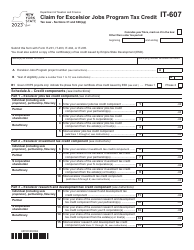

This version of the form is not currently in use and is provided for reference only. Download this version of

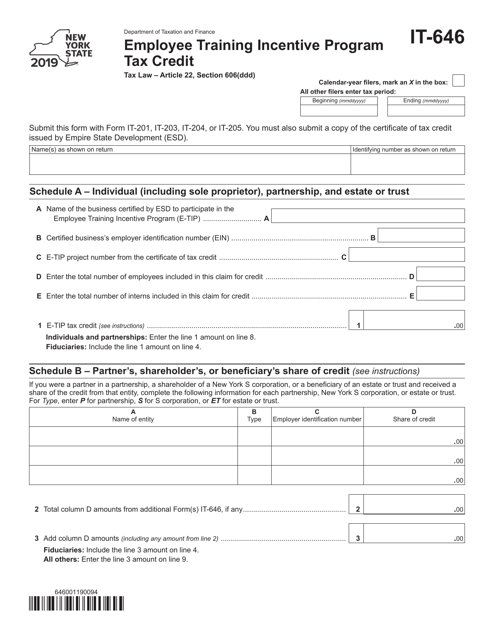

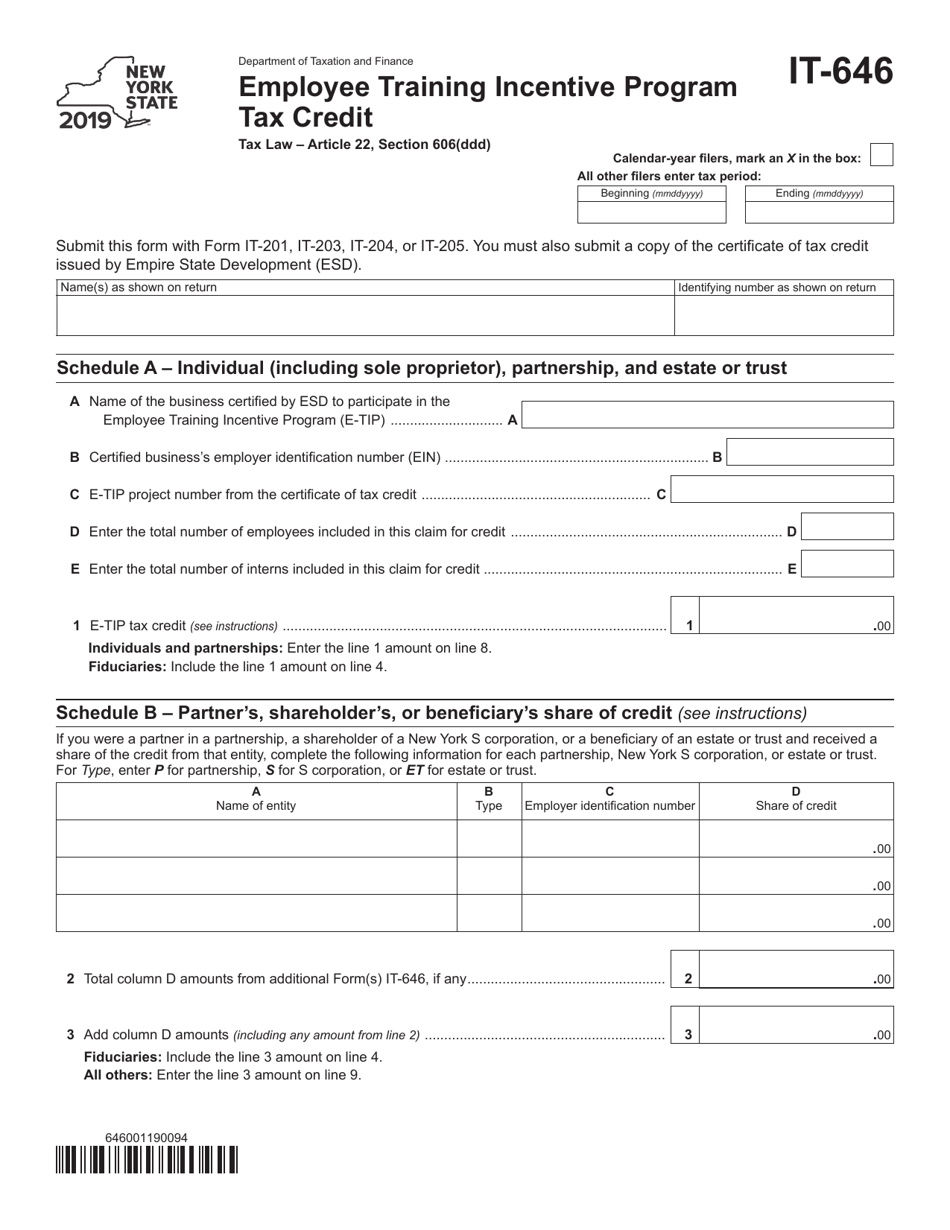

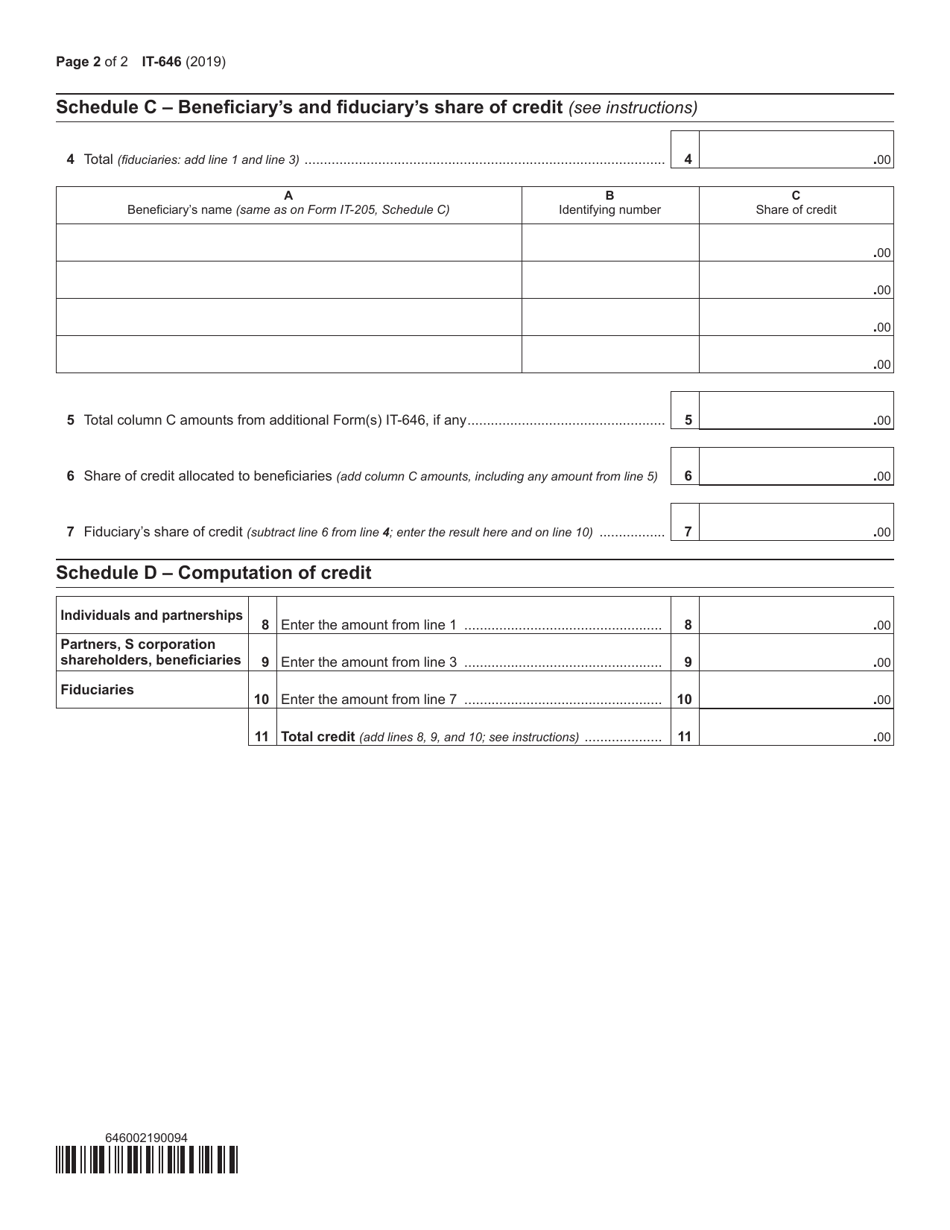

Form IT-646

for the current year.

Form IT-646 Employee Training Incentive Program Tax Credit - New York

What Is Form IT-646?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-646?

A: Form IT-646 is the form used to claim the Employee Training Incentive Program Tax Credit in New York.

Q: What is the Employee Training Incentive Program Tax Credit?

A: The Employee Training Incentive Program Tax Credit is a tax credit available to businesses in New York that provide eligible training to their employees.

Q: Who is eligible for the Employee Training Incentive Program Tax Credit?

A: Businesses in New York that provide eligible training to their employees are eligible for the Employee Training Incentive Program Tax Credit.

Q: How do I claim the Employee Training Incentive Program Tax Credit?

A: To claim the Employee Training Incentive Program Tax Credit, you need to complete and file Form IT-646 with the New York State Department of Taxation and Finance.

Q: What training expenses are eligible for the tax credit?

A: Eligible training expenses include costs related to courses, seminars, conferences, and other training programs that enhance the skills of your employees.

Q: What is the amount of the tax credit?

A: The amount of the tax credit is equal to a percentage of the eligible training expenses.

Q: Are there any limitations on the tax credit?

A: Yes, there are limitations on the tax credit, including a maximum credit amount and a per-employee limit.

Q: When is the deadline to file Form IT-646?

A: The deadline to file Form IT-646 is the same as the due date for the business's New York State tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-646 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.