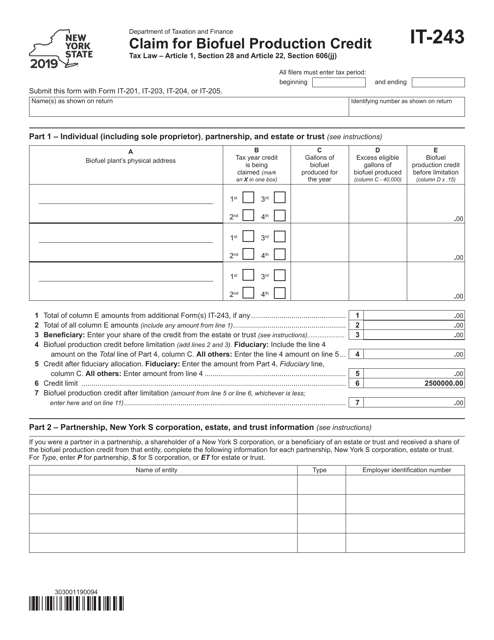

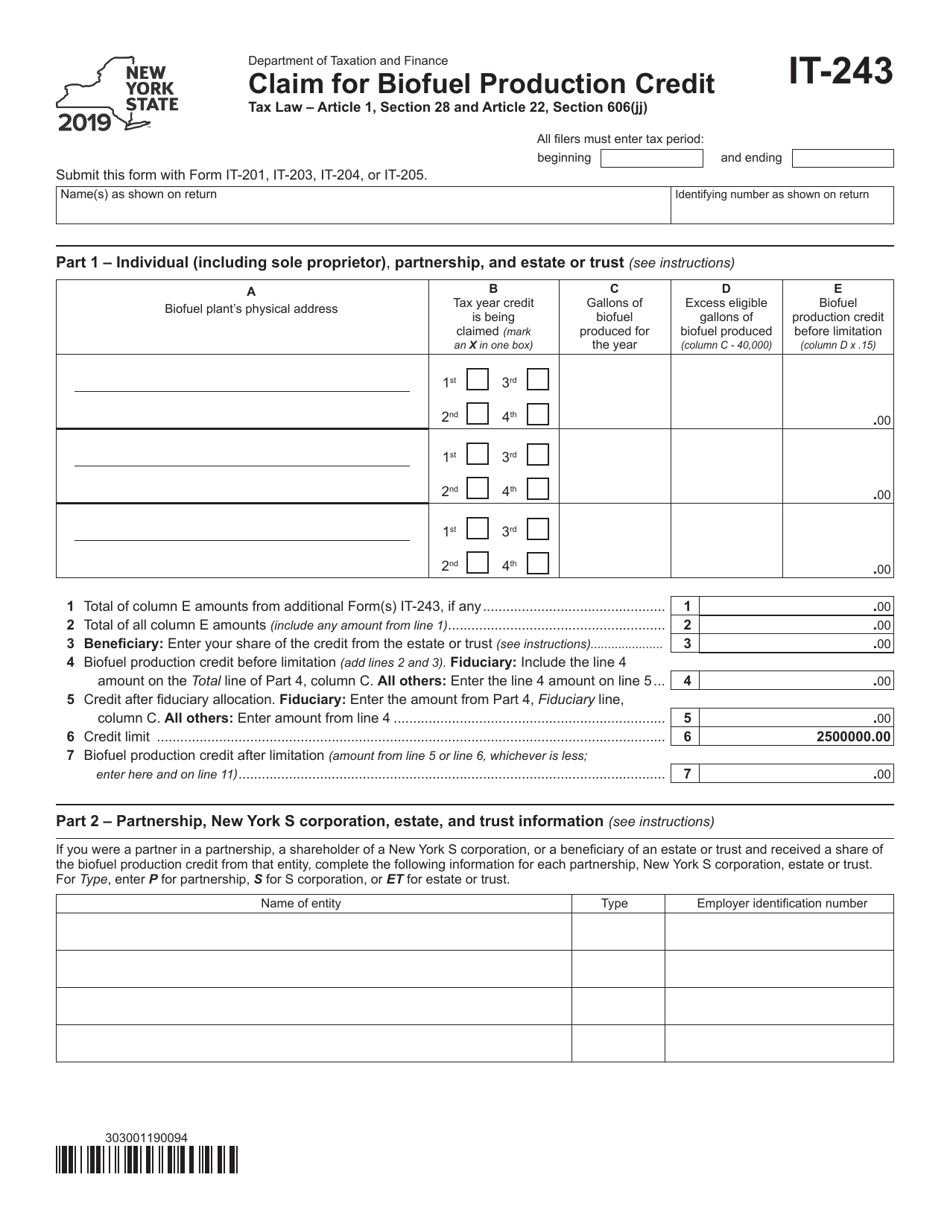

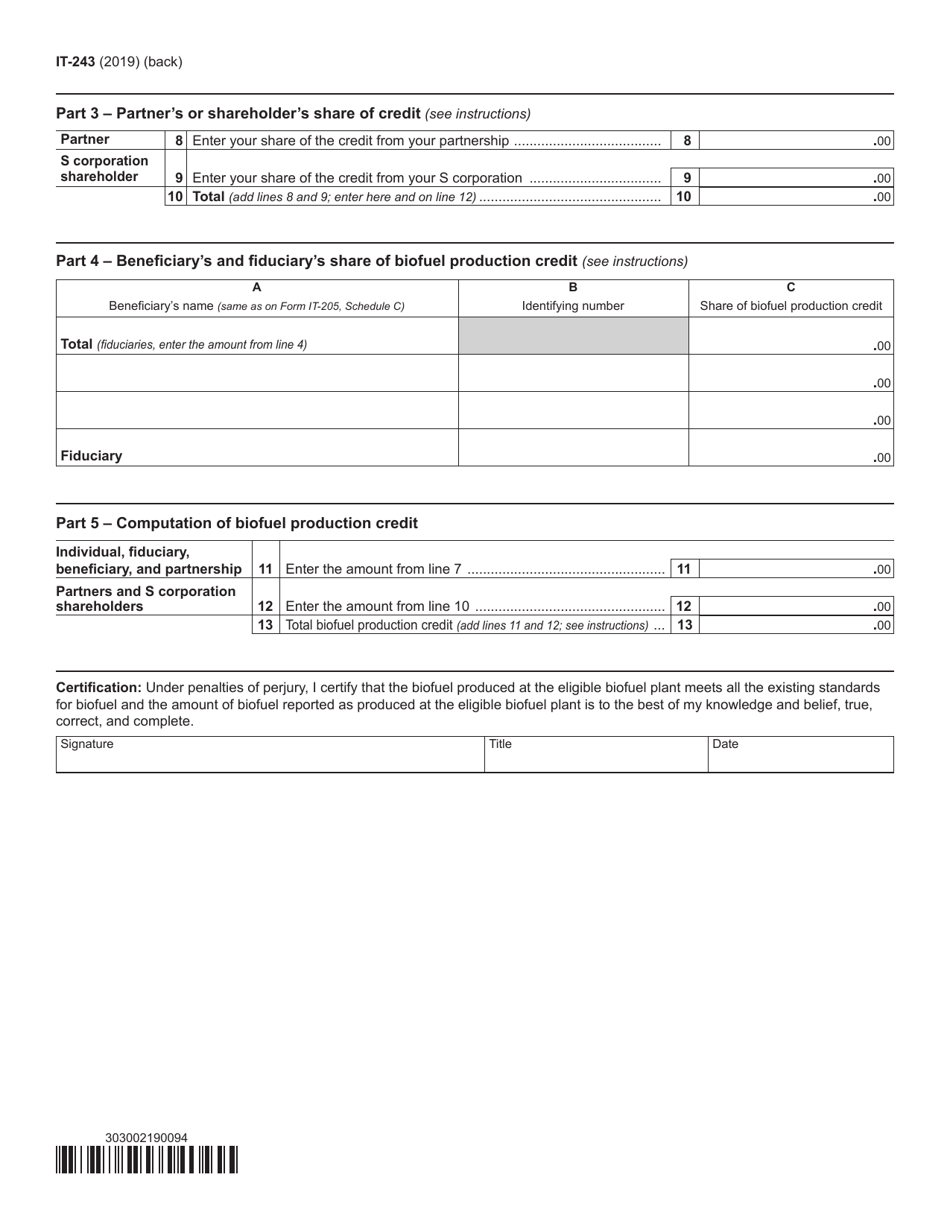

Form IT-243 Claim for Biofuel Production Credit - New York

What Is Form IT-243?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-243?

A: Form IT-243 is the Claim for Biofuel Production Credit specifically for residents of New York.

Q: What is the purpose of Form IT-243?

A: The purpose of Form IT-243 is to claim the Biofuel Production Credit offered by the state of New York.

Q: Who can use Form IT-243?

A: Residents of New York who meet the eligibility requirements for the Biofuel Production Credit can use Form IT-243.

Q: What is the Biofuel Production Credit?

A: The Biofuel Production Credit is a tax credit provided by the state of New York to individuals or businesses involved in biofuel production.

Q: How do I fill out Form IT-243?

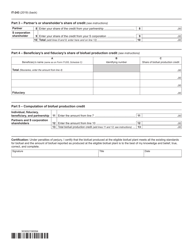

A: The instructions for filling out Form IT-243 are provided along with the form. Follow the instructions carefully and provide the required information.

Q: When is the deadline to file Form IT-243?

A: The deadline to file Form IT-243 is usually April 15th of the corresponding tax year.

Q: Is there a fee to file Form IT-243?

A: No, there is no fee to file Form IT-243.

Q: Are there any supporting documents required with Form IT-243?

A: Yes, you may need to attach additional documentation to support your claim for the Biofuel Production Credit. Refer to the instructions provided with the form for the specific requirements.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-243 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.