This version of the form is not currently in use and is provided for reference only. Download this version of

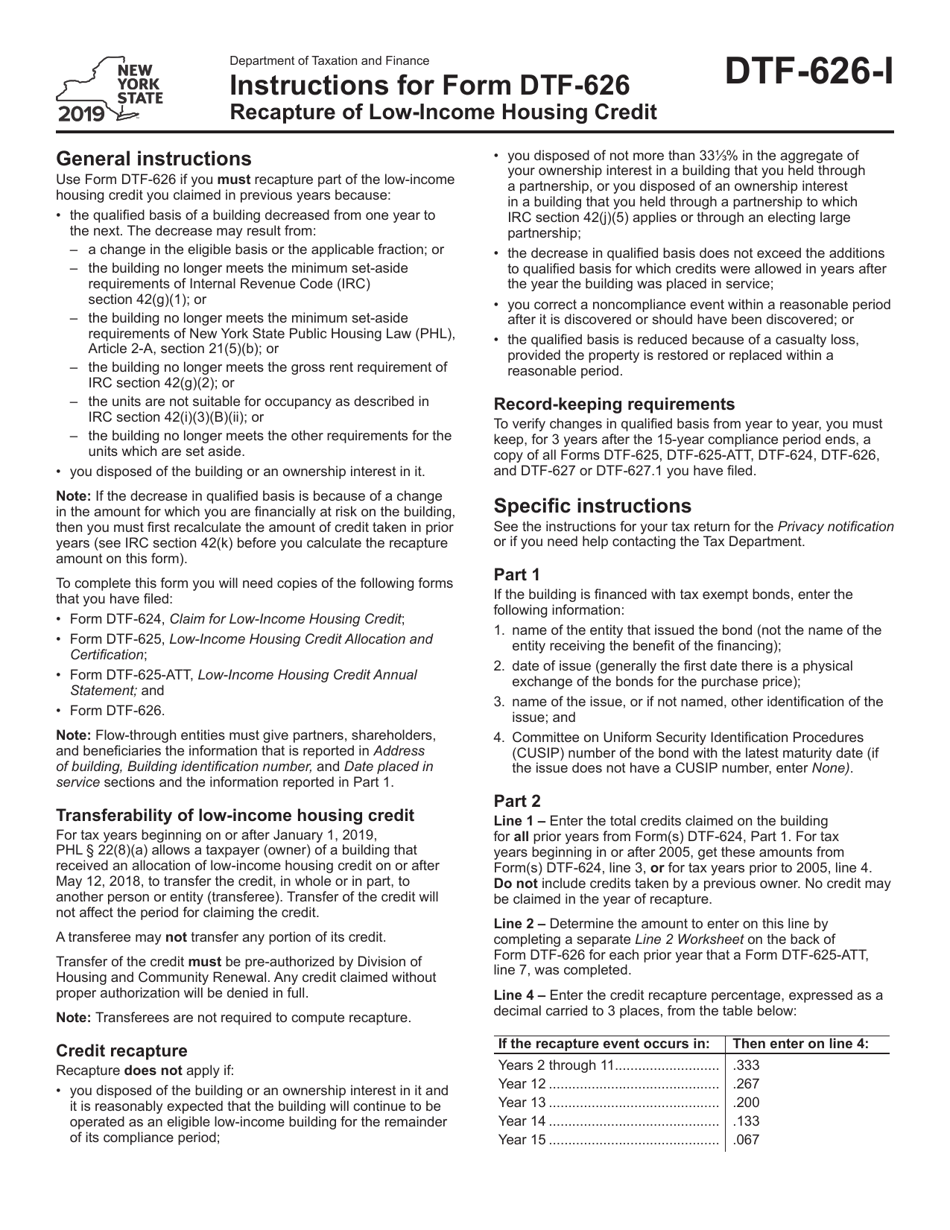

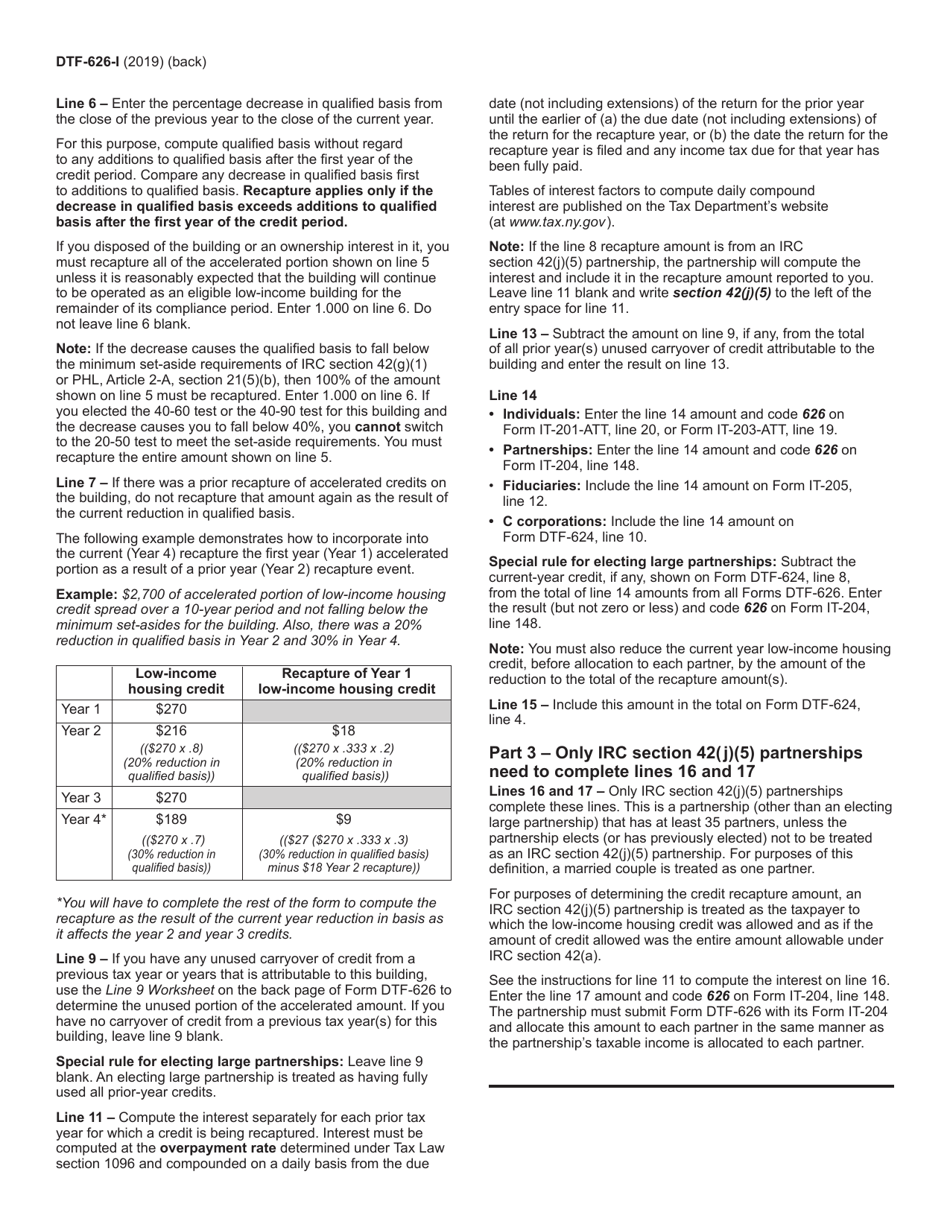

Instructions for Form DTF-626

for the current year.

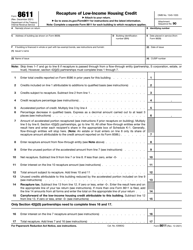

Instructions for Form DTF-626 Recapture of Low-Income Housing Credit - New York

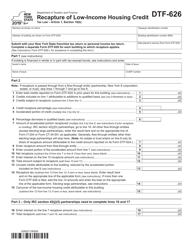

This document contains official instructions for Form DTF-626 , Recapture of Low-Income Housing Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form DTF-626 is available for download through this link.

FAQ

Q: What is Form DTF-626?

A: Form DTF-626 is a document used in New York to recapture low-income housing credit.

Q: Who should file Form DTF-626?

A: Form DTF-626 should be filed by taxpayers who need to recapture the low-income housing credit in New York.

Q: What is the purpose of recapturing low-income housing credit?

A: The purpose of recapturing low-income housing credit is to ensure that the credit is being used appropriately and in compliance with the law.

Q: When should Form DTF-626 be filed?

A: Form DTF-626 should be filed within 90 days after the event that triggered the recapture, such as a change in ownership or noncompliance with the requirements.

Q: What information is required on Form DTF-626?

A: Form DTF-626 requires information about the taxpayer, the property, and the reason for the recapture.

Q: Are there any penalties for failing to file Form DTF-626?

A: Yes, there are penalties for failing to file Form DTF-626, including interest charges and possible legal action.

Q: Is there a fee associated with filing Form DTF-626?

A: No, there is no fee associated with filing Form DTF-626.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.