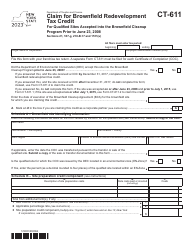

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IT-611

for the current year.

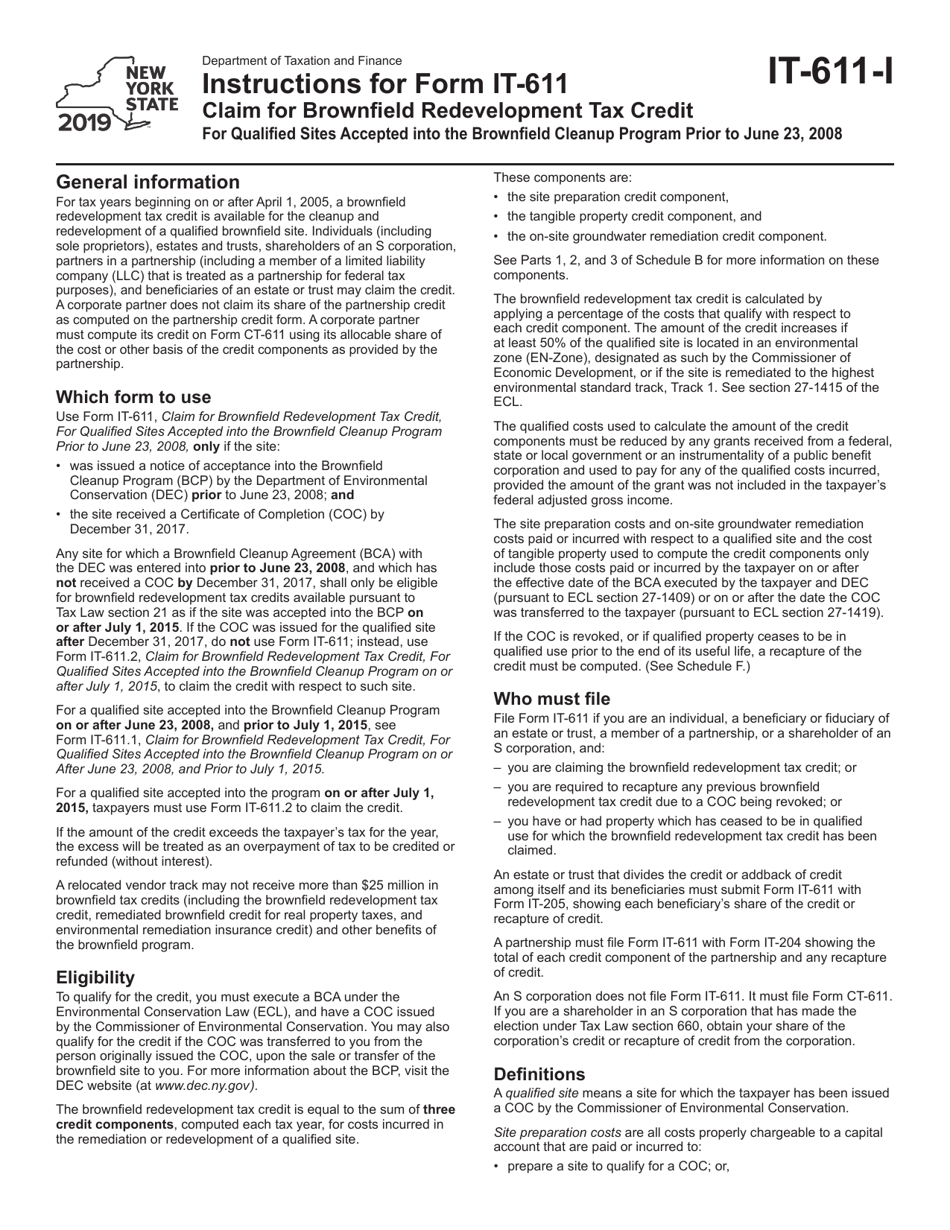

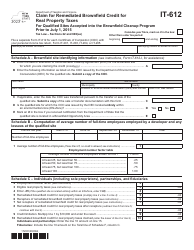

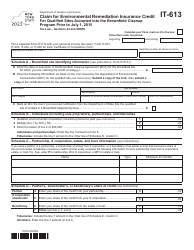

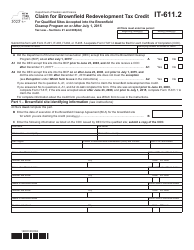

Instructions for Form IT-611 Claim for Brownfield Redevelopment Tax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program Prior to June 23, 2008 - New York

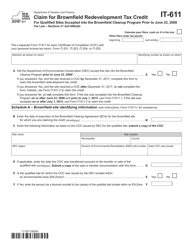

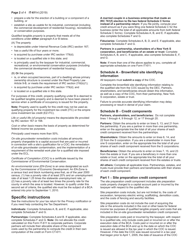

This document contains official instructions for Form IT-611 , Claim for Brownfield Cleanup Program Prior to June 23, 2008 - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-611 is available for download through this link.

FAQ

Q: What is Form IT-611?

A: Form IT-611 is a form used to claim the Brownfield Redevelopment Tax Credit for qualified sites accepted into the Brownfield Cleanup Program before June 23, 2008 in New York.

Q: What is the Brownfield Redevelopment Tax Credit?

A: The Brownfield Redevelopment Tax Credit is a tax credit given to individuals or entities who clean up and redevelop contaminated sites in New York.

Q: What is the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is a program in New York that encourages the cleanup and redevelopment of contaminated sites.

Q: What is the deadline for filing Form IT-611?

A: There is no specific deadline mentioned for filing Form IT-611. It is advisable to file it as soon as possible after completing the cleanup and redevelopment of the qualified site.

Q: Who is eligible to claim the Brownfield Redevelopment Tax Credit?

A: Individuals or entities who participate in the Brownfield Cleanup Program and have satisfied the eligibility requirements are eligible to claim the Brownfield Redevelopment Tax Credit.

Q: How do I complete Form IT-611?

A: The instructions for completing Form IT-611 are provided along with the form. Follow the instructions carefully and provide all the required information.

Q: What documentation do I need to submit with Form IT-611?

A: You may need to submit documentation such as a copy of the site acceptance letter, a copy of the brownfield site application, and any other supporting documents as required by the form instructions.

Q: Can I claim the Brownfield Redevelopment Tax Credit for multiple sites?

A: Yes, you can claim the Brownfield Redevelopment Tax Credit for multiple qualified sites accepted into the Brownfield Cleanup Program before June 23, 2008 in New York.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.