This version of the form is not currently in use and is provided for reference only. Download this version of

Form DTF-626

for the current year.

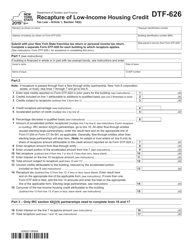

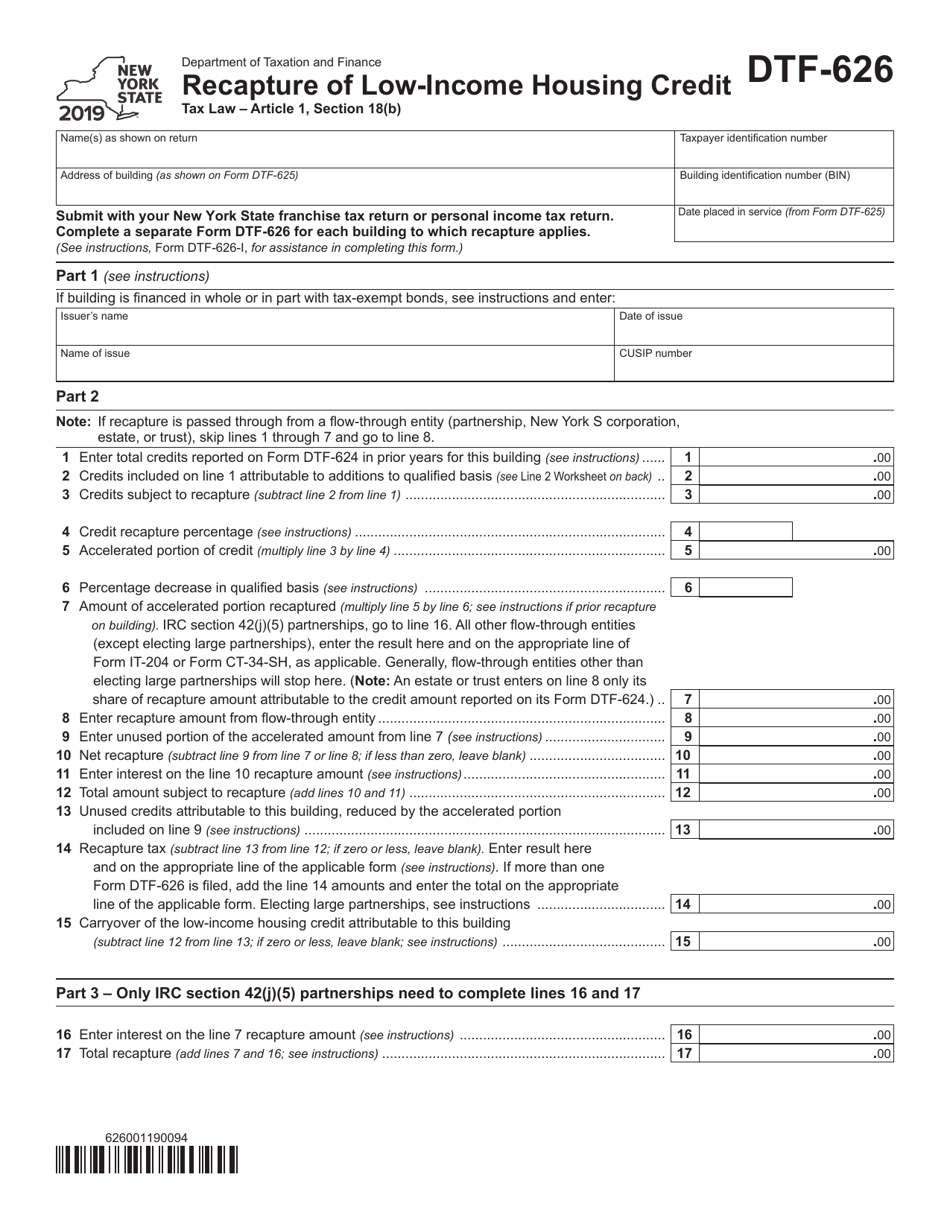

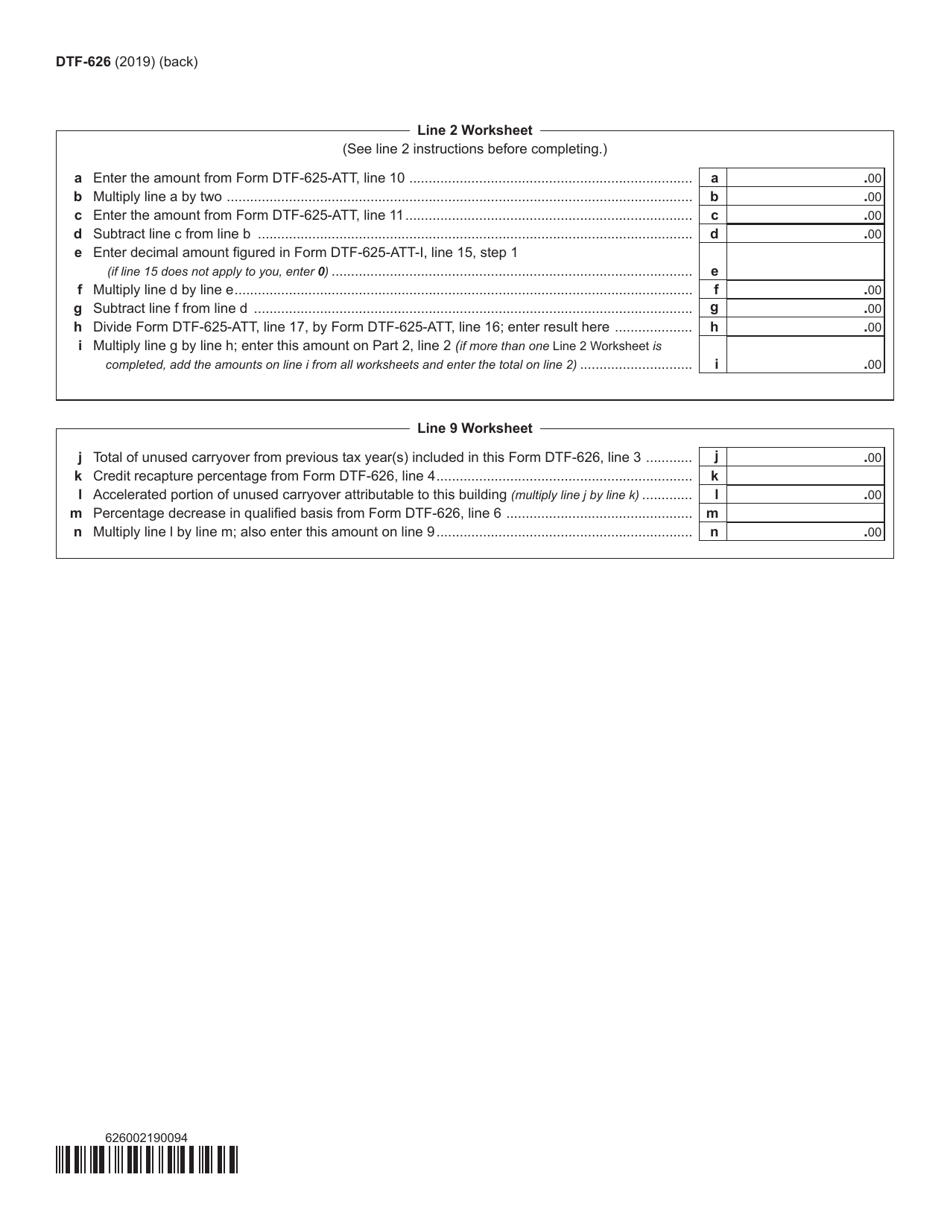

Form DTF-626 Recapture of Low-Income Housing Credit - New York

What Is Form DTF-626?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DTF-626?

A: Form DTF-626 is the Recapture of Low-Income Housing Credit form used in the state of New York.

Q: What is the purpose of Form DTF-626?

A: The purpose of Form DTF-626 is to calculate and recapture low-income housing credits previously claimed.

Q: Who needs to file Form DTF-626?

A: Individuals, businesses, or organizations that have claimed low-income housing credits in New York may need to file Form DTF-626.

Q: When should Form DTF-626 be filed?

A: Form DTF-626 should be filed with the New York State Department of Taxation and Finance when a recapture of low-income housing credit is required.

Q: Is there a deadline for filing Form DTF-626?

A: Yes, there is a deadline for filing Form DTF-626. The specific deadline can be found on the form or by contacting the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-626 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.