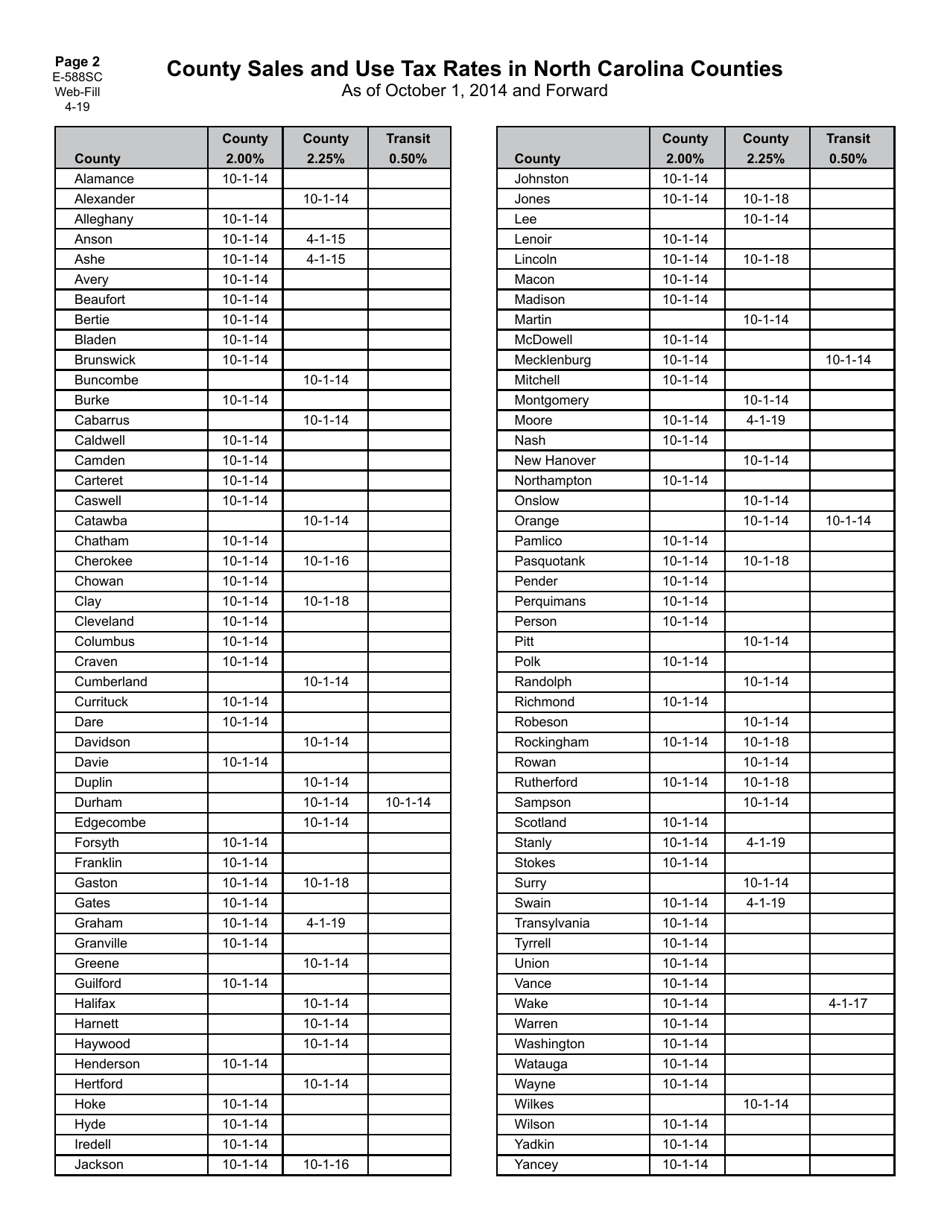

A: Form E-588SC covers state, county, and transit sales and use taxes.

Q: What types of service contracts are eligible for a refund?

A: Certain cancelled service contracts are eligible for a refund, but the specific eligibility requirements are outlined in the instructions for Form E-588SC.

Q: Is there a deadline to file Form E-588SC?

A: Yes, Form E-588SC must be filed within the time period specified in the instructions, generally within three years from the date of the cancelled service contract.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

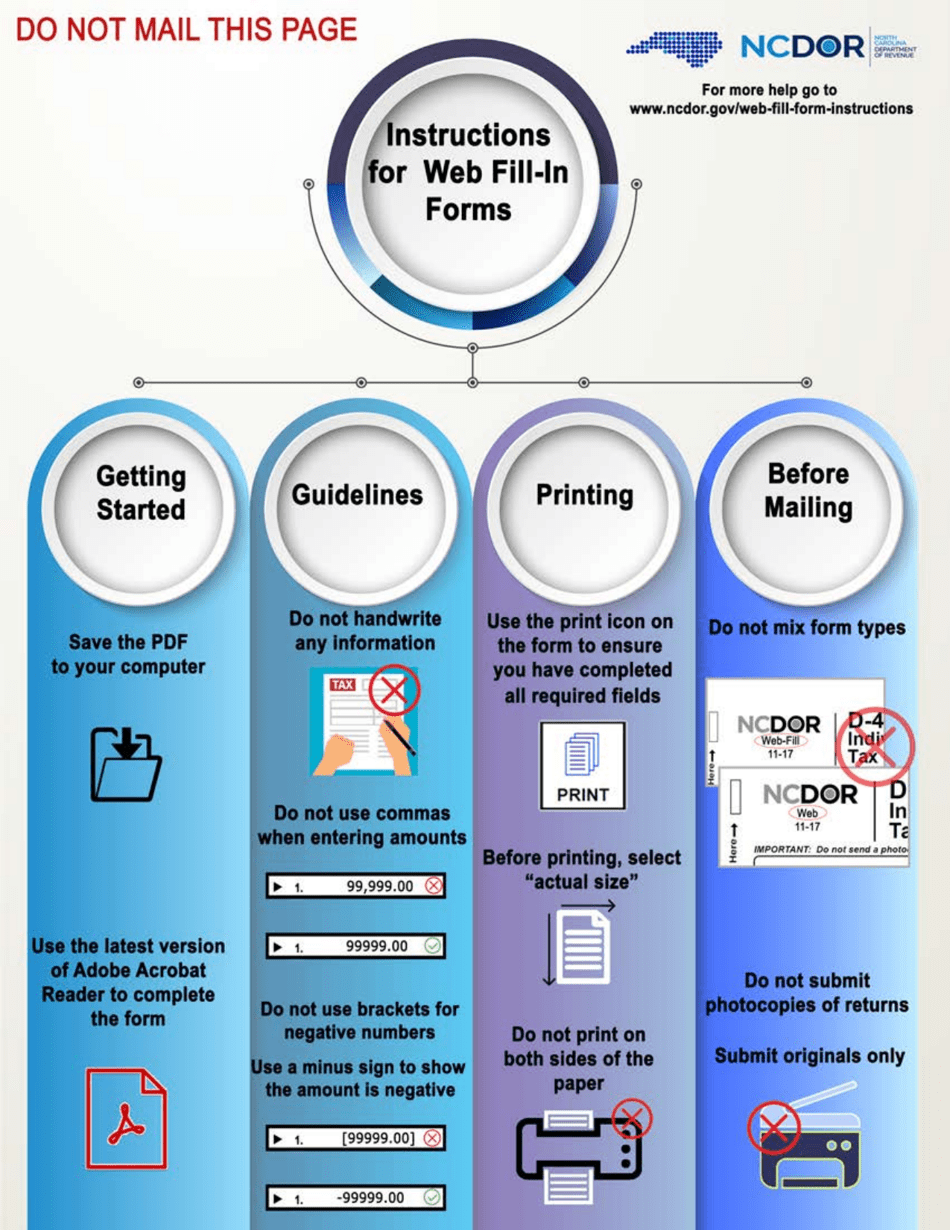

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-588SC by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.