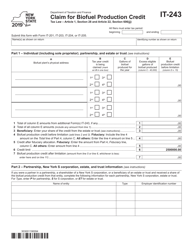

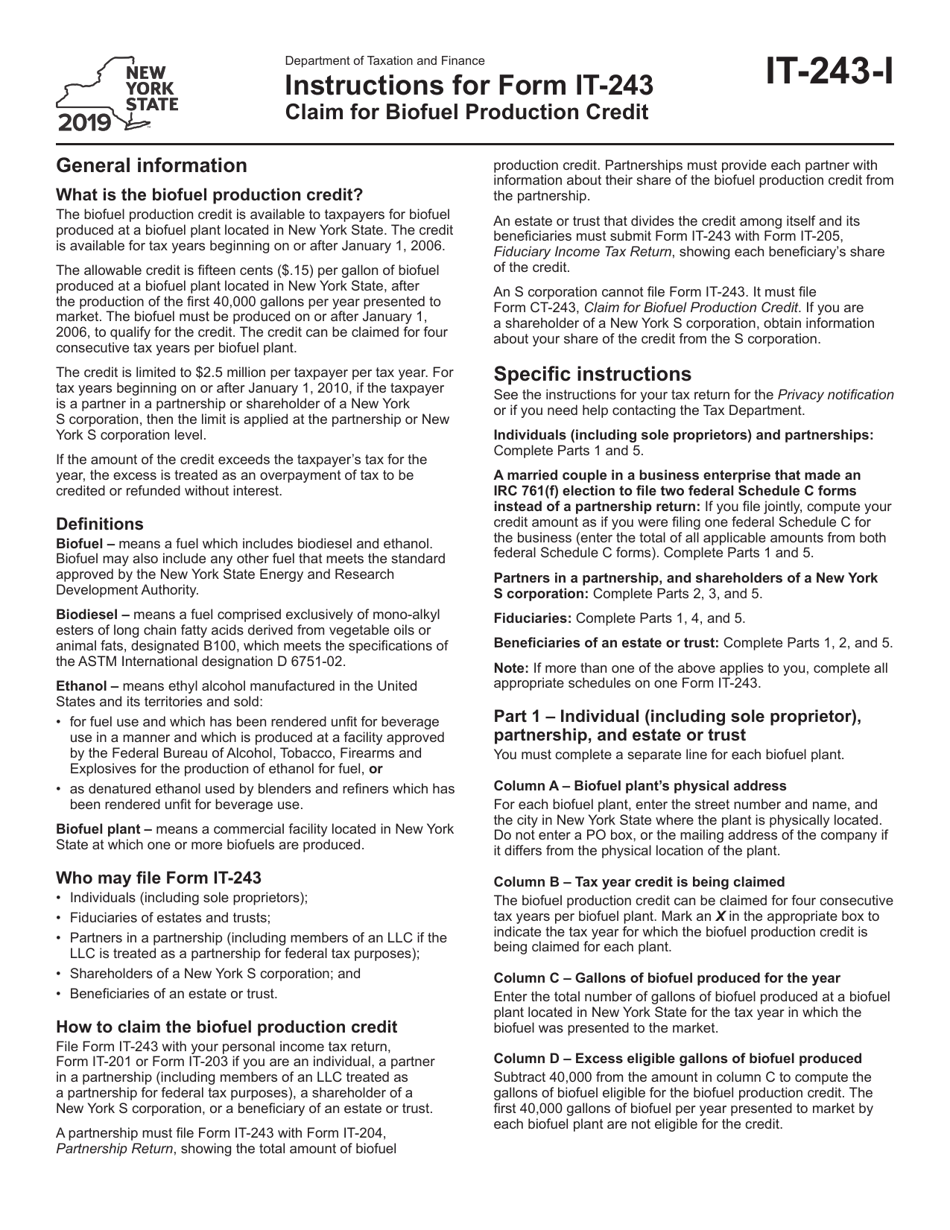

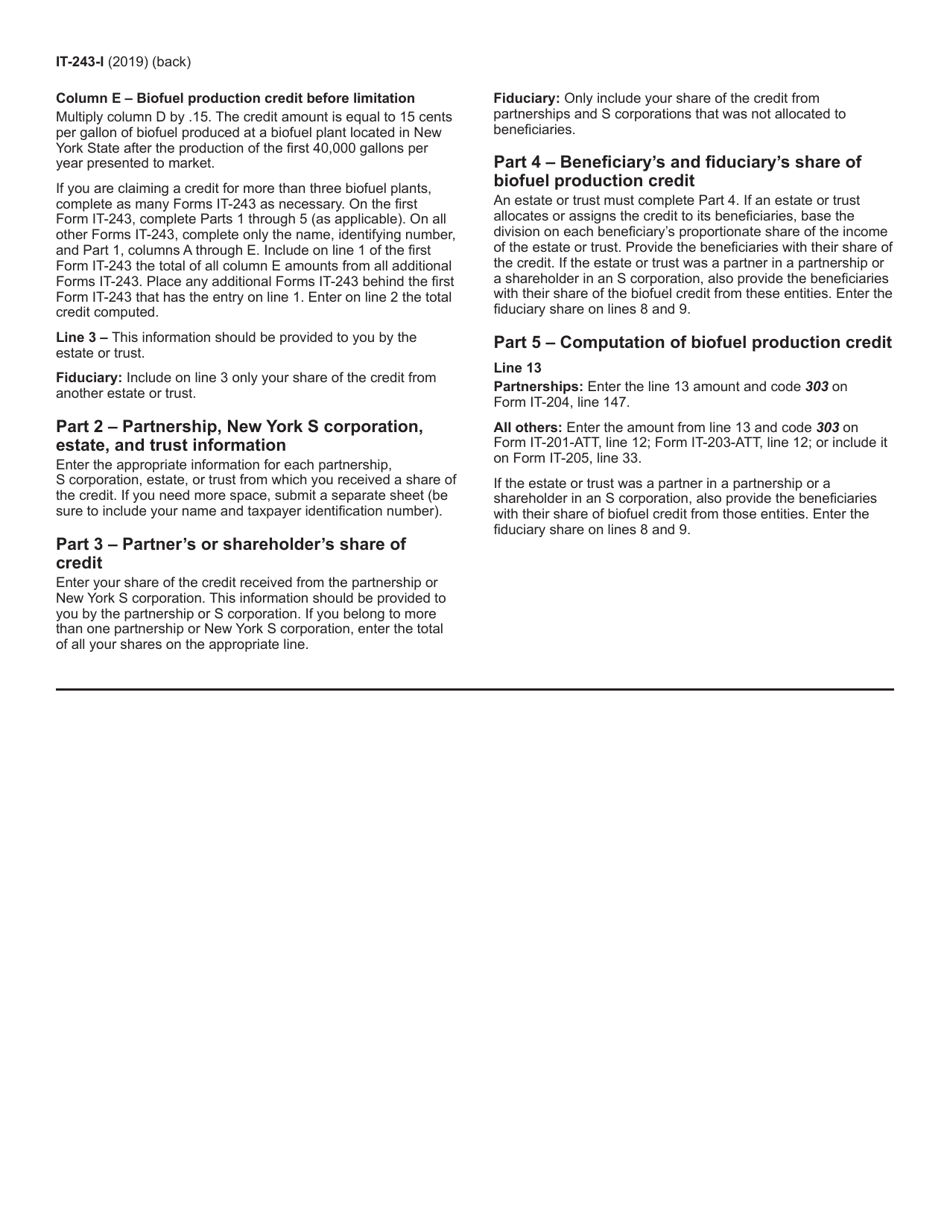

Instructions for Form IT-243 Claim for Biofuel Production Credit - New York

This document contains official instructions for Form IT-243 , Claim for Biofuel Production Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-243 is available for download through this link.

FAQ

Q: What is Form IT-243?

A: Form IT-243 is a tax form used in New York to claim the Biofuel Production Credit.

Q: What is the Biofuel Production Credit?

A: The Biofuel Production Credit is a tax credit provided to individuals or businesses that produce biofuels.

Q: Who can file Form IT-243?

A: Any individual or business in New York who is eligible for the Biofuel Production Credit can file Form IT-243.

Q: How do I qualify for the Biofuel Production Credit?

A: To qualify for the Biofuel Production Credit, you must meet certain criteria such as producing eligible biofuels and meeting all applicable requirements.

Q: What documentation do I need to include with Form IT-243?

A: You will need to include supporting documentation such as production records, receipts, and any other relevant documents that prove your eligibility for the Biofuel Production Credit.

Q: When is the deadline to file Form IT-243?

A: The deadline to file Form IT-243 is typically April 15th of the year following the tax year for which you are claiming the Biofuel Production Credit.

Q: Can I e-file Form IT-243?

A: No, Form IT-243 can only be filed by mail and cannot be e-filed.

Q: Are there any fees associated with filing Form IT-243?

A: There are no fees required to file Form IT-243.

Q: How long does it take to process Form IT-243?

A: Processing times can vary, but you can generally expect to receive a response within a few weeks to a few months after filing.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.