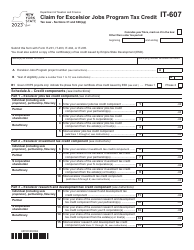

This version of the form is not currently in use and is provided for reference only. Download this version of

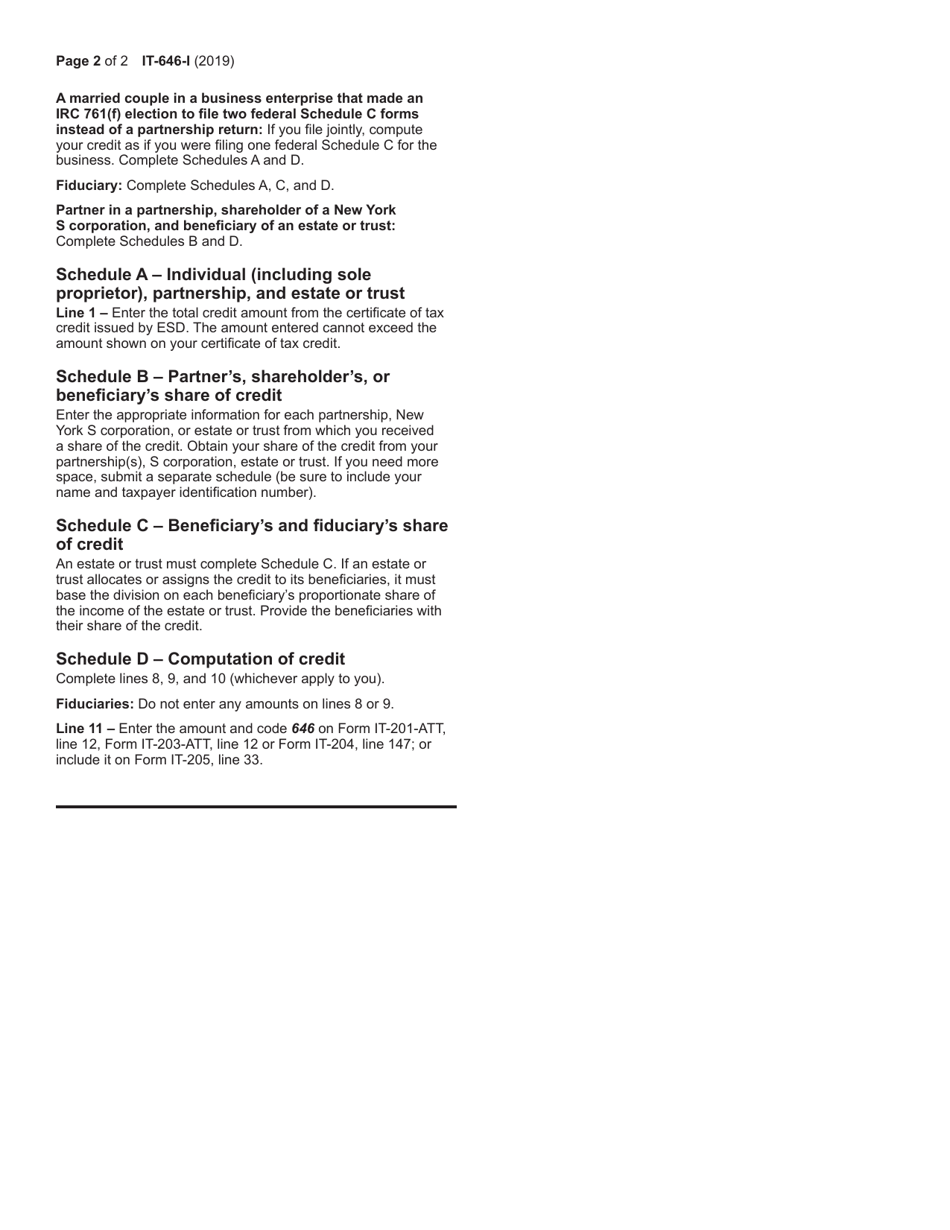

Instructions for Form IT-646

for the current year.

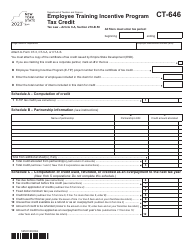

Instructions for Form IT-646 Employee Training Incentive Program Tax Credit - New York

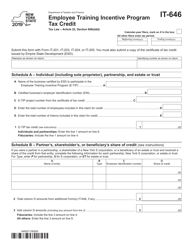

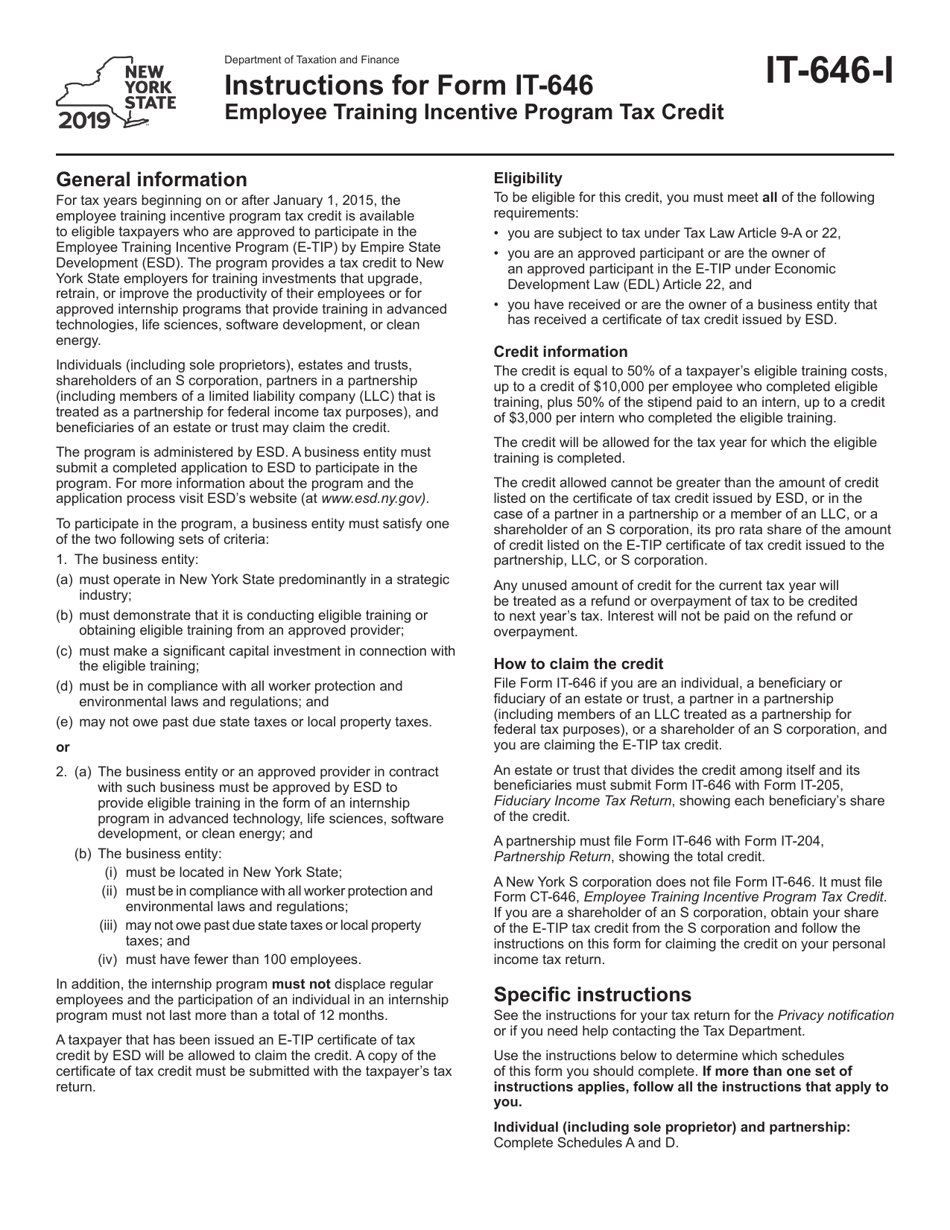

This document contains official instructions for Form IT-646 , Employee Training Incentive Program Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-646 is available for download through this link.

FAQ

Q: What is Form IT-646?

A: Form IT-646 is a tax form for the Employee Training Incentive Program Tax Credit in New York.

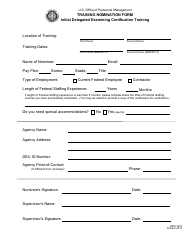

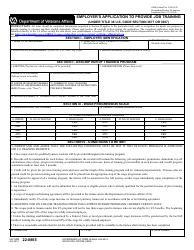

Q: What is the Employee Training Incentive Program Tax Credit?

A: It is a tax credit in New York that incentivizes employers to provide training opportunities for their employees.

Q: How do I qualify for the Employee Training Incentive Program Tax Credit?

A: To qualify, you must be an eligible employer who has incurred eligible training expenses.

Q: What are eligible training expenses?

A: Eligible training expenses include the cost of employee training materials, instructor fees, and certain other related expenses.

Q: What is the credit amount?

A: The credit amount is 10% of eligible training expenses, up to a maximum credit of $10,000 per employee per taxable year.

Q: When should I file Form IT-646?

A: You should file Form IT-646 with your New York State income tax return for the taxable year in which the eligible training expenses were incurred.

Q: Are there any limitations or restrictions?

A: Yes, there are certain limitations and restrictions, such as a maximum credit of $10,000 per employee and a total statewide credit limit.

Q: Are there any deadlines for filing?

A: Yes, Form IT-646 must be filed on or before the due date of your New York State income tax return for the taxable year.

Q: Can I claim this credit for previous years?

A: No, the credit is only available for eligible training expenses incurred in the current taxable year.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.