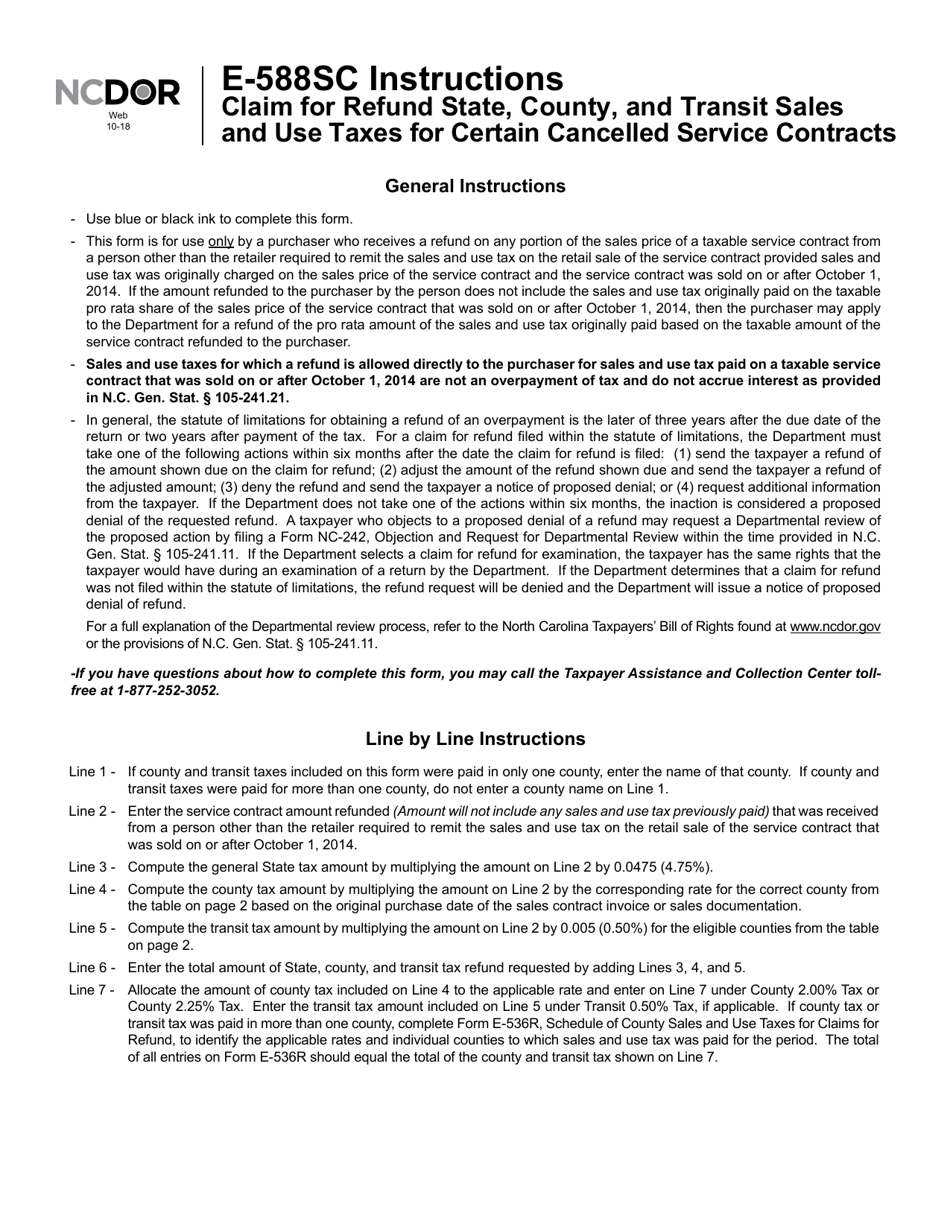

Instructions for Form E-588SC Claim for Refund State, County, and Transit Sales and Use Taxes for Certain Cancelled Service Contracts - North Carolina

This document contains official instructions for Form E-588SC , Claim for Refund State, County, and Transit Sales and Use Taxes for Certain Cancelled Service Contracts - a form released and collected by the North Carolina Department of Revenue. An up-to-date fillable Form E-588SC is available for download through this link.

FAQ

Q: What is Form E-588SC?

A: Form E-588SC is a form used in North Carolina to claim a refund for state, county, and transit sales and use taxes for certain cancelled service contracts.

Q: Who can use Form E-588SC?

A: Form E-588SC can be used by individuals or businesses in North Carolina who have cancelled service contracts and are eligible for a refund of sales and use taxes.

Q: What taxes can be refunded with Form E-588SC?

A: Form E-588SC allows for a refund of state, county, and transit sales and use taxes.

Q: What kind of service contracts are eligible for a refund?

A: Certain cancelled service contracts are eligible for a refund using Form E-588SC. The specific eligibility criteria are outlined in the form instructions.

Q: When should I file Form E-588SC?

A: Form E-588SC should be filed within three years from the date the service contract was cancelled.

Q: Is there a fee to file Form E-588SC?

A: There is no fee to file Form E-588SC.

Q: Who should I contact for more information or assistance?

A: For more information or assistance with Form E-588SC, you can contact the North Carolina Department of Revenue.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of Revenue.