This version of the form is not currently in use and is provided for reference only. Download this version of

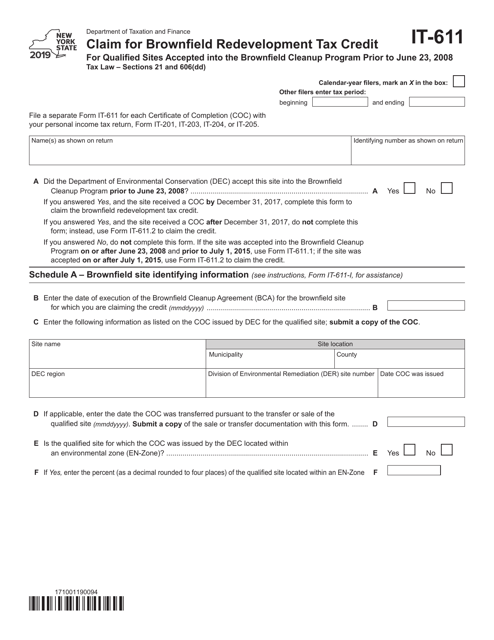

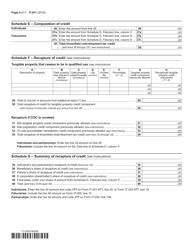

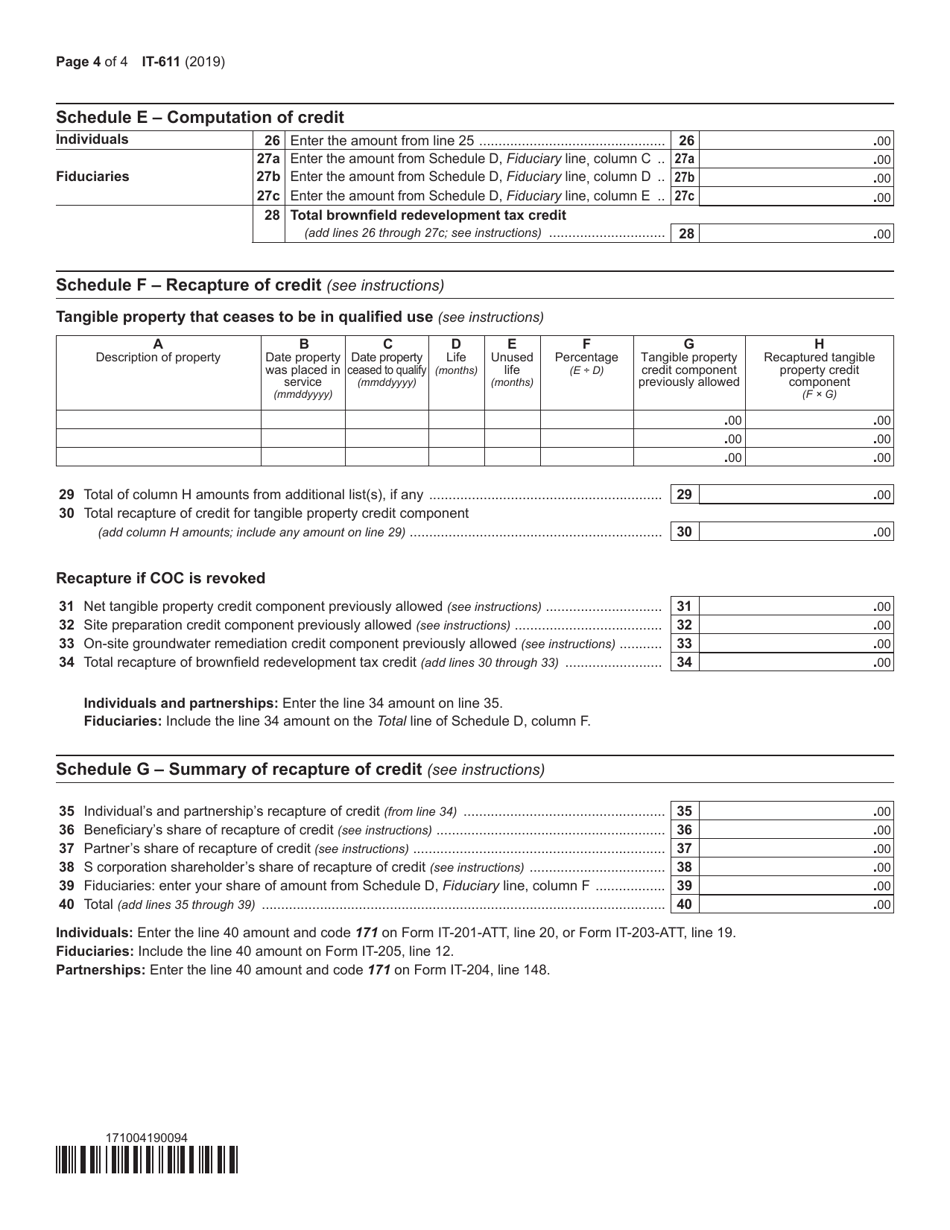

Form IT-611

for the current year.

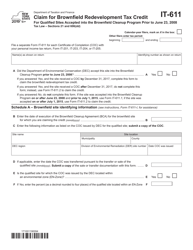

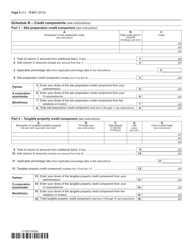

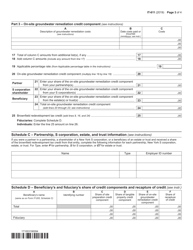

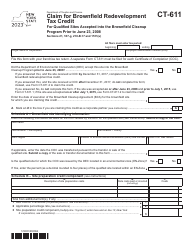

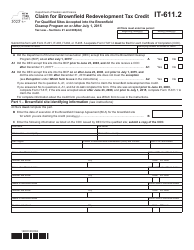

Form IT-611 Claim for Brownfield Redevelopment Tax Credit - for Qualified Sites Accepted Into the Brownfield Cleanup Program Prior to June 23, 2008 - New York

What Is Form IT-611?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-611?

A: Form IT-611 is a claim for Brownfield RedevelopmentTax Credit specifically for qualified sites accepted into the Brownfield Cleanup Program prior to June 23, 2008 in the state of New York.

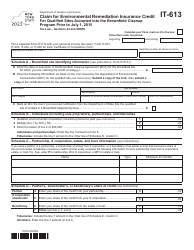

Q: What is the Brownfield Redevelopment Tax Credit?

A: The Brownfield Redevelopment Tax Credit is a tax incentive program in New York that provides eligible developers with a tax credit for the remediation and redevelopment of contaminated sites.

Q: Who is eligible to claim the Brownfield Redevelopment Tax Credit?

A: Developers who have qualified sites accepted into the Brownfield Cleanup Program prior to June 23, 2008 in New York are eligible to claim the Brownfield Redevelopment Tax Credit.

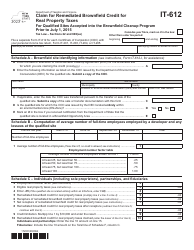

Q: What is the purpose of the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is designed to incentivize the remediation and redevelopment of contaminated sites in order to promote environmental cleanup and stimulate economic development.

Q: When should Form IT-611 be filed?

A: Form IT-611 should be filed within three years from the completion date of the qualified brownfield site.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-611 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.